Material Handling Equipment Market Report Scope & Overview:

To get more information on Material Handling Equipment Market - Request Free Sample Report

The Material Handling Equipment Market size was estimated at USD 216.77 Billion in 2023 and is expected to reach USD 353.67 Billion by 2032 at a CAGR of 5.59% during the forecast period of 2024-2032.

The robots have been adopted in the material handling sector, which has in turn, has altered the various operations and production processes. Several manufacturing facilities are using automated mobile robots in their production facilities to enhance productivity. Thus, the high usage of this equipment in the supply chain vertical will yield more profits to the delivery partners. Additionally, the industry will also respond once the demand for automation and usage of robots increases, which in turn, will increase the demand for more automated products.

Overall, as per firms’ private investment in industrial equipment and machinery, which is an indicator of the US economy, and thus, a healthy US economy will encourage activity in the other industries’ largest downstream markets. However, whether an increase in the investment in the industrial equipment and machinery upturn will stimulate and result in the expansion of demand and production of this product is yet to be seen. From the report, the market is expected to grow from factors like increased worker safety awareness, escalating demands for managing bulk materials, and industry 4.0 with the greater use of the Internet of Things. The market for this product will also have high demand because of the increased need to reduce downtime and the concern for enhancing supply chain efficiency. The Material Handling Equipment Market is being driven by the increased pace of adoption and the continuous technological developments in the market, which has led to the establishment of fully automated industrial facilities. Companies continue to modernize their production facilities and infrastructure to increase their production capacity.

Moreover, the e-commerce application segment is poised to witness substantial growth throughout the forecast period because of the increased adoption of shopping online mechanisms, large online retailers like Amazon, and the expansion of our logistics infrastructure. This means that several warehouse owners are investing in efficient material handling equipment to enhance the overall management of the supply chain.

In January 2023: Crown equipment corporation, expanded its product portfolio with Internal combustion and Electric counterbalance forklifts that can offer a carrying capacity up to 5.5 tons.

MARKET DYNAMICS

DRIVERS

The Material Handling Equipment Market is driven by e-commerce growth, automation, and warehouse expansion but faces high capital costs and regulatory challenges.

One of the most substantial drivers of the Material Handling Equipment Market is the exponential growth of e-commerce. Although only one decade ago, e-commerce has been a relatively limited market, it is now a global phenomenon that changes the behavior of consumers and forces the logistics industry to keep up with the pace. The need for fast and efficient supply chain operations contributes to the growing demand for advanced material handling systems. Specifically, the majority of the target systems, which include automated guided vehicles, conveyor systems, automated storage & retrieval systems, and warehouse robotics, serve the purpose of high-speed sorting, packing, and distributing large amounts of products. Moreover, the increasing frequency of omni-channel retail, where customers prefer that their online and offline shopping experiences with the same brand are smoothly integrated, adds to the complexity of logistics and requires more advanced material handling solutions.

Another factor that also contributes to that happening is that the most prominent e-commerce companies, such as Amazon, Alibaba, and Walmart, have been setting new standards for order fulfilment for all other businesses that want to remain competitive. Both the frequency and the speed of the order placement dictate that the warehouses work 24/7 and handle a great amount of goods, minimizing the time and resources spent on human intervention. In addition, the operation of these systems is connected with Warehouse Management Systems (WMS) and Warehouse Control Systems in order to improve accuracy, efficiency, and throughput.

The emphasis on worker safety and ergonomics drives the adoption of material handling equipment that reduces manual labor, minimizes injury risks, and enhances workplace efficiency.

The increasing emphasis on improving workplace safety and ergonomics is propelling the use of material handling equipment. In addition, the workplace manual handling of goods in warehouses or production floors often results in workplace injuries, which include musculoskeletal disorders. As companies have become more concerned about their workplace health and safety obligations, they have been investing in equipment that will significantly decrease the manual labor required and practically eliminate the risk generating injury.

Material handling systems include automated pallet jacks, lifting devices that reduce their ergonomic discomfort to workers, or robotic arms. These are designed to eliminate pressure on the physiques of the workers, resulting in a better and safer work environment. High level forklifts and pallet jacks that have been installed with sensors that will avoid collision with any objects in their proximity. Further, the robotic systems may handle parts that would have been impossible for human operators unassisted to lift. The result of using this machinery is not only safer workers but also better productivity. This is because tasks may be carried out more quickly, with fewer errors. Additionally, the integration of the ergonomic designs in the machinery ensures that the workers will operate the machinery at their comfort, minimizing the exhaustion of workers and exposure of workers to possible work injuries. Finally, the companies that have invested in material handling machines have detected that it significantly reduces their insurance costs and also that workers lose fewer workdays.

RESTRAIN

Complexity in system integration hinders the seamless adoption of new material handling technologies alongside existing systems.

Businesses often experience problems when they try to integrate the new material handling systems with the older technology they use. Many firms use both old equipment and new technologies, which are not always compatible. As a result, enterprises have to deal with some delays and additional costs while making sure that all the systems interact well and work efficiently at the same time.

In addition, the introduction of such tools and technologies as artificial intelligence, machine learning and the Internet of Things also requires extensive knowledge and preparations. Business owners need to hire employees who will work with this equipment; therefore, the operational costs increase as well.

Technological obsolescence poses a challenge as rapidly evolving innovations can quickly render material handling equipment outdated.

With the rapid technological evolution in the material handling sector, companies that invest in new equipment face the risk of experiencing technological obsolescence. Although a specific system is seen as cutting-edge at present, there are usually newer and more efficient types of systems in the consumer marketplace.

Therefore, firms may be discouraged from investing heavily in high-end material handling equipment because their acquisition could be considered as obsolete and lose their value relatively soon after implementation. Therefore, the need for continuous upgrading, and the possibilities that a firm’s rivals would adopt newer types of technologies, ultimately postpones some of these businesses’ decisions to make significant investments in material handling equipment.

Key Segmentation Analysis

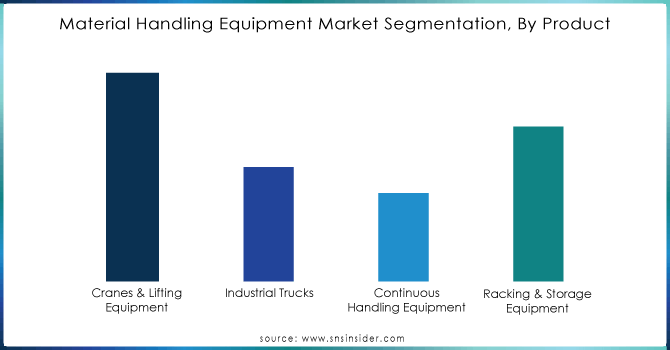

By Product

The cranes and lifting equipment segment dominated the market and accounted for over 38.2% share of the market revenue in 2023. Wide utilization in various end-use industries such as construction, manufacturing, motor vehicle lifts, and lifting accessories is anticipated to drive the market for material handling equipment. Continuous handling equipment assures smooth run picking, sorting, and packaging whereas traditional handling equipment is prone to picking errors.

Need any customization research on Material Handling Equipment Market - Enquiry Now

By Application

E-commerce segment led the market and accounted for over 32.6% share of the market revenue in 2023. Increased penetration of online shopping platforms, existence of large online merchants, and rising logistics infrastructure are expected to drive the demand for this product in the e-commerce industry. Several grocery stores have turned into convenience stores offering fast-food-like products such as frozen food, ready-to-eat products, and fresh items, thereby promoting the growth of the food industry.

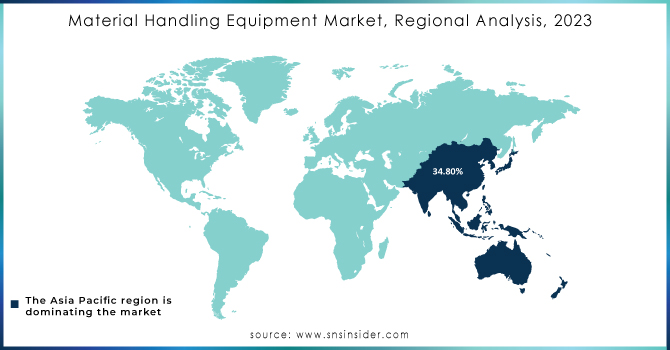

KEY REGIONAL ANALYSIS

The Asia-Pacific is dominating the Material Handling Equipment Market in 2023, and the market share more than 34.8%. The growth of the Asian market is attributed to the robust economic progress of India, China, and certain countries within ASEAN, with cumulative development of the market in the Asia Pacific. The growing investment in infrastructure development to develop larger logistics parks and delivery centers supporting the e-commerce shoppers entail the market size in the forecast period. Furthermore, China is estimated to witness phenomenal growth, with the country’s potential as the manufacturing hub for the equipment industry. Also, the country holds the largest market share with the growing automotive and manufacturing facilities supported by construction activities across the country.

KEY PLAYERS

The major key players are BEUMER GROUP, Daifuku Co., Ltd., Honeywell International, Inc., KION GROUP AG, Mecalux, S.A, Murata Manufacturing Co.., Ltd., SSI SCHAEFER, Swisslog Holding AG, TOYOTA INDUSTRIES CORPORATION, Vanderlande Industries B.V., and others

Recent Developments

In April 2023: Crown equipment corporation, a global manufacturer and supplier of material handling equipment has launched its newly developed SP1500 high level order pickers with pioneering features such as ergonomically developed operator compartment with customizable controls for quicker and safer order picking.

In March 2023: KION Group, a leader in the material handling equipment sector has made a strategic alliance with the Li-Cycle, a lithium-ion resource leader to strengthen their battery recycling and sustainability offerings position in the industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 216.77 Billion |

| Market Size by 2032 | USD 353.67 Billion |

| CAGR | CAGR of 5.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product(Cranes & Lifting Equipment, Industrial Trucks, Continuous Handling Equipment, Racking & Storage Equipment) • By Application (Automotive, Food & Beverages, Chemical, Semiconductor & Electronics, E-commerce, Aviation, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BEUMER GROUP, Daifuku Co., Ltd., Honeywell International, Inc., KION GROUP AG, Mecalux, S.A, Murata Manufacturing Co., Ltd., SSI SCHAEFER, Swisslog Holding AG, TOYOTA INDUSTRIES CORPORATION, Vanderlande Industries B.V. |

| Key Drivers | • The Material Handling Equipment Market is driven by e-commerce growth, automation, and warehouse expansion but faces high capital costs and regulatory challenges. • The emphasis on worker safety and ergonomics drives the adoption of material handling equipment that reduces manual labor, minimizes injury risks, and enhances workplace efficiency. |

| RESTRAINTS | • Complexity in system integration hinders the seamless adoption of new material handling technologies alongside existing systems. • Technological obsolescence poses a challenge as rapidly evolving innovations can quickly render material handling equipment outdated. |