Video Editing Software Market Report Scope and Overview:

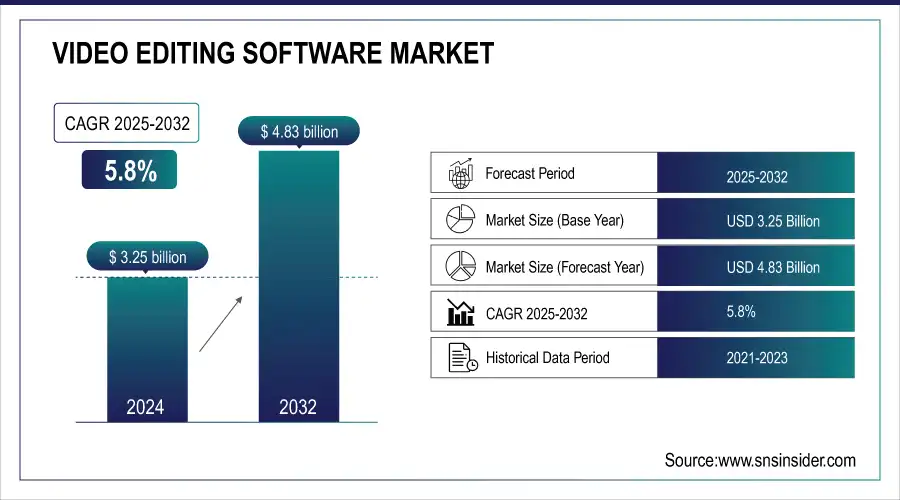

The Video Editing Software Market size was valued at USD 3.25 billion in 2024 and is expected to grow to USD 4.83 billion by 2032 and grow at a CAGR of 5.8 % over the forecast period of 2025-2032.

Get More Information on Video Editing Software Market - Request Sample Report

The rapid growth of the film and media sector, combined with numerous Over-The-Top (OTT) platforms, and social networks having more influence over people than anything else, these days & easy Internet availability along with advances in technology & user-friendly video editing software have been key factors for growth and expansion of the video editing software market. For Instance, the rate of users of OTT is recorded at around 51% in 2024, due rise in the advanced mobile phone penetration in the market increasing online video streaming, and increasing screen time on entertainment platforms. Moreover, on average paid subscribers for Netflix were recorded at around 278 million worldwide in Y24, and the revenue generated by Netflix was around USD 2 billion up to the second quarter of Y24.

Video Editing Software Market Size and Forecast:

-

Market Size in 2024: USD 3.25 billion

-

Market Size by 2032: USD 4.83 billion

-

CAGR: 5.8% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Video Editing Software Market Highlights:

-

Increasing adoption of AI has driven video editing software to enhance design, color effects, backgrounds, and advanced transformations. For example, Google launched the AI tool Vids in July 2024, offering low-cost AI-generated storyboards and customizable templates.

-

Top providers such as Webdew, Adobe, Canva, Forth&Fur, Alconost, Signature Video Group, and Fog Coast Production generate significant revenue through high-quality videos and strong client bases.

-

Major companies are entering strategic collaborations to expand capabilities, including Hour One with Google Cloud and Walt Disney with Epic Games in 2024.

-

Platforms like TikTok, ByteDance, Thriller, and Dubsmash drive market growth, with ByteDance earning over USD 40 billion in 2023.

-

Growth in online video streaming, gaming content, and professional-quality video demand fuels the need for advanced editing tools.

-

Intense competition from low-cost providers pressures premium brands, requiring differentiation through AI features, multi-platform support, and superior user experience.

With the Increasing demand and adoption of AI in every industry, the Video editing software market has also invested in expanding features in design, color effects, background, and different amazing transformations. For Instance, Google launched a new AI video tool called Vids, in July 2024, to provide customers with low-cost video editing services like AI-generated storyboards, customizable templates, and a royalty-free stock content library.

The Top video editor software providers are Webdew, Adobe, Canva, forth& fur, Alconost, Signature Video Group, and Fog Coast Production, and are earning millions with strong client bases and providing high-quality videos and including high investments. As with changing customers' preferences for quality and features, major companies are moving towards collaboration/ partnership or investments in software. For Instance, Hour One has announced Collaboration with Google Cloud to bring innovation into video production with the help of AI, with a huge customer base by entering the Google Cloud market. Like the same, Walt Disney has planned to collaborate with Epic Games in 2024, to expand their reach towards new gaming and entertainment platforms, with the multiyear project. Moreover, in 2024, Canva has gained popularity in photo and video editing and has earned around 9 million dollars.

The growing prevalence of short video-making, and irreverent content posted by Gen Z, majorly boosts the use of applications like TikTok, byteDance, thriller, dub smash clapper, and many more is major driving revenue growth in the Video Editing Software market. Among all these, ByteDance has gained market traction and earned the largest revenue of more than USD 40 billion in 2023. In the U.S., for example, the total time invested on social media by people, of 30-32% of the time, people invest in TikTok, and revenue generated by TikTok is around USD 16 billion in 2023.

Video Editing Software Market Drivers:

- Increasing demand for gaming and ongoing trends for online video streaming, driving the market growth.

With digital media platforms becoming popular, there is a great demand for video materials and the need to have them of high quality. Just as consumers have become familiar with the concept of streaming HD, their baseline expectation for video quality has risen. This leads to the need for video editing software that caters to professional-level content creation. Furthermore, this need has increased due to the transition from traditional television to online video streaming services. Businesses have the opportunity to reap significant profits from the spike in video consumption caused by the ease of use and extensive content libraries provided by streaming platforms. To take advantage of this trend, there is an increased need for effective video editing software that can produce high-quality footage quickly.

Video Editing Software Market Restraints:

-

High competition with cheap video editing providers to sustain premium brands.

The video editing industry is experiencing high competition as numerous low-cost providers enter the market, offering basic editing tools at minimal prices. This trend puts significant pressure on premium brands to sustain their market position and justify higher pricing. To remain competitive, premium providers focus on differentiating through advanced features such as AI-assisted editing, high-resolution rendering, multi-platform support, and collaborative workflows. Superior customer service, regular software updates, and robust security features further enhance their value proposition. Additionally, branding, user experience, and integration with other creative tools play a critical role in maintaining customer loyalty. Despite cost pressures, premium brands leverage innovation, quality, and specialized services to protect margins and uphold their reputation in a crowded marketplace.

Video Editing Software Market Segment Analysis:

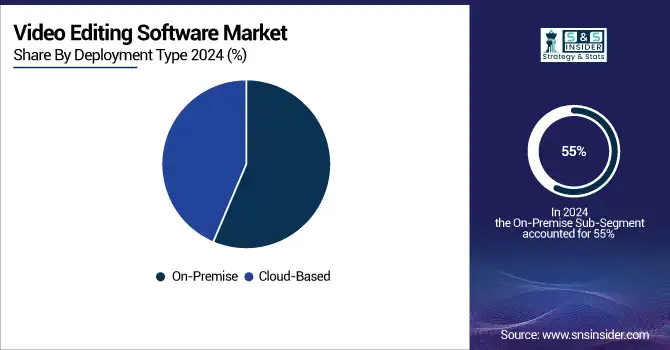

By Deployment Type

This rise in demand for low-budget and easy-to-use solutions for video editing is driving the growth of the on-premise segment with more than 55% of revenue share in 2024. People in today's generation are investing much time in social media, making reels, content videos, and other kinds of entertainment stuff, which need cheaper and free software for editing and changing features. For Instance, in cheap and free video editing segments, DaVinci Resolve is famous and also provides tutorials for beginners to learn and edit. For Instance, with the various editing features DaVinci earned a revenue of around USD 7-8 Billion in 2023.

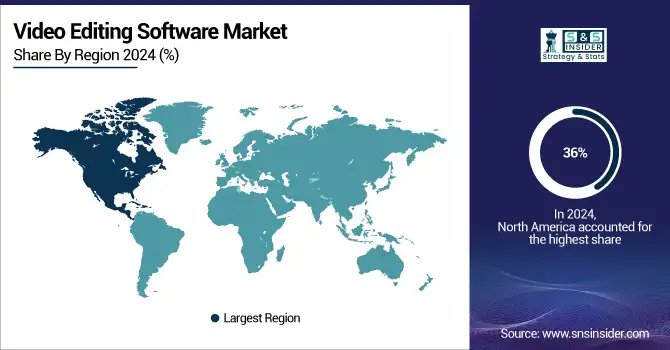

Video Editing Software Market Regional Analysis:

North America Video Editing Software Market Trends:

North America is the leading region with more than 36% market share in the Global Video Editing Software Market in 2024, due to the reason that some of the leading video editing companies (like Adobe and Apple) are located in this area. Also, video editing software has huge potential due to the high demand in the local market in this direction for producing videos.

Need any customization research/data on Video Editing Software Market - Enquiry Now

Europe Video Editing Software Market Trends:

Europe is expected to be the second-largest video editing software market in the world, with more than a quarter of global sales. Avid Technology and Corel Corporation are up there with the biggest video editing software companies in this area. The demand for video content in this domain is so huge that the other area growing quite well around it is indeed a market of Video Editing Software.

Asia-Pacific Video Editing Software Market Trends:

The video editing software market in Asia Pacific is expanding at a significant rate, during the forecast period. This region's market is expanding due to factors like the rising use of social media, businesses and organizations' growing need for video content, and the increased uptake of cloud-based video editing software.

Latin America and Middle East Video Editing Software Market Trends:

Latin America and the Middle East are experiencing steady growth, driven by rising digital content creation, expanding social media penetration, and adoption of affordable and cloud-based video editing software solutions.

Video Editing Software Market Key Players:

-

Autodesk, Inc.

-

Adobe, Inc.

-

CyberLink Corporation

-

Corel Corporation

-

Apple, Inc.

-

Avid Technology, Inc.

-

TechSmith Corporation

-

Magix Software GmbH

-

ArcSoft, Inc.

-

Wondershare Technology Group Co., Ltd.

-

Blackmagic Design

-

Movavi

-

FXHome (HitFilm)

-

Pinnacle Studio (Corel)

-

Lightworks

-

Shotcut

-

Kdenlive

-

VSDC Free Video Editor

-

Clipchamp (Microsoft)

-

InShot

Video Editing Software Market Competitive Landscape:

Ozone, established in 2021 by Max von Wolff, is a San Francisco-based startup specializing in cloud-powered, AI-assisted video editing solutions. Dubbed the "Figma for video," Ozone enables real-time collaboration, automated editing tasks, and seamless cloud workflows. Targeting content creators and marketers, the platform offers features like auto-captioning, silence removal, and AI-generated media. Backed by Y Combinator and a $7.1 million seed funding round, Ozone is rapidly scaling its innovative approach to video production.

-

In November 2023, Ozone, the manufacturer of AI-driven video editing in the cloud raised seed funding from Y Combinator (a venture capital firm), to launch an Open beta that provides efficient video editing experience in less time and effectively.

Wondershare Technology Group Co., Ltd., founded in 2003 by Wang Wei, is a leading software development company headquartered in Shenzhen, China. The company specializes in multimedia, data recovery, and PDF solutions, offering a range of products including Filmora, PDFelement, Dr.Fone, and Recoverit. Wondershare's commitment to innovation has led to the development of user-friendly software solutions that empower individuals and businesses to achieve their goals.

-

Wondershare, AI-powered video editing program and Filmora has released new feature called, Filmora 13.1.0 to enhance the program's audio production capabilities. Along with enhanced AI music generation and text-to-speech, and new customization possibilities that meet the needs of video producers with greater diversity.

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.25 billion |

|

Market Size by 2032 |

USD 4.83 billion |

|

CAGR |

CAGR of 5.8 % From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• by Deployment Type (On-Premise and Cloud-Based) |

|

Regional Analysis/Coverage |

North America (USA, Canada, Mexico), Europe |

|

Company Profiles |

Autodesk, Inc., Adobe, Inc., CyberLink Corporation, Corel Corporation, Apple, Inc., Avid Technology, Inc., TechSmith Corporation, Magix Software GmbH, ArcSoft, Inc., Wondershare Technology Group Co., Ltd., Blackmagic Design, Movavi, FXHome (HitFilm), Pinnacle Studio (Corel), Lightworks, Shotcut, Kdenlive, VSDC Free Video Editor, Clipchamp (Microsoft), InShot |