Water Quality Sensor Market Report Scope & Overview:

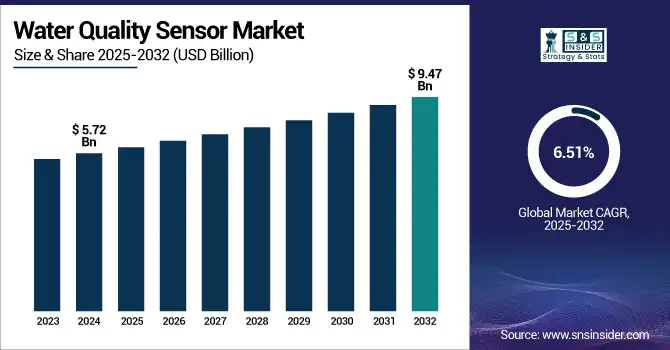

The Water Quality Sensor Market size was valued at USD 5.72 billion in 2024 and is expected to reach USD 9.47 billion by 2032, growing at a CAGR of 6.51% over the forecast period of 2025-2032.

To Get more information on Water Quality Sensor Market - Request Free Sample Report

The water quality sensor market growth is fueled by growing demand for real-time environmental monitoring and worldwide awareness of water pollution. Governments, municipalities, and industries are spending money on water quality monitoring systems to have clean, safe, and compliant water to drink for agriculture and industrial purposes. Sophisticated technologies such as smart water quality sensors, which combine IoT, cloud connectivity, and data analytics, are transforming the detection of water parameters, including pH, turbidity, temperature, and dissolved oxygen. They improve accuracy, minimize intervention by humans, and offer actionable insights for water management systems. Water quality detectors are also gaining wider acceptance across industries because of their portability and versatility in different environmental settings.

Innovation here is all about miniaturization, wireless communication, and multi-parameter sensing. Increasing opportunity lies in smart cities, aquaculture, and wastewater treatment of industrial processes, where automated water quality control is critical. Startups and traditional players are embracing AI-driven predictive maintenance and cloud-based platforms to facilitate efficient water infrastructure. Smart water quality sensors have enormous scope to transform traditional monitoring systems into predictive, efficient, and reactive networks, for a robust shift towards sustainable water resource management. As tighter environmental regulations are getting implemented in the world, this market will grow steadily with time through modernization and infrastructural development.

In May 2025: The Krishna Jal Yatra was launched on May 12, 2025, at Kudalasangama, Karnataka, by Hunagund MLA Vijayanand Kashappanavar. Led by Krishna Kutumba, the Yatra aims to raise awareness about the Krishna River's role in sustaining several districts.

Water Quality Sensor Market Dynamics

Drivers

-

Rising Water Pollution Fuels Demand for Real-Time Monitoring Solutions

The problem of water pollution has been aggravating worldwide with uncontrolled industrialisation, urbanisation, and high agricultural intensification. Factories send raw effluent into rivers, and urban runoff pushes oil, heavy metals, and garbage into bodies of water. Furthermore, overuse of fertilizers and pesticides in agriculture results in nutrient pollution, leading to algal blooms and degradation of aquatic ecosystems. These pollutants contaminate surface and groundwater and have a grave effect on human and ecological health. With the increasing amount of environmental stress, real-time water quality monitoring is becoming more critical. Advanced sensor technology for causal pollutant Detection, monitoring, and regulatory compliance is becoming increasingly accepted by government and industry. This transition is having a tremendous impact on the water quality sensor market, which has been witnessing a robust demand for continuous, precise, and automated monitoring equipment. There is a fast-developing market with an increasing number of technological solutions to improve water management and to secure healthy water for human well-being.

In April 2025, Florida Water Pollution Crisis: A Tampa Bay Times investigation reveals that agricultural runoff and wastewater discharges are causing severe algal blooms in Florida, damaging springs and coastal ecosystems. The blooms are killing seagrass, the main food for manatees, leading to rising deaths. The crisis has sparked urgent demands for stricter regulations and real-time water quality monitoring.

Restraint

-

Financial Constraints Limiting Sensor Deployment in Water Monitoring

The commercialization of more sophisticated water quality sensors generally encounters initial cost-to-benefit difficulties from installation, calibration, and integration with existing programs. These systems often utilize expensive instruments and the labor of trained personnel, which adds to the capital costs. Furthermore, the maintenance of the system can be costly due to sensor fouling, recalibration requirements, and environmental degradation, particularly in rugged and/or remote environments. For small-scale users such as rural communities or small commercial enterprises, the investment may not be affordable, especially in developing countries where the budget is often very tight. The continual cost of consumables, maintenance, and data infrastructure additionally compounds the problem, severely restricting mass roll-out despite the obvious advantages of real-time water monitoring.

In March 2025: The Sustainability Directory article highlights how low-cost sensors are revolutionizing water resource management by enabling broader, real-time monitoring especially in underserved regions. These affordable technologies address limitations of costly traditional systems but face challenges in accuracy and maintenance.

Water Quality Sensor Market Segmentation Analysis

By Type

The TOC (Total Organic Carbon) Sensor is the dominant segment in the water quality sensor market, accounted for 32% of the market share in 2024. These sensors are important for such industries as pharmaceuticals, food & beverage, and municipal water treatment that require the precise measurement of organic content to maintain water quality. What TOC Sensors Do TOC sensors contribute to identifying organic pollutants in water, as well as ensuring its adherence to government standards, and improving production efficiency. The implementation of those sensors in industrial or municipal systems and processes, which are required to monitor water purity, is spreading, and makes them the dominating sensor-type.

Chlorine Residual Sensor is the fastest growing segment of the water quality sensor market, based on product, the demand for accurate measurement of chlorine level in water in water and wastewater treatment and distribution facilities. Chlorine is an essential disinfectant to protect water for making it safe to drink by humans. Accurate length measurement to control the concentration helps users achieve useful control of the application process without having an excess of chlorine, which can also be dangerous. With growing global concerns over water quality and safety, cities, factories, and water treatment facilities continue to turn to chlorine residual sensors to adhere to government regulations and streamline their water treatment processes, driving growth in the market.

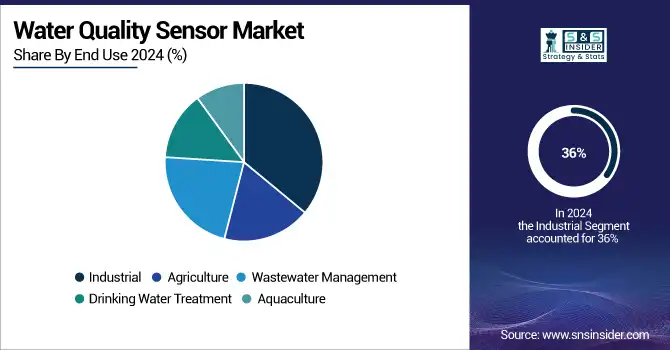

By End-Use

The Industrial segment dominated the market and accounted for 36% of the water quality sensor market share. This is attributed to the increase in use of water quality sensors in end-use industries, including manufacturing, chemical processing, and power generation. They need to control the water quality strictly, be respectful of the law and regulations, efficient production process, and prevent secondary pollution. The segment will remain the most attractive, with a growing shift towards sustainability and efficiency across industries continuing to drive demand for advanced water quality monitoring in industrial setups.

The Wastewater Management segment in the water quality sensor market is expected to grow at a high CAGR with increasing global concerns of water pollution and the urgent requirement for sustainable wastewater management. Rising industrial effluents, agricultural effluents, and urbanization have significantly increased the need for advanced wastewater treatment options. Water Quality Sensors Water quality sensors are essential tools for measuring and monitoring parameters that can cause contamination, compliance issues, and health problems. Advanced water quality sensors are increasingly becoming vital in wastewater management, brought about by the rise in water conservation & environmental protection measures by governments and industries, which is fueling high growth in this segment.

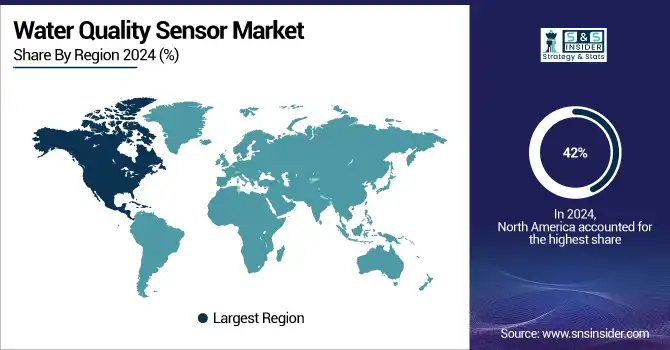

Water Quality Sensor Market Regional Outlook

North America dominated with a market share of over 42% in 2023, as the region has made substantial investments in water quality monitoring technologies and infrastructure. The area is also subject to strong government regulations, mainly in the U.S., regarding drinking water and to protect the environment. The new water contamination problems drive adoption. Municipal water utilities, manufacturing industries, and environmental agencies in the U.S. a collaboratively deploying water quality sensors to guarantee regulatory compliance, optimize treatment processes, and work to minimize the public health issues that are associated with water pollution.

The U.S. water quality sensor market is projected to grow from USD 1.83 billion in 2024 to USD 2.94 billion by 2032, at a CAGR of 6.14%. The growth of this market is mainly driven by growing concerns over water pollution, increasing regulatory pressures to control water pollution, and increasing awareness about the need for water quality monitoring. Increased use is being attributed to innovations in sensor technology and IoT momentum.

The Asia Pacific region is the fastest-growing in the water quality sensor market, fueled by rapid urbanization, industrialization, and water pollution challenges. Advanced water monitoring systems. Worth mentioning here are that major countries such as China and India are spending whopping amounts on advanced water monitoring solutions, to combat the excess/shortage of water and water pollution. Government programs, including strict environmental regulations and widespread infrastructure development, are promoting the use of water quality sensors. Increasing concerns about the quality of industrial wastewater, agricultural effluent, and unclean drinking water are driving the need for real-time water monitoring and management systems that can help protect public health and promote the sustainable use of water.

China is in the lead, due to its fast industrial expansion, and stringent environmental laws, as well as huge investments in water monitoring systems. They are a leading contender due to their leadership in pollution abatement and smart water management.

Europe holds a significant position in the water quality sensor market, with leading countries such as Germany, the UK, and France that are the front-runners in the development of water monitoring systems. The growing attention to environmental sustainability in the region and stringent environmental standards, such as the EU Water Framework directive, are expected to promote the use of water quality sensors. These laws and regulations encourage communities and industries to improve and/or upgrade their water management facilities to comply with water quality standards.

Germany leads the European water quality monitoring systems market due to its strong industrial infrastructure and stringent environmental regulations. The country emphasizes advanced monitoring technologies to ensure compliance and sustainability across sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in Water Quality Sensor Market are:

Water quality sensor companies are Atlas Scientific LLC, Eksoy Ltd., TriOS Mess- und Datentechnik GmbH, Thermo Fisher Scientific Inc., Endress+Hauser Group, OTT Hydromet (Hach Company), Thames Water Utilities Limited, Libelium Comunicaciones Distribuidas S.L., Xylem Inc., Honeywell International Inc.

Recent Development

-

In April 2025: Atlas Scientific published a blog post detailing the importance of RTD (Resistance Temperature Detector) sensors in water quality monitoring. The article explains how RTD sensors provide accurate temperature measurements, which are crucial for assessing water quality parameters. It also discusses the advantages of RTD sensors over other temperature sensing technologies.

-

In April 2025 – Honeywell International Inc. reported an 8% year-over-year sales growth in the first quarter of 2025. This increase was attributed to advancements in water and wastewater treatment solutions, reflecting the company's commitment to sustainable technologies. Honeywell's focus on environmental solutions contributed significantly to its overall performance during this period.

-

In March 2025: Endress+Hauser launched its Water Challenge 2025 on World Water Day, encouraging employees to raise funds through physical activities. Each kilometer covered translates into donations matched by the company. The initiative supports clean water access for Hibemandla Primary School in South Africa. It also aligns with the 2025 theme, “Glacier Protection.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.72 Billion |

| Market Size by 2032 | USD 9.47 Billion |

| CAGR | CAGR of 6.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Chlorine Residual Sensor, TOC Sensor, Turbidity Sensor, Conductivity Sensor, PH Sensor, ORP Sensor) • By End Use (Industrial, Agriculture, Wastewater Management, Drinking Water Treatment, Aquaculture) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Atlas Scientific LLC, Eksoy Ltd., TriOS Mess- und Datentechnik GmbH, Thermo Fisher Scientific Inc., Endress+Hauser Group, OTT Hydromet (Hach Company), Thames Water Utilities Limited, Libelium Comunicaciones Distribuidas S.L., Xylem Inc., Honeywell International Inc. (with sources) |