Veterinary Software Market Size & Overview:

Get more information on Veterinary Software Market - Request Free Sample Report

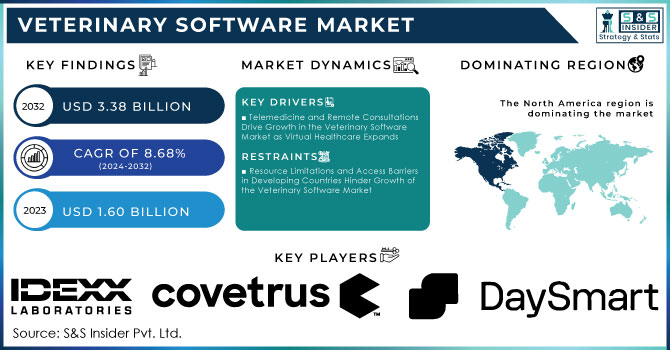

Veterinary Software Market was valued at USD 1.60 billion in 2023 and is expected to reach USD 3.38 billion by 2032, growing at a CAGR of 8.68% from 2024-2032.

The veterinary software market is witnessing a strong growth rate; this has been mainly because of the increasing rate of pet ownership and more and more adoption of pet healthcare management solutions. In 2024, Americans own pets in 66% of households, and in 2023, the U.S. spent a record USD 147 billion on pet expenses. With basic dog expenditure averaging USD 1,533 per year, increasingly more people are investing in animal care and forming a growing market for digital tools that improve the productivity of veterinary practices. During the past decade, software applications that allow the management of appointments, patient records, and treatment plans have become an integral necessity for veterinary clinics all over the country.

The most exciting development in veterinary software, however, is Artificial Intelligence. With AI-based diagnostic tools, which can diagnose with a 90% accuracy rate, diagnostic error has decreased by 40%. Moreover, 39.2% of vets revealed they use AI tools in their practice, and 65.8% reported using them daily or weekly. Such advancement is set to transform veterinary animal care since veterinarians will have more accurate and efficient methods by which to understand, diagnose, and treat conditions, which could end up with better outcomes for their patients.

Shortly, the veterinary software market will be increasing the adoption of cloud-based solutions to allow for the seamless management and collaboration of data across more than one device that would be the actual key player. Open doors for growth into emerging markets where veterinary care is just beginning to modernize, as AI tools continue to see widespread adoption. Since the average lifetime cost of a dog can reach USD 93,000, technological inventions are elevating the quality of care as well as bringing appreciative value both to the owners and veterinary professionals.

VETERINARY SOFTWARE MARKET DYNAMICS

DRIVERS

Telemedicine and Remote Consultations Drive Growth in the Veterinary Software Market as Virtual Healthcare Expands

Telemedicine and remote consultation are the primary drivers of the veterinary software market. The rise of virtual care, the main driver of these services, especially in rural and underserved areas, increases the demand for telehealth-enabled platforms in veterinary care. Telemedicine, for example, saves about 82 minutes every year compared to a medical appointment in Australia, thereby manifesting efficiency. Similarly, 116.7 million users worldwide are expected to utilize online doctor consultations in 2024, reflecting a general trend toward virtual healthcare. Such solutions enable veterinarians to expand their services through remote consultations and continuous health monitoring of pets, which not only increases accessibility but also convenience for pet owners. This change in veterinary care delivery is essentially revolutionizing the industry.

AI and Technological Advancements Drive Growth in the Veterinary Software Market by Enhancing Diagnostic Accuracy, Treatment Efficiency, and Overall Care

The use of artificial intelligence and machine learning in veterinary practices is the major factor that feeds the veterinary software market. AI-powered virtual assistants have placed a 25% improvement in customer satisfaction rates with better client experience and reduction of administrative activities in veterinary clinics. AI-based predictive analytics have also reduced the mortality rate of dairy cows by 15%. Contributions have also been made in the protection of endangered species to a level of up to 70% in veterinary care for wildlife. AI algorithms are also advancing pet care with up to 82% accuracy in predicting the likelihood of food allergies in dogs. As these technologies continue to evolve, they will push much more adoption of veterinary software powered by AI into the future of the animal healthcare industry.

RESTRAINTS

Resource Limitations and Access Barriers in Developing Countries Hinder Growth of the Veterinary Software Market

Resource scarcity and limitations in access to modern veterinary care severely hinder the growth of the veterinary software market in many developing countries. Such regions have poorly funded veterinary clinics, inadequate structures, and a lack of skilled professionals, which limits them from embracing modern technologies such as AI-powered software. These, in turn, restrict investment into digital solutions, hence preventing the widespread provision of innovative veterinary care, causing market growth in such fields to lag. Growth in the market is, therefore hindered by this difference in access to high-quality veterinary services.

VETERINARY SOFTWARE MARKET SEGMENT ANALYSIS

BY PRACTICE TYPE

Small animals dominated veterinary software revenue in 2023, accounting for around 42% of market shares, mainly due to higher incidence of pet ownership, as well as large amounts of spending on healthcare for pets. Urban dwellers have to spend a lot of money on digital tools designed for routine check-ups, diagnostics, and preventive care for cats and dogs and other companion animals. Meanwhile, specialized "Other Practice Types," which include such subfields as care for exotic animals as well as wildlife conservation are expected to grow at the fastest rate, with an estimated CAGR of 12.01% for 2024 to 2032. That would be mainly influenced by further interest in higher care options for a variety of animal species, supported by advancements in veterinary technology and growing concerns over diversity and conservation measures.

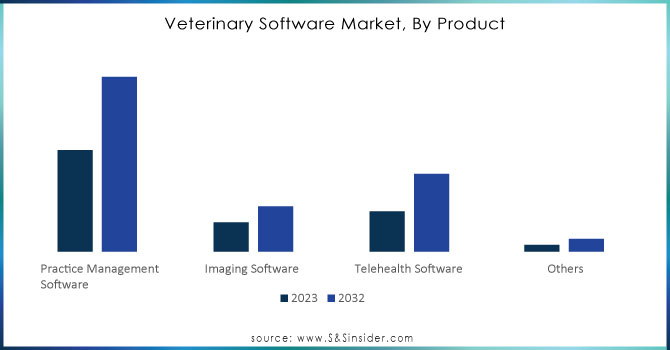

BY PRODUCT

In the year 2023, practice management software held a majority share of 62% in the veterinary software market, mainly because of its intrinsic importance to the clinic's daily operations, such as scheduling, billing, and patient records. It is an essential investment for veterinary practices as it enhances the efficiency of clinics, ultimately improving client care due to streamlined practices. Telehealth software is further expected to grow with the highest CAGR of 10.73% between 2024 to 2032, driven by escalating remote consultation requirements and easily accessible veterinary services, especially for underprivileged locations. This pattern reflects the increased accessibility and ease of digital healthcare solutions.

BY END USER

Veterinary hospitals and clinics are capturing the maximum share of veterinary software market revenue with about 84%, due to the heavy dependence of such facilities on digital tools for managing their patient volumes and complex administrative work. Such facilities would require sophisticated solutions for scheduling, diagnosis, billing, and managing patient records; therefore, calling for more advanced software. Veterinary hospitals and clinics are also expected to expand at the highest growth rate, close to 9.08% CAGR from 2024 to 2032, with growing use of the adoption of digital healthcare technologies focused on ensuring improvements in operational efficiency and care delivery capabilities across more comprehensive networks of veterinary practices.

BY DELIVERY MODE

Cloud and web-based veterinary software generated around 82% of revenue in 2023 as more and more veterinarians demand flexible, scalable, and accessible solutions that can access a veterinarian's patient records, appointments, and billing from anywhere. Such platforms provide easy data sharing and real-time access, which is important to multi-location practices and other forms of remote consultations. This segment is forecasted to expand strongly at a CAGR of 9.23% from 2024 to 2032, as veterinary practices increasingly implement cloud-based technology to improve efficiency, enhance security, and reduce infrastructure costs, which are increasingly becoming attractive to modern veterinary operations.

VETERINARY SOFTWARE MARKET REGIONAL ANALYSIS

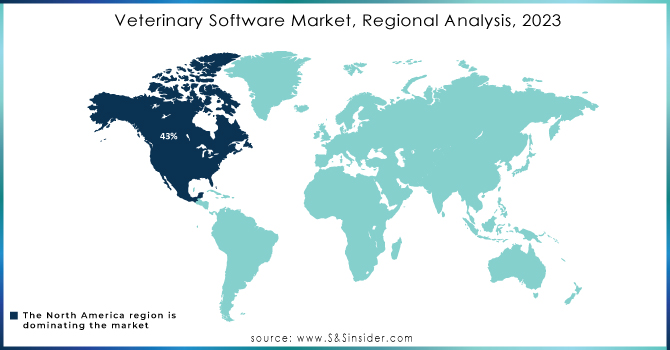

In 2023, North America held the biggest share of veterinary software revenue, at 43%, due to higher pet ownership rates, massive investments in pet healthcare, and early adoption of digital technologies within veterinary practice. The region has established infrastructure and a strong demand for advanced healthcare solutions, including practice management and telehealth tools, as veterinarians seek to manage growing caseloads efficiently and provide better client services.

The Asia Pacific region is expected to propel the growth with a stupendous CAGR of 10.36% from 2024 to 2032. This region exhibits rapid growth as pet ownership increases, awareness about veterinary care goes higher, and modernization of veterinary practices advances within emerging markets. Growing interest by the government and private organizations for veterinary technology, in turn, addresses an escalating demand for quality pet care and leads this region to gain more momentum for veterinary software adoption.

Need any customization research on Veterinary Software Market - Enquiry Now

LATEST NEWS -

1] In February 2024, IDEXX introduced Vello, a new pet parent engagement software. This platform includes automated appointment reminders, health service alerts, online scheduling, and two-way messaging, fully integrated with IDEXX's practice management software to enhance client communication and streamline operations.

2] In January 2024, Covetrus unveiled its NetSuite solution at VMX 2024, aimed at boosting efficiency in veterinary practices through integrated technology. Additionally, Covetrus partnered with Zoetis Diagnostics to enable seamless data exchange, strengthening veterinarians' diagnostic capabilities and patient care quality.

KEY PLAYERS

-

IDEXX Laboratories (Cornerstone, Neo)

-

Covetrus Inc. (formerly Henry Schein) (AVImark, eVetPractice)

-

Hippo Manager (Hippo Manager Practice Management, Hippo Manager TeleVet)

-

Shepherd Veterinary Software (Shepherd Veterinary Software Platform, Shepherd Analytics)

-

DaySmart Software (DaySmart Vet, Vetter)

-

Digitail (Digitail Veterinary Software, Digitail Telemedicine)

-

ProVet (by NordHealth) (Provet Cloud, Provet Telemedicine)

-

OnwardVet (OnwardVet Cloud Practice Management, OnwardVet TeleVet)

-

Asteris (Asteris Keystone PACS, Asteris VetPACS)

-

Carestream Health (Vue PACS for Veterinary, Cloud-based Imaging Platform)

-

Heska Corporation (Mars Inc.) (Heska View Imaging, Element AIM)

-

Oehm und Rehbein GmbH (dicomPACS, ORCA Cloud)

-

VetStoria (VetStoria Online Booking, VetStoria Analytiacs)

-

Instinct Science, LLC (Instinct EMR, Instinct Treatment Plans)

-

Planmeca OY (Romexis Veterinary Software, Planmed Verity for Veterinary)

-

ezyVet (ezyVet Practice Management Software, ezyVet Go Mobile App)

-

Vetport (Vetport Cloud Veterinary Software, Vetport Client Portal)

-

Animal Intelligence Software, Inc. (AI Veterinary Software, AI Practice Management)

-

InstaVet (InstaVet Practice Management System, InstaVet Appointment Scheduling)

-

Vetspire (Vetspire EMR, Vetspire AI Analytics)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.60 Billion |

| Market Size by 2032 | USD 3.38 Billion |

| CAGR | CAGR of 8.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Practice Management Software, Imaging Software, Telehealth Software, Others) • By Delivery Mode (Cloud/Web-Based, On-premise) • By Practice Type (Small Animals, Mixed Animals, Equine, Food-producing Animals, Other Practice Types) • By End User (Veterinary Hospitals/Clinics, Other End Use) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IDEXX Laboratories, Covetrus Inc., Hippo Manager, Shepherd Veterinary Software, DaySmart Software, Digitail, ProVet (by NordHealth), OnwardVet, Asteris, Carestream Health, Heska Corporation (Mars Inc.), Oehm und Rehbein GmbH, VetStoria, Instinct Science, LLC, Planmeca OY, ezyVet, Vetport, Animal Intelligence Software, Inc., InstaVet, Vetspire. |

| Key Drivers | • Telemedicine and Remote Consultations Drive Growth in the Veterinary Software Market as Virtual Healthcare Expands • AI and Technological Advancements Drive Growth in the Veterinary Software Market by Enhancing Diagnostic Accuracy, Treatment Efficiency, and Overall Care |

| RESTRAINTS | • Resource Limitations and Access Barriers in Developing Countries Hinder Growth of the Veterinary Software Market |