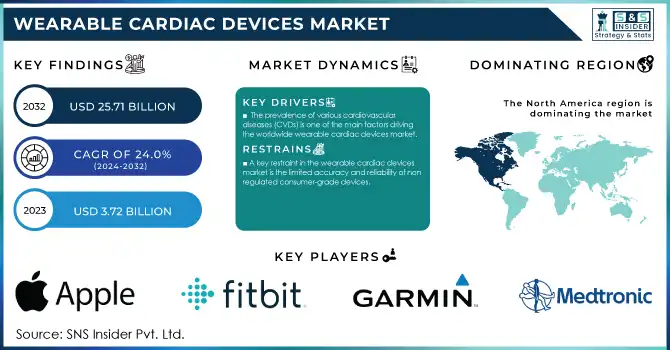

Wearable Cardiac Devices Market Size & Trends:

The Wearable Cardiac Devices Market size was valued at USD 3.72 billion in 2023 and is projected to reach USD 25.71 billion by 2032, growing at a CAGR of 24.0% from 2024-2032.

To get more information on Wearable Cardiac Devices Market - Request Free Sample Report

The wearable cardiac devices market has witnessed rapid growth due to developing healthcare technologies and increasing demand for remote patient monitoring. This data-driven landscape has not only fueled research efforts but has also paved the way for a new generation of devices—such as smartwatches, ECG monitors, and wearable patches—that aim to monitor and manage heart issues in real-time, serving as a non-invasive method for monitoring heart conditions like atrial fibrillation, heart failure, and arrhythmias. The increasing global burden of cardiovascular diseases and the rising adoption of personalized healthcare solutions are driving the market growth.

Recent changes have majorly impacted the development of the wearable cardiac devices market. In May 2024, the atrial fibrillation (AFib) history feature of the Apple Watch became the first-ever digital health technology to qualify for the FDA’s Medical Device Development Tools (MDDT) program; a milestone in digital health innovation. This designation formally classifies Apple Watch as a class II photoplethysmography (PPG) analysis software, a precedent that opens the door for an over-the-counter heart health monitoring tool. Furthermore, in July 2024, Samsung launched the Galaxy Ring, along with Galaxy Watch7 and Galaxy Watch Ultra to transform wellness experiences by unlocking the power of Galaxy AI and featuring advanced cardiac monitoring capabilities.

Another key advance comes from Royal Philips, which rolled out its ambulatory cardiac monitoring service in Spain in May 2024, using its wearable patch in tandem with AI-based cardiology analytics. Using this system, healthcare providers can discover heart arrhythmias not typically detected by conventional monitors, leading to improved clinical outcomes and patient comfort. Philips announced this solution is helping 14 healthcare providers in Spain, showing the potential clinical scale wearables can have.

Mitigating the increasing rates of cardiovascular diseases worldwide, the need for wearable cardiac devices is likely to see a rise in demand, underpinned by constant technological improvements, regulatory approvals, and increasing acceptance of remote health solutions. These elements are expected to drive the market in the following years.

Wearable Cardiac Devices Market Dynamics

Drivers

-

The prevalence of various cardiovascular diseases (CVDs) is one of the main factors driving the worldwide wearable cardiac devices market.

According to the 2024 Heart Disease and Stroke Statistics published by the American Heart Association, heart disease has been the leading cause of death in the United States for the past century. Globally, over 64 million individuals are affected by heart failure, with rising rates attributed to sedentary lifestyles, unhealthy dietary habits, and aging populations. As conditions such as atrial fibrillation, arrhythmias, and heart failure become more prevalent—especially among the aging population—there is increasing demand for continuous and real-time cardiac monitoring. As per the World Health Organization (WHO), cardiovascular diseases (CVDs) are the leading cause of death globally, with the elderly being the high-risk group. Wearable cardiac devices address the trend towards proactive health management as a means to help prevent an early onset of heart conditions and provide complex and comprehensive detection of symptoms in the convenience of a device worn on your wrist or within clothing where a large number of patients will never see their doctor until symptoms arise and it’s too late. This increasing demand for preventive healthcare is also expected to further propel the market growth.

-

Rapid innovations in the field of wearables such as improvements in sensors, battery life, and integration with AI are another major factor that is expected to boost the growth of the wearable cardiac devices market.

Analytics powered by artificial intelligence are improving the accuracy and useful operation of these devices, allowing improved detection of cardiac abnormalities, like irregular heartbeats and arrhythmias. As an example, the FDA approval of Apple Watch’s AFib history feature represents a significant step toward the convergence of advanced technologies in the personalization of healthcare. Advancements in these smart wearables, in conjunction with cloud computing, and data analytics enable healthcare providers to provide more accurate and real-time monitoring, thus making wearable cardiac devices fundamental tools for monitoring heart health. As technology continues to mature, their devices will share an even greater complexity, approachability, and the ability to deliver more detailed insights into the state of a user’s cardiovascular health, continuing the market’s momentum.

Restraint

-

One of the major restraints in the wearable cardiac devices market is the limited accuracy and reliability of consumer-grade devices, particularly those not regulated by medical authorities

Although these devices are convenient and allow for real-time monitoring, the data they produce is not always as accurate as traditional medical devices, which raises concerns for both health professionals and consumers alike. In detecting serious heart conditions such as arrhythmias or atrial fibrillation, the risk of false positives or negatives can be especially worrisome. FDA-approved devices are rigorously tested to ensure accuracy, but devices sold to consumers are not necessarily held to the same standards, many being wearable cardiac devices. This issue of regulatory ambiguity can reduce the confidence that stakeholders have in such devices, hindering adoption by healthcare providers and stymying the full potential of the market.

Wearable Cardiac Devices Market Segmentation Insights

By Product Type

In 2023, The wearable defibrillator segment dominated the market with 42% market share due to the rising cases of sudden cardiac arrests (SCA) and arrhythmia increasing, the need for such life-saving devices capable of detecting heart rhythm abnormalities and delivering shocks automatically has increased. The evolving technology has drastically changed the design of wearable defibrillators, making them more comfortable, lightweight, and effective, thus making them suitable for long-term use. In addition, the rising focus on preventive healthcare is motivating people who are at risk of cardiac events to use these devices for continuous heart monitoring. Yet, as technology improves and they receive regulatory approval, the medical community is starting to embrace wearable defibrillators, triggering swift growth and use among patients who need cardiac monitoring and emergency response.

In 2023, the patch segment is expected to experience the fastest growth during the forecast period, with a 25% market share, owing to comfort, convenience, and effective monitoring. These patches are small, lightweight, and designed for long-term, continuous use, perfect for patients needing regular monitoring of their heart health. Unlike other devices, patches are unobtrusive, so patients can wear them during daily activities without the pain associated with other devices. A patch, that sticks to the skin, offers continuous monitoring in real-time through sensors that can capture significant heart parameters such as heart rate, ECG, and rhythm. Healthcare AI is also being increasingly adopted thanks to advancements such as remote patient monitoring, as well as the integration of AI and cloud connectivity, improving diagnostic accuracy and enabling real-time, alert-based intelligence. Wearable patches have become an indispensable means of clinical and personal cardiac health management with FDA-approved solutions on the market

By Application Type

In 2023, the home healthcare segment dominated the wearable cardiac devices market, with a 56% market share. The growing trend of remote health has led to the increased adoption of a wearable cardiac device to monitor the heart in patients' homes. Examples are patients with chronic heart diseases, e.g., arrhythmia or heart failure, who would benefit from continuous monitoring outside the clinic to detect abnormalities early and intervene. This, paired with the epidemiological data of the continuous advancements in telemedicine and remote patient monitoring technology, explains the segment's dominance as an important tool for affordability, comfort, and convenience in heart health monitoring at home. As healthcare systems worldwide focus on cost-efficient and accessible care options, this trend is likely to persist.

The Remote Patient Monitoring (RPM) segment is expected to experience the fastest growth Due to the increasing requirement for continuous heart health tracking through Remote Patient Monitoring, healthcare professionals can track patients' conditions in real-time, allowing for early intervention while minimizing the need for hospital visits. As cardiovascular diseases continue to rise and more patients are operating with telemedicine and home healthcare, RPM solutions are being used to manage heart conditions better than ever before. They provide advantages such as enhanced patient outcomes, convenience, and cost savings for healthcare providers. This trend is only likely to accelerate as healthcare systems contract

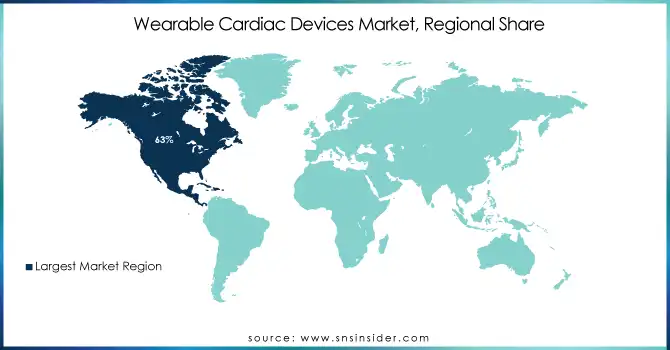

Wearable Cardiac Devices Market Regional Analysis

In 2023, North America dominated the wearable cardiac devices market with a market share of 63% due to the sophisticated healthcare framework soaring demand for state-of-the-art technology, and high healthcare expenditure in the region. In particular, the United States devotes significant resources to cardiac care, as cardiovascular diseases top the list of leading causes of death in the nation. It has further driven the global adoption of wearable devices for the early detection and monitoring of heart diseases. Moreover, the presence of key market players such as Apple and Medtronic, supportive regulatory frameworks, and strong reimbursement policies would further contribute towards the market dominance. In addition, the growing rate of heart disease and the rising awareness of the population and their proactive approach towards health also help North America lead this market.

The Asia Pacific wearable cardiac devices market is projected to be the fastest-growing region 25.08% of CAGR throughout the forecast period, due to increasing healthcare investments and an emphasis on preventive care. For countries such as India and China, which are dealing with large populations and rising rates of cardiovascular diseases, the demand for affordable and innovative solutions to healthcare is tremendous. The growing penetration of wearable technologies (driven by both government initiatives to enhance healthcare infrastructure and heightened consumer awareness) will also fuel market growth. Moreover, the increasing adoption of remote patient monitoring devices in technologically advanced countries such as South Korea coupled with the growing telemedicine driving the growth of the region. Asia Pacific presents a promising growth market for wearable cardiac devices due to rising disposable income and growing emphasis on digital health solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Wearable Cardiac Devices Companies

-

Apple Inc. (Apple Watch Series, Apple Watch Ultra)

-

Fitbit (now part of Google) (Fitbit Charge 5, Fitbit Sense)

-

Garmin Ltd. (Garmin Venu 2, Garmin Forerunner 945)

-

Biotronik (CardioMessenger Smart, Wearable ECG Patch)

-

AliveCor (KardiaMobile 6L, KardiaBand)

-

Medtronic (Guardian Connect, Micra Transcatheter Pacemaker)

-

Philips Healthcare (Philips Biosensor BX100, Philips IntelliVue MP5)

-

Samsung Electronics (Samsung Galaxy Watch 5, Samsung Galaxy Fit 2)

-

Oura Health (Oura Ring, Oura Ring Generation 3)

-

Empatica (Embrace2, E4 Wristband)

-

iRhythm Technologies (Zio XT Patch, Zio Service)

-

Johnson & Johnson (LifeScan OneTouch, Biosense Webster Carto)

-

Welch Allyn (Connex Spot Monitor, CardioPerfect)

-

Withings (Withings ScanWatch, Withings Steel HR)

-

Huawei Technologies (Huawei Watch GT 3, Huawei Band 6)

-

Cardiac Insight (Cardea SOLO, Cardea 360)

-

Abbott Laboratories (Freestyle Libre 2, CardioMEMS HF System)

-

Noble Biomaterials (Bioguard ECG patches, Bioguard Pulse Wearable)

-

Spacelabs Healthcare (LifeSync Wireless ECG System, XPREZZON)

-

VivaLnk (Flex ECG, Skin temperature sensor)

Key suppliers

-

VivoTech

-

GE Healthcare

-

Toshiba Medical Systems

-

STMicro electronics

-

Maxim Integrated

-

NXP Semiconductors

-

Flextronics

-

Honeywell

-

Murata Manufacturing

-

Analog Devices

Recent Developments

-

In May 2024, Apple made a significant achievement with its Watch’s atrial fibrillation (AFib) history feature, becoming the first-ever digital health technology to qualify for the FDA’s Medical Device Development Tools (MDDT) program. This approval recognizes the Apple Watch’s photoplethysmography (PPG) analysis software as a class II device, marking it as an over-the-counter tool for monitoring AFib.

-

In July 2024, Samsung Electronics unveiled its new lineup of wearable devices, including the Galaxy Ring, Galaxy Watch7, and Galaxy Watch Ultra. These new additions expand the capabilities of Galaxy AI, delivering comprehensive wellness experiences and further extending the reach of wearable health technology to a broader audience.

-

May 2024, Royal Philips, a global leader in health technology, announced the nationwide launch of its ambulatory cardiac monitoring service in Spain in May 2024. The service utilizes Philips' innovative wearable ePatch, paired with its AI-driven Cardiologs analytics platform. The ePatch, now being used by 14 Spanish healthcare providers, helps detect life-threatening heart arrhythmias, such as atrial fibrillation (AF). This advanced solution offers superior patient comfort, improves access to care, enhances clinical outcomes, and reduces healthcare costs compared to traditional Holter monitors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.72 Billion |

| Market Size by 2032 | US$ 25.71 Billion |

| CAGR | CAGR of 24.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Holter Monitors, Patch, Defibrillators, Others) • By Application Type (Home Healthcare, Remote Patient Monitoring, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Fitbit (now part of Google), Garmin Ltd., Biotronik, AliveCor, Medtronic, Philips Healthcare, Samsung Electronics, Oura Health, Empatica, iRhythm Technologies, Johnson & Johnson, Welch Allyn, Withings, Huawei Technologies, Cardiac Insight, Abbott Laboratories, Noble Biomaterials, Spacelabs Healthcare, VivaLnk, and other players. |

| Key Drivers | •The prevalence of various cardiovascular diseases (CVDs) is one of the main factors driving the worldwide market for wearable cardiac devices •Rapid innovations in the field of wearables such as improvements in sensors, battery life, and integration with AI are another major factor that is expected to boost the growth of the wearable cardiac devices market. |

| Restraints | •One of the major restraints in the wearable cardiac devices market is the limited accuracy and reliability of consumer-grade devices, particularly those not regulated by medical authorities |