Wheat Germ Oil Market Report Scope & Overview:

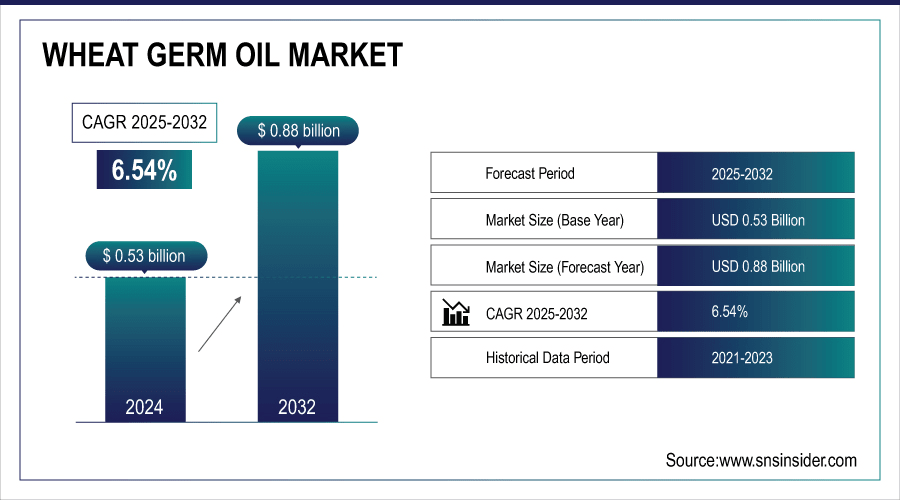

The Wheat Germ Oil Market size was valued at USD 0.53 Billion in 2024 and is projected to reach USD 0.88 Billion by 2032, growing at a CAGR of 6.54% during 2025-2032.

The global market covers comprehensive wheat germ oil market analysis of the market dynamics, segments by product, nature, applications, distribution channels, and region. Market growth is attributed to factors such as high health awareness, increased usage of essential oils in cosmetics and dietary supplements, and the rising demand for natural and organic oil. However, due to consumer perception that cosmeceuticals provide more nutrient and multiple functions, it drives the adoption across food, skincare and nutraceutical, and creates suction of steady growth and innovation opportunity globally.

-

Over 40% of consumers globally use wheat germ oil as a dietary supplement to boost immunity and overall health.

-

Over 35% of skincare product users prefer formulations containing wheat germ oil for its vitamin E and antioxidant benefits.

To Get More Information On Wheat Germ Oil Market - Request Free Sample Report

Wheat Germ Oil Market Trends:

-

Wheat germ oil offers regenerative, moisturizing, and anti-aging benefits, making it highly valuable in skincare and personal care products.

-

It is increasingly incorporated into fortified foods and nutraceuticals to enhance nutritional value.

-

Rising health-conscious and beauty-focused consumers are driving product development and market penetration globally.

-

Growth opportunities are expanding through online retail and direct-to-consumer channels.

-

E-commerce provides convenience, variety, and access to premium wheat germ oil products, boosting sales.

-

Subscription models and bundle offerings create recurring revenue and allow cost-effective market expansion.

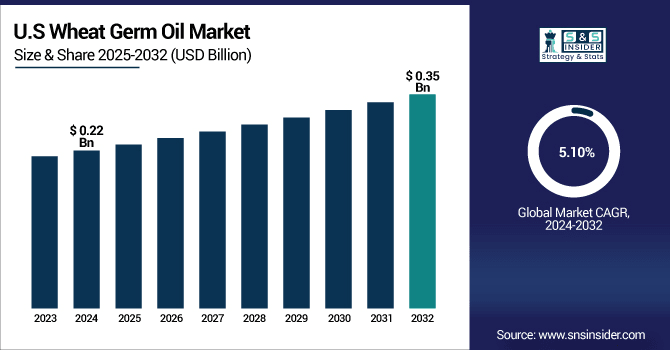

The U.S. Wheat Germ Oil Market size was valued at USD 0.22 Billion in 2024 and is projected to reach USD 0.35 Billion by 2032, growing at a CAGR of 5.10% during 2025-2032.

The U.S. market growth is primarily attributed to increasing consumer preference for healthy oils and organic skincare and beauty products. The rising focus on heart health, benefits of antioxidants, and preventive care has led to the growing adoption of the product. Additionally, advancements in supplement and cosmetic formulations are increasing attractiveness. Along with the increasing consumer preference for natural and functional ingredients, these trends are helping to market development and product acceptance for wheat germ oil in the U.S. to be stable.

Wheat Germ Oil Market Growth Drivers:

-

Increasing Utilization of Wheat Germ Oil in Skincare and Dietary Supplements Expands Market Opportunities Rapidly

In skin care and dietary supplement formulations, wheat germ oil is one of the most beneficial with regenerative, moisturizing, and anti-aging functions. These benefits are utilized in the cosmetic and personal care industries to address growing consumer demand for natural offers. Wheat germ oil is also used in fortified foods and nutraceutical products to improve the nutritional value. More health-conscious consumers, as well as beauty enthusiasts, are spurring product development and penetration. With the increasing adoption of wheat germ oil across various industries, the revenue generation from the market is going to be consistent and uniform across the globe.

-

Over 40% of health-conscious consumers globally use wheat germ oil as a dietary supplement to boost immunity.

-

Over 35% of skincare enthusiasts globally prefer products containing wheat germ oil for its moisturizing and anti-aging benefits.

Wheat Germ Oil Market Restraints:

-

High Production Costs and Limited Availability of Raw Materials Restrict Market Expansion

Extraction costs for wheat germ oil are high, and the raw material, the wheat germ has to be high quality. Production costs are higher owing to seasonal dependence, scarcity of quality wheat types and more processing efforts. All this makes the product expensive and drives price-sensitive consumers away from wheat germ oil. Also, the procurement of raw material for small-scale manufacturers is not easy and it makes it difficult for them to scale out operations. While this will attract consumer attention and increase demand in developing regions, growth is limited by high manufacturing costs and dependence on supply chain factors, which hinder penetration of these markets.

Wheat Germ Oil Market Opportunities:

-

Expansion of E-commerce and Direct-to-Consumer Channels Enhances Market Reach and Profitability Opportunities

Increasing penetration of online retail and direct-to-consumer channels opens the door for new growth opportunities for wheat germ oil. With the growing prevalence of e-commerce, consumers are more prone to purchase health and beauty products online as it provides convenience, variety and access to premium brands. E-commerce power the marketing, educating of products and targeting of direct audiences and the success in sales volumes. Subscription models and bundle offerings also lead to repeat revenue. This trend allows manufacturers to penetrate markets economically, cut distribution cost and discover niche consumer groups resulting in low-cost scale growth.

-

Over 55% of health and beauty consumers globally research and buy oils and supplements online for convenience and variety.

-

Over 40% of online shoppers are influenced by product reviews and ratings when purchasing health oils like wheat germ oil.

Wheat Germ Oil Market Segment Analysis:

-

By Product, Edible Oils held the largest share of around 45.20% in 2024, whereas Germ-enriched Bread is projected to be the fastest-growing segment with a CAGR of 7.20%.

-

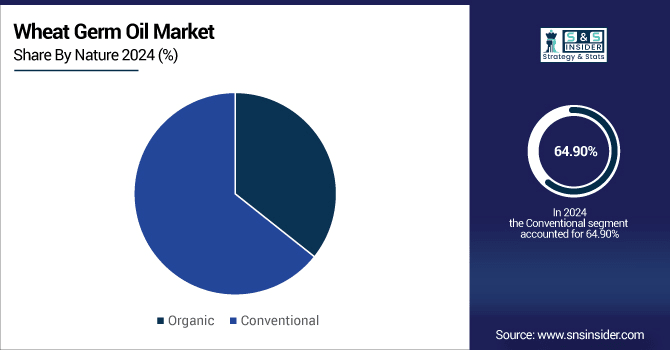

By Nature, Conventional segment dominated the market with approximately 64.90% share in 2024, while Organic segment is expected to register the highest growth with a CAGR of 7.50%.

-

By Application, Skincare accounted for the leading share of nearly 28.50% in 2024, whereas Dietary supplements segment is anticipated to be the fastest-growing segment with a CAGR of 6.90%.

-

By Distribution Channel, Hypermarkets & Supermarkets segment led the market with about 34.88% share in 2024, whereas Online Retailing is forecasted to grow the fastest at a CAGR of 7.40%.

By Nature, Conventional Segment Dominate While Organic Segment Shows Rapid Growth

In 2024, Conventional segment held the largest revenue share of around 64.90% in the Wheat Germ Oil Market, and this segment is likely to gain ample amount of traction in the years to come, owing to easy availability and cost-effectiveness compared to organic variants. It does this by providing a consistent supply to the food and cosmetics industries like it always has through traditional production methods. Cargill, Inc. is one of the prominent manufacturers of conventional wheat germ oil products globally. Organic segment is projected to register the highest CAGR of approximately 7.50% during the forecast period 2024-2032, owing to rising consumer preference for chemical-free oils, sustainable oil, and non-GMO oil. The global organic wheat germ oil market is expected to witness a significant growth rate during the forecast period due to rising awareness of environmental & health effects, and increasing demand for clean-label products.

By Product, Edible Oils Leads Market While Germ-enriched Bread Registers Fastest Growth

In 2024, Edible Oils segment led the Wheat Germ Oil Market holding over 45.20% revenue share owing to wheat germ oil's wide usage as cooking oil, in salad dressings and as an ingredient in many fortified food products. This means it has a rich nutritional content, it has a high level of vitamin E, and it has antioxidant properties – it is always a favorite health and wellness product to carry in your pantry. Bunge Limited is engaging in the production of wheat germ-based edible oils to strengthen its position in the market. However, the Germ-enriched Bread segment is anticipated to register the fastest CAGR of nearly 7.20% in the upcoming years owing to the rising consumer preference for functional bakery items with improved nutrient profiles, particularly in urban regions, during 2025 to 2032.

By Application, Skincare Segment Lead While Dietary Supplements Segment Registers Fastest Growth

The Skincare segment was the leading segment and accounted for more than 28.50% revenue share in 2024 of Wheat Germ Oil Market on account of its established anti-aging, moisturizing, and regenerative properties It is used in creams, lotions, and serums by cosmetic manufacturers in response to increasing consumer demand for natural skin-care products. Wheat Germ Oil is also being utilized for some skin-care products by The Body Shop. On the basis of application, the dietary supplements segment is projected to be the fastest-growing segment during the forecast period, registering a CAGR of 6.90% during 2025-2032 owing to rise in consumption of wheat germ oil for heart health, antioxidant benefits, and immune system support by health-conscious consumers globally.

By Distribution Channel, Hypermarkets & Supermarkets Segment Lead While Online Retailing Grows the Fastest

Hypermarkets & Supermarkets segment accounted for the highest revenue share of about 34.88% in the year 2024, owing to ease of accessibility, bulk purchase and visibility in organized retail. And this is further catalyzed by brand promotions and loyalty programs to make purchases in these channels. A mass distributor of wheat germ oil is through Walmart by retail. Online Retailing segment is projected to attain the fastest CAGR of approximately 7.40%, within the forecast period of 2025-2032, owing to growing e-commerce penetration, convenience, and availability of niche & premium wheat germ oil products. Furthermore, online platforms also provide in-depth details of the products and customer review that improves trust and willingness to buy.

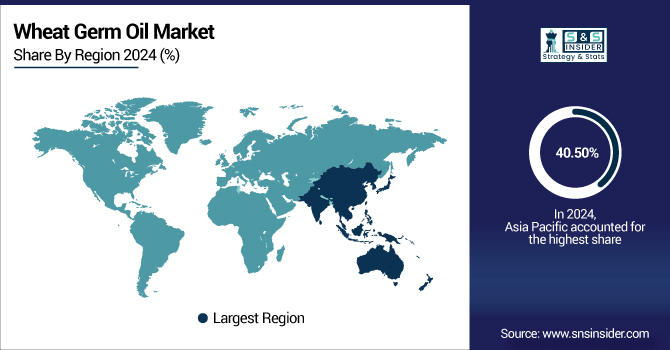

Asia Pacific Wheat Germ Oil Market Insights:

The Asia Pacific region led the worldwide Wheat Germ Oil Market with a top income share of about 40.50% in 2024 owing to the high consumption of natural oils and increasing health awareness, and also having established wheat cultivation in this region. The positive demand for the market is set to drive the major growth factors such as rapid urbanization, increasing disposable income and expanding cosmetic and nutraceutical industries. The Asia Pacific is projected to rise with the fastest CAGR of approximately 7.50% over 2024-2032 owing to rising health-minded individuals, growing e-commerce platforms, and increasing acceptance of fortified and organic products in China, India, and Japan.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Wheat Germ Oil Market Insights:

North America Wheat Germ Oil Market is growing owing to the increase in health and wellness-conscious consumers and natural skin care products. Demand fuelled by higher uptake in dietary supplements and fortified foods The region is led by the U.S. and Canada due to high retail networks, growing e-commerce, and increased consumer preference for organic, nutrient-rich, functional wheat germ oil products.

Europe Wheat Germ Oil Market Insights:

The Europe wheat germ oil market is projected to witness steady growth strategy in the upcoming years owing to increasing health consciousness and rising demand for natural and organic oils. Consumers are looking for nutrient-dense oils for topical use, as dietary supplements and in fortified foods. With the presence of a strong retail network and the success of clean-label, functional wheat germ oil products, as well as premium wheat germ oil products, countries such as Germany, France, and the UK remain at the forefront of consumption.

Latin America (LATAM) and Middle East & Africa (MEA) Wheat Germ Oil Market Insights:

Middle East & Africa and Latin America Wheat Germ Oil Market is witnessing a decent growth in the region owing to increasing health awareness and demand for natural and nutrient dense oils. The analytical segments of the report are driven by the key countries such as UAE, Saudi Arabia, Brazil and Argentina, where a high consumption of the products is expected driven by increasing penetration of retail networks, e-commerce and penetration of consumption in cosmetics, dietary supplements and fortified foods.

Competitive Landscape for Wheat Germ Oil Market:

Archer Daniels Midland Company is one of the world's largest producers of food-quality oils. Offering cold-pressed wheat germ oil, which is packed with nutrients and beneficial for dietary supplement as well as skincare preparations, as well as refined wheat germ oil, which is appropriate for food applications or as a component in personal care, their wheat germ oil portfolio comprises a hot-cooked grime absorbed mid and lower microwave. ADM extracts premium oils containing vitamin E and antioxidants from oilseeds using natural and sustainable practices and offers them to health-conscious consumers and to the global cosmetic and nutraceutical industries.

-

In January 2024, Archer Daniels Midland Company was recognized as a major player in the wheat germ oil market, according to a report by Global Market Insights Inc. This recognition underscores ADM's significant role in the industry.

Cargill is a global leader in food and agriculture, and the company has specialty wheat germ oils for nutritional and cosmetic markets. Their Specialty Wheat Germ Oil is a source of specialized nutrition containing dietary essential fatty acids for dietary supplements and functional foods while Cosmetic Grade Wheat Germ Oil offers moisturizing physiological activities and antioxidant phytochemicals for skincare products. Cargill continues to address global trends toward natural, nutrient-rich, and functional oils with an unwavering commitment to quality, sustainable sourcing and innovation.

-

In May 2025, Cargill earned the top spot on the inaugural Edible Oil Supplier Index, published by the Access to Nutrition Initiative (ATNi), for its efforts in removing industrially produced trans-fatty acids from its entire edible oils portfolio.

Bunge Limited is a global agribusiness and food company with expertise in oilseed processing. Wheat Germ Oil: Bunge® Wheat Germ Oil, a nutrient-dense oil for cooking and baking, and Bunge® Refined Wheat Germ Oil, used for fortified foods and product applications in personal care products. Bunge is combining of high-quality extraction techniques with a dedication to sustainable sourcing, grower inclusivity and solutions-based innovation to deliver premium Oils which deliver is just oils abundant in vitamins, antioxidants and multifunctional benefits to food and cosmetic industries globally.

-

In August 2025, Bunge Loders Croklaan, a division of Bunge, expanded its organic oils and fats portfolio in Europe to meet the growing demand for organic products.

Wheat Germ Oil Market Key Players:

Some of the Wheat Germ Oil Market Companies are:

-

Archer Daniels Midland Company

-

Cargill, Incorporated

-

Bunge Limited

-

Scoular Company

-

Henry Lamotte Oils GmbH

-

Viobin Corporation

-

Grupo Plimon

-

Agroselprom Ltd

-

Henan Kunhua Biological Technology Co., Ltd.

-

NOW Foods

-

CONNOILS LLC

-

NutriPlex Formulas Inc.

-

The J.M. Smucker Company

-

Country Life LLC

-

GNC (General Nutrition Centers, Inc.)

-

Swanson Health Products

-

Herbal Biosolutions

-

PHM Brands

-

Geyer Ingredients GmbH & Co. KG

-

SkinKraft Labs

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 0.53 Billion |

| Market Size by 2032 | USD 0.88 Billion |

| CAGR | CAGR of 6.54% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Edible Oils, Cereals, Germ-enriched Bread and Others) • By Nature (Organic and Conventional) • By Application (Capsules, Soft gel, Skincare, Hair care, Dietary supplements and Others) • By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Convenience Stores, Online Retailing and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Archer Daniels Midland Company, Cargill, Incorporated, Bunge Limited, Scoular Company, Henry Lamotte Oils GmbH, Viobin Corporation, Grupo Plimon, Agroselprom Ltd , Henan Kunhua Biological Technology Co., Ltd., NOW Foods, CONNOILS LLC, NutriPlex Formulas Inc., The J.M. Smucker Company, Country Life LLC, GNC (General Nutrition Centers, Inc.), Swanson Health Products, Herbal Biosolutions, PHM Brands, Geyer Ingredients GmbH & Co. KG and SkinKraft Labs. |