Personalized Nutrition Market Report Scope & Overview:

Get more information on Personalized Nutrition Market - Request Free Sample Report

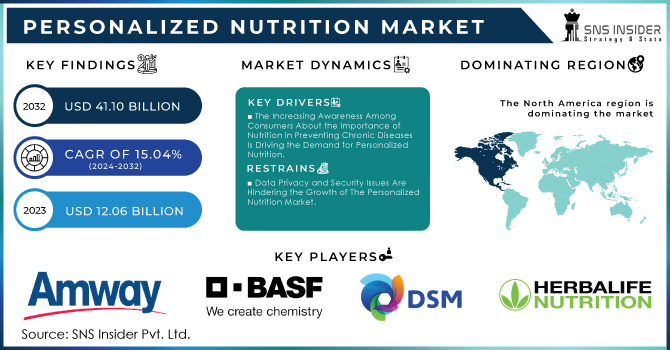

The Personalized Nutrition Market Size was valued at USD 12.06 Billion in 2023, and is expected to reach USD 41.10 Billion by 2032, and grow at a CAGR of 15.04% over the forecast period 2024-2032.

Big data combined with artificial intelligence (AI) as an incorporated technological solution is improving the accuracy and individualization of dietary recommendations substantially fueling market demand. Using large amounts of data in health and nutritional research, AI algorithms can analyze regional or nationwide indications of dietary patterns from different sources as well as individual records for personalized nutrition advice. The increase also reflects official figures showing an increasing number of diet-related chronic diseases in the country, a trend being addressed by this technological innovation. Non-communicable diseases NCDs, most of them which are diet-related represent 71% of all deaths worldwide according to the World Health Organization (WHO).

According to the U.S. Centers for Disease Control and Prevention (CDC), chronic diseases are responsible for 7 out of every 10 deaths in the United States, killing more than 1.7 million Americans each year. These conditions also cause general morbidity, which causes physical disability as well as account for a major portion of over USD 3 trillion of health care costs annually that remain uncontrolled or managed by existing treatment regimes. These are dramatic calls to action, especially when considering how well-timed and capable personalized nutrition solutions built on big data with AI components can address the problem. They provide far more precise, personalized dietary advice; thus not only improving health outcomes but also moving closer to the public health goal of reducing chronic disease.

MARKET DYNAMICS:

KEY DRIVERS:

-

The Increasing Awareness Among Consumers About the Importance of Nutrition in Preventing Chronic Diseases Is Driving the Demand for Personalized Nutrition.

-

The Integration of Big Data and AI Enables More Accurate and Personalized Dietary Recommendations Propelling Market Growth.

RESTRAINTS:

-

The Higher Cost of Personalized Nutrition Services and Products Is Impeding the Growth of The Market.

-

Data Privacy and Security Issues Are Hindering the Growth of The Personalized Nutrition Market.

OPPORTUNITY:

-

The Rising Disposable Incomes in Developing Countries Offer Significant Growth Potential for Personalized Nutrition.

-

Collaborating With Healthcare Providers Is Enhancing the Adoption of Personalized Nutrition Solutions.

KEY MARKET SEGMENTATION:

By Form

In 2023, the tablets segment was the market leader and generated over 55% of total revenues overall. The largest revenue share of supplements was held by tablets due to their widespread availability. They are both safe to consume, cheap to manufacture, and efficient at delivering nutrients. Tablets come in all different shapes and tones. They are made by adding dry ingredients together to form a tablet which can be easily crumbled in the stomach. Similarly, most tablets also contain fillers like this to add mouthfeel appeal or taste. Whereas others have a degradation preventing coating from passing through the stomach and maintaining its form until it arrives at the small intestine, where most of the primary nutrients get adsorbed.

Similarly, Capsules Are a Form of Supplement. In capsules, the food is protected by a shell which breakdown in the digestive tract allowing it to be absorbed into the bloodstream and metabolized. A benefit of liquid-based supplements and vitamins is that they allow one to be more specific when adding dosages of different nutrients, enabling a personalized blend. Higher adoption for children and the geriatric population is leading the liquid form segment to grow faster over the forecast period. The tablets are easy to eat for the aging population and also get absorbed faster into the system.

By Product

The category of personalized nutrition Dietary supplements, and nutraceuticals was the leading segment in 2023 with a share of 51%. A few reasons help explain why this group has risen. Dietary supplements and nutraceuticals, such as vitamins minerals engine acids herbal products since the dawn of personal health. products used by users. They have a long-standing presence in the market with strong consumer reach ensuring sustained growth. Rising awareness of wellness and health, in turn, is paving the way for more bespoke functionalities of supplements like better immunity, cognition, and metabolism support.

On the other hand, functional foods and beverages, sports nutrigenomics along digitized DNA are newer categories that lack share but present strong growth potential. While demand for functional foods and beverages is rising due to their extra health benefits beyond basic nutrition, traditional dietary supplements remain key competitors. Nutrigenomics for sports, with a focus on a personalized nutrition approach to improving athletic performance earlier perspective by analyzing the Genetic information of athletes, is a growing niche but targeted only specific segments so far. By the same token, Digital DNA techniques are at an early stage but are potentially useful for certain research and high-end consumer purposes. Therefore, a mature market, wide consumer acceptance of the individualized approach, and the increasing push towards customized health solutions established them as the biggest category within the personal nutrition industry.

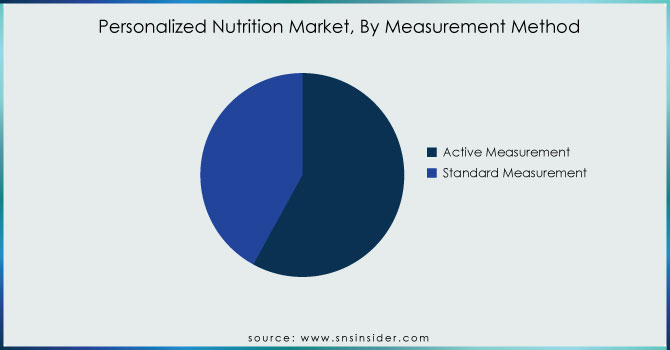

By Measurement Method

The active measurement segment dominated the personalized nutrition market in 2023 and accounted for a share of around 58%, as it can offer real-time and accurate information about an individual, which helps them to understand their health better. Active measurement approaches using wearables and continuous glucose monitors allow for the collection of real-time data on an hourly or minute-by-minute basis, providing these types of personalized dietary recommendations. They record such health metrics as blood glucose levels, physical activity, and nutritional consumption information that offer users interpretable feedback to correct their diets or daily routines accordingly. Real-time data collection is in line with the growing consumer-driven need for quick, information-driven insights to inform health choices. Hence, the aforementioned factors are skyrocketing the growth of the segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

North America holds the largest share of 44% in 2023 due to the large number of operating industries in these areas, and their governmental investment along with increased research opportunities. This is a major factor driving growth in personalized nutrition AI. For example, in October 2022, GenoPalate Inc. announced that it secured USD 5.6 million in equity financing to enhance its product line personalized nutrition sector. The company offers personalized nutrition supplements and online programs. To increase user engagement, GenoPalate will add to its existing nutritional health data platform on both web and mobile applications.

On the other hand, Asia Pacific is estimated to register the highest growth during 2024-2032, driven by strong product pipelines in personalized nutrition & supplements and an increasing patient population. Along the same line, also India is becoming a hotbed of personalized nutrition and supplements with amazing startups. An example would be the Indian nutraceutical startup BhookhaHaathi which in April 2020 introduced AI-based personalized nutrition services. The system gathers the necessary data to advise each user. The company is leveraging its existing nutraceutical business.

KEY PLAYERS:

The key market players include Amway, BASF, DSM, HerbalifeNutrition Ltd, DNAfit, Care/of, Nutrigenomix, Zipongo, Viome, Habit, Wellness Coaches USA, LLC., Atlas Biomed Group Limited and other players.

RECENT DEVELOPMENTS

-

In August 2022, Herbalife Nutrition introduced its new digital transformation program referred to as "Herbalife One" which focuses on the development of one single platform that can provide a more simplified and integrated experience for distributors and their customers from all around the world. By doing this the organization will become more efficient and productive.

-

In August of 2022, Amway revealed an investment in microbiome start-up Holzapfel Effective Microbes (HEM), as part of their move into personalized probiotic supplement solutions. In this work, HEM applied an approach called Personalized Pharmaceutical Meta-Analytical Screening (PMAS) to study the application of gut microbiota for human health and wellness. It will support the company with its role in the personalized nutrition market.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 12.06 Billion |

|

Market Size by 2032 |

US$ 41.10 Billion |

|

CAGR |

CAGR of 15.04% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Product (Dietary Supplements & Nutraceuticals, Functional Foods & Beverages, Sports Nutrigenomics & Digitized DNA) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Amway, BASF, DSM, HerbalifeNutrition Ltd, DNAfit, Care/of, Nutrigenomix, Zipongo, Viome, Habit, Wellness Coaches USA, LLC., Atlas Biomed Group Limited and other players |

|

Key Drivers |

•The increasing awareness among consumers about the importance of nutrition in preventing chronic diseases is driving the demand for personalized nutrition. |

|

RESTRAINTS |

•The Higher Cost of Personalized Nutrition Services and Products Is Impeding the Growth of The Market. |