AI in Enterprise Communications and Collaboration Market Report Scope & Overview:

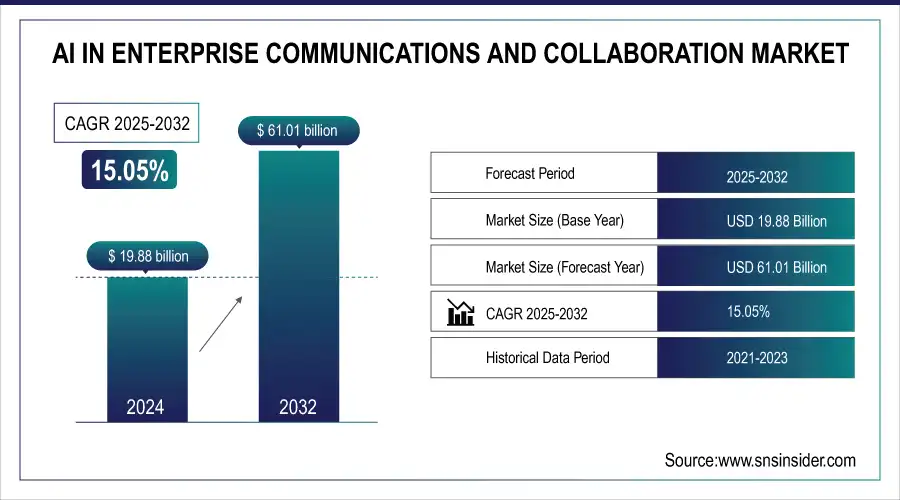

The AI in Enterprise Communications and Collaboration Market size was valued at USD 19.88 billion in 2024 and is expected to reach USD 61.01 billion by 2032, expanding at a CAGR of 15.05% over the forecast period of 2025-2032.

To Get more information on AI in Enterprise Communications and Collaboration Market - Request Free Sample Report

The AI in Enterprise Communications and Collaboration Market is rapidly expanding as organizations adopt AI to enhance communication, productivity, and workflow automation. Tools like intelligent virtual assistants, chatbots, NLP, and ML streamline internal processes, support hybrid work, and improve real-time collaboration. Cloud-based solutions are increasingly favored for their scalability and flexibility, while sectors such as IT & telecom, BFSI, healthcare, and retail lead adoption. AI integrations with platforms like Microsoft Teams, Zoom, and Slack are creating smarter, more responsive work environments.

Market Size and Forecast

-

AI in Enterprise Communications and Collaboration Market Size in 2024: USD 19.88 Billion

-

AI in Enterprise Communications and Collaboration Market Size by 2032: USD 61.01 Billion

-

CAGR: 15.05% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

AI in Enterprise Communications and Collaboration Market Trends

-

Rising demand for streamlined workflows and remote collaboration is driving AI adoption in enterprise communications.

-

Integration with chatbots, virtual assistants, and automated meeting tools is enhancing productivity and engagement.

-

Growing focus on real-time analytics and sentiment analysis is improving decision-making and team performance.

-

Adoption of cloud-based collaboration platforms is enabling scalability, flexibility, and seamless connectivity.

-

Increasing need for secure, compliant, and intelligent communication solutions is shaping market growth.

-

Expansion across IT, BFSI, healthcare, and manufacturing sectors is boosting adoption.

-

Collaborations between AI solution providers, software vendors, and enterprises are accelerating innovation and deployment.

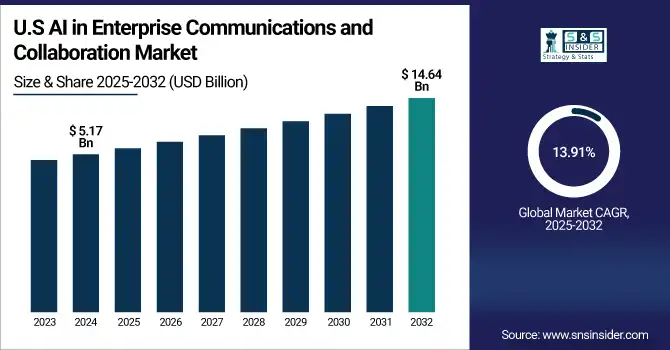

The U.S AI in Enterprise Communications and Collaboration Market size reached USD 5.17 billion in 2024 and is expected to reach USD 14.64 billion in 2032 at a CAGR of 13.91% from 2025 to 2032.

The United States dominates the AI in Enterprise Communications and Collaboration Market due to its robust digital infrastructure, high enterprise IT spending, and early adoption of AI-powered communication tools. Leading companies like Microsoft, Google, Cisco, and Zoom are headquartered in the U.S., enabling rapid innovation and integration of AI into business communication platforms. The widespread implementation of hybrid and remote work models has further driven demand for intelligent collaboration tools. Additionally, strong government initiatives supporting AI development and favorable regulatory frameworks encourage AI adoption.

AI in Enterprise Communications and Collaboration Market Growth Drivers:

-

Rising Adoption of AI-Driven Communication Tools to Support Remote and Hybrid Work Models Accelerates Market Expansion

The increasing shift toward hybrid and remote work environments has significantly driven the adoption of AI-based communication and collaboration tools. Enterprises are leveraging AI for real-time language translation, sentiment analysis, and automated meeting summarization to improve productivity and engagement across distributed teams. Tools such as Microsoft Teams, Google Meet, and Zoom have integrated AI capabilities to streamline communication and enhance decision-making. In 2025, Zoom launched new AI Companion features offering real-time feedback and meeting analytics, while Cisco introduced AI-based noise suppression and voice enhancement tools.

AI in Enterprise Communications and Collaboration Market Restraints:

-

Data Privacy and Compliance Concerns with AI-Based Communication Solutions Limit Broader Adoption Across Regulated Industries

As AI tools assume greater roles in genuine internal communications, the challenges of data privacy and regulatory compliance become more pressing. In some industries, such as healthcare, finance, and legal services, there are stringent regulations on the way a business handles and stores data, making it difficult for organizations to embrace AI-driven collaboration tools. Concerns around potential data misuse and not being compliant with GDPR, HIPAA, or other frameworks mean organizations are apprehensive about deploying AI-based enterprise collaboration tools.

AI in Enterprise Communications and Collaboration Market Opportunities:

-

Integration of Generative AI for Contextual Communication and Workflow Automation Opens New Growth Avenues for Enterprises

Generative AI is driving a new wave of transformational innovation in enterprise communications by tailoring the employee experience and automating low-level collaboration work. Products like Slack GPT and Microsoft Copilot allow employees to auto-generate messages, summarize threads, and pull real-time thread insight as part of a conversation. In 2025, Salesforce allowed business customers to use generative AI to inject intelligence into communication workflows across CRM platforms by launching Einstein Copilot Studio. Tools and products like this lower cognitive load, increase the speed of responses, and help provide contextual support during conversations through meetings or messaging, thus improving their productivity.

AI in Enterprise Communications and Collaboration Market Challenges:

-

Limited AI Literacy Among Enterprise Users Slows Effective Utilization and ROI from Communication Platforms

As AI tools are quickly being incorporated into enterprise sites, there are related issues where enterprise employees do not have the familiarity and understanding of how best to use these features. Employees are often unaware of the unused AI features and/or do not value their usefulness, such as real-time suggestions, voice assistants, and sentiment monitoring. As a result, when organizations adopt any advanced platform, future functionality is left unused or underutilized, affecting full return on investment for the organization. Additionally, the digital skills gap affects the adoption of AI tools by mid-market organizations and organizations that are not technology-based.

AI in Enterprise Communications and Collaboration Market Segment Analysis

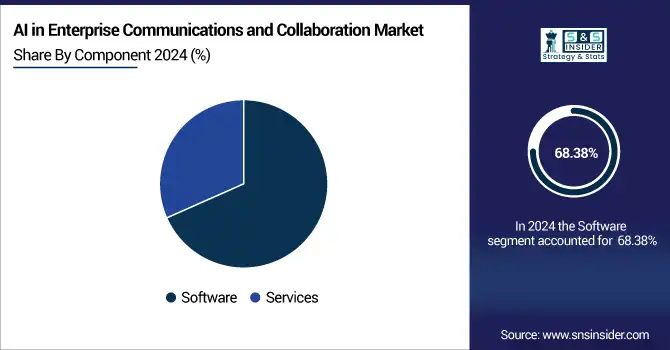

By Component, Software dominates the AI in Enterprise Collaboration market. Services are expected to grow fastest.

The software segment accounted for the largest share of revenue in 2024, capturing 68.38% of the market. This dominance is fueled by the rising adoption of AI-powered tools such as automated meeting assistants, real-time transcription, and smart scheduling systems. Companies like Microsoft rolled out AI-enhanced Teams Premium, while Zoom launched its AI Companion to improve meeting productivity. The demand for intelligent automation to streamline communication workflows is the key driver behind the growth of the software segment in this market.

The services category is expected to grow the fastest with a projected CAGR of 15.74% over the forecast period. The increase is due to increasing enterprise reliance on AI integration services, deployment assistance, and customized AI communication services. Salesforce expanded its consulting business with the integration of Einstein GPT, and Cisco grown its Webex analytics services through an AI perspective. The rising complexity of enterprise systems, combined with the need for customized AI deployment, is driving the growth of this category.

By Deployment, Cloud-based solutions dominate the market. On-premises deployment is expected to grow fastest.

Cloud-based solutions dominated the market in 2024, accounting for 62.48% of total revenue. Enterprises are increasingly favoring cloud-based AI collaboration platforms for their scalability, flexibility, and cost-efficiency. Google enhanced Workspace with live AI-based summarization and translation features, while Microsoft expanded Copilot capabilities across cloud-based Office 365. The widespread shift to hybrid work environments and the need for real-time, secure access to collaboration tools continue to fuel cloud-based adoption.

The on-premises segment is growing at the fastest rate, with a CAGR of 15.71% during the forecast period. This surge is primarily driven by heightened concerns around data privacy and industry-specific compliance mandates. IBM advanced its Watson Assistant for on-premises environments, while Avaya integrated secure AI capabilities into its UC infrastructure. The need for localized control and the emergence of stricter AI governance are accelerating demand for on-premises deployment models.

By Technology, Chatbots dominate the market. Intelligent Virtual Assistants (IVAs) are expected to grow fastest.

Chatbots held the highest share among technologies in 2024, contributing 41.38% to the overall market. These tools have become essential in automating internal communications, handling HR queries, and managing IT service tickets. Microsoft Bot Framework and Google’s Dialogflow are widely used to enhance responsiveness and reduce administrative workload. The ability to deploy cost-effective, scalable automation is the primary driver for chatbot leadership in this segment.

Intelligent Virtual Assistants (IVAs) are the fastest-growing technology, with a CAGR of 16.32% through the forecast period. These AI solutions offer contextual task automation, voice-driven scheduling, and hands-free support. In 2024, Zoom enhanced its AI Companion with personalized productivity prompts, while Microsoft expanded Copilot features in enterprise applications. The rising need for intuitive, natural language interfaces and multitasking capabilities in business environments is pushing rapid IVA adoption.

By Industry Vertical, IT and telecommunications dominate the market. Healthcare is expected to grow fastest.

The IT and telecommunications sector emerged as the top contributor in 2024, generating 29.46% of the total market revenue. This segment benefits from high digital maturity and continuous demand for agile communication systems. Cisco introduced predictive meeting insights through Webex, while Salesforce integrated Einstein GPT with Slack to optimize collaboration. Strong emphasis on workflow automation, system integration, and real-time analytics drives robust AI adoption in this sector.

The healthcare segment is the fastest-growing industry vertical, projected to expand at a CAGR of 16% during the forecast period. Growth is being driven by the increasing use of AI in patient communications, virtual consultations, and medical scheduling. In 2024, Microsoft launched Azure Health Bot with clinical AI capabilities, and Zoom enhanced its HIPAA-compliant AI features. The urgent need for scalable, secure, and intelligent communication systems is accelerating AI adoption in the healthcare ecosystem.

AI in Enterprise Communications and Collaboration Market Regional Analysis

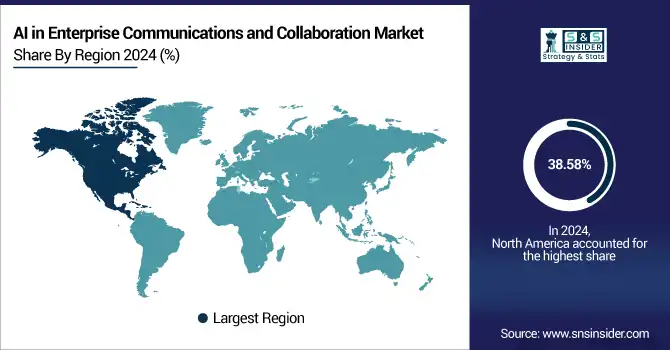

North America AI in Enterprise Communications and Collaboration Market Insights

North America leads the global market, accounting for 38.58% of revenue share in 2024. The region benefits from early adoption of AI technologies, strong cloud infrastructure, and a concentration of leading tech giants like Microsoft, Google, and IBM. Robust enterprise IT budgets and a growing remote workforce further drive investment in AI-powered communication tools and collaboration platforms across sectors such as BFSI, healthcare, and telecom. The United States dominates the region due to its advanced digital infrastructure, high AI R&D spending, and the presence of global AI providers offering cutting-edge enterprise solutions tailored to large-scale operations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe AI in Enterprise Communications and Collaboration Market Insights

Europe continues to expand steadily in the AI enterprise communication space, supported by GDPR-compliant solutions and rising adoption in financial services, manufacturing, and government sectors. Cloud providers are investing in sovereign AI technologies and green data centers to meet sustainability and privacy demands. Germany is the leading country in Europe, driven by its strong enterprise sector, industrial digitization initiatives, and increasing integration of AI with enterprise software and communication platforms.

Asia Pacific AI in Enterprise Communications and Collaboration Market Insights

Asia Pacific is the fastest-growing region, with a CAGR of 21.59%, fueled by rapid digitalization, expanding enterprise ecosystems, and growing investment in cloud and AI technologies. Countries such as China, India, and Singapore are witnessing a surge in demand for intelligent collaboration platforms to support large, distributed workforces. China leads the region due to large-scale AI infrastructure investments, strong government support for AI development, and adoption of enterprise AI tools across both state-owned and private corporations.

Middle East & Africa and Latin America AI in Enterprise Communications and Collaboration Market Insights

The Middle East & Africa and Latin America regions are steadily advancing in AI-driven enterprise communications, fueled by digital transformation strategies, smart city initiatives, and growing sectors like healthcare, fintech, and government. The UAE leads in MEA with strong government backing and early adoption, while Brazil dominates Latin America with a vibrant tech ecosystem and rising cloud infrastructure investments.

AI in Enterprise Communications and Collaboration Market Competitive Landscape:

Microsoft Corporation

Microsoft Corporation is a global technology leader specializing in software, hardware, cloud computing, and enterprise solutions. With a strong presence in productivity and collaboration tools, Microsoft drives digital transformation for organizations worldwide. Its Microsoft 365 suite, including Teams, Outlook, and Azure cloud services, enables seamless communication, workflow automation, and enterprise-grade security. Microsoft focuses on integrating AI and intelligent automation into its platforms to enhance efficiency, decision-making, and remote and hybrid workforce collaboration.

2025 – Microsoft Corporation Launched AI-powered unified communications in Microsoft Teams Phone, enabling flexible calling, AI-driven customer insights, and seamless global collaboration within Microsoft 365 for mobile and hybrid workforces.

Amazon.com, Inc. (AWS)

Amazon.com, Inc., through its AWS division, is a global leader in cloud computing, AI, and enterprise technology solutions. AWS provides scalable infrastructure, AI services, and enterprise tools to drive digital innovation and automation. With offerings like Amazon Bedrock, Amazon Connect, and AI agent frameworks, AWS enables organizations to build secure, intelligent, and cloud-based enterprise communication systems, enhancing productivity, scalability, and customer engagement across industries.

-

2025 – Amazon.com, Inc. (AWS)Introduced Amazon Bedrock AgentCore, a secure, scalable toolkit for building and deploying enterprise-grade AI agents on AWS, supported by a USD 100 million investment in the Generative AI Innovation Center.

-

2025 – Amazon.com, Inc. (AWS) Signed a strategic collaboration with Kore.ai to integrate AI-powered enterprise communications and agent solutions (Bedrock, Amazon Q, Amazon Connect), accelerating AI agent adoption in enterprise environments.

Salesforce (Slack)

Salesforce, a leading customer relationship management (CRM) provider, offers Slack as a collaboration platform, integrating communication, workflow, and AI-driven productivity tools. Slack enhances enterprise communication with messaging, file sharing, and automation, while Salesforce’s ecosystem enables secure, scalable enterprise collaboration. Salesforce continuously integrates AI and data-driven insights into Slack, providing intelligent workflows, secure enterprise data management, and optimized collaboration for hybrid and remote workforces globally.

-

2025 – Salesforce (Slack) Updated Slack plans in June to enhance access to Salesforce, security, and AI features broadening enterprise users’ access to AI-driven collaboration tools. (slack.com)

-

2025 – Salesforce (Slack) Revised Slack’s terms of service to restrict third-party AI access to Slack data reinforcing data security and customer control in enterprise collaboration workflows.

-

2024 – Slack Rolled out Slack AI, a suite of generative AI features that summarize threads, recaps channels, and extract institutional knowledge, significantly boosting productivity in everyday workflows.

Key Players

The major key players of the AI in Enterprise Communications and Collaboration Market

-

Afiniti

-

Amazon.com, Inc.

-

Audeering

-

Cisco

-

Google

-

International Business Machines Corporation (IBM)

-

Microsoft Corporation

-

Salesforce

-

Slack

-

Zoom

-

Adobe Inc.

-

Oracle Corporation

-

ServiceNow

-

RingCentral, Inc.

-

Genesys

-

Five9, Inc.

-

Workday, Inc.

-

Atlassian Corporation Plc

-

Freshworks Inc.

-

ZoomInfo Technologies LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.88 Billion |

| Market Size by 2032 | USD 61.01 Billion |

| CAGR | CAGR of 15.05% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component, (Software, Services) •By Deployment, (On-premises, Cloud-Based) •By Technology, (Intelligent Virtual Assistants, Chatbots, Natural Language Processing, Machine Learning, Others) •By Industry Vertical, (IT and Telecom, Healthcare, BFSI, Manufacturing, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Afiniti, Amazon.com, Inc., Audeering, Cisco, Google, International Business Machines Corporation (IBM), Microsoft Corporation, Salesforce, Slack, Zoom, Adobe Inc., Oracle Corporation, ServiceNow, RingCentral, Inc., Genesys, Five9, Inc., Workday, Inc., Atlassian Corporation Plc, Freshworks Inc., ZoomInfo Technologies LLC |