Whole Genome Sequencing Market Size & Trends

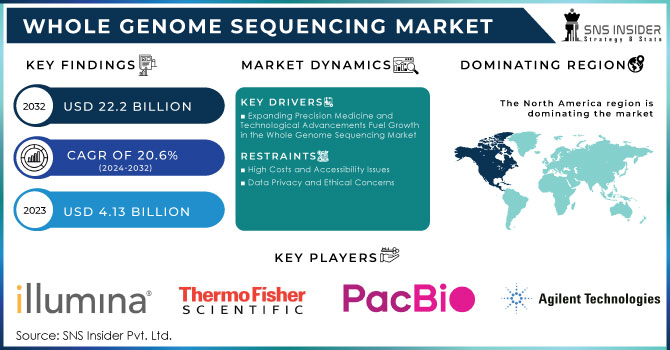

The Whole Genome Sequencing Market size was valued at USD 4.13 billion in 2023 and is expected to reach USD 22.2 billion by 2032 and grow at a CAGR of 20.6% over the forecast period 2024-2032.

Get More Information on Whole Genome Sequencing Market - Request Sample Report

The Whole Genome Sequencing (WGS) market is witnessing robust growth. These are primarily due to technological advances in genome sequencing, reduction in costs, and the increasing need for personalized medicine. It is the rapid innovation in sequencing technologies, especially in next-generation sequencing platforms, which have changed the whole game of genome sequencing. It enables high-throughput sequencing and thereby the analysis of massive amounts of genetic data fast and cost-effectively. Not only is WGS becoming more technically feasible, but also with emerging technologies like nanopore and single-cell sequencing, WGS is reaching a wider array of users from the research institution level to clinical laboratories. For instance, in May 2024, SOPHiA GENETICS partnered with Microsoft and NVIDIA to establish a scalable WGS analytical solution for healthcare institutions; meaning that growth in the field will only be on an increase from here.

The cost of sequencing the whole genome has dramatically decreased in the last decade, making the activity possible for routine clinical applications increasingly over the years. As the price of sequencing continues to drop, healthcare providers are more prone to incorporating genomic data into everyday practice. This, in turn, is important for personalized medicine, as it allows for targeted treatments that are tailored to an individual's genetic profile and, therefore, can improve patient outcomes. In March 2023, Mumbai-based Godrej Memorial Hospital launched its genome testing initiative that could screen more than 150 genetic conditions, including cancer and diabetes, through its Health Genometer Smart Plan via an AI-powered device.

Aside from its application in the field of personalized medicine, WGS is fast becoming mainstream in different industries. In cancer research, for instance, it determines mutations that cause the growth of tumors; it therefore aids in creating targeted therapies. It is also helping in infectious disease management by monitoring outbreaks and tracking changes in the pathogen. The technology is also being used in the agricultural sector for improving crop and livestock breeding. Increasing cancer rates globally are also driving the growth of the WGS market. For instance, it is estimated that 1.9 million new cases of cancer and around 609,820 cancer deaths will occur in the United States alone in 2023. WGS would, therefore provide critical diagnostic information for medical testing and treatment development as well as preventive health-care measures by allowing the recognition of genetic mutations associated with the risk of cancer.

| Region | Regulatory Body | Key Regulations/Guidelines | Status |

|---|---|---|---|

| North America | FDA, NIH | CLIA, CAP guidelines | Active |

| Europe | European Medicines Agency (EMA), ECDC | GDPR, IVDR | Active |

| Asia-Pacific | PMDA (Japan), TGA (Australia) | National guidelines for genomics | Active |

| Latin America | ANVISA (Brazil) | Regulatory frameworks under development | Emerging |

| Middle East & Africa | National Health Authorities | Varies by country | Emerging |

Whole Genome Sequencing Market Dynamics

Drivers

- Expanding Precision Medicine and Technological Advancements Fuel Growth in the Whole Genome Sequencing Market

The leading growth driver in the whole genome sequencing market is expanding applications of this technology in precision medicine. For, WGS has always played a pivotal role in precision medicine because the solutions of healthcare will be tailored according to one's specific genetic profile. It identifies the genetic mutations and variants connected with diseases, which will steer the decision-making process toward the selection of targeted therapies. For example, in oncology, WGS allows the precise understanding of genetic alterations within a tumor, thus being used to inform personalized treatment strategies for better patients. Yet WGS is increasingly used today for the diagnosis of rare genetic disorders, prenatal screening, and pharmacogenomics example, whether an individual should receive a specific type of drug based on their genetic makeup. Growing demand for genomic data, valued by health care providers and regulatory bodies, is driving the clinic use for WGS, hence growth in the market.

Technological advancements propel the growth of the WGS market. The advancement in next-generation sequencing (NGS) has dramatically reduced the costs and the time required to sequence a genome, putting research and clinical use on more accessible terms. Bioinformatics technology has improved the analysis of data, allowing for more accurate interpretations of intricate genomic information. Investment by the government and private sectors in WGS continues to accelerate growth. Such major initiatives are also seen with the UK Biobank and the U.S. NIH's All of Us Research Program. Additionally, the increased R&D in the private sector and the increase in venture capital in genomics-based start-ups will support technological growth and broad-based applications, which will again spur market growth.

Restraints

-

High Costs and Accessibility Issues

-

Data Privacy and Ethical Concerns

Whole Genome Sequencing Market Segmentation Insights

By Product & Service

Consumables dominated the whole genome sequencing market with a significant share of 61.1% in the year 2023. Because of the rising need for genomic studies and personalized medicine, high-quality reagents, kits, and other consumables are being demanded at much higher rates. Most of these products are essential in sample preparation, library construction, and sequencing, especially in both research and clinical applications. Since consumable purchases are a frequent feature, this ensures steady revenues to the manufacturers, and the subsequent and upward innovations are enhancing their efficiency and reliability, thus driving the market growth.

The services segment, on the other hand, is expected to grow at the highest CAGR of 25.1% during the forecast period. With WGS becoming well-established in personalized medicine and research, the demand is surfacing for specialized services such as data analysis, interpretation, and bioinformatics. This is important for healthcare providers and researchers in managing and interpreting complex genomic data and delivering precise results and actionable insights. Advances in sequencing technology have meant greater volumes of data, which has required an increasing amount of support from experts working on data management. In addition, outsourcing sequencing and analytical work from specialized providers to institutions has also driven growth in this segment and allowed organizations to focus more purely on core research activities.

By Type

Large whole genome sequencing led the majority 58.6% share in 2023 with the biggest share since it covers almost all applications from cancer genomics, population studies, and complex trait research. Large WGS permits a whole-scale understanding of genetic variations, making it very valuable for researchers working on disease mechanisms and evolutionary biology. Technology has made large-scale projects feasible with a reduction in costs and increased throughput.

The small whole-genome sequencing segment is likely to have the highest compound annual growth rate at a CAGR of 24.7% during the forecast period. This technique sequences much smaller genomes than its close cousin, from those of bacteria and viruses, of the kind needed for research into infectious diseases and antibiotic resistance. As researchers zero in more on particular genetic variations without the hassle of larger genomes, demand will be there for targeted analysis. This will make small WGS a primary growth area in the genomics industry with the rising attention given to microbiome studies and precision agriculture.

By Workflow

In 2023, the sequencing segment took the largest share, 52.0%, primarily because it is considered indispensable in streamlining the entire process of sequencing, starting with sample preparation, through the production of sequencing libraries, and up to analysis. Complete workflows are comprehensive, making them efficient, accurate, and thus indispensable for research and clinical applications. As sequencing technologies advance, standardized and user-friendly workflows are increasingly in demand, making it easier for the technology to be fully adopted at different institutions. Twist Bioscience Corporation introduced Twist Full Length Unique Dual Index Adapters in October 2023. The adapters allow PCR-free whole genome sequencing and large-scale multiplexing on its silicon-based high-quality synthetic DNA platform. Improvements in automation as well as in bioinformatics tools have improved throughput and data management, making workflows now more reliable, accountable, and more available, thereby fostering the growth of this segment.

The data analysis segment is expected to register the highest growth CAGR of 23.7% over the forecast period. The fast-growing rate of genomic data generation is attributed to exponentially advancing sequencing technologies. High adoption of whole-genome sequencing involves the integration of sophisticated tools for data analysis to interpret complex genomic information. The integration of artificial intelligence and machine learning into the analysis of data enhances predictive accuracy and accelerates interpretation, thus having a greater demand within this segment.

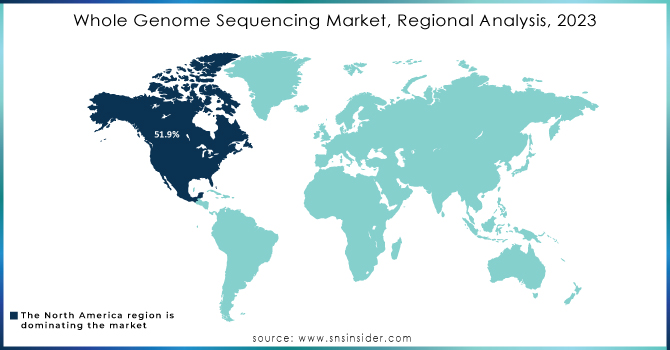

Whole Genome Sequencing Market Regional Analysis

In 2023, North America dominated the whole-genome sequencing market with a remarkable share of 51.9%. It is led by significant public and private sector investment through programs such as government funding and venture capital funding. Supportive well-equipped research infrastructures by top-tier universities and institutes help make rapid breakthroughs in the field of genomics. The U.S. market for WGS is expected to expand further, backed by strong market players, a robust regulatory framework, and a vibrant ecosystem for biotechnology innovation.

Strong growth is also witnessed in the WGS market in Europe due to continuous investments in related personalized medicine and genomics-based research. Progress for the UK and France is made through government initiatives, such as the 100,000 Genomes Project and the National Plan for Genomic Medicine, respectively. Growth further results from leadership in Germany through bioinformatics and healthcare technology with partnerships in drug development.

The WGS market in the Asia-Pacific region is likely to grow at the highest rate, at 25.4% CAGR. The major factors driving this growth are faster-than-average technological advancement and good government support for genomics research in China and Japan. Tremendous growth can be witnessed across the region, further boosted by China's "Healthy China 2030" plan and the emergence of leading companies in genomics, as well as Japan's focus on precision medicine and its requirements for an aging population.

Need Any Customization Research On Whole Genome Sequencing Market - Inquiry Now

Key Players in the Global Whole Genome Sequencing Market

-

Thermo Fisher Scientific Inc.

-

BGI Group

-

Pacific Biosciences of California, Inc. (PacBio)

-

Oxford Nanopore Technologies Ltd.

-

Agilent Technologies, Inc.

-

10x Genomics, Inc., and others.

Key Players Offering Services Related to Whole Genome Sequencing

-

GeneDx (a subsidiary of OPKO Health, Inc.)

-

Myriad Genetics, Inc.

-

Fulgent Genetics, Inc.

-

Macrogen, Inc.

-

Zymo Research Corporation

-

Ginkgo Bioworks, Inc.

-

Array Genomics, and others.

Recent Developments in the Whole Genome Sequencing Market

In September 2024, MGI Tech Co., Ltd. announced it had obtained global rights to commercialize and distribute its latest sequencing products, CycloneSEQ-WT02 and CycloneSEQ-WY01. These new technologies incorporate notable advancements in protein engineering, flow cell design, and base calling algorithms, all aimed at improving accuracy and throughput in genomic sequencing.

In January 2024, Ultima Genomics revealed plans to introduce a range of high-capacity instruments capable of sequencing a human genome for as little as USD 100, according to the company's leadership.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.13 billion |

| Market Size by 2032 | US$ 22.2 billion |

| CAGR | CAGR of 20.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service (Instruments, Consumables, Services) • By Type (Large Whole Genome Sequencing, Small Whole Genome Sequencing) • By Workflow (Pre-sequencing, Sequencing, Data Analysis) • By Application (Human Whole Genome Sequencing, Plant Whole Genome Sequencing, Animal Whole Genome Sequencing, Microbial Whole Genome Sequencing) • By End-Use (Academic & Research Institutes, Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Inc., Thermo Fisher Scientific Inc., BGI Group, Pacific Biosciences of California, Inc. (PacBio), Oxford Nanopore Technologies Ltd., Agilent Technologies, Inc., 10x Genomics, Inc, GeneDx (a subsidiary of OPKO Health, Inc.), Myriad Genetics, Inc., Fulgent Genetics, Inc., Macrogen, Inc., Zymo Research Corporation, Ginkgo Bioworks, Inc., Array Genomics |