Defibrillator Market Size Analysis & Trends:

Get more information on Defibrillator Market - Request Free Sample Report

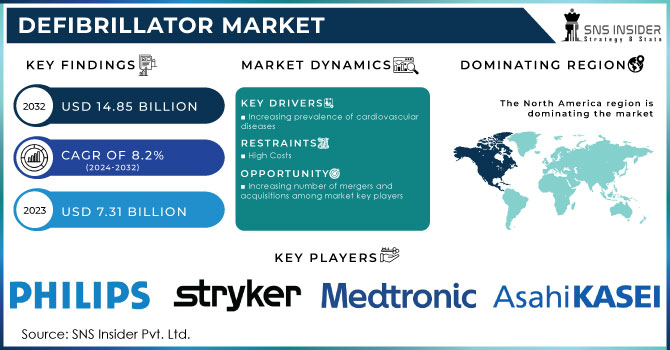

The Defibrillator Market Size was valued at USD 7.31 billion in 2023 and is expected to reach USD 14.85 billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

A surge in product development endeavors, coupled with the escalating incidence of sudden cardiac arrest, is significantly bolstering demand. Heightened public awareness of the condition, alongside supportive policies and initiatives from governments and healthcare organizations, is further propelling market expansion.

Demand for defibrillators is driven by the increasing recognition of sudden cardiac arrest as a serious health risk, particularly among young people and athletes. The need for implantable cardiac defibrillators (ICDs) is especially acute in athletes who have experienced cardiac arrest, as these devices offer crucial protection against recurrent life-threatening events. As research continues to explore safe return-to-sport guidelines for ICD patients, the demand for these devices is expected to grow alongside the expanding understanding of their role in preventing cardiac catastrophe. According to Data USA, in 2022, the sports industry employed 35,481 athletes and competitors. While men dominated the field at 88.1%, women comprised 11.9% of the workforce. The majority of athletes were young adults: 8,123 aged 25 to 29, 6,386 aged 20 to 24, and 4,853 aged 30 to 34.

The staggering prevalence of sudden cardiac arrest underscores the critical demand for defibrillators. In the United States alone, an estimated 300,000 to 450,000 individuals succumb to cardiac arrest annually. This alarming statistic, corroborated by the American Heart Association's report of over 436,000 cardiac arrest deaths, highlights the urgent need for accessible and effective defibrillation solutions. The condition's indiscriminate nature, affecting people of all ages and backgrounds, further emphasizes the importance of widespread defibrillator deployment. These sobering figures illuminate the substantial market potential for defibrillators and the imperative role they play in saving lives.

The supply of defibrillators has been steadily increasing to match the growing demand. A robust ecosystem of manufacturers, including established medical device companies and specialized startups, is actively engaged in developing and producing a wide range of defibrillator models. These devices cater to diverse end-users, from hospitals and emergency medical services to public access locations like airports, schools, and commercial establishments. The United States boasts a network of approximately 6,120 hospitals. Among these, nearly 800 cardiac hospitals underwent rigorous evaluation by U.S. News & World Report to determine the top 50 heart hospitals in the nation.

Technological advancements have also streamlined the manufacturing process, leading to increased production capacity and cost-efficiency. This, coupled with the growing recognition of defibrillators as life-saving devices, has encouraged investments in research and development, further stimulating supply. However, ensuring equitable distribution of defibrillators across different regions and income levels remains a challenge. While the supply of defibrillators has shown significant growth, aligning it precisely with the fluctuating demand for these critical devices continues to be a focal point for industry stakeholders.

The defibrillator market is witnessing exciting advancements. According to healthdirect.gov.au, manufacturers are developing smaller, lighter, and user-friendly AEDs, like the HeartHero model. These portable devices offer voice and visual prompts to guide anyone, even children, through the CPR process. This accessibility holds immense promise for individuals at high risk of sudden cardiac arrest (SCA). Imagine storing or carrying this life-saving device at home or on the go, ensuring immediate response in an emergency. However, the cost for individual buyers and the need for maintenance remain potential limitations. Additionally, for some high-risk individuals, implantable defibrillators may be a more suitable solution.

Market Dynamics

Drivers

-

Increasing prevalence of cardiovascular diseases

Cardiovascular conditions like coronary artery disease and cardiac arrest affect a significant section of the population worldwide. The rising fatalities around the world is caused by the rising prevalence of cardiovascular illnesses. In 2022, The Centers for Disease Control and Prevention (CDC) estimate that CVD will be responsible for over 725,000 deaths in the US. Furthermore, arrhythmia-related sudden cardiac death is more likely as a result of coronary artery disease. In the US, there are reported to be over 356,000 out-of-hospital cardiac arrests (OHCA) each year, according to research from the Coronary Artery Disease Foundation from 2022.

Restraints

-

High Costs

The initial purchase price of defibrillators, especially advanced models, can be prohibitive for individuals, small businesses, and developing countries.

-

High Maintenance Costs

-

Public Awareness

-

Skill Requirement

Opportunity

-

Increasing number of mergers and acquisitions among market key players

The defibrillator market's major competitors are increasingly acquiring rival companies to diversify their product portfolios internationally. These acquisitions assist producers of implanted and external defibrillators in increasing their financial foundations, expanding into new areas, and providing patients with a wide selection of products. Despite the rising cost challenges, acquisitions help defibrillator manufacturers retain their profit margins and expand their presence around the world.

Challenges

-

Lack of awareness about sudden cardiac arrests in developing nations

Defibrillators are required to follow strict regulatory guidelines and quality standards in order to deliver precise and accurate test results. It can be challenging for manufacturers to comply with changing legislation because it calls for ongoing improvements to practices, hardware, and software. The establishment and maintenance of a quality management system (QMS) is commonly required of defibrillator manufacturers to ensure compliance with legal standards. Part of this involves putting policies and procedures into place for the design, development, manufacture, installation, servicing, and post-market monitoring of the analyzers. To receive market approval for their Defibrillators, manufacturers must carefully navigate the regulatory environment and adhere to the relevant regulations.

Defibrillator Market Segmentation Analysis

By Product

In 2023, the Implantable Cardioverter Defibrillator {ICD} segment dominated the defibrillator market with a 51.02% share due to the development of ICD technology, the rising popularity of subcutaneous ICDs, and the dedication of players to the introduction of novel ICDs. The National Medical Products Administration of the People's Republic of China (NMPA) granted MicroPort Scientific Corporation (China) marketing authorization for their Platinum implantable cardioverter defibrillator across China in May 2022.

By Patient Type

In 2023, the adult segment dominated the defibrillator market growth with a 53.04% share due to the risk of cardiac arrest rising as the proportion of adults with cardiovascular disorders increases. An estimated 379,638 adults in the US experienced sudden cardiac arrest in 2022, according to data from the Sudden Cardiac Arrest Foundation. It is expected that this number will rise sharply in the next years. Also contributing to the segment's expansion is the growing number of elderly patients who are more susceptible to developing arrhythmias and people who are becoming more aware of the availability of public access defibrillators.

By End User

In 2023, the hospital segment dominated the defibrillator market share of 79.9% during the forecast period owing to the most cardiac patients are being admitted to hospitals and because more operations are being done in hospitals. Additionally, hospitals are using both ICDs and external defibrillators more frequently to treat patients suffering from sudden cardiac arrest as well as for other purposes. As of January 2022, Boston Scientific, for instance, estimated that there were approximately 689,216 ICDs distributed worldwide.

Regional Analysis

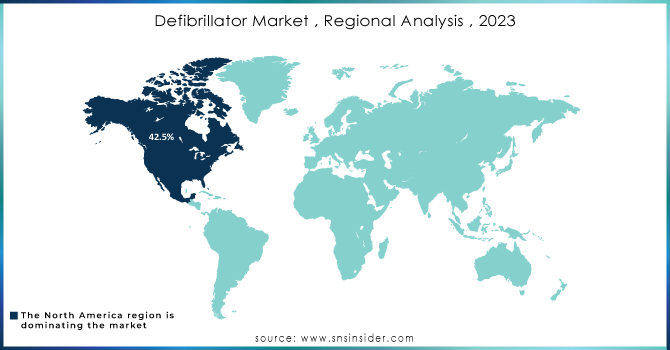

North America held a significant market share growth of 42.5% in 2023 and is likely to maintain its dominance during the forecast period due to initiatives by key players, favorable rules, and modern healthcare facilities in the United States and Canada. For instance, Boston Scientific stated that in 2022, it distributed around 34,271 of its CRT-Ds product line, which includes the Resonate, Autogen, Dynagen, Incepta, and Cognis devices, globally. Out of these, 17,300 were registered in the U.S. alone indicating a high adoption rate.

Asia-Pacific is witness to expand fastest CAGR rate of 9.7% during the projected period due to the growing patient population, expanding healthcare infrastructure, and the frequency of heart illnesses. Due to the widespread use of defibrillators and supporting policies, the Japanese market is driving regional growth. Nihon Kohden, a market leader in Japan, reported sales of manual external defibrillators totaling over USD 68,400 in 2022.

Need any customization research on Defibrillator Market - Enquiry Now

Key Players

The major key players are Medtronic, Stryker, Koninklijke Philips N.V., Asahi Kasei Corporation, Boston Scientific Corporation, Abbott, MicroPort Scientific Corporation, Nihon Kohden Corporation, Shenzhen Comen Medical Instruments Ltd., BIOTRONIK SE & Co. KG, Metrax GmbH, and Others.

Recent Development

ZOLL Medical (2024): Introduced a compact and lightweight AED designed for public access defibrillation.

Nihon Kohden (2024): Unveiled a portable AED with advanced data management capabilities.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.31 Billion |

| Market Size by 2032 | US$ 14.85 Billion |

| CAGR | CAGR of 8.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Implantable Cardioverter Defibrillator {ICD}, Transvenous ICD, External Defibrillators) • By Patient Type (Adults, Pediatric) • By End User (Hospital, Pre Hospital, Public Access Market, Alternate Care Market, Home Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Medtronic, Stryker, Koninklijke Philips N.V., Asahi Kasei Corporation, Boston Scientific Corporation, Abbott, MicroPort Scientific Corporation, Nihon Kohden Corporation, Shenzhen Comen Medical Instruments Ltd., BIOTRONIK SE & Co. KG, Metrax GmbH |

| Key Drivers |

• Increasing prevalence of cardiovascular diseases |

| Market Challenges | • Lack of awareness about sudden cardiac arrests in developing nations |