Video Management System Market Report Scope & Overview:

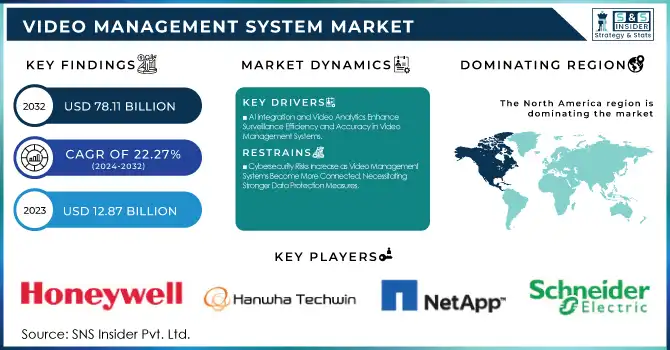

The Video Management System Market was valued at USD 15.73 billion in 2024 and is projected to grow at a USD 78.11 billion & CAGR of 22.27% by 2032.

To Get More Information on Video Management System Market - Request Sample Report

The report contains in-depth analysis on adoption rates of emerging technologies, user demographics in 2023, cost-effectiveness of VMS solutions, and increasing regulatory compliance adoption. Driven by advances in video surveillance technologies, increasing security concerns, and a need for effective video management solutions, the market encompasses industries like retail, transportation, and government.

Market Size and Forecast:

-

Market Size in 2024 USD 15.73 Billion

-

Market Size by 2032 USD 78.11 Billion

-

CAGR of 22.27% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Video Management System Market Trends:

-

Increasing integration of AI and video analytics in VMS for facial recognition, license plate detection, and anomaly monitoring.

-

Enhanced real-time threat detection and reduced manual intervention through predictive and automated analytics.

-

Growing adoption of AI-powered VMS in sectors such as retail, healthcare, and public safety.

-

Expansion of smart city initiatives driving demand for scalable, adaptive, and integrated video surveillance solutions.

-

Focus on urban infrastructure management, including traffic monitoring and crime prevention, using advanced VMS technologies.

Video Management System Market Growth Drivers:

-

AI Integration and Video Analytics Enhance Surveillance Efficiency and Accuracy in Video Management Systems.

The integration of artificial intelligence and video analytics into video management systems transforms the modern landscape of surveillance. AI-powered solutions enable advanced features such as facial recognition, license plate recognition, and anomaly detection, thereby greatly enhancing the capability to monitor and analyze large volumes of video in real time. Axis Communications highlighted how AI-based analytics helps enhance security with features such as facial recognition and anomaly detection that enhance threat detection accuracy and speed. The above technologies also help minimize manual intervention, enabling security personnel to spend more time on critical incidents. Predictive analytics also allow risks to be predicted before they develop into actual events, hence surveillance systems are more proactive. The adoption of AI-integrated VMS becomes indispensable in retail, healthcare, and public safety.

Video Management System Market Restraints:

-

Cybersecurity Risks Increase as Video Management Systems Become More Connected, Necessitating Stronger Data Protection Measures.

The video management system's tendency to be networked and have its storage in the cloud introduces more and more cybersecurity vulnerabilities with every step forward. The great expansion of networked surveillance and remote access capabilities leaves these systems even more susceptible to cyberattacks, such as hacking, data breaches, and ransomware. The average cost in 2024 for a data breach involving VMS was USD 4.88 million. Additionally, in January 2023, according to research more than 150 Motorola ALPR cameras in U.S. cities, including Nashville, exposed real-time video feeds and vehicle data due to security flaws. Organizations must have strong security measures to prevent unauthorized access and ensure data integrity, adding complexity to VMS deployment. This is an ongoing challenge requiring significant investment in cybersecurity infrastructure to secure systems against evolving threats.

Video Management System Market Opportunities:

-

Rising Demand for Integrated VMS Solutions in Smart Cities and Urban Infrastructure Development Drives Market Growth Opportunities.

As smart cities continue to evolve, the demand for integrated, advanced video surveillance solutions is unfolding at a great rate. VMS technologies are basically what signify the development of smart infrastructure in terms of urban planning, public safety, and more by ensuring traffic management. One of the most notable examples is the video surveillance system launched by Madrid in January 2025, which covers four districts with 83 AI-powered cameras, capable of facial recognition, license plate identification, and tracking movement, amidst growing privacy concerns and legal debates.These systems enable real-time monitoring of public spaces, promote efficient traffic flow, and minimize crime in congested areas. As cities continue to adopt smart infrastructure, there will be an increased demand for scalable, adaptive solutions, thereby providing VMS providers with ample growth opportunities in modern urban setting

Video Management System Market Segment Analysis:

By Technology

In 2024, the IP-based VMS segment dominated the Video Management System market with a 68% revenue share, driven by the growing demand for high-definition surveillance, remote monitoring, and integration with technologies like AI and cloud storage. Conversely, the Analog-based VMS segment is expected to grow at a CAGR of 24.34% from 2025 to 2032, fueled by the increasing adoption of cost-effective solutions, particularly in emerging markets where affordability and reliable performance are key considerations.

By Application

In 2024, the Security & Surveillance segment dominated the Video Management System market with a 31% revenue share, driven by the rising global security concerns and smart city initiatives. Meanwhile, the Data Integration segment is expected to grow at a 25.63% CAGR from 2025 to 2032, fueled by the increasing need for businesses to consolidate and analyze data from diverse sources like IoT devices and sensors, enhancing operational efficiency and data-driven decision-making.

By End-user

In 2024, the Government segment dominated the Video Management System market with a 30% revenue share, driven by increasing demand for public safety, crime prevention, and regulatory requirements. Meanwhile, the Transportation and Logistics segment is projected to grow at a 28.41% CAGR from 2025 to 2032, fueled by the need for enhanced security and operational efficiency in transportation networks. The integration of IoT and automation is expected to further boost demand for intelligent, data-driven surveillance systems.

By Deployment

In 2024, the On-premises segment led the Video Management System market with a 58% revenue share, driven by the demand for control, security, and local data management. Meanwhile, the Cloud segment is set to grow at a 23.24% CAGR from 2025 to 2032, fueled by the increasing need for scalable, cost-effective solutions with remote accessibility and secure data storage.

By Enterprise Size

In 2024, the Large Enterprise segment dominated the Video Management System market with a 69% revenue share, driven by substantial investments in scalable and integrated security solutions for critical infrastructure. Meanwhile, the Small & Medium-Sized Enterprise segment is expected to grow at a 23.73% CAGR from 2025 to 2032, fueled by the increasing affordability of cloud-based VMS solutions that offer cost-effective, scalable, and easy-to-manage options for enhancing security in smaller organizations.

By Component

In 2024, the Solution segment led the Video Management System market with a 70% revenue share, driven by the demand for integrated, scalable surveillance solutions offering real-time monitoring and data analysis. Meanwhile, the Services segment is expected to grow at a 24.29% CAGR from 2025 to 2032, fueled by the increasing need for installation, maintenance, and support services. The growing reliance on advanced VMS systems is boosting demand for expert consultation, system integration, and long-term service agreements.

Video Management System Market Regional Analysis:

North America Video Management System Market Insights

In 2024, North America has dominated the Video Management System market with largest revenue share of approximately 39%. The dominance is contributed by the region having sophisticated infrastructure, high demand for security solutions, and early adoption of cutting-edge technologies. Notably, governments, commercial sectors, and enterprises in North America are investing significantly in VMS to enhance safety, monitor critical infrastructure, and protect assets. Furthermore, the presence of key industry players and technological advancements in artificial intelligence, cloud computing, and analytics further strengthened the region's leading position in the market.

Asia Pacific Video Management System Market Insights

Asia Pacific is expected to grow at the fastest CAGR of 24.39% from 2025 to 2032. A key factor fueling its growth lies in the increasing urbanization in the region, growing security concerns, and the heightened requirement of surveillance systems in different sectors. Governments and private sector organizations in developing regions of China and India are investing in VMS solutions to uphold public safety, safeguard their assets, and back smart city initiatives. The growth is also being driven by the adoption of new technologies in the region and the expansion of transportation and logistics sectors. Asia Pacific is thus a key growth driver for the global VMS market.

Europe Video Management System Market Insights

Europe’s video management system market is growing steadily, driven by smart city initiatives, public safety investments, and rising adoption of AI-powered surveillance solutions. Strong regulatory frameworks and government funding for urban security projects accelerate deployment. Increasing demand for facial recognition, license plate identification, and predictive analytics in retail, transportation, and healthcare sectors further supports market expansion.

Latin America (LATAM) and Middle East & Africa (MEA) Video Management System Market Insights

The LATAM and MEA VMS markets are expanding due to rising urbanization, infrastructure development, and growing security concerns. Governments and enterprises are adopting AI-integrated VMS for traffic management, crime prevention, and public safety monitoring. Limited availability of skilled personnel and increasing investment in smart city projects create opportunities for scalable, advanced, and integrated video surveillance solutions across these regions.

Do You Need any Customization Research on Video Management System Market - Enquire Now

Video Management System Market Key Players:

-

Bosch (BVMS, DIVAR IP Recording Solutions)

-

Hanwha Techwin Co (Wisenet WAVE VMS, Wisenet SSM)

-

Honeywell International (MAXPRO VMS, Pro-Watch Video Management System)

-

Schneider Electric (Pelco VideoXpert Professional, Pelco VideoXpert Enterprise)

-

Axis Communications (AXIS Camera Station, AXIS Companion)

-

Johnson Controls International (exacqVision VMS, victor Video Management System)

-

Hikvision Digital (HikCentral Professional, iVMS-4200)

-

Dahua Technology (DSS Pro, SmartPSS)

-

Kedacom (KDVMS, KEDACOM NVRs)

-

Verint Systems (EdgeVMS, Nextiva Video Management Software)

-

Axxonsoft (Axxon Next, Axxon Intellect Enterprise)

-

Avigilon Corporation (Avigilon Control Center (ACC), Avigilon Cloud Services)

-

Panasonic i-PRO Sensing Solutions (Video Insight VMS, i-PRO MonitorCast)

-

Eagle Eye (Eagle Eye Cloud VMS, Eagle Eye CameraManager)

-

Arcules (Arcules Cloud VMS, Arcules Integrated Video and Access Control)

-

Rhombus (Rhombus VMS, Rhombus AI Analytics)

-

Qumulex (Qumulex QxControl, Qumulex QxVMS)

-

Pelco (VideoXpert Professional, VideoXpert Enterprise)

-

Genetec (Security Center Omnicast, Stratocast)

-

Verkada (Command Platform, Verkada Cameras)

-

Milestone Systems (XProtect Essential+, XProtect Corporate)

-

Identiv (Hirsch Velocity Software, 3VR Video Management System)

-

March Networks (Command Enterprise Software, Searchlight for Banking)

-

IndigoVision (Control Center, FrontLine Body Worn Cameras)

-

Qognify (Qognify VMS, Cayuga)

-

Senstar (Symphony VMS, Senstar Safe Spaces)

-

Exacq Technologies (exacqVision Professional, exacqVision Enterprise)

-

American Dynamics (Victor VMS, VideoEdge NVRs)

Competitive Landscape for Video Management System Market:

Hanwha Vision is a leading provider of video management system (VMS) solutions, offering AI-powered surveillance technologies for real-time monitoring and analytics. Its product portfolio includes advanced VMS platforms, cameras, and integrated security solutions designed for retail, public safety, transportation, and smart city applications. By combining scalability, automation, and predictive analytics, Hanwha Vision enhances security, operational efficiency, and situational awareness in modern surveillance environments.

-

In January 2025, Hanwha Vision introduced advanced AI-powered surveillance solutions at Intersec Dubai 2025, showcasing how AI can enhance security and operational efficiency across various industries.

Bosch is a global leader in video management systems, providing advanced AI-enabled surveillance solutions for real-time monitoring and analytics. Its offerings include VMS platforms, IP cameras, and integrated security systems tailored for smart cities, public safety, transportation, and commercial applications. Bosch’s solutions enhance situational awareness, operational efficiency, and proactive threat detection, supporting the growing demand for intelligent and scalable video surveillance.

-

In December 2024, Bosch announced the sale of its security and communications technology business, including its Video Management System (BVMS), to private equity firm Triton for over 1 billion euros (approximately 1.06 billion USD)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 15.73 Billion |

| Market Size by 2032 | USD 78.11 Billion |

| CAGR | CAGR of 22.27% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Technology (Analog-based VMS, IP-based VMS) • By Deployment (Cloud, On-premises) • By Enterprise Size (Small & Medium Size Enterprise, Large Enterprise) • By Application (Security & Surveillance, Intelligent Streaming, Advanced Video Management, Data Integration, Navigation Management, Storage Management, Others) • By End-user (BFSI, Government, IT & Telecommunication, Healthcare and Life Sciences, Manufacturing, Transportation and Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Bosch, Hanwha Techwin Co, Honeywell International, Schneider Electric, Axis Communications, Johnson Controls International, Hikvision Digital, Dahua Technology, Kedacom, Verint Systems, Axxonsoft, Avigilon Corporation, Panasonic i-PRO Sensing Solutions, Eagle Eye, Arcules, Rhombus, Qumulex, Pelco, Genetec, Verkada, Milestone Systems, Identiv, March Networks, IndigoVision, Qognify, Senstar, Exacq Technologies, American Dynamics. |