Women’s Hormonal Supplements Market Report Scope & Overview:

To Get More Information on Women’s Hormonal Supplements Market - Request Sample Report

The Women’s Hormonal Supplements Market Size was valued at USD 4.50 Billion in 2023, and is expected to reach USD 8.50 Billion by 2032, and grow at a CAGR of 7.6% over the forecast period 2024-2032.

The Hormonal Balance Supplements Market is experiencing significant growth which leads to a boost in the prevalence of hormonal disorders including polycystic ovary syndrome (PCOS), thyroid disorder, and menopause issues. Health stats accentuate the problems and underscore the need for serious solutions from the government.

The Centers for Disease Control and Prevention (CDC) states that around 10% of women aged between 15-44 years are affected by polycystic ovary syndrome (PCOS). A hormonal condition that can be associated with an irregular menstrual cycle, lack of ovulation (so difficulty getting pregnant), and risk factors for type II diabetes including insulin resistance. This high prevalence of PCOS in women indicates an urgent need for dietary supplements to help alleviate these symptoms and improve the quality of life.

Thyroid disorders are another big worry with the American Thyroid Association saying that as many as 20 million Americans have a kind of thyroid disease. But fall is also when I begin to see more women with ailing thyroids, which are five to eight times less efficient than men's. Thyroid disorders such as hypothyroidism and hyperthyroidism have numerous symptomatic manifestations, including weight changes, fatigue, and mood issues; thus, their proper management is essential. Not just that support helps, supplements containing iodine, selenium, and other important nutrient function boosters for thyroids have gained a lot of popularity these days.

Symptoms associated with menopause are a major factor driving the market for hormonal balance supplements. In the United States, an estimated 1.3 million women enter menopause annually as per North America Menopause Society. This phase comes with symptoms of hot flashes, night sweats, and mood swings; however, they also bring thin bones. Symptoms may be so severe that many turn to supplements in order not to suffer too much and still stay healthy throughout this time of life.

To sum up middle age and especially post menopause stage, most women are getting vulnerable to PCOS and thyroid problems leading many of them to consider Hormonal balance supplements. This growing disease burden highlights the need for ongoing innovation and investment in this space addressing an ever-growing segment of women who are looking to amend these conditions with a better mode of effective relief.

MARKET DYNAMICS:

KEY DRIVERS:

-

Growing Awareness About Women's Health Issues, Including Hormonal Imbalances, Menstrual Health, And Menopause, Is Driving Demand for Specialized Supplements.

-

The Increasing Incidence of Hormonal Disorders Such as Polycystic Ovary Syndrome (PCOS), Thyroid Disorders, And Menopause-Related Issues Is Driving the Market for Hormonal Balance Supplements.

RESTRAINTS:

-

The Stringent Regulatory Environment for Dietary Supplements, Including Hormonal Balance Products, Can Act as A Barrier to Market Entry and Expansion.

-

Concerns About the Safety and Efficacy of Hormonal Balance Supplements Can Hinder Market Growth.

OPPORTUNITY:

-

Innovations In Supplement Formulation, Such as The Use of Bioavailable Ingredients, Advanced Delivery Systems, And Personalized Nutrition, Offer Significant Growth Opportunities.

-

Tapping Into Emerging Markets in Regions Such as Asia-Pacific, Latin America, And the Middle East Presents Significant Growth Potential.

KEY MARKET SEGMENTATION:

By Type

Vitamins and minerals had the highest market share regarding women's hormonal balance supplements in 2023, around 42%. The reasons behind this dominance are broad consumer knowledge, strong scientific evidence in favor of them, and government initiatives promoting healthiness. The NIH states that vitamin and mineral deficiencies among women are common, including B vitamins, Vitamin D, magnesium, and calcium which affect hormones. It is for this reason that the NIH has suggested a critical need to consume these nutrients in intake from dietary supplements. According to the U.S. Department of Health and Human Services (HHS), approximately half of the women in America have taken dietary supplements, with multivitamins being the most popular due to their overall perceived health benefits and nutrient contributions. Regulations on health supplement manufacturing like the U.S Dietary Supplement Health and Education Act (DSHEA) help protect consumers by providing a framework to ensure the safety and efficacy of these supplements which in turn boosts confidence. The ability to capitalize on consumer spending while possessing the credibility of science and regulatory approval rendered by vitamins and minerals this unique market positioning in women's hormonal balance supplements.

By Consumer Group

The menopausal women consumer group accounted for the largest proportion of sales within the women's hormonal balance supplements industry which is 51%. There is an Increased Global Aging Women Population which is responsible for Increased Menopause population. This has caused significant demand in this segment. The World Health Organization (WHO) predicts that by 2030, there will be around 1.2 billion postmenopausal women across the globe and a large proportion of them experience symptoms such as hot flushes/flashers, night sweats, mood swings etc. Other governments and health agencies have been working to improve awareness of menopause, urging women to adopt good nutrition habits when managing symptoms like these. In the United States, as an example: The National Institutes of Health (NIH) has sponsored a major body of research on menopause, focusing attention on quality-of-life issues surrounding hormonal balance. This increase in awareness combined with the significant population of women who fall into menopausal age categories is expected to fuel sales for supplemental products targeting symptoms experienced during this time, thus positioning this consumer group as being among the top consumer segment of hormonal balance supplements by 2023.

By Indication

The largest market share was held by the segment for Menopause Relief, in 2023, within the women's hormonal balance supplements market. More than 1.3 million women entering menopause annually in the United States have sparked surging demand for products that offer relief from symptoms like hot flashes, night sweats, and mood swings; according to health statistics gathered by the U.S. government. The North American Menopause Society (NAMS) states that approximately 80% of women undergoing menopause exhibit these symptoms, fueling the need for safe treatments. This demographic change along with improvement in perceptions and the acceptance of menopause as a serious health concern, has created a large market for supplements that have been designed to address these symptoms specifically. Meanwhile, according to the National Institutes of Health (NIH), there is a trend towards using natural and alternative therapies instead of hormone replacement therapy (HRT), enhancing use in Menopause Relief. This market-leading position is further backed by significant marketing and consumer education, along with continued product innovation that appeals to the growing ranks of health-seeking menopausal women who increasingly expect effective relief for their symptoms without many of the risks recognized as associated with synthetics.

REGIONAL ANALYSIS:

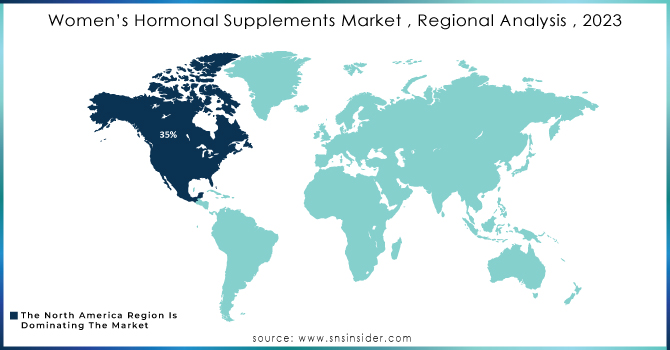

North America was the foremost regional market for women’s hormonal balance supplements in 2023. It accounted for a substantial 35% share due to the high awareness level, established healthcare infrastructure, and strong spending power of the consumers. The U.S. Department of Health and Human Services estimates that about 80% of American women take dietary supplements. Dietary products are broadly accepted and incorporated into women’s daily health regimens. Besides, the U.S. Centers for Disease Control and Prevention reports that about 20% of women in the U.S. undergo menopause every year. It creates demand for menopausal relief supplements. Tight regulatory measures, such as regulatory agencies like the Food and Drug Administration, ensure that supplements are safe and effective for consumers. Rising health awareness and more proactive approaches to health management, combined with comprehensive public health education programs, have resulted in the following healthy demand for women’s hormonal balance supplements in the market.

Do You Need any Customization Research on Women’s Hormonal Supplements Market - Enquire Now

KEY PLAYERS:

The key market players include Nature Made, Garden of Life, Nature's Way, Now Foods, Blackmores, Swisse Wellness, Vitabiotics, Church & Dwight, Bayer, Pfizer and other players.

RECENT DEVELOPMENTS

-

Herbalife launched in February 2024, the GLP-1 Nutrition Companion Product Combos Designed to Supplement the Nutrition Needs of Individuals Taking Weight-Loss Medications.

-

Nature's Bounty Launches a Brand Campaign to Bring Together its Total Product Offering and Bond on an Emotional Level with Consumers in June 2024 It's in the ‘Your Nature’ campaign to reframe the brand positioning for a new era in nutritional supplement marketing, centered around continual themes of positivity and soul-searching.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.50 Billion |

| Market Size by 2032 | US$ 8.50 Billion |

| CAGR | CAGR of 7.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Vitamins and Minerals, Proteins and Amino Acids, Probiotics and Enzymes, Omega-3 Fatty Acids & Others) •By Consumer Group (Menopausal Women, Premenopausal Women, Postmenopausal Women & Women with Hormonal Imbalances) •By Indication (Hormonal Balance, Menopause Relief, PMS Management, Fertility Support, Weight Management & Sleep Improvement) •By Form (Tablets, Capsules, Powders, Liquid Drops & Gummies) •By Distribution Channel (Pharmacies and Drug Stores, Health and Beauty Stores, Supermarkets and Hypermarkets & Online Retail) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nature Made, Garden of Life, Nature's Way, Now Foods, Blackmores, Swisse Wellness, Vitabiotics, Church & Dwight, Bayer, Pfizer and other players |

| Key Drivers | •Growing Awareness About Women's Health Issues, Including Hormonal Imbalances, Menstrual Health, And Menopause, Is Driving Demand for Specialized Supplements. •The Increasing Incidence of Hormonal Disorders Such as Polycystic Ovary Syndrome (PCOS), Thyroid Disorders, And Menopause-Related Issues Is Driving the Market for Hormonal Balance Supplements. |

| RESTRAINTS | •The Stringent Regulatory Environment for Dietary Supplements, Including Hormonal Balance Products, Can Act as A Barrier to Market Entry and Expansion. •Concerns About the Safety and Efficacy of Hormonal Balance Supplements Can Hinder Market Growth. |