Biomass Power Generation Market Report Scope & Overview:

Get More Information on Biomass Power Generation Market - Request Sample Report

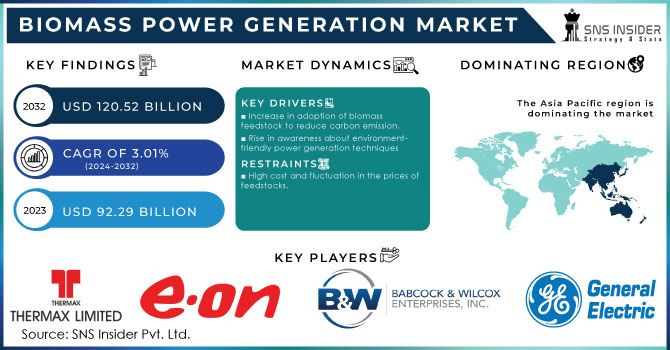

The Biomass Power Generation Market size was valued at USD 92.29 billion in 2023 and is expected to grow to USD 120.52 billion by 2032 and grow at a CAGR of 3.01% over the forecast period of 2024-2032.

Biomass is an alternative source of energy which generate through energy from natural sources like land, sun, air, and water. Biomass is used for various purposes like heating, electric power generation, etc. It includes a large variety of materials such as wood, animal and human waste, and agricultural residue.

Direct combustion is applied to generate electricity from biomass. To produce high-pressure steam, biomass is burned to high temperatures. The produced steam flows over the series of turbine blades which causes rotation of the turbine. Due to this rotation, the turbine drives the generator causing electricity production. As the substitute for the portion of coal in an existing power plant furnace biomass is used. This technique is called co-firing which means the combustion of two different materials at the same time.

For different biomass sources, different methods are used for combustion.

-

Woody biomass- gasified to generate electricity

-

Corn Stover and wheat straw- anaerobic digester is used to convert into gas

-

Very wet wastes of animal and human sewage- Converted into medium-energy content gas in an anaerobic digester.

-

Other Types of biomass - converted into bio-oil through pyrolysis.

As compared to other renewable energy options biomass is one of the most advantageous in terms of dispatch ability, controllability, and availability. One of the disadvantages of biomass combustion is that it produces emissions that need to be controlled by the rules and regulations of the government.

Market Dynamics

Drivers

-

Increase in adoption of biomass feedstock to reduce carbon emission.

-

Rise in awareness about environment-friendly power generation techniques

-

Increase in demand for clean sources of the renewable energy

-

Stringent rules and regulations by the government

The market for Biomass Power Generation is being driven by an increase in demand for clean and renewable energy sources. This trend is a response to the growing concern for the environment and the need to reduce carbon emissions. Biomass Power Generation is a sustainable and eco-friendly solution that utilizes organic materials such as wood, crops, and waste to produce electricity. As the world becomes more conscious of the impact of traditional energy sources on the environment, the demand for Biomass Power Generation is expected to continue to rise.

Restrain

-

High cost and fluctuation in the prices of feedstocks.

Opportunities

-

Advancement in the technique of biomass power generation

-

Increasing investment in R&D of biomass power generation technologies.

Challenges

-

High initial investment in generating biomass power.

The high initial investment required for generating biomass power is a significant obstacle for the biomass power generation market. While the potential benefits of biomass power are numerous, the upfront costs can be prohibitive for many investors. This financial barrier can limit the growth and development of the industry, hindering progress toward a more sustainable energy future.

Impact of COVID-19

The COVID-19 pandemic has had a significant impact on the biomass power generation sector. The scarcity of labor force, limited maintenance, and operational staff in power generation plants have hit the industry hard. The widespread suspension of economic activity, disruption of the supply chain, and concern for employee safety have contributed to the reduction of power demand and generated considerable risk for the entire value chain. As a result of the lockdown, the sector has faced falling demand for power, poor financial health, disruption of the supply chain for under-construction biomass power projects, labor shortages, and delays in the acquisition of land and equipment. These challenges have made it difficult for the industry to maintain its operations and meet the needs of its customers.

Impact of Russia-Ukraine War:

The biomass power generation market relies heavily on the availability of biomass feedstock, which includes wood chips, agricultural waste, and other organic materials. However, the war has disrupted the supply chain of these materials, leading to a shortage of biomass feedstock and affecting the growth of the biomass power generation market.

Impact of Recession:

As the economy has slowed down, demand for renewable energy sources is also slowed down. This has led to a decrease in investment in the biomass power generation industry, which has had a ripple effect throughout the market. One of the main challenges facing the biomass power generation market during the recession has been the lack of funding. Many investors have been hesitant to invest in renewable energy projects due to the economic uncertainty. This has made it difficult for companies in the biomass power generation industry to secure the necessary funding to continue their operations.

Key Market segmentation

By Technology

-

Combustion

-

Gasification

-

Anaerobic Digestion

-

Pyrolysis

-

Co-firing

-

LFG

-

Others

By Feedstock

-

Agricultural Waste

-

Forest Waste

-

Animal Waste

-

Municipal waste

By Fuel

-

Solid

-

Liquid

-

Gaseous

Regional Analysis

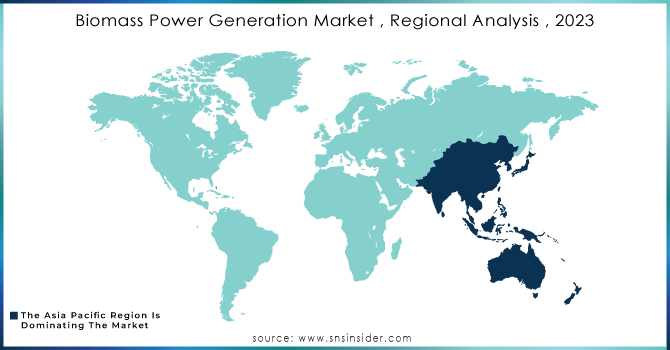

By region, Asia Pacific dominated the market and is anticipated to show lucrative growth during the forecast period. This is owing to the increasing investment in biomass power generation projects. The rising adoption of environmental power generation techniques and stringent government rules and regulations regarding carbon emissions propel the growth of the biomass power generation market. The rising population and increasing per capita income of the population further increase the demand for the biomass power generation market.

North America and Europe are also expecting to grow at a significant growth rate due to the use of biomass for different purposes to meet the rising demand for electricity in this region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Babcock & Wilcox Enterprises Inc., E.ON SE, General Electric Co., John Wood Group Plc, Thermax Ltd., Valmet Oyj, Acciona SA, Ameresco Inc, Andritz AG, Vattenfall AB, and other key players will be included in the final report.

| Report Attributes | Details |

| Market Size in 2023 | US$ 92.29 Bn |

| Market Size by 2032 | US$ 120.52 Bn |

| CAGR | CAGR of 3.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Combustion, Gasification, Anaerobic Digestion, Pyrolysis, Co-firing, LFG, and others) • By Feedstock (Agricultural Waste, Forest Waste, Animal Waste, Municipal waste) • By Fuel (Solid, Liquid, Gaseous) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Babcock & Wilcox Enterprises Inc., E.ON SE, General Electric Co., John Wood Group Plc, Thermax Ltd., Valmet Oyj, Acciona SA, Ameresco Inc, Andritz AG, Vattenfall AB, and other |

| Key Drivers | • Increase in adoption of biomass feedstock to reduce carbon emission. • Rise in awareness about environment-friendly power generation techniques |

| Market Opportunities | • Advancement in the technique of biomass power generation • Increasing investment in R&D of biomass power generation technologies. |