Water Treatment Polymers Market Report Scope & Overview:

Get more information on Water Treatment Polymers Market - Request Sample Report

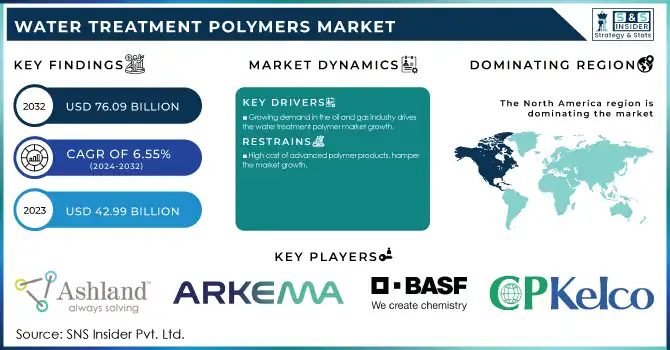

The Water Treatment Polymers Market Size was USD 42.99 Billion in 2023 and is expected to reach USD 76.09 Billion by 2032 and grow at a CAGR of 6.55% over the forecast period of 2024-2032.

The industrial sector is a major contributor to global water consumption, with industries like textiles, food and beverage, pharmaceuticals, and chemicals relying heavily on water for various essential processes, including cooling, cleaning, and manufacturing. As industrialization continues to expand, the demand for water across these sectors grows, placing increasing pressure on freshwater resources. This surge in industrial water usage also leads to a significant rise in wastewater generation, which, if not properly treated, can have harmful effects on the environment. To address this challenge, effective water treatment is crucial to ensure that wastewater is either safely returned to the environment or reused within industrial processes in a sustainable manner. Water treatment polymers play a vital role in these processes by facilitating the removal of contaminants from industrial wastewater.

According to the U.S. Environmental Protection Agency (EPA), over USD 3 billion in funding has been allocated through the Water Infrastructure Finance and Innovation Act (WIFIA) to support water reuse projects, highlighting the growing emphasis on sustainable water management practices.

The rising demand in the power generation industry is among the most water-intensive sectors, with a heavy dependence on treated water for its processes, including preparation of boiler feedwater and operations of cooling systems drives the market growth. To avoid scaling, corrosion, and fouling that can impact the efficiency and safety of the boiler operation, purification of boiler feedwater is required. To enable the water used in power plants to meet more stringent quality requirements, water treatment polymers (such as coagulants, flocculants, and anti-scalants) are indispensable.

Renewable energy projects like concentrated solar power (CSP) and geothermal plants drive up the development of the water treatment polymer market. Such technologies frequently have high-temperature, and specific chemical conditions, and often need specialized water treatment. CSP plants, for example, rely on treated water to make steam and cool, while geothermal systems require a treatment solution to address mineral scaling and corrosion found in high-salinity conditions.

Water Treatment Polymers Market Dynamics

Drivers

-

Growing demand in the oil and gas industry drives the water treatment polymer market growth.

Water treatment polymer demand is high in the oil and gas industry, as the sector relies on effective water management in exploration, production, and refining. Polymers play an important role in the separation of oil, water, and solids from produced water during treatment where the properties of flocculation and coagulation are increased which is important in meeting environmental regulations. In EOR (enhanced oil recovery) some polymers are applied to enhance the water injection efficiency increasing the amount of oil getting extracted, for example: polyacrylamides. Additionally, increasing usage of advanced water recycling methods in the industry, such as re-using treated wastewater for hydraulic fracturing, is another factor expected to propel market growth for these polymers over the next few years.

The demand for high-performance water treatment solutions has grown rapidly as governments and regulatory agencies across the globe continue to strict guidelines on wastewater discharge by the oil and gas industry. As an example, the U.S. Environmental Protection Agency (EPA) has lowered the maximum concentrations of pollutants allowed in oils and gas wastewater discharges, which require efficient polymers to reach those levels. Likewise, nations in the center east, Saudi Arabia, and UAE among others are utilizing overpowering water treatment advances fit to their water preservation dividers to higher urge polymer applications in the sector.

Restraint

-

High cost of advanced polymer products. hamper the market growth.

The major growth restraints of the water treatment polymers market include high price of advanced polymer products. Polymers specialized, for example in high-end applications like oil and gas or wastewater recycling, are costly because of complicated production processes and high standards in the raw materials used. Polymers, for example, that can remove certain contaminants or operate under very harsh industrial conditions, can command large price premiums. Here again, the costs will be a prohibitive factor preventing the SMEs from using these solutions, particularly in low capital markets where there less availability of funds for advanced technological use.

In addition, disposal and regulatory costs from the residual presence of these polymers also represent a long-term cost. One example would be that these spent polymer solutions must be disposed of in an environmentally safe manner since so many of these chemicals are non-biodegradable, which could increase costs.

Opportunities

The chemical, petrochemical, and oil and gas sectors are driving demand for water treatment polymers.

These industries are major consumers of water and operate within a highly regulated environment. These sectors rely heavily on water for a variety of processes, inevitably generating significant volumes of wastewater. Stringent environmental regulations necessitate the use of advanced water treatment technologies to ensure compliance. Water treatment polymers serve as a critical tool in this process, facilitating effective clarification, purification, and adherence to regulatory standards. Beyond basic treatment requirements, these industries often have specific needs, such as enhanced oil recovery in the oil & gas sector or specialized purification processes in the chemical industry. This diverse range of applications further underscores the crucial role water treatment polymers play as a driving force in market demand.

Water Treatment Polymers Market Segmentation Analysis

By Product Type

The polyacrylamides type held the largest market share around 42% in 2023. This leadership position can be attributed to the ever-growing demand for flocculants, of water treatment. Flocculants are utilized across a wide spectrum of industries, from the high-precision world of semiconductor production to the heavyweights of oil & gas and mining & metals. Their effectiveness in agglomerating suspended particles in water makes them indispensable for critical clarification and purification processes. Polyacrylamides excel in this area, consistently demonstrating superior performance. This has cemented their position as the preferred choice for numerous industries, ultimately solidifying their dominance in the water treatment polymers market.

By Application

The sludge treatment dominated the water treatment polymer market and held a share of around 38% in 2023. It is specially targeted towards the byproducts of wastewater treatment processes, specifically the solids that get separated from the water. With urbanization and industrialization, the amount of wastewater and the consequent sludge produced has increased dramatically, creating the need for efficient and cost-effective sludge treatment technologies. Such technologies are thickening, dewatering, stabilization, and disposal, which are necessary for sustainable waste management to comply with environmental standards by minimizing the degradation of environmental safety by waste.

This is especially crucial in the case of sludge treatment as it targets the disposal problems associated with solid waste which is an important scientific dilemma of our time. This also encompasses processes that promote the reuse of treated water and sludge in industries such as agricultural activities and energy production.

By End-Use

The industrial segment dominated the water treatment polymer market in 2023, the industrialization has fueled a surging demand for effective water treatment solutions. As industries expand and production intensifies, access to clean water becomes paramount. Power plants, constantly striving to meet increasing energy demands, require robust water treatment processes for steam generation and cooling tower operations. These processes rely heavily on water treatment polymers to function efficiently. The established correlation between industrial growth, power generation needs, and the critical role of clean water treatment suggests the industrial segment's dominance will likely continue for the foreseeable future.

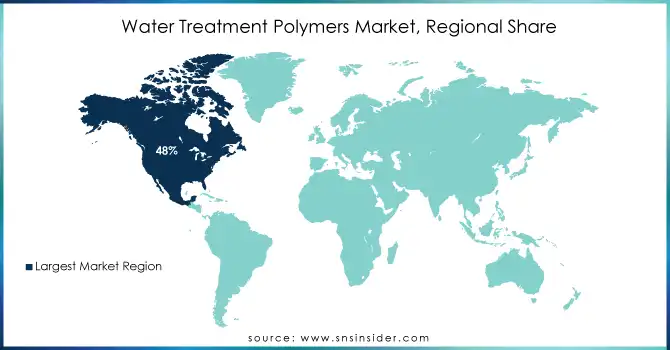

Water Treatment Polymers Market Regional Overview

North America dominated the water treatment polymers market, holding a whopping 48% share in 2023. This dominance is largely driven by the booming oil and gas sector. From drilling and well completion to ongoing production and enhanced oil recovery, the industry heavily relies on these polymers. As the US fracking technology continues to evolve, a technique called enhanced oil recovery is expected to play an even bigger role, further propelling the North American market. water treatment polymers offer superior customization compared to other injection fluids used in this process, making them a prime choice. Within North America, the US holds the largest market share, while Canada boasts the fastest growth rate. This highlights the regional strength and potential for further expansion.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Water Treatment Polymers Market

-

Ashland (Aqualon Water-Soluble Polymers, VersaFlex Polymeric Coatings)

-

Arkema (Rilsan PA11, Pebax Polymers)

-

BASF SE (Polymers for Water Treatment, Sokalan Polymers)

-

CP Kelco US Inc. (Kelzan XCD, Keltrol XR)

-

DuPont (Corian Water Treatment Solutions, Hytrel Thermoplastic Elastomers)

-

Gantrade Corporation (Galoryl Polymers, Luvitec)

-

SNF Group (Superfloc Polymers, Zetag)

-

Kemira (Kemira Water Treatment Polymers, Kemira Flocculants)

-

Kuraray Co. Ltd (Kuraray Polymers, Clearol Polyacrylamide)

-

Merck KGaA (Millipore Water Purification, Millipore Filters)

-

Mitsubishi Chemical Corporation (Mitsubishi Polymer Flocculants, Sumikagel)

-

Nouryon (Dissolvine Chelating Agents, Peridur Flocculants)

-

Polysciences Inc. (Polyacrylamide-based Polymers, Flocculant and Coagulant Polymers)

-

Sumitomo Seika Chemicals Company (Seprod Series, Seakem Flocculants)

-

Suez Water Technologies (Polymers for Water Treatment, Thermax Ion Exchange Resins)

-

Solvay (Aflammit Polymers, Aquafloc Water Treatment Products)

-

Lanxess (Baypure Polymers, Lewatit Ion Exchange Resins)

-

Solenis (Baker Hughes Polymers, Trident Flocculants)

-

Clariant (Hostafloc Polymers, Flocculants for Water Treatment)

-

Dow Chemical Company (Nalco Water Solutions, Acumer Specialty Polymers)

Recent Development:

-

In April 2024: Arkema is setting its sights on expanding its eco-friendly offerings in North America. They're working towards ISCC+ certification for their acrylic production facilities there. This certification will complement similar efforts in other regions. Ultimately, their goal is to offer a wider range of bio-based resins and additives globally, catering to all major coating technologies like UV/LED/EB, waterborne, high solids, and powders.

-

In February 2023: Ashland company invented a new product iSolveSM, for food and beverage consumers. This online resource provides easy access to information on Ashland's ingredients, innovations, and regulatory documents. Essentially, it's a one-stop shop for all things food and beverage from Ashland.

-

In August 2022: Arkema designed SYNAQUA 9511 acrylic polyol emulsion to be an eco-friendly alternative for industrial paint manufacturers. This waterborne solution delivers significantly lower VOC emissions while maintaining performance in 2K or 1K stoving systems. In simpler terms, it helps paint formulators achieve sustainability goals without sacrificing performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 42.99 Billion |

| Market Size by 2032 | US$ 76.09 Billion |

| CAGR | CAGR of 6.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Application (Fresh-Water Treatment, Waste-Water Treatment) • By End-use (Residential Buildings, Commercial Buildings, Municipality, Industrial) • By Product Type (Organic Water Treatment Polymers, Inorganic Water Treatment Polymers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ashland, Arkema, BASF SE, CP Kelco US Inc., DuPont, Gantrade Corporation, SNF Group, Kemira, Kuraray Co. Ltd, Merck KGaA, Mitsubishi Chemical Corporation, Nouryon, Polysciences Inc., SNF Group, Sumitomo Seika Chemicals Company, Suez Water Technologies |

| Drivers | • Growing demand over oil and gas industry in the water treatment polymer market. |

| Opportunity | • The chemical, petrochemical, and oil and gas sectors are driving demand for water treatment polymers. |