White Oil Market Report Scope & Overview

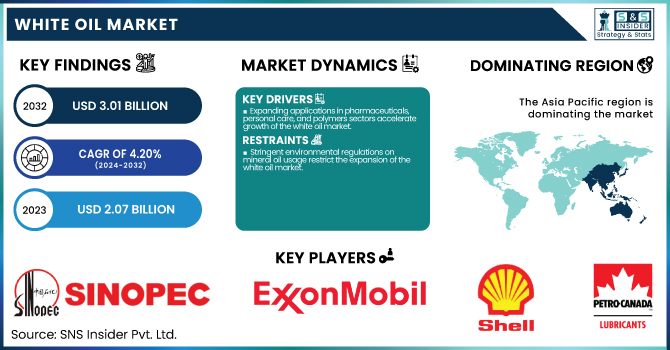

The White Oil Market size was USD 2.07 billion in 2023 and is expected to reach USD 3.01 billion by 2032 and grow at a CAGR of 4.20% over the forecast period of 2024-2032.

To Get more information on Aviation Crew Management Systems Market - Request Free Sample Report

This report on the white oil market delivers comprehensive statistical insights and emerging trends essential for understanding industry dynamics. It includes an in-depth analysis of production capacity and utilization rates by country and oil type for 2023, offering a clear view of global manufacturing strengths. The report presents feedstock pricing trends across key countries and types, shedding light on cost structures. It also evaluates the regulatory landscape by country and oil type, outlining its impact on market operations. Environmental metrics such as emissions data, waste management practices, and sustainability efforts are assessed regionally. Furthermore, it highlights innovation trends and R&D developments segmented by type in 2023. These insights provide stakeholders with critical data to support strategic decisions, compliance planning, and innovation initiatives.

The United States held the largest market share in the White Oil Market in 2023 due to its expansive industrial base, strong demand from key end-use sectors such as personal care, pharmaceuticals, polymers, and food processing. The country benefits from well-established manufacturing infrastructure, robust R&D capabilities, and a favorable regulatory environment that supports the use of high-purity white oils across applications. Additionally, the presence of major white oil producers and strategic investments in innovation and production capacity have bolstered the country’s dominance. In the United States, the market size was USD 290 million in 2023 and is expected to reach USD 445 million by 2032, growing at a CAGR of 4.84% over the forecast period of 2024–2032. The growing demand for pharmaceutical-grade and cosmetic-grade white oils, coupled with rising health and hygiene awareness, continues to drive market growth in the region.

Market Dynamics

Drivers

-

Expanding applications in pharmaceuticals, personal care, and polymers sectors accelerate growth of the white oil market.

The growing utilization of white oil in pharmaceuticals, cosmetics, and polymer manufacturing is significantly fueling market expansion. White oil is preferred in these sectors for its high purity, non-toxicity, and chemical stability. In the pharmaceutical industry, it is used in laxatives, ointments, and creams, while in the personal care sector, it is a key ingredient in lotions, baby oils, and hair products. The rising demand for clean-label and hypoallergenic ingredients is pushing manufacturers to rely more on white oil. Additionally, in the polymers industry, white oil acts as a processing aid and extender in thermoplastic elastomers and polystyrene. These diverse applications, coupled with increasing consumer awareness around product safety and purity, are major contributors to the steady growth of the global white oil market across developed and emerging regions.

Restrain

-

Stringent environmental regulations on mineral oil usage restrict the expansion of the white oil market.

Despite the rising demand, stringent environmental and regulatory policies surrounding the use of mineral oils, especially in food and pharmaceutical applications, present a notable restraint to the white oil market. Various regulatory agencies such as the FDA, EFSA, and REACH have imposed strict guidelines on purity levels, permissible usage, and residual content in white oil formulations. This necessitates costly compliance, extensive testing, and reformulation for producers, particularly in North America and Europe. Moreover, the growing public concern over petroleum-based ingredients in skincare and health-related products is pushing manufacturers to explore alternative bio-based oils. These factors collectively restrict the broader use of white oils and discourage small-scale manufacturers from entering the market due to high compliance costs and the need for continuous monitoring, thus restraining potential market growth.

Opportunity

-

Growing shift toward bio-based and sustainable white oil alternatives creates lucrative market opportunities.

The increasing consumer preference for environmentally sustainable and plant-based alternatives is generating significant opportunities for innovation in the white oil market. As awareness around eco-friendly and biodegradable products rises, industries such as cosmetics, pharmaceuticals, and food are shifting toward bio-based oils that offer similar functional properties to petroleum-derived white oils. This trend has prompted several major producers to invest in R&D to develop plant-derived white oils that meet regulatory and performance standards. Additionally, government support for sustainable chemicals and the rising adoption of green chemistry practices further contribute to the expansion of this niche segment. As companies seek to differentiate themselves through sustainability, the development and commercialization of renewable white oil alternatives are expected to offer strong competitive advantages and open new revenue streams in the global market.

Challenge

-

Fluctuating feedstock prices and supply chain disruptions pose a challenge to the white oil market.

Volatile crude oil prices, which directly influence the cost of white oil feedstock, present a major challenge for manufacturers and end-users alike. The market remains highly susceptible to geopolitical tensions, OPEC production decisions, and global supply chain constraints that have become more frequent in the post-pandemic era. Disruptions in raw material availability, transportation bottlenecks, and inflationary pressures significantly impact production costs and pricing strategies for white oil. Furthermore, unexpected regulatory changes in oil-exporting countries may create delays and inconsistency in supply. These factors lead to increased operational costs and difficulties in maintaining steady profit margins, particularly for manufacturers operating under tight quality controls and regulatory compliance. Consequently, feedstock instability and global logistics issues remain key hurdles for sustained growth in the white oil market.

Segmentation Analysis

By Application

Personal Care held the largest market share, around 26% 2023. It is owing to its high and steady process across a variety of applications. White oil is a highly refined, non-toxic hydrocarbon mineral oil with excellent emollient properties, which make it an important component in the formulation and manufacture of skincare products such as baby oils, lotions, creams, hair care products, and cosmetics. Answering to the increasing need worldwide for nondangerous, hypo-allergic, and dermato-examined commodities has made the white oil’s obsessions for mineral oil of very-high purity. Additionally, rising disposable incomes, urbanization and growing awareness among consumers about personal hygiene and grooming, particularly in developing economies, are further aspects driving the demand in the personal care market. White oil also enjoys a stronghold in this segment, as a majority of cosmetics and skincare manufacturers prefer white oil due to its stability and an efficient carrier for active ingredients.

Regional Analysis

Asia Pacific held the largest market share, around 52%, in 2023. It is due to the rapid growth of end use industries such as personal care, pharmaceuticals, plastics, and food processing. This has driven demand for white oil from various industries in many developing countries that have undergone significant industrialization and urbanization, especially in China, India, Japan, and South Korea. Factors such as the moderate population increase, increasing disposable incomes, and rapid shift towards consumer-oriented economies has increased the consumption of cosmetics, baby care products, and food packaging and is most likely to drive growth over the upcoming years. In addition, domestic application like major manufacturing hubs and conducive government policies in supporting the industrial set-up have favoured local production reducing dependence on imports. Besides, a spurt in domestic Advanced Refining Technologies and growing interest of regional companies in R&D of ultra-pure white oils are other key factors boosting the share of Asia Pacific in global market.

The White Oil Market in North America accounts of a considerable market share as being one of the regions with very well-built industrial base, strong regulatory framework and demand for the high-value sectors such as pharmaceuticals and personal care and food processing. This is particularly true in the United States, where the major portion of the demand for pharmaceutical-grade and cosmetic-grade white oils is exercised because of the strict FDA regulations that demand the purity and safety of the product. Moreover, the partiality of key market players, established complete refining infrastructure, and regular product innovation of specialty chemical formulations have stimulated the growth over the region. Moreover, increasing consumer attention toward biodegradable formulations of personal care and healthcare goods has also driven the demand for high-end white oils during the following years. Lastly, the rising expenditure on health and well-being products in the U.S. as well as Canada has propelled the demand further, establishing a robust stance of North America in the global market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Sinopec Corp. (Medicinal White Oil, Cosmetic White Oil)

-

ExxonMobil Corp. (ProPure, Marcol)

-

Shell plc (Ondina, Luminol)

-

British Petroleum (BP) (Enerpar, Paraflex)

-

Petro-Canada Lubricants Inc. (PURETOL, PRIMOL)

-

Indian Oil Corporation Ltd. (Seriol, Meditex)

-

Nippon Oil Corporation (Nisseki White, Nisseki Clean)

-

H&R Group (Sonneborn White Oil, Carnation)

-

Sasol Ltd. (Sasolwax, Luminol)

-

Savita Oil Technologies (Savonol, SavoMed)

-

TotalEnergies (Finavestan, Gemseal)

-

Panama Petrochem Ltd. (Panol, Panwhite)

-

Fuchs Petrolub SE (Fuchs White Oil, Catenex)

-

Eastern Petroleum Pvt. Ltd. (Epol, Epwhite)

-

JX Nippon Oil & Energy Corporation (Nisseki White Oil, JX Pure)

-

Bharat Petroleum Corporation Limited (BPCL) (Medinol, Petrowhite)

-

Calumet Specialty Products Partners (Drakeol, Penreco White Oil)

-

Seojin Chemical Co., Ltd. (Seolube, Seowhite)

-

APAR Industries Ltd. (Aparol, Aparmed)

-

Gandhar Oil Refinery (Divyol White Oil, Divyol Medicinal Oil)

Recent Development:

-

In February 2024, Chevron Lummus Global (CLG) successfully commissioned the world’s largest white oil hydro processing facility for Hongrun Petrochemical in Shandong Province, China. The plant addressing the needs of a wide range of industrial applications.

-

In May 2024, Sonneborn, a prominent white oil manufacturer, formed a strategic partnership with IMCD, a distributor of specialty chemicals. This alliance is designed to strengthen the distribution network for Sonneborn’s premium white oils in targeted regions, enhancing customer accessibility and expanding the company’s market reach.

-

In 2023, ExxonMobil launched a new line of biodegradable white oils specifically developed for the cosmetics and personal care industries. This innovation underscores the company’s commitment to environmental sustainability and responds to the growing demand for eco-friendly product solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.07 Billion |

| Market Size by 2032 | USD3.01 Billion |

| CAGR | CAGR of4.20 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Adhesives, Agriculture, Food, Pharmaceutical, Personal Care, Textile, Polymers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sinopec Corp., ExxonMobil Corp., Shell plc, British Petroleum (BP), Petro-Canada Lubricants Inc., Indian Oil Corporation Ltd., Nippon Oil Corporation, H&R Group, Sasol Ltd., Savita Oil Technologies, TotalEnergies, Panama Petrochem Ltd., Fuchs Petrolub SE, Eastern Petroleum Pvt. Ltd., JX Nippon Oil & Energy Corporation, Bharat Petroleum Corporation Limited (BPCL), Calumet Specialty Products Partners, Seojin Chemical Co., Ltd., APAR Industries Ltd., Gandhar Oil Refinery |