Geomarketing Market Report Scope & Overview:

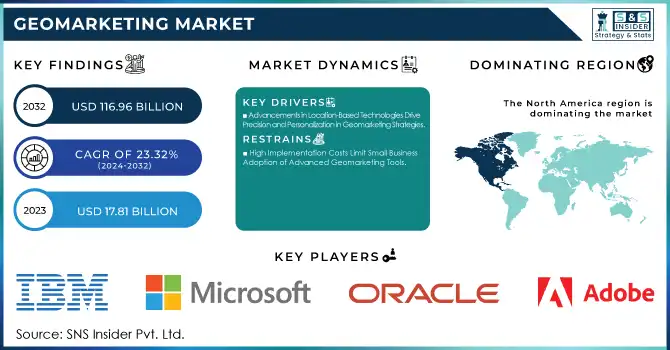

The Geomarketing Market was valued at USD 17.81 billion in 2023 and is expected to reach USD 116.96 billion by 2032, growing at a CAGR of 23.32% from 2024-2032.

To Get More Information on Geomarketing Market - Request Sample Report

The geomarketing market is experiencing rapid growth, fueled by the growing dependence on location-specific data and sophisticated analytics. As companies aim to enhance their marketing tactics, geographic knowledge has proven essential for refining decision-making and reaching the appropriate customers. The combination of GIS and spatial data allows businesses to improve their campaigns, aiding in the continuous growth of the market. The increase in demand for tailored marketing has further expedited this trend, as companies acknowledge the significance of engaging consumers according to their geographical preferences. Indeed, 70% of consumers show a readiness to accept tailored offers according to their location, and with almost 60% of online searches currently happening on mobile devices, the importance of location-based targeting has become increasingly vital.

This demand is especially apparent in the retail, real estate, and tourism sectors, where location significantly influences customer interaction. As customers progressively demand individualized and localized experiences, companies are utilizing geospatial data to create customized marketing tactics and product solutions. Actually, in October 2024, HERE Technologies launched an EV charge-aware routing service in India, aimed at alleviating range anxiety for electric vehicle users by offering dynamic routes that consider elements such as battery level, traffic conditions, and accessible charging stations. Moreover, the surge in mobile devices and the increasing integration of IoT technologies have established a setting where real-time, location-based marketing is essential for successful customer interaction and engagement. These elements are boosting the need for geomarketing solutions, promoting expansion in the industry.

Looking to the future, the geomarketing market holds significant opportunities, especially with emerging technologies like AI, machine learning, and big data analytics. In 2023, Oracle integrated AI into its cloud apps, enhancing location-based marketing with personalized, data-driven campaigns. IBM's 2024 consumer study also underscores AI’s role in transforming retail, with consumers seeking personalized, seamless, and sustainable experiences through tools like virtual assistants and inventory management. These technologies enable businesses to gain deeper insights into consumer behavior, fostering more sophisticated marketing strategies. Moreover, the development of augmented reality and the expansion of 5G networks will open new opportunities for hyper-targeted, location-based marketing. As a result, the geomarketing market is poised for continued growth, offering innovative ways to engage consumers in more personalized and localized ways.

Geomarketing Market Dynamics

Drivers

-

Advancements in Location-Based Technologies Drive Precision and Personalization in Geomarketing Strategies

The rapid development of location-based technologies, such as GPS, IoT devices, and advanced mobile systems, is transforming the geomarketing landscape. These innovations enable businesses to access real-time data on consumer movements, behaviors, and preferences with remarkable precision. As a result, marketers can tailor their strategies to deliver highly personalized, location-specific content and offers. This increased ability to target customers based on their geographical location enhances engagement and conversion rates, making it a valuable tool for both large enterprises and small businesses alike. Moreover, as mobile device usage continues to rise, the integration of location-based technologies into marketing platforms becomes more seamless, unlocking new opportunities for location-driven campaigns. Businesses that leverage these advancements can optimize their marketing efforts, gain deeper insights into consumer habits, and ultimately drive more effective customer acquisition and retention strategies

-

Big Data and Personalized Marketing Drive Targeted, Effective Geomarketing Strategies for Businesses

The rise of big data and advanced analytics is revolutionizing how businesses approach marketing. The growing availability of large, diverse datasets including detailed consumer behavior insights enables companies to make more informed decisions and tailor their campaigns with unmatched precision. By analyzing vast amounts of data, businesses can identify patterns, predict future trends, and segment their target audiences more effectively. This enables marketers to design highly personalized experiences that resonate with individual consumers based on their preferences and actions. Moreover, the ability to leverage data to craft custom offers and targeted promotions boosts customer engagement and conversion rates. As consumer expectations for personalized experiences grow, businesses that effectively harness big data and analytics will continue to lead in the competitive geomarketing space, ensuring better customer acquisition, retention, and overall satisfaction.

Restraints

-

High Implementation Costs Limit Small Business Adoption of Advanced Geomarketing Tools

The integration of advanced geomarketing tools, such as GPS technology, big data analytics, and location-based marketing platforms, often requires significant upfront investment. For smaller businesses, the costs associated with acquiring and deploying these technologies can be prohibitively high. These expenses include not only the purchase of the necessary software and hardware but also the costs of training staff, maintaining systems, and ensuring smooth integration with existing marketing strategies. As a result, many small businesses may hesitate to adopt geomarketing solutions, despite the potential benefits. Furthermore, the ongoing operational costs such as data storage, analytics services, and software updates can add to the financial burden. This high cost of entry creates a barrier for smaller businesses, limiting their ability to leverage the advantages that geomarketing offers compared to larger competitors with more substantial budgets.

-

Data Privacy Concerns Limit Consumer Trust and Adoption of Location-Based Geomarketing Strategies

Location-based marketing, a core aspect of geomarketing, relies heavily on collecting and utilizing personal data to offer targeted services and promotions. However, concerns about data privacy and security are growing among consumers. As businesses gather detailed information about consumer movements, behaviors, and preferences, many individuals worry about how their data is being used, stored, and shared. The lack of transparency or control over personal information can result in skepticism and distrust, leading to hesitation in adopting services that rely on such data. Moreover, data breaches and misuse of personal information by companies can exacerbate these concerns, causing consumers to opt-out of location-based marketing or avoid engaging with certain brands. This growing unease about data privacy creates challenges for businesses, limiting the full potential of geomarketing solutions and slowing widespread adoption.

Geomarketing Market Segment Analysis

By Component

The Software segment dominated the Geomarketing Market in 2023, capturing a substantial revenue share of approximately 69%. This dominance can be attributed to the increasing reliance on advanced software solutions that enable businesses to collect, analyze, and leverage location-based data effectively. As companies prioritize data-driven decision-making, software tools that integrate geographic information systems , big data analytics, and machine learning have become essential in delivering targeted marketing strategies and improving customer engagement. The high demand for scalable, customizable, and real-time software solutions further contributed to this segment's market leadership.

The Services segment is projected to grow at the fastest CAGR of about 24.93% from 2024 to 2032. This growth is driven by the increasing need for businesses to not only implement geomarketing solutions but also to ensure their ongoing optimization and support. As more companies adopt geomarketing strategies, the demand for consulting, system integration, and maintenance services has surged. These services help businesses maximize the value of their investments in software, ensuring effective implementation and continuous adaptation to evolving market needs.

By Location

The Outdoor segment led the Geomarketing Market in 2023, capturing approximately 61% of the revenue share. This dominance can be attributed to the growing adoption of location-based advertising in outdoor environments, such as billboards, transit ads, and digital signage. Outdoor advertising leverages real-time data to target specific audiences based on geographic location, significantly enhancing campaign effectiveness. With an increasing number of brands looking to engage consumers on the move, the outdoor segment's ability to provide large-scale, high-visibility marketing solutions solidified its market leadership.

The Indoor segment is expected to grow at the fastest CAGR of about 39% from 2024 to 2032. This rapid growth is driven by the rising demand for hyper-targeted marketing within indoor spaces, such as shopping malls, airports, and retail stores. As businesses seek to engage customers in more personalized ways, indoor geomarketing solutions enable precise tracking and tailored offers based on consumers' real-time location within these venues. The shift towards enhancing customer experience and the increasing integration of technologies like Bluetooth and Wi-Fi positioning systems are fueling the growth of the indoor segment.

By End Use

The Retail & E-Commerce segment dominated the Geomarketing Market in 2023, holding the largest revenue share of approximately 30%. This dominance is driven by the increasing reliance on location-based marketing to enhance customer targeting and drive sales. Retailers and e-commerce platforms leverage geomarketing to deliver personalized offers, promotions, and recommendations to consumers based on their proximity and past behaviors. With the rise of omnichannel shopping experiences, these businesses are utilizing geomarketing solutions to seamlessly connect online and offline consumer interactions, making this segment a major contributor to market growth.

The Travel & Hospitality segment is expected to experience the fastest CAGR of about 27.84% from 2024 to 2032. The surge in demand for personalized travel experiences and services is the key factor behind this rapid growth. Travel companies are increasingly using geomarketing to offer real-time, location-based services, such as tailored promotions, itineraries, and recommendations. With the growing trend of mobile-enabled travel solutions and the importance of delivering highly targeted offers to consumers at the right place and time, this segment is poised for significant expansion in the coming years.

Regional Analysis

North America dominated the Geomarketing Market in 2023, capturing approximately 38% of the revenue share. This market leadership is largely attributed to the region's advanced technological infrastructure and high adoption of location-based marketing solutions across industries such as retail, e-commerce, and real estate. Companies in North America are quick to embrace innovative geomarketing tools, utilizing data analytics, GPS technology, and mobile platforms to enhance customer engagement and personalize marketing strategies. The region's strong focus on digital transformation and consumer-driven marketing strategies further solidified its dominance in the market.

Asia Pacific is expected to experience the fastest CAGR of about 25.19% from 2024 to 2032. This rapid growth can be attributed to the region's increasing digitalization, growing smartphone penetration, and the rising demand for personalized marketing experiences. As businesses in countries like China, India, and Japan recognize the potential of location-based marketing, the adoption of geomarketing solutions is expanding rapidly. Additionally, the region's booming e-commerce and retail sectors, coupled with the emergence of smart cities, are driving significant investments in geomarketing technologies, positioning Asia Pacific for continued growth in the coming years.

Do You Need any Customization Research on Geomarketing Market - Enquire Now

Key Players

-

IBM Corporation (IBM Watson, IBM Cloud)

-

Microsoft Corporation (Azure Maps, Power BI)

-

Cisco Systems Inc. (Cisco Meraki, Cisco Digital Network Architecture)

-

Oracle Corporation (Oracle Cloud Infrastructure, Oracle Spatial and Graph)

-

Adobe Inc. (Adobe Analytics, Adobe Experience Cloud)

-

Salesforce.com Inc. (Salesforce Marketing Cloud, Salesforce Maps)

-

Qualcomm (Qualcomm Location Services, Qualcomm Atheros)

-

Xtremepush (Xtremepush Platform, Xtremepush Location-based Marketing)

-

Software AG (webMethods, Cumulocity IoT)

-

MobileBridge (MobileBridge Engage, MobileBridge Insights)

-

Saksoft (Saksoft IoT Solutions, Saksoft Data Analytics)

-

Google (Google Maps Platform, Google Ads)

-

Ericsson (Ericsson Location Services, Ericsson IoT Accelerator)

-

ESRI (ArcGIS Online, ArcGIS Business Analyst)

-

Cloud4Wi (Cloud4Wi Engagement, Cloud4Wi Insights)

-

HERE Technologies (HERE Location Services, HERE Indoor Positioning)

-

Plot Projects (PlotProjects Analytics, PlotProjects API)

-

HYP3R (HYP3R Location Marketing, HYP3R Audience Segmentation)

-

Reveal Mobile (Reveal Mobile Insights, Reveal Mobile Proximity)

-

Galigeo (Galigeo for Salesforce, Galigeo Location Intelligence)

-

Navigine (Navigine Indoor Navigation, Navigine Analytics)

-

CleverTap (CleverTap Engage, CleverTap Insights)

-

Airship (Airship Engagement, Airship Personalization)

-

Bluedot Innovation (Bluedot Location Intelligence, Bluedot Geofencing)

-

Foursquare (Foursquare Places, Foursquare Attribution)

-

Brillio (Brillio Location Analytics, Brillio Data Engineering)

-

Purple WiFi (Purple WiFi Analytics, Purple Guest WiFi)

-

GeoMoby (GeoMoby Location Analytics, GeoMoby Push Notifications)

-

Carto (CARTO Builder, CARTO for Location Intelligence)

-

Quuppa (Quuppa RTLS, Quuppa Positioning System)

Recent Developments:

-

IBM and Microsoft Open New Experience Zones (September 2024):

IBM and Microsoft opened three new IBM-Microsoft Experience Zones within IBM's Client Innovation Centers, providing businesses with access to location-based services powered by AI, hybrid cloud, and other Microsoft technologies to enhance customer engagement and improve geomarketing efforts. -

Cisco’s AI-Enabled ICT Workforce Consortium (April 2024):

Cisco, along with companies like IBM and Microsoft, launched an initiative focused on using AI to reshape the workforce. This AI-driven approach can also impact location-based marketing by allowing companies to understand customer behaviors in real-time and target consumers more accurately through geomarketing strategies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.81 Billion |

| Market Size by 2032 | USD 116.96 Billion |

| CAGR | CAGR of 23.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment Mode (Cloud, On-Premises) • By Location (Indoor, Outdoor) • By End Use (BFSI, IT & Telecommunication, Retail & E-Commerce, Media & Entertainment, Travel & Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Microsoft Corporation, Cisco Systems Inc., Oracle Corporation, Adobe Inc., Salesforce.com Inc., Qualcomm, Xtremepush, Software AG, MobileBridge, Saksoft, Google, Ericsson, ESRI, Cloud4Wi, HERE Technologies, Plot Projects, HYP3R, Reveal Mobile, Galigeo, Navigine, CleverTap, Airship, Bluedot Innovation, Foursquare, Brillio, Purple WiFi, GeoMoby, Carto, Quuppa |

| Key Drivers | • Advancements in Location-Based Technologies Drive Precision and Personalization in Geomarketing Strategies • Big Data and Personalized Marketing Drive Targeted, Effective Geomarketing Strategies for Businesses |

| RESTRAINTS | • High Implementation Costs Limit Small Business Adoption of Advanced Geomarketing Tools • Data Privacy Concerns Limit Consumer Trust and Adoption of Location-Based Geomarketing Strategies |