Next-generation sequencing Market Size & Overview

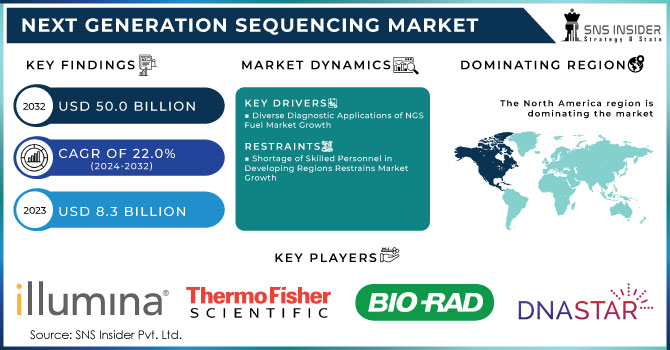

The Next-Generation Sequencing Market size was worth USD 8.3 billion in 2023 and is estimated to reach a valuation of USD 50.0 billion by 2032, propelling at a CAGR of 22.0% over the forecast period of 2024-2032.

To Get More Information on Next Generation Sequencing Market - Request Sample Report

Transforming Genomics Research and Clinical Diagnostics Among Augmented Investments and Technological Advancements Globally.

The Next-Generation Sequencing (NGS) market growth is driven by its impact clinical diagnostics, genomics research, and precision medicine. The beginning of NGS technology, that allow largely parallel sequencing of DNA, has substantially accelerated people’s ability to decode entire genomes with high speed and cost-efficiency. The COVID-19 pandemic also boosted the adoption of NGS technologies as the global pharmaceutical and biotechnology companies globally intensified their research efforts to develop diagnostic tools and vaccines.

For instance, Oxford Nanopore Technologies’ MinION Mk1C played an important role in China by sequencing the COVID-19 samples, which further highlights NGS’s critical role in the pandemic response. Furthermore, the integration of NGS into clinical diagnostics by companies such as Pediatrix Medical Group and GeneDx Inc. showcases its surging role in healthcare, particularly in newborn care.

| Year/Period | Milestone/Event | Description |

|---|---|---|

| 1970s | Development of Sanger Sequencing | Frederick Sanger developed the chain-termination method for sequencing DNA, laying the foundation for NGS. |

| 1980s | Introduction of Automated Sequencing | Automation of sequencing technologies, accelerating the process and reducing manual labor. |

| 1990s | Human Genome Project (HGP) | The HGP aimed to map the entire human genome, increasing the demand for faster and more accurate sequencing methods. |

| Mid-2000s | Emergence of Next Generation Sequencing Technologies | Companies like 454 Life Sciences introduced NGS platforms, enabling massive parallel sequencing. |

| Late 2000s | Commercialization of NGS by Illumina and Others | Illumina and other companies revolutionized sequencing with high-throughput platforms. |

| 2010s | Rapid Advancements in Sequencing Speed & Cost Reduction | NGS technologies advanced rapidly, reducing costs dramatically and increasing the speed of genome sequencing. |

| 2020s | Long-Read Sequencing & Clinical Applications | Advances in long-read sequencing (PacBio, Oxford Nanopore) and clinical diagnostics in personalized medicine. |

Surging Investments and Technological Advancements Propel NGS Market Growth

The Next-Generation Sequencing (NGS) market growth is driven by the rising technological advancements and surging investments in research and development. Institutions including DNA Script and Harvard University have secured multi-million-dollar grants for improving the NGS capabilities by incorporating DNA synthesis and sequencing into streamlined and single instruments. National genome mapping initiatives, such as the U.K.’s 100,000 Genomes Project and France’s Genomic Medicine 2025 plan, are also driving demand for NGS as these projects aim to unravel the connections between genetics and diseases, particularly cancer and rare genetic disorders.

The key advantages of NGS including its cost-effectiveness, accuracy, and rapid turnaround are further boosting its adoption in clinical diagnostics. As the cost of whole-genome sequencing continues to decline, akin to Moore’s law in technology, NGS is becoming more accessible for a broad range of applications. Market leaders, such as Illumina, Roche, and Agilent Technologies are actively innovating and forming strategic collaborations to enhance NGS capabilities. For instance, Invitae Corporation’s introduction of LiquidPlex Dx and FusionPlex Dx in Europe exemplifies the advanced genomic profiling utilized in oncology diagnostics, reflecting the growing integration of NGS into clinical settings.

Next-generation sequencing Market Dynamics

Drivers:

Diverse Diagnostic Applications of NGS Fuel Market Growth

A major driver of the Next-Generation Sequencing (NGS) market is its expanding range of diagnostic applications. The decrease in sequencing costs has broadened NGS’s use across various disease diagnoses. Companies are actively developing test kits and services for non-invasive prenatal testing, genetic screening, and cancer diagnostics. For instance, a March 2024 collaboration between Thermo Fisher Scientific Inc. and Bayer AG aimed to develop advanced companion diagnostic assays. Government initiatives, including product approvals and enhanced reimbursement coverage, are also supporting market growth. Additionally, the increasing prevalence of chronic diseases and heightened research efforts in expanding NGS applications contribute to the market’s robust expansion.

Technological advancements in NGS products and the expansion of related services are significantly boosting the market. As NGS adoption rises, personalized medicine is gaining momentum, with genome sequencing costs decreasing. The competitive landscape has spurred innovation, with companies launching state-of-the-art products. For instance, in June 2022, PerkinElmer Inc. introduced the BioQule NGS System, an automated benchtop solution designed to advance NGS research, showcasing the industry's drive toward more sophisticated and accessible sequencing technologies.

Restraints:

Shortage of Skilled Personnel in Developing Regions Restrains Market Growth

Despite the NGS market's global expansion, its growth is constrained by a shortage of skilled personnel in developing regions. The advanced nature of NGS technology necessitates specialized knowledge, and the lack of trained professionals to operate these systems in emerging economies limits the technology's widespread adoption.

Next-generation sequencing Market Segmentation Analysis

By Product

In 2023, the consumables segment held the dominant Next-Generation Sequencing (NGS) market share of 74.7%. This dominance is attributed to the frequent use of consumables, such as target enrichment and sample preparation kits, which are essential for both research and commercial NGS applications. The high demand for these consumables is driven by NGS's extensive adoption in diverse fields, including cancer genomics and various diagnostic applications. As pharmaceutical companies and research institutions increasingly rely on NGS technology for gene sequencing, the demand for consumables has surged. This segment’s exponential growth highlights the critical role these products play in supporting advancements in NGS technologies across various industries, thereby driving overall market expansion.

By Technology

In 2023, the targeted sequencing & resequencing segment is expected to dominate the Next-Generation Sequencing (NGS) market, capturing a 73.1% share. This segment is also anticipated to be the fastest-growing throughout the forecast period. The growing popularity of whole genome sequencing (WGS) has spurred the demand for targeted sequencing, which focuses on specific gene sites and isolated genetic expressions within large genomic datasets.

Targeted sequencing offers a more efficient and cost-effective approach by zeroing in on critical genomic regions rather than analyzing the entire genome. The market is teeming with companies providing specialized targeted sequencing services, further propelling growth. As WGS gains traction in clinical diagnostics and research, the demand for targeted sequencing is expected to rise, reinforcing its dominance and accelerating expansion within the broader NGS market.

By Workflow

In 2023, the sequencing segment held the highest market share within the Next-Generation Sequencing (NGS) market, driven by its pivotal role in the workflow. NGS sequencing is crucial for providing precise liquid measurements and automating tasks such as tube and microplate management, streamlining research processes. This automation allows researchers to focus on data analysis rather than operational tasks.

Meanwhile, NGS data analysis is projected to be the fastest-growing segment, with a forecasted CAGR of 22.89%. This growth is driven by the increasing acceptance of sequencing platforms in clinical diagnostics, as reduced installation costs make these technologies more accessible. The availability of genomic and proteomic data presents substantial expansion opportunities. Companies, such as Illumina have bolstered their data analysis capabilities through acquisitions, such as the DRAGEN Bio-IT Platform, enhancing the efficiency of sequencing data interpretation and management. Additionally, cloud-based platforms including Genomatix and DNAnexus are advancing data analysis solutions.

By Application

In 2023, the oncology segment is expected to lead the Next-Generation Sequencing (NGS) market, commanding a 27.8% share and positioning itself as one of the fastest-growing segments. This dominance is driven by the extensive use of NGS for DNA and RNA sequencing, epigenetics studies, and analyzing chromosomal abnormalities, which collectively account for over 75% of global sequencing data. The rising prevalence of cancer worldwide necessitates advanced technologies including NGS to assist oncologists in understanding the molecular mechanisms of cancer and tumor cells.

NGS is instrumental in identifying genetic mutations, facilitating precision medicine, and supporting early diagnosis. Companies, such as Myriad Genetics are leading this initiative by offering genetic testing that helps patients assess their cancer risks. As the demand for advanced cancer diagnostics rises, the oncology segment is expected to continue growing and remain a key driver of NGS market expansion.

By End User

In 2023, the academic research segment is projected to dominate the Next-Generation Sequencing (NGS) market with a significant 53.7% share. This dominance is due to the widespread adoption of NGS technologies in universities and research institutions for various genomic studies. The increasing availability of scholarships for PhD research focused on NGS is expected to drive demand for NGS products and services, further boosting market growth during the forecast period.

Additionally, on-site bioinformatics training programs are anticipated to enhance revenue in this segment. These workshops, which focus on practical applications of NGS sequencing and data processing, are becoming integral to academic research settings, providing researchers with hands-on expertise. The continuous integration of NGS technologies in the academic sector positions it as one of the fastest-growing segments, contributing significantly to the overall expansion of the NGS market.

Next-generation sequencing Market Regional Outlook

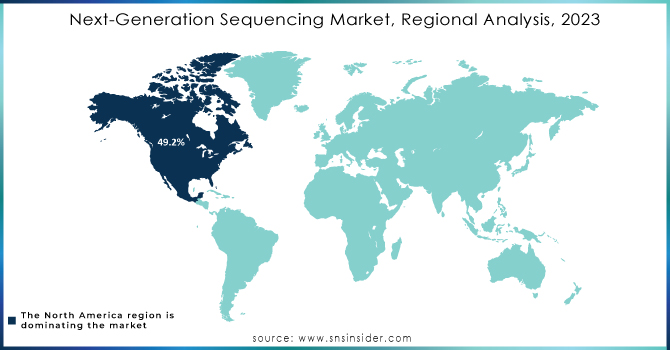

In 2023, North America led the Next-Generation Sequencing (NGS) market with a notable 49.2% share. This dominance is primarily driven by the region's robust clinical laboratory infrastructure, which extensively utilizes NGS for genetic testing services. North America benefits from substantial R&D investments, a well-established healthcare research infrastructure, and advancements in whole genome sequencing (WGS), all contributing to market growth. These factors position North America for continued expansion throughout the forecast period.

The Asia Pacific region is projected to be the fastest-growing market, driven by significant developments in NGS technologies in countries including China and Japan. Emerging economies, such as India and Australia are also playing a crucial role, with advancements in healthcare, R&D, and clinical development frameworks enhancing the region's growth potential.

In the U.K., the NGS market is expected to grow in line with the broader European market, driven by the increased development of companion diagnostics and the establishment of molecular diagnostic facilities. Strategic partnerships between European and Eastern market players are also anticipated to support the growth of the NGS market in the region over the forecast period.

Do You Need any Customization Research on Next Generation Sequencing Market - Enquire Now

Key Players in the Next-generation sequencing Market

-

Illumina (NovaSeq Series, MiSeq, NextSeq Series)

-

F. Hoffman-La Roche Ltd. (GeneReader, NimbleGen)

-

QIAGEN (GeneReader NGS System, QIAseq)

-

Thermo Fisher Scientific, Inc. (Ion Proton System, Ion S5 System, Applied Biosystems GeneMapper Software)

-

Bio-Rad Laboratories, Inc. (ddPCR (Droplet Digital PCR))

-

Oxford Nanopore Technologies (MinION, GridION, PromethION)

-

PierianDx (PierianDx Platform)

-

Genomatix GmbH (Genomatix Suite)

-

DNASTAR, Inc. (Lasergene Genomics Suite)

-

Perkin Elmer, Inc. (BioQule NGS System)

-

Eurofins GATC Biotech GmbH (GATC Biotech NGS Services)

-

BGI (BGISEQ Series)

-

PacBio (Sequel II System)

-

Agilent Technologies (SureSelect, InfinityLab) and others.

Recent Developments

-

In February 2024, Integrated DNA Technologies (IDT) partnered with Element Biosciences, Inc. to create more efficient and streamlined next-generation sequencing (NGS) workflows.

-

In January 2023, QIAGEN entered into a strategic collaboration with Helix, a leading population genomics company based in California, to advance NGS-based companion diagnostics for hereditary diseases.

| Report Attributes | Details |

| Market Size in 2023 | US$ 8.3 Billion |

| Market Size by 2032 | US$ 50.0 Billion |

| CAGR | CAGR of 22.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product & Service (Consumables, Platforms, & Services) • By Technology (WGS, Whole Exome Sequencing, Targeted Sequencing & Resequencing) • By Application (Oncology, Clinical Investigation, Reproductive Health, HLA Typing/Immune System Monitoring, Metagenomics, Epidemiology & Drug Development, Agrigenomics & Forensics, Consumer Genomics) • By End User (Academic Research, Clinical Research, Hospitals & Clinics, Pharma & Biotech Entities, Other Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Illumina, F. Hoffman-La Roche Ltd., QIAGEN, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Oxford Nanopore Technologies, PierianDx, Genomatix GmbH, DNASTAR, Inc., Perkin Elmer, Inc., Eurofins GATC Biotech GmbH, BGI |

| Key Drivers | • Advancements in NGS platforms |

| Market Challenges | • The storage, processing, and interpretation of the massive amounts of data produced by next-generation sequencing |