X-ray Inspection System Market Size & Growth:

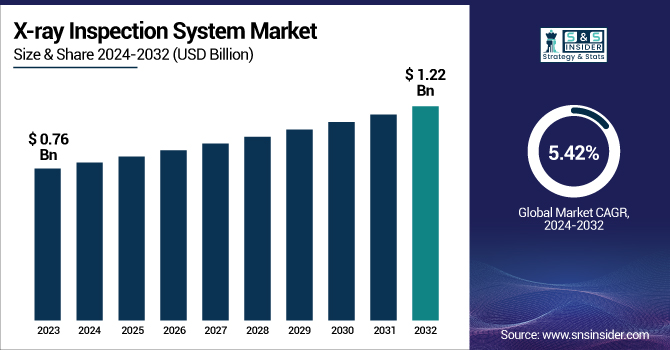

The X-ray Inspection System Market was valued at USD 0.76 billion in 2023 and is expected to reach USD 1.22 billion by 2032, growing at a CAGR of 5.42% over the forecast period 2024-2032. Additive manufacturing & 3D printing are transforming how products and components are manufactured, providing efficient methods of producing lightweight, strong, and intricate parts, creating new avenues for internal defect detection and structural integrity in advanced manufacturing, which is expected to develop new technologies in the X-ray inspection system market. Anomaly detection fueled by AI & machine learning helps minimize errors and speeds up the inspection process. X-ray inspection is a non-destructive test critical to aerospace & defense for aircraft, satellites, and munitions. Moreover, fab utilization, along with supply chain innovations creates efficiencies in semiconductor manufacturers, allowing for quality control over miniaturized electronics.

To Get more information on X-ray Inspection System Market - Request Free Sample Report

The U.S. X-ray Inspection System Market is estimated to be USD 0.14 Billion in 2023 and is projected to grow at a CAGR of 5.73%. The inherent growth of the X-ray inspection system market in the U.S. is primarily attributed to rising demand for non-destructive testing (NDT) from aerospace, automotive, and electronics manufacturing industries, stringent FDA and USDA regulations in food & pharmaceuticals, and increasing adoption of artificial intelligence-powered automated inspection systems due to high precision quality control and defect detection in industrial applications.

X-ray Inspection System Market Dynamics

Key Drivers:

-

Accelerating Demand for X-ray Inspection Systems Driven by Stringent Quality Standards and Technological Advancements

Rising quality control requirements across industries such as automotive, aerospace, electronics, and food &pharmaceuticals are driving the demand for the X-ray Inspection System Market. Market growth is further characterized by the growing acceptance of non-destructive testing (NDT) methods to identify defects, contaminants, and structural inconsistencies in products. Real-time inspection, accuracy, and better cost-effectiveness are playing pivotal roles in speeding up the shift from digital imaging to film-based imaging. Moreover, stringent regulations regarding food safety and medical device manufacturing standards are leading to the implementation of X-ray inspection systems on the production lines. The expansion of the automotive sector, particularly in EVs, is another significant driving factor, creating demand for advanced inspection systems for battery packs, power electronics, and lightweight components.

Restrain:

-

Challenges in X-ray Inspection Systems Include Regulatory Compliance Safety Concerns Technical Complexities and Adoption Barriers

The X-ray inspection system with strict regulatory compliance and the safety concern related to radiation exposure itself is one of the problems faced by treatment centers over the years. Although modern systems are designed with safety in mind, the X-ray industry is highly regulated by agencies such as the FDA, OSHA, and the IAEA. That necessitates investing in targeted staff training, effective shielding, and ongoing monitoring, which delays adoption in some sectors. Finally, operational challenges also arise from the technical complexities associated with system calibration, upkeep, and integration with existing production lines. As noted by Asta et al, the software and expertise needed to automate X-ray inspections of complex products' multi-layered parts (e.g., PCBs and aerospace components) can be a cost barrier for the smaller manufacturers.

Opportunity:

-

AI-Driven X-ray Inspection Smart Manufacturing and 3D Imaging Unlock Growth Opportunities Across Industries

Increasing implementation of AI-based X-ray examination systems presents growth opportunities as they improve the automation and precision of results. Another significant opportunity comes from the increasing need for high-precision industries, such as electronics and aerospace, for 3D X-ray inspection. In addition, the growth of Industry 4.0 and smart manufacturing is driving the demand for companies to accommodate X-ray inspection within automated production, increasing throughput. Rapid industrialization along with investments in advanced manufacturing technologies in emerging markets in Asia-Pacific is expected to boost the market growth of machine vision systems over the forecast period.

Challenges:

-

Skilled Workforce Shortage and Cybersecurity Risks Challenge Widespread Adoption of Advanced X-ray Inspection Systems

The big challenge is the shortage of people who can successfully run and interpret X-ray inspection results. Highly trained professionals are needed to investigate defects, contaminants, and dissimilarities in materials across industries including electronics, aerospace, and food & pharmaceuticals. However, the lack of both experienced radiographers and quality inspectors can restrict the large-scale use of sophisticated X-ray systems. In addition, as companies shift to more AI-based and cloud-enabled X-ray inspection solutions, cyber-security and data management risks become new challenges, compelling strong cyber security, and protection from unauthorized access to data.

X-ray Inspection System Market Segment Analysis

By Technology

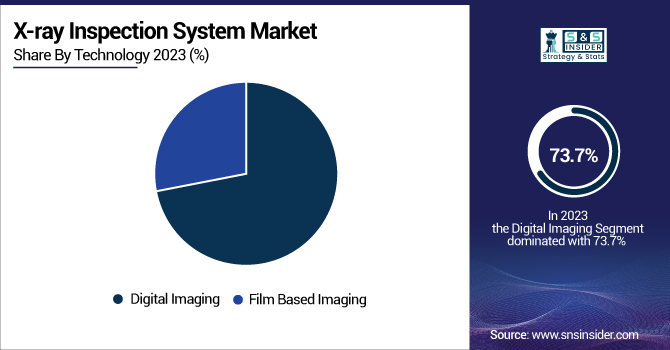

In the X-ray Inspection System Market digital imaging held a 73.7% market share in 2023 and is anticipated to witness the fastest CAGR from 2024 to 2032. The reasons behind the popularity of digital imaging include time efficiency, accurate data transmission, and affordable data storage than film-based conventional imaging. As a result of this, buyers are utilizing digital X-ray inspection for various applications, including the detection of defects, quality control, regulatory compliance, etc., at both the industrial and consumer levels in electronics, automotive, aerospace, and food & pharmaceutical industries. Increasing Industry 4.0, automation & AI-enabled inspection systems are also boosting the demand for digital imaging. It benefits from the advantages of higher resolution, ease of data storage, and the option of cloud integration making it the solution of choice. Also, the stringent safety regulations regarding food processing and healthcare are fueling the demand for matured digital X-ray solutions across various industries. Market growth is also driven by the introduction of 3D digital X-ray imaging and continuous technological advancements.

By Dimension

In 2023, 2D X-ray inspection led the X-ray Inspection System Market with a 69.3% share and is expected to have the highest growth opportunity during the forecast period driven by their cost-effectiveness, ease of use, and widespread adoption in industries such as electronics, automotive, aerospace, and food & pharmaceuticals. Two-dimensional X-ray machines are the industry standard for an array of uses applicable to basic defect detection, foreign object detection, and quality control. The dominance of these robots is also backed by their simplicity of merging into an existing production line.

The segment for 3D X-ray inspection is predicted to have the highest CAGR from 2024 to 2032 because of its advanced imaging, depth profiling, and detailed defect-recognition in highly complex structures such as PCBs, EV batteries, and aerospace components. The growing need for high-accuracy non-destructive testing (NDT) and the incorporation of AI-driven automated inspection systems is driving the adoption of 3D X-rays in advanced manufacturing and medical diagnostics.

By Vertical

In 2023, the X-ray Inspection System Market was most heavily influenced by the manufacturing sector, which accounted for 29.6% of the market share due to its wide-ranging applications for quality control, defect detection, and process optimization. Advancements of X-ray Inspection along with high servant industries electronics scanners-X-ray relationship score with aerospace or metal fabrication heavily based upon X-ray inspection for reliability and compliance with demanding industry standards. In manufacturing, the adoption of non-destructive testing (NDT) has surged because of stricter safety regulations and the use of automated inspection systems.

The automotive segment is anticipated to grow with the highest CAGR from 2024 to 2032 due to the rising prevalence of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and lightweight materials. Increasing demand for EV batteries, electronic components, and safety-critical part inspection with high precision is expected to implement the adoption of 3D X-ray (X-ray CT) and AI-powered inspection solutions. This will mean automotive manufacturers will continue to see an increase in demand for X-ray inspection systems as automakers continue to invest in automation and quality assurance.

X-ray Inspection System Market Regional Overview

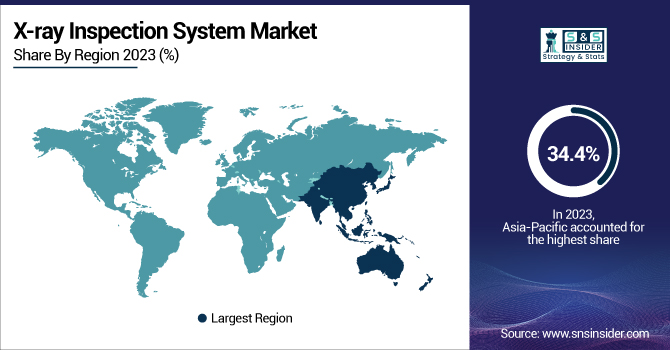

In 2023, the X-ray Inspection System Market was led by Asia-Pacific with a 34.4% market share as a result of rapid industrialization, increased manufacturing activities due to a booming economy, and strict quality control regulations. This leads to traditional powerhouses in electronic, automobile, and semiconductor manufacturing such as China, Japan, South Korea, and India, being heavily responsible for most material processing and at the same time greenhouse gas emissions. For example, leading semiconductor defect detection and quality assurance TSMC and Samsung Electronics have been performed with advanced X-ray inspection systems. Moreover, the growing EV sector in China, driven in part by firms such as BYD and NIO, is boosting the requirement for battery examination solutions. Moreover, the increasing deployment of automated production lines and boosting of Industry 4.0 is progressively driving the utilization of X-ray inspection across the region.

From 2024 to 2032, North America will exhibit the quickest growth because of developments in sectors such as aerospace, automotive, and food safety regulations. AI-driven and 3D X-ray inspection systems are embraced by various industries, like the United States. X-ray inspection is being incorporated to improve EV battery safety by companies such as Tesla, and advanced imaging solutions are being adopted by companies such as Boeing, and Lockheed Martin for the inspection of aircraft components. To comply with stringent food safety regulations from the U.S. FDA, food processing giants such as Tyson Foods and Nestlé USA are also adopting high-precision X-ray inspection systems for contaminant detection and compliance.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in X-ray Inspection System Market are:

-

Mettler-Toledo International Inc. (X34 X-ray Inspection System)

-

Nordson Corporation (Quadra Series X-ray Inspection System)

-

Comet Yxlon GmbH (YXLON FF35 CT)

-

Anritsu Corporation (KD74 Series X-ray Inspection System)

-

Viscom AG (X7056-II)

-

North Star Imaging Inc. (X5000 Series)

-

Nikon Metrology (XT V Series)

-

Ishida Co., Ltd. (IX-GN Series)

-

Omron Corporation (VT-X750)

-

Toshiba IT & Control Systems Corporation (TXPR Series)

-

General Electric Company (phoenix nanotom m)

-

Smiths Detection Group Ltd. (HI-SCAN 6040 CTiX)

-

3DX-RAY Ltd. (AXIS-CXi)

-

VisiConsult X-ray Systems & Solutions GmbH (VC.3D.XD)

-

Thermo Fisher Scientific Inc. (Xper Conveyor X-ray Inspection System)

Recent Trends

-

In November 2024, Mettler-Toledo introduced new X-ray inspection systems, including the X52 Dual Energy and X6 Series, featuring advanced detection technologies for contaminant identification and product integrity checks, catering to industries like food, pharmaceuticals, and manufacturing.

-

In February 2025, Nordson showcased advanced Optical, X-ray, and Metrology solutions, including the SQ7000+ AOI system and Dynamic Planar CT software.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.76 Billion |

| Market Size by 2032 | USD 1.22 Billion |

| CAGR | CAGR of 5.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Digital Imaging, Film Based Imaging) • By Dimension (2D, 3D) • By Vertical (Manufacturing, Oil & gas, Aerospace, Government Infrastructure, Automotive, Power Generation, Food & Pharmaceuticals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Mettler-Toledo International Inc., Nordson Corporation, Comet Yxlon GmbH, Anritsu Corporation, Viscom AG, North Star Imaging Inc., Nikon Metrology, Ishida Co., Ltd., Omron Corporation, Toshiba IT & Control Systems Corporation, General Electric Company, Smiths Detection Group Ltd., 3DX-RAY Ltd., VisiConsult X-ray Systems & Solutions GmbH, Thermo Fisher Scientific Inc. |