Cobalt Market Report Scope & Overview:

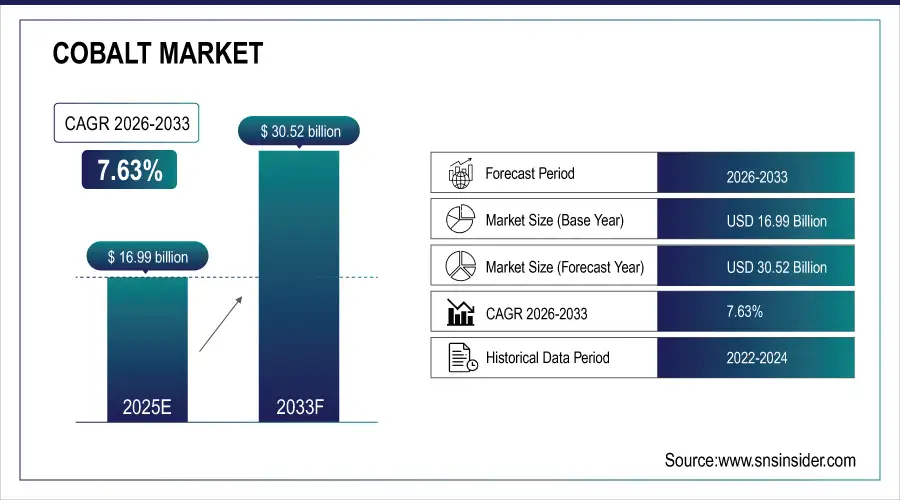

The Cobalt Market Size was valued at USD 16.99 Billion in 2025E and is projected to reach USD 30.52 Billion by 2033, growing at a CAGR of 7.63% during the forecast period 2026–2033.

The Cobalt Market analysis report observes growth driven by increasing demand for electric vehicles, rising penetration in energy storage solutions, growing applications in aerospace, electronics, and night vision, expanding use in industrial and healthcare segments, and the shift toward battery-grade cobalt.

Cobalt production reached 160,000 tons in 2025, driven by EV battery demand, energy storage growth, and rising industrial and electronics applications.

Market Size and Forecast:

-

Market Size in 2025: USD 16.99 Billion

-

Market Size by 2033: USD 30.52 Billion

-

CAGR: 7.63% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Cobalt Market - Request Free Sample Report

Cobalt Market Trends:

-

Growing demand for battery-grade cobalt is boosting growth, especially from electric vehicle and energy storage businesses.

-

Per capita consumption is rising in Asia-Pacific, Europe and North America due to the growing presence of renewable energy and electric vehicle (EV) infrastructure.

-

Rising use of cobalt across aerospace, electronics and medical applications is broadening market requirement.

-

Demand for responsible cobalt from economic activity and investment is changing the production approach and transparency in supply chains.

-

There will be consolidation in the marketplace as major players see innovation, strategic partnerships and differentiation through high-purity and specialty cobalt products.

U.S. Cobalt Market Insights:

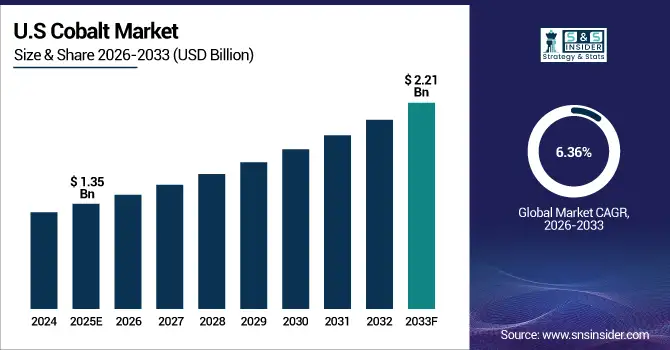

The U.S. Cobalt Market is projected to grow from USD 1.35 Billion in 2025E to USD 2.21 Billion by 2033, at a CAGR of 6.36%. Market growth is contributed from an increase in electric vehicles production, growing energy storage projects, technological developments and demand for industrial & electronics applications across country.

Cobalt Market Growth Drivers:

-

Surging demand for electric vehicle batteries and energy storage solutions is accelerating cobalt market growth.

Surging demand for electric vehicle batteries and energy storage solutions is the primary driver of the Cobalt Market growth. Demand for battery-grade cobalt is growing off the back of expanding EV and renewable energy storage adoption, but it is also seeing rising use in aerospace, electronics and healthcare. Investment in sustainably sourced and ethical production, combined with advanced mining and refining methods, is improving supply efficiency underpinning long term market development.

Battery-grade cobalt demand grew 12% in 2025, driven by rising EV production, expanding energy storage, and growing industrial applications.

Cobalt Market Restraints:

-

Political instability, ethical sourcing challenges, and volatile prices are limiting large-scale investment and supply expansion in cobalt.

Political instability, ethical sourcing challenges, and volatile prices are key restraints for the Cobalt Market. Miners also have to deal with complicated supply chains tied up in mining regulations, trade barriers and regional conflicts. Higher costs within sustainable and conflict-free sourcing limits the wiggle room in pricing which affects the margin. Furthermore, volatile cobalt prices and short supply in high purity products have deterred large investment and existing or new entrants would face difficulty raising output for increasing market share.

Cobalt Market Opportunities:

-

Growing electric vehicle and renewable energy adoption presents opportunities for battery-grade cobalt innovation and sustainable supply chain development.

Growing electric vehicle and renewable energy adoption presents a major opportunity for the Cobalt Market. Growing demand for battery-grade cobalt is driving producers to develop new methods of extraction, processing and sustainable sourcing. Companies are increasingly needing to invest in conflict-free supply chains and sustainable production practices. Not only does this move toward responsible, high-quality cobalt support technological progression, it also builds brand value and market differentiation and long-term growth potential in the industry.

Battery-grade cobalt accounted for 38% of total cobalt production in 2025, driven by rising EV adoption and expanding energy storage projects.

Cobalt Market Segmentation Analysis:

-

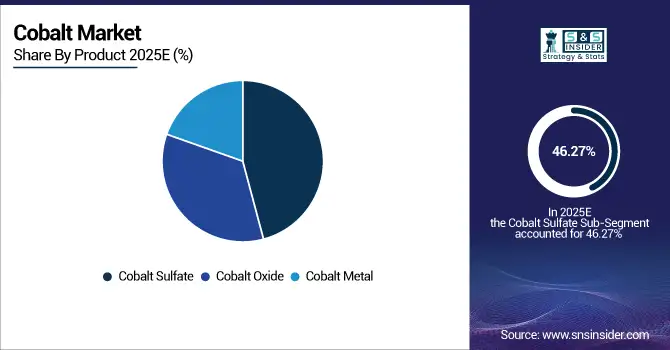

By Product, Cobalt Sulfate held the largest market share of 46.27% in 2025, while Cobalt Metal is expected to grow at the fastest CAGR of 8.34%.

-

By Type, Battery-Grade dominated with a 54.68% share in 2025, while Pharmaceutical-Grade is projected to expand at the fastest CAGR of 7.92%.

-

By Form, Powder accounted for the highest market share of 42.85% in 2025, while Cathode is expected to record the fastest CAGR of 8.76%.

-

By Application, Batteries held the largest share of 61.43% in 2025, while Aerospace is projected to grow at the fastest CAGR of 7.58%.

-

By End-Use Industry, Automotive dominated with a 49.37% market share in 2025, while Energy Storage is anticipated to grow at the fastest CAGR of 8.21%.

By Product, Cobalt Sulfate Dominates While Cobalt Metal Expands Rapidly:

Cobalt Sulfate segment dominated the market as it acts as a vital raw material for lithium-ion battery production and is widely used in electric vehicles and energy storage systems. Its stable procurement is backed by a well-integrated supply chain with major cathode producers in the industry. Cobalt Metal is the fastest growing segment expected in superalloys, magnetic materials, and catalysts Pacemakers are forcobalt-60 implants. Its growing market penetration is driven by high demand from the aerospace, defense and advanced manufacturing industries.

By Type, Battery-Grade Cobalt Dominates While Pharmaceutical-Grade Cobalt Expands Rapidly:

Battery-Grade segment dominated the market as a result of its important role in EV battery and portable consumer electronic. Its high purity, energy density, and electrochemical performance make it the backbone of electrification initiatives. Pharmaceutical-Grade is the fastest growing segment, due to high uses in vitamin supplements, diagnostic tools and healthcare technologies. The ever-increasing need for medical grade materials and trace element nutrition have created great potential in this niche category.

By Form, Powder Form Dominates While Cathode Form Expands Rapidly:

Powder segment dominated the market due to its adaptability across applications in catalysts, ceramics, batteries, and electronic components. Its high surface reactivity and industrial scalability make it a preferred input for large-volume production. Cathode Form is the fastest growing segment, propelled by surging use in advanced lithium-ion and solid-state batteries. Continuous technological innovations aimed at improving battery efficiency and lifecycle are accelerating the adoption of cathode-grade cobalt across energy and EV applications.

By Application, Batteries Dominate While Aerospace Expands Rapidly:

The batteries segment dominated the market as the metal is an essential part of lithium-ion battery cathodes employed in EVs, electronics, and renewable systems. Continued electrification and clean energy transitions result in ongoing demand and dependence of industry to cobalt-based compound. Aerospace is the fastest growing segment, with growing cobalt superalloy demand in high temperature turbine and engine components. Its adoption is gaining momentum due to increasing aircraft production and investments in the space industry.

By End-Use Industry, Automotive Dominates While Energy Storage Expands Rapidly:

Automotive segment dominated the market on account of increasing demand for electric and hybrid vehicles. Auto manufacturers’ emphasis on battery life, efficiency and recyclability is increasing the dependence of next-generation EV production on cobalt. Energy Storage is the fastest growing segment as renewable penetration drives demand for cost-effective long-duration batteries. Rising investment in grid stability, household storage and renewable back up options are driving cobalt’s place in the evolving world of energy infrastructure.

Cobalt Market Regional Analysis:

Asia-Pacific Cobalt Market Insights:

The Asia pacific cobalt market is dominated with 58.64% of market share, growth of electric vehicle production, increasing energy storage projects and number of industrial applications are rising in the region. Growth is being driven primarily by China, Japan, India and South Korea, where the manufacturing of batteries and investment in renewable energy lead the world. Growing use of EVs, government incentives and advances in battery-grade cobalt are nurturing regional market dominance with sustained growth prospects throughout Asia-Pacific.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Cobalt Market Insights:

China Cobalt Market growth is attributed to the swift adoption of electric vehicles, expansion in energy storage projects and massive battery production. Government subsidies, industrial development, and advancements in battery-grade cobalt drive the demand for cobalt and hence China is one of the highest revenue-generating countries to ASEAN Cobalt Market second to the Asia-Pacific industry.

Europe Cobalt Market Insights:

The Europe Cobalt Market is the fastest growing region with a CAGR of 9.37%, supported by increasing electric vehicles sales, renewable energy projects along with battery manufacturing and recycling taking place in Germany, France and UK. Growth is facilitated by government incentives, technological innovation and sustainable sourcing initiative. Strengthening investments in grid-scale energy storage and EV infrastructure are driving demand faster, with regional innovators preparing for sustained market presence and long-term expansion.

Germany Cobalt Market Insights:

Germany is an important market for cobalt with strong demand coming from electric vehicle batteries, energy storage and industrial applications. Growth is bolstered by government incentives, technological advancement and a sustainability-oriented sourcing. Strong growth of EV sales and fast-growing battery industry has been contributing to Germany being the largest market in EU.

North America Cobalt Market Insights:

North America is an important Cobalt Market that is supported by robust demand for electric vehicle batteries, energy storage solutions and industrial applications. Growth is driven by increasing EV production, innovation in battery-grade cobalt technology and investments into renewable energy projects. Elaborated government support for clean energy and acceptance of high-end battery technologies across the region are further cementing market presence in these regions to contribute significantly to sustain a long-term growth outlook in North America.

U.S. Cobalt Market Insights:

The U.S. Cobalt Industry is expected to be led by the growing adoption of electric vehicles, growing size of renewable energy-based projects and increasing battery grade cobalt demand. Market growth is driven by investments in advanced battery technologies, industrial applications and sustainable sourcing practices and government incentives and expanding energy storage infrastructure.

Latin America Cobalt Market Insights:

The Latin America Cobalt Market to grow with the increasing mining activities and demand for battery-grade cobalt. Energy storage, EV supply chains and industrial applications are driving growth. Influential markets including Brazil, Mexico and Chile are gaining an advantage from sustainable mining techniques along with creating new export channels.

Middle East and Africa Cobalt Market Insights:

The Middle East & Africa Cobalt Market is further projected to come across as growing with rising demand for energy storage, electric vehicles (EVs), and industrial applications. Growing mining enterprises, investments in battery grade cobalt, and responsible sourcing practices are the major third-party trends. Growth is also underpinned by infrastructure investment and regional export prospects.

Cobalt Market Competitive Landscape:

Glencore Plc, founded in 1974 and headquartered in Switzerland, is one of the world’s largest diversified natural resource companies with a major focus on cobalt mining and trading. Its market primacy is due to large-scale operations in the Democratic Republic of Congo and a vertically integrated supply chain from extraction to refining and distribution. Battery and automotive manufactures collaborations, together with operational efficiency, scale and long life of contracts underpin Glencore’s position as one of the largest suppliers for cobalt.

-

In May 2025, Glencore partnered with Cobalt Blue Holdings to supply cobalt hydroxide from its KCC and Mutanda mines in the Democratic Republic of Congo. This supports the Kwinana refinery in Australia, enhancing production of battery-grade cobalt and strengthening Australia’s role in the cobalt supply chain.

China Molybdenum Co., Ltd., established in 1982 and based in China, is a leading mining and metals company, commanding a strong position in the cobalt market. Its supremacy stems from the ownership of high-grade cobalt units, notably Tenke Fungurume Mine in the Democratic Republic of Congo. Well-developed mines, cost effective processing facilities and well-established ties to end users have resulted in a consistent supply of cobalt. Technology, sustainability and distribution investments have strengthened its position as a leader in the cobalt industry.

-

In April 2025, CMOC launched a new batch of high-purity battery-grade cobalt, producing 30,414 tonnes. This launch targets the growing demand from electric vehicle and energy storage industries, enhancing production efficiency and strengthening CMOC’s position as a key supplier of premium cobalt products.

Umicore SA, founded in 1906 and headquartered in Belgium, is a leader in materials technology and recycling, specializing in cobalt for batteries and energy storage. The company holds a leadership position in the advanced exploration, recycling and production of high-purity cobalt. The commitment to ethical sourcing, sustainability and R&D innovation adds credibility in the market. Working with electric vehicle OEMs, strong supply ties and leading battery material technology make Umicore a top cobalt supplier.

-

In May 2025, Umicore launched a high-purity cobalt initiative at its upcoming homogeneous catalysts facility, starting operations in 2027. This launch supports advanced automotive and energy applications, reinforcing Umicore’s innovation leadership and ability to meet growing demand for premium cobalt materials.

Cobalt Market Key Players:

-

China Molybdenum Co., Ltd.

-

Vale S.A.

-

Sherritt International Corporation

-

Jinchuan Group International Resources Co., Ltd.

-

Sumitomo Metal Mining Co., Ltd.

-

Freeport Cobalt

-

Cobalt 27 Capital Corp.

-

Huayou Cobalt Co., Ltd.

-

First Cobalt Corp.

-

Eurasian Resources Group (ERG)

-

China Northern Rare Earth (Group) High-Tech Co., Ltd.

-

Li-Cycle Holdings Corp.

-

China Nonferrous Metal Mining Group Co., Ltd.

-

GEM Co., Ltd.

-

Clean TeQ Holdings Limited

-

CBMM (Companhia Brasileira de Metalurgia e Mineração)

-

Zhejiang Huayou Cobalt Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 16.99 Billion |

| Market Size by 2033 | USD 30.52 Billion |

| CAGR | CAGR of 7.63% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Cobalt Sulfate, Cobalt Oxide, Cobalt Metal) • By Type (Battery-Grade, Industrial-Grade, Pharmaceutical-Grade, Others) • By Form (Powder, Pellet, Cathode, Others) • By Application (Batteries, Aerospace, Catalysts, Alloys, Electronics, Others) • By End-Use Industry (Automotive, Energy Storage, Electronics, Chemical, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Glencore Plc, China Molybdenum Co., Ltd., Umicore SA, Vale S.A., Sherritt International Corporation, Jinchuan Group International Resources Co., Ltd., Sumitomo Metal Mining Co., Ltd., Freeport Cobalt, Cobalt 27 Capital Corp., Huayou Cobalt Co., Ltd., First Cobalt Corp., Eurasian Resources Group (ERG), Katanga Mining Limited, China Northern Rare Earth (Group) High-Tech Co., Ltd., Li-Cycle Holdings Corp., China Nonferrous Metal Mining Group Co., Ltd., GEM Co., Ltd., Clean TeQ Holdings Limited, CBMM (Companhia Brasileira de Metalurgia e Mineração), Zhejiang Huayou Cobalt Co., Ltd. |