Water Softening Systems Market Report Scope & Overview:

Get More Information on Water Softening Systems Market - Request Sample Report

The Water Softening Systems Market size is expected to value at USD 2.91 billion in 2023 and is projected to reach USD 5.31 billion by 2032, with a growing CAGR of 6.9% over the forecast period 2024-2032.

The water softening systems market is experiencing significant growth, Rapid urbanization and the declining availability of fresh water are primary contributors to this trend. With more than 60% of the global GDP generated from urban areas, understanding the economic influence of these regions is critical. Urban centers are increasingly recognizing the importance of water softening systems as essential for ensuring the quality of water for residential, commercial, and industrial applications.

One of the key drivers behind the expansion of this market is the growing awareness of water quality issues among consumers. Hard water, which contains high levels of calcium and magnesium, can cause various problems, including scale buildup in plumbing and water-using appliances, as well as corrosion and performance degradation in industrial equipment. As consumers become more informed about the adverse effects of hard water, the demand for effective water softeners has surged, leading to increased sales and installations.

Technological advancements also play a crucial role in the market's growth. Innovations such as ion exchange resins, membrane filtration systems, and salt-free alternatives are making water softening more efficient and appealing to consumers. These advancements not only improve the effectiveness of water softening systems but also address concerns related to environmental impact, as many consumers seek more sustainable options. Moreover, stringent water quality standards enforced across various sectors including residential, commercial, and industrial are propelling the demand for water softening systems. These regulations necessitate the use of effective water treatment solutions, further enhancing market growth.

MARKET DYNAMICS

DRIVERS

- The rising awareness of hard water's detrimental effects on health and appliances is fueling consumer demand for water softening systems to enhance overall water quality.

The rising awareness of water quality issues, particularly concerning hard water, significantly drives the demand for water softening systems. Hard water, characterized by high levels of calcium and magnesium, can lead to several adverse effects on health and household appliances. Consumers are increasingly informed about these impacts, prompting them to seek effective solutions to enhance water quality in their homes.

Hard water can cause a range of health problems, such as skin irritation, dryness, and hair damage, making consumers more conscious of the water they use for daily activities. Additionally, hard water contributes to scale buildup in plumbing and appliances, reducing their efficiency and lifespan. For instance, water heaters, dishwashers, and washing machines are particularly affected, leading to costly repairs and replacements. As a result, consumers are recognizing the long-term financial benefits of investing in water softening systems to mitigate these issues. Moreover, health-conscious consumers are increasingly aware of the benefits of softened water for cooking and bathing. The desire for healthier lifestyles and improved well-being drives the demand for water softeners that can remove harmful minerals from the water supply. With a growing emphasis on water quality, manufacturers and service providers in the water treatment industry are responding by developing innovative and efficient water softening technologies. This increasing concern for water quality is a significant factor fueling the expansion of the water softening systems market, as consumers prioritize cleaner, safer, and more efficient water for their households.

- Technological advancements in water softening, like salt-free systems and reverse osmosis, improve efficiency and cater to eco-conscious consumers seeking sustainable water treatment solutions.

The rising awareness of water quality issues has significantly impacted consumer preferences and choices regarding water treatment solutions. With the negative effects of hard water such as scale buildup, reduced appliance lifespan, and potential health risks consumers are increasingly seeking effective solutions to enhance their water quality. This growing concern has prompted the adoption of advanced water softening technologies designed to address these challenges while aligning with environmental values. Technological advancements have led to the development of innovative water softening systems, such as salt-free softeners and reverse osmosis units. Salt-free systems use a different mechanism to condition water, preventing scale formation without adding sodium to the water supply. This appeals particularly to health-conscious consumers and those concerned about sodium intake, as traditional salt-based systems can contribute to elevated sodium levels in drinking water. Additionally, salt-free systems often require less maintenance and generate less waste, further enhancing their appeal.

Reverse osmosis, on the other hand, not only softens water but also effectively removes a wide range of contaminants, including heavy metals, chlorine, and other impurities. This multi-functionality makes it an attractive choice for consumers who prioritize comprehensive water quality. Together, these innovations in water softening technology not only meet the rising demand for high-quality water but also resonate with environmentally conscious consumers. As more individuals recognize the importance of water quality for health and sustainability, the demand for advanced water treatment solutions is likely to continue to grow, driving further innovation in the sector.

RESTRAIN

- Growing awareness of the health risks and damage caused by hard water drives consumers to seek effective water softening solutions to enhance water quality.

As awareness of the detrimental effects of hard water on health and appliances grows, consumers are increasingly prioritizing water quality in their households. Hard water can lead to various issues, such as scale buildup in pipes and appliances, skin irritations, and decreased efficiency in soap and detergent use. This concern drives demand for water softening systems, as consumers seek effective solutions to improve their water quality. However, while the awareness is rising, the high installation and maintenance costs of these systems can be a significant barrier for many. The initial investment required for purchasing and installing water softeners can be steep, especially for families in low-income regions. Additionally, ongoing maintenance costs, including salt replenishment and system upkeep, may discourage potential buyers, limiting the adoption of water softening solutions despite the pressing need for improved water quality. Thus, addressing these financial concerns is essential for expanding market reach.

KEY SEGMENTATION ANALYSIS

By Type

The salt-based type is dominating the market with a share of around 56.04% in 2023. This has been the most popular and commonly recognized type. By the help of ion exchange process, the systems use salt majorly sodium chloride in order to remove minerals from hard water which includes calcium and magnesium. Also, it prolongs the life of water-using appliances and is well-known for their efficiency in reducing hardness of water.

By Application

The Industrial application is dominating the market with a share of around 43.08% in 2023. Industries such as manufacturing, pharmaceuticals, food and beverage, need to deploy water-softening systems because large amount of water is required for the operations and these systems helps in removing the minerals that can lead to scaling and damage to machinery and equipment thus making it a primary factor in their dominance.

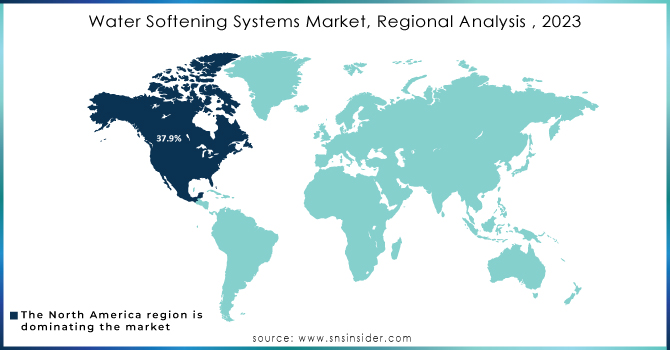

REGIONAL ANALYSIS

North America region is dominating the market with a share of around 37.9% of the total market. This dominance is because of its early adoption and high consciousness towards the environment. Chemicals and pollutants are affecting the water supply in the region because of evolving industrial and manufacturing operations. Almost 82% of homes are based on hard water regions, which is putting a pressure over the infrastructure. This is a key factor for the dominance of water softening systems in this region.

Need any customization research on Water Softening Systems Market - Enquiry Now

KEY PLAYERS

Some of the major key players of Water Softening Systems Market

-

Marlo Incorporated: (MARLO MGT Series Water Softener)

-

Kinetico Incorporated: (Kinetico Premier Series)

-

EcoWater Systems LLC: (EcoWater ESD 2752 Water Softener)

-

Culligan International Company: (Culligan High-Efficiency Water Softener)

-

General Electric Company: (GE SmartWater Water Softener)

-

Canature Environmental Products Co., Ltd: (Canature Whole House Water Softener)

-

Harvey Water Softeners Ltd: (Harvey TwinTec S4 Water Softener)

-

Pelican Water Systems: (Pelican Advantage Series)

-

BWT AG: (BWT Perla Silk Water Softener)

-

Evoqua Water Technologies: (Evoqua Ion Exchange Softener)

-

3M Purification Inc.: (3M Aqua-Pure Water Softener)

-

Pentair PLC: (Pentair Fleck 5600SXT)

-

A.O. Smith Corporation:(A.O. Smith Water Softening Systems)

-

Whirlpool Corporation (Whirlpool WHES40E Water Softener)

-

Vaillant Group: (Vaillant aquatec Soft VSC)

-

Honeywell International Inc.: (Honeywell Smart Home Water Softener)

-

Siemens AG: (Siemens AQUAtech Softening Systems)

-

WaterBoss Inc.: (WaterBoss 700 Water Softener)

-

Veolia Water Technologies: (Veolia Ionsoft Water Softener)

-

Hydrotech Water Softening Systems: (Hydrotech 89 Series)

RECENT DEVELOPMENTS

In February 2023: A.O. Smith Corporation introduced Aquasana OptimH2O Whole House Water Softener, a new water softening system that is intended to remove more hardness minerals than prior systems.

In June 2023: Culligan Water, introduced the first AI WatereBot, Cullie. The water industry trailblazer innovated this technology by using ChatGpt's conversational abilities to enhance website interactions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.91 Billion |

| Market Size by 2032 | USD 5.31 Billion |

| CAGR | CAGR of 6.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Salt Based, Salt Free) • By Application (Residential, Commercial, Industrial) • By Process (Ion Exchange, Distillation, Reverse Osmosis) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Marlo Incorporated, Kinetico Incorporated, EcoWater Systems LLC, Culligan, International Company, General Electric Company, Canature Environmental Products Co., Ltd, Harvey Water Softeners Ltd, Pelican Water Systems, BWT AG, Evoqua Water Technologies,3M Purification Inc,Pentair PLC, A.O. Smith Corporation, Whirlpool Corporation , Vaillant Group, Honeywell International Inc, Siemens AG, WaterBoss Inc, Veolia Water Technologies, Hydrotech Water Softening Systems |

| Key Drivers | • The rising awareness of hard water's detrimental effects on health and appliances is fueling consumer demand for water softening systems to enhance overall water quality. • Technological advancements in water softening, like salt-free systems and reverse osmosis, improve efficiency and cater to eco-conscious consumers seeking sustainable water treatment solutions. |

| RESTRAINTS | • Growing awareness of the health risks and damage caused by hard water drives consumers to seek effective water softening solutions to enhance water quality. |