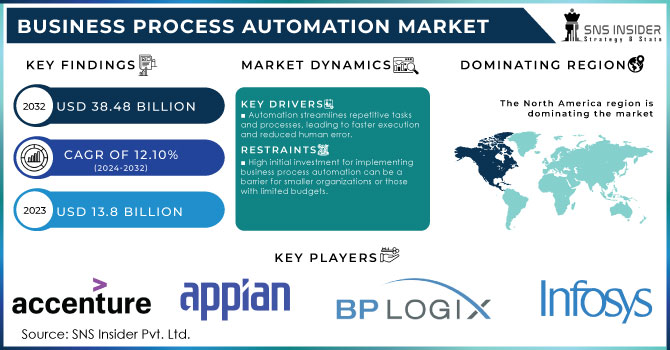

Business Process Automation Market Size:

The Business Process Automation Market size was valued at USD 13.8 Billion in 2023. It is expected to Reach USD 38.48 Billion by 2032 and grow at a CAGR of 12.10% over the forecast period of 2024-2032. Growing focus on the optimization of resources using automated business processes and communication between different business systems as well as advantages of utilizing IT process automation in an enterprise is further fuelling demand for Business Process Automation solutions & services globally. It helps in attaining maximum optimum of resources due to the elimination of manual intervention, which enables the workforce concentrate on their core competencies. BPA solutions unify the systems across an organization, which can lead to less overhead time and more efficient use of resources. Smartsheet also reveals that 69% of workers say automation could cut down on time wasted at work, and 59% think it might save them over six hours per week.

Get More Information on Business Process Automation Market - Request Sample Report

Organizations with global operations face challenges in onboarding employees, tracking performance, and managing HR functions. In a report published in 2024, it has been found out that about 55% of the enterprises in US have employed BPA solutions which is an increase of around 12% over last year this boost seems to indicate the increased popularity of digital transformation in U.S. companies looking for ways to do things faster and better. U.S. Business Automation Council survey in 2024, shows year-over-year growth in American companies' investments in BPA at a rate of about 18% The push to engage more automation in order enhance much-needed operational efficiencies and reduce cost.

AI technology further enhances BPA by optimizing and automating tasks performed by skilled experts. Customer experience which is a critical part of BPA also improve because it is the aiding factor for data cleaning and programmable automation as well as reporting in an efficient way. For example, The National Association of Software and Service Companies (NASSCOM) had reported a 60% increase in business efficiency as an effect resulting from automation. In customer service, BPA reduced response times to half helping improve service quality. 25% of companies are also currently using AI to screen resumes or job applications.

Drivers

-

Automation streamlines repetitive tasks and processes, leading to faster execution and reduced human error.

-

Automation reduces the need for manual intervention, which can significantly cut down on operational expenses.

-

Automation tools often come with advanced analytics capabilities, providing businesses with valuable insights into their processes.

-

The adoption of AI, machine learning, and other advanced technologies in automation systems enhances their capabilities, driving further growth in the market.

Business Process Automation (BPA) significantly boosts efficiency and productivity by streamlining repetitive tasks and optimizing workflows. Organizations recognized productivity gains from automating, that averaged in the 20% to 30 % range. In the year 2024, a study was conducted that businesses using BPA solutions are found to have recorded massive reductions up to around 25% in process cycle times and an increase of about 20% operational efficiency. Using automation for menial work, like data entry on the back end and order processing, invoice management or lead generation (among many others). BPA eliminate manual intervention, minimize human error and reduce time for task completion. for example, an automated invoicing system might be able to process thousands of invoices per day where manual processing can only handle a fraction of that volume. This efficiency gain is particularly impactful for industries with high transaction volumes, such as finance and retail. Automation allows already overworked employees to complete low-value-added tasks without requiring a significant amount of time and resources, thereby freeing them up to concentrate on activities that involve creativity or strategic vision. This, in return will boost up the productivity level and encourages innovation within the organizations. Companies that invested in automation technologies saw an average return on investment (ROI) of 30% within the first year, primarily due to gains in efficiency and productivity.

Restraints

-

High initial investment for implementing business process automation can be a barrier for smaller organizations or those with limited budgets.

-

Integrating automation solutions into existing systems and processes can be complex and time-consuming.

High investments at the beginning of setting up business process automation (BPA) is one of the major restraints in this market. The problem is that these costs can be high even for small and medium-sized enterprises (SMEs), which hampers their ability to automate. Another important constraint is the complexity of automation solution implementation. A 40% of organizations experience significant delays in automation projects due to integration issues and process alignment challenges. This has resulted in longer deployment timelines and budget overruns, with these 35% reporting that their automation projects have taken an average of six to twelve months more than initially planned. Most of the times, integrating automation tools with existing systems and processes demands specialized skills as well as thoughtful planning which can be a considerable obstacle for many organizations.

Segment Analysis

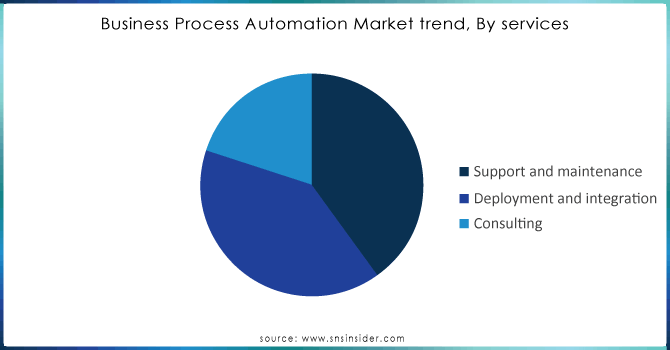

By Service

The Support and maintenance segment dominated the Business Process Automation (BPA) market with largest revenue share of more than 45% in 2023. Support and maintenance services are important as they resolve customer related concerns that directly affects their satisfaction. Software vendors usually have support teams dedicated to helping their customers, providing many services including customer and technical service portals post-deployment help, maintenance of software etc. To keep customer satisfaction high, service providers placed a great emphasis on further developing their product knowledge base. They did so by gathering information from customer interviews and surveys, enabling them to enhance their product. The support & maintenance services also serve as the single contact point to resolve customer issues, providing customers with easy help access. They also have facilities for customers to perform several other tasks like using customer portals, access forums and technical tips or download software update which is additional supportive aid. These resources assist users in understanding and using the software better, helping them to maximize their return on investment. These are the services which will built stronger customer relationships and add value to the overall consumer experience in turn bolstering robust growth of BPA market.

Need any customization research on Business Process Automation Market - Enquiry Now

By Deployment model

The on-premises segment dominated the market with significant market share of more than 65%. In this model where software or platforms are installed and operated on the premises of the customer utilizing their servers, computing infrastructure etc. The cost of installing these platforms is part of the company's Capital Expenditure CAPEX, as this includes owning these platforms. This is traditionally used in applications that deal with sensitive and confidential data.

Organizations collect data from a number of machine learning (ML), IT devices, sensors clickstreams and other gadgets. Organizations are able to use that data and ingest it into their own databases while using the on-premises deployment model in order security of this data This approach mandates the setup of adequate hardware and software at company premises, upkeep of such hardware or cyber securities measurements to be taken care-off by companies itself including training staffs, managing upgradation for versions as well facilitation for data backups in case parts crashed etc. For larger enterprises, the on-premises deployment model may be more viable given its especially high initial costs and manual effort requirements. These are the types of organizations that can usually afford and skilfully manage such installations. SMEs, on the other hand who face the problem of limited financial and human resources in being able to implement an on-premises BPA platform. In industries where the highest levels of data security and compliance are required, large organizations must maintain control over their own sensitive information. Hence, on-premises deployment of BPA is expected to have a significant share in the growth of the market over the forecast period.

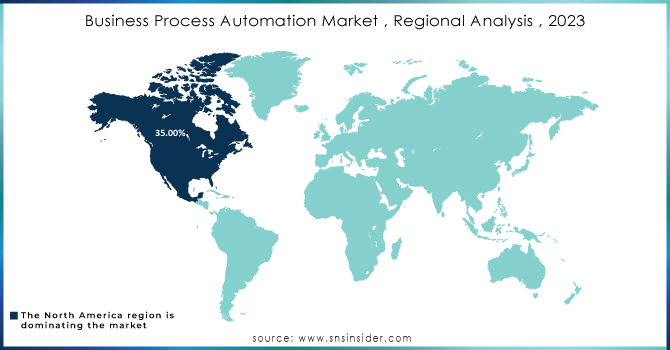

Regional analysis

In 2023, North America held the largest share with more than 35%. The world's largest economy, quick adoption of new technology, and the presence of major corporations like Appian Corporation, Genpact, and International Business Machine Corporation, among others, are all contributing factors to the rise of this region. The USA is considered one of the most lucrative markets for factory automation and industrial control systems, driven by industry 4.0 technology. According to the most recent statistics released by the U.S. Census Bureau in 2019, there are about 6.1 million employer enterprises in the United States. Additionally, a lot of firms in the region have made it possible for BPA to be widely used, fostering the expansion of the North American region. Organisations using BPA have achieved, on average, a 20% improvement in productivity. This gain is attributed to the automation of repetitive tasks and streamlined processes. In 2024 the 47% of U.S. businesses reported a reduction in manual processing time by 25% due to BPA implementation. This efficiency improvement enables workers to then focus on strategic tasks which builds the foundation for additional growth in business.

The highest CAGR of more than 20% is anticipated for Asia Pacific between 2024 and 2032. Growing economies like India, which is going through a significant digitization shift, might be help for the expansion of this region. In addition, the region is home to some of the world's most developed economies, such as China, Japan, and South Korea, which have been eager to adopt new technologies and hence propel the market's expansion. Due to their prominence as global manufacturing hubs, China and India have helped BPA become more widely used in the region's manufacturing sectors, which has fuelled its development. Demand in the Asia-Pacific region is expected to grow by 4.0X from 2024 to 2032. India is seen as a significant opportunity for the Business Process Automation market.

KEY PLAYERS

The major players in the Business Process Automation Market are Accenture, Appian Corporation, BP Logix, Inc., Genpact, Infosys Limited, International Business Machines Corporation, Kissflow Inc., Nintex Global Ltd., Open Text Corporation, Salesforce and other players

RECENT DEVELOPMENTS

-

UiPath launched platform upgrade adds AI and machine-learning-backed RPA (robotic process automation) capabilities aimed at improving operational efficiency while automating complex business processes in June 2023.

-

Microsoft announced in March 2023 that it would integrate Power Automate with its Azure AI services, enabling organizations to use automation powered by artificial intelligence for smarter workflows and data transformation.

-

In December 2022, IBM enhances its reliability and increased innovation in business process automation by leveraging new capabilities now available with the availability of advanced analytics to support AI powered decision making within their IBM Cloud Pak for Business Automation.

-

Nintex Global Ltd: In July 27, 2023, Nintex Global Ltd. announced that it has acquired Process Street, a low-code workflow automation platform. The acquisition will help Nintex expand its reach into the small and medium-sized business market.

| Report Attributes | Details |

| Market Size in 2023 | US$ 13.8 Bn |

| Market Size by 2032 | US$ 38.48 Bn |

| CAGR | CAGR of 12.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By component (Platforms, Services) • By services (Consulting, Deployment and integration, Support and maintenance) • By Deployment Type (Cloud, On premises) • By organization size (Small and Medium-sized Enterprises (SMEs), Large Enterprises) • By business function (Human Resource Automation, Supply Chain Automation, Accounting and Finance Automation, Sales and Marketing Automation, Customer Service Support Automation, Others) • By verticals (BFSI, Manufacturing, IT, Telecommunications, Retail and Consumer Goods, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Accenture, Appian Corporation, BP Logix, Inc., Genpact, Infosys Limited, International Business Machines Corporation, Kissflow Inc., Nintex Global Ltd., Open Text Corporation |

| Key Drivers | • Automation streamlines repetitive tasks and processes, leading to faster execution and reduced human error. • Automation reduces the need for manual intervention, which can significantly cut down on operational expenses. |

| Market Restraints | • There is a shortage of skilled resources in the business process automation market. |