Non-Destructive Testing Market Report Scope & Overview:

The Non-Destructive Testing Market size is value USD 20.56 Billion in 2023 and is expected to reach USD 39.79 Billion by 2032 with a growing CAGR of 7.61 % over the forecast period 2024-2032.

To get more information on Non-Destructive Testing Market - Request Free Sample Report

The non-destructive testing market is experiencing a profound transformation, driven by Industry 4.0 advancements and technological innovations. The integration of artificial intelligence, machine learning, and industrial IoT has revolutionized inspection processes, significantly improving accuracy and efficiency in quality control. This digital shift is especially noticeable in the United States, where industrial robot installations saw a 12% increase in 2023, totaling 44,303 units. Automation investments are boosting NDT adoption, enabling faster, more precise inspections through advanced techniques like embedded systems, cloud computing, and analytics, which optimize error detection and process management. However, global geopolitical challenges, such as tensions between the U.S. and China, the Russia-Ukraine conflict, and the ongoing war in Israel, have disrupted global supply chains, particularly impacting raw material availability and inflating costs, which has consequently affected demand in several industries. The semiconductor sector, in particular, has been affected by strict export controls, which in turn slow production across multiple sectors, including automotive, oil and gas, and power.

On the other hand, the renewable energy sector is emerging as a key driver for NDT services, with substantial growth in wind and solar energy projects. As of June 2024, China led global offshore wind farm deployment with 129 operational sites, followed by the UK with 39. In 2023, Asia-Pacific's solar capacity reached 840.6 gigawatts, indicating a growing demand for NDT services in renewable energy infrastructure. The automotive industry's shift to electric and autonomous vehicles is further propelling NDT requirements, with global sales of plug-in electric vehicles hitting 13.7 million units in 2023. The aerospace sector is also expanding, with Boeing delivering 528 commercial aircraft, a 10% increase from 2022. This growth in automotive and aerospace sectors reinforces the critical role NDT plays in ensuring product safety, quality, and compliance, making it a crucial component of modern industries.

Market Dynamics

Drivers

-

Accelerated Growth of the Non-Destructive Testing Market Fueled by Technological Advancements in Inspection

Innovations in ultrasonic, radiographic, and eddy current testing methods are enhancing the accuracy, speed, and cost-effectiveness of NDT procedures. The integration of advanced technologies such as artificial intelligence (AI), machine learning, and industrial IoT is further revolutionizing inspection processes, enabling real-time data analysis, predictive maintenance, and more efficient quality control. These advancements are especially significant in sectors like aerospace, automotive, oil and gas, and infrastructure, where product quality and safety are paramount. For instance, new automated NDT systems, utilizing AI and cloud computing, are enhancing the precision of defect detection while reducing human error. Additionally, the advent of 3D and computed tomography (CT) scanning technologies allows for in-depth analysis of complex structures, providing more comprehensive insights into material integrity. Such innovations are not only improving inspection accuracy but also increasing the overall speed of testing, making it more cost-efficient for industries. Moreover, drones and robotic inspection technologies are expanding the scope of NDT, allowing for safer and more efficient inspections of hard-to-reach areas, such as high-rise buildings, offshore structures, and pipelines. These advancements are driving demand for NDT services, as industries seek to leverage cutting-edge technologies to enhance operational efficiency and ensure product safety. The NDT market is thus poised for significant expansion, supported by these technological breakthroughs that are shaping the future of quality control and safety inspections worldwide.

Restraints

-

Impact of Regulatory and Compliance Barriers on Non-Destructive Testing Market Growth

NDT processes are subject to stringent regulations and standards that vary across industries and regions, including safety standards, environmental regulations, and quality assurance requirements. The need to meet these evolving regulations can be costly for companies, especially as they must invest in training, certification, and the acquisition of the latest inspection technologies. Additionally, ensuring compliance with these regulations often requires frequent audits, documentation, and upgrades to existing systems, adding to operational complexity. For instance, the aviation, energy, and manufacturing sectors face particularly stringent regulations regarding safety and performance, making NDT a crucial but burdensome process. As companies strive to keep pace with changing laws and standards, they may experience delays, which can slow down project timelines and increase operational costs. The need to constantly adapt to new compliance requirements can also deter smaller organizations from investing in advanced NDT technologies, further limiting market expansion. This regulatory landscape is especially challenging for industries like aerospace, energy, and oil & gas, where the risks associated with non-compliance are high and penalties can be severe.

Segment Analysis

By Type

The services segment of the Non-Destructive Testing market dominates, accounting for around 70% of the total market share in 2023, driven by increasing demand for on-site inspections across industries like aerospace, automotive, and energy. In North America, robust infrastructure and stringent safety regulations fuel demand for specialized NDT service providers. Europe also contributes significantly, driven by automotive and manufacturing sectors focusing on safety and compliance. In Asia-Pacific, rapid industrialization, particularly in China and India, leads to greater adoption of NDT services in manufacturing, construction, and energy sectors. As industrial growth accelerates, the services segment is expected to continue its dominance, supported by the need for regular inspections, regulatory compliance, and asset management across various industries.

By Testing Technology

The Ultrasonic Testing (UT) segment holds a dominant share of approximately 35% in the Non-Destructive Testing market in 2023, driven by its broad applicability in industries like aerospace, automotive, oil and gas, and manufacturing. UT is widely recognized for its ability to detect internal flaws and measure material thickness, making it crucial for ensuring the integrity of structures and components. Its versatility and cost-effectiveness further fuel its growth, as it can inspect both surface and subsurface defects with high precision. Additionally, advancements in phased array ultrasonic testing (PAUT) and automated systems are improving inspection speed and accuracy. The increasing demand for stringent safety standards and high-quality materials across sectors is also contributing to the segment's dominance. These factors collectively solidify ultrasonic testing as a key player in the NDT market.

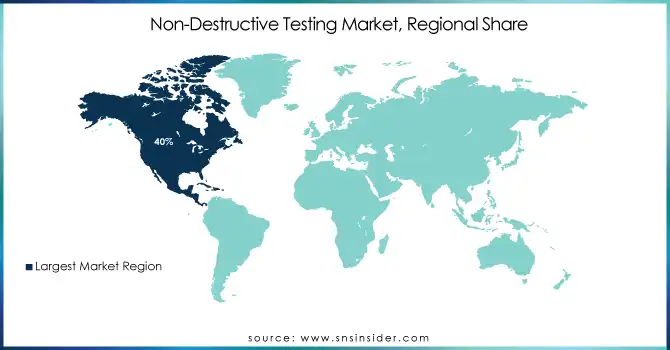

Regional Analysis

North America dominates the Non-Destructive Testing market, accounting for approximately 40% of the global market share in 2023. This dominance is driven by significant technological advancements, high demand for quality control across various industries, and a strong focus on safety and regulatory compliance. The United States, in particular, plays a pivotal role, with its well-established aerospace, automotive, oil and gas, and manufacturing sectors, all of which heavily rely on NDT techniques for ensuring product integrity and safety. The U.S. is also home to some of the leading NDT equipment and service providers, contributing to the region's market growth. Furthermore, the country’s investments in advanced technologies, such as digital radiography, ultrasonic testing, and automated systems, are boosting the efficiency and accuracy of NDT processes. Canada also contributes significantly to the market, especially in the energy sector, driven by its oil sands and mining industries. The region’s robust regulatory environment, coupled with increasing industrial automation, is expected to sustain North America's leading position in the NDT market.

Asia-Pacific is the fastest-growing region in the Non-Destructive Testing market, with robust growth expected over the forecast period from 2024 to 2032. The rapid industrialization and significant investments in infrastructure development, particularly in countries like China, India, Japan, and South Korea, are driving this expansion. China, as the largest market in the region, is at the forefront of NDT adoption, supported by its booming manufacturing, construction, and aerospace industries. The country's commitment to developing cutting-edge technologies, including ultrasonic and digital radiography testing, is contributing to market growth. India is also witnessing rapid growth due to its expanding automotive, oil and gas, and power sectors, with increased demand for quality control and safety compliance. In Japan, a focus on the automotive and electronics sectors, alongside advancements in precision testing, is fueling the demand for NDT services. South Korea, known for its technological advancements in industrial automation, is another key player in driving market growth. Moreover, the region's significant investments in renewable energy projects, particularly solar and wind power, are further propelling the need for advanced NDT solutions. The increasing adoption of Industry 4.0 technologies, coupled with government initiatives promoting safety standards and infrastructure development, ensures that Asia-Pacific remains the fastest-growing region in the NDT market.

Need any customization research on Non-Destructive Testing Market - Enquiry Now

KEY PLAYERS

Some of the major players in Non-Destructive Testing Market with their product:

-

Previan Technologies, Inc. (X-ray systems, ultrasound equipment)

-

Bureau Veritas (Inspection services, certification, and testing services)

-

Fischer Technology Inc. (Helmut Fischer) (Coating thickness gauges, material testing equipment)

-

MISTRAS Group (Ultrasonic testing systems, corrosion monitoring solutions)

-

Comet Group (YXLON International) (X-ray and CT inspection systems)

-

MME Group (Ultrasonic inspection equipment, automated testing systems)

-

TWI Ltd. (Welding inspection services, advanced NDT technologies)

-

Nikon Corporation (Industrial microscopes, 3D measurement systems)

-

Olympus Corporation (Ultrasonic testing systems, phased array ultrasonic devices)

-

Sonatest (Ultrasonic testing equipment, phased array systems)

-

Acuren (Inspection services, corrosion monitoring, NDT equipment rental)

-

Intertek Group plc (Inspection and testing services, analytical services)

-

CREAFORM (3D scanning equipment, portable measurement systems)

-

Vidisco Ltd. (X-ray inspection systems, portable NDT systems)

-

SGS S.A. (Testing and inspection services, material testing equipment)

-

General Electric (X-ray and ultrasound inspection systems, industrial inspection services)

-

Testia (Non-destructive testing systems, aerospace inspection technologies)

-

Baker Hughes (Ultrasonic inspection tools, automated NDT systems)

-

Zetec Inc. (Eddy current and ultrasonic testing equipment, software solutions)

-

Applied Technical Services (ATS) (Eddy current testing equipment, corrosion monitoring solutions)

List of Suppliers who provide Raw Material and Component for the Non-Destructive Testing Market:

-

3M

-

General Electric (GE)

-

Honeywell International

-

Schlumberger

-

BASF

-

Linde Group

-

Thermo Fisher Scientific

-

Mouser Electronics

-

TE Connectivity

-

Siemens

Recent Development

-

August 2024 – RFA adds MISTRAS Group as associate member to support biorefinery operational excellence MISTRAS Group has joined the Renewable Fuels Association to enhance the efficiency, safety, and sustainability of the renewable fuels industry. Their expertise in non-destructive testing (NDT), inline inspections, and data analytics will help improve asset integrity and operational performance for biorefineries.

-

October 2024 – Creaform released VXintegrity 3.0: A Modern Approach to Infrastructures Fitness-For-Service (FFS) Analyses 3.0, integrating Finite Element Analysis (FEA) and API 579 standards, transforming data into actionable insights for assessing infrastructure integrity. The new version simplifies Level I and II evaluations and significantly speeds up Level III assessments, reducing downtime and costs for asset owners in the oil and gas industry

| Report Attributes | Details |

| Market Size in 2023 | USD 20.56 Billion |

| Market Size by 2032 | USD 39.79 Billion |

| CAGR | CAGR of 7.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Equipment, Services) • By Testing Technology( Radiography Testing, Ultrasonic Testing, Magnetic Particle Testing, Liquid Penetrant Testing, Visual Inspection Testing, Eddy Current Testing, Other Testing Technologies) • By End-User (Oil and Gas, Power and Energy, Construction, Automotive and Transportation, Aerospace, Defense, Other End User Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Previan Technologies, Inc., Bureau Veritas, Fischer Technology Inc. (Helmut Fischer), MISTRAS Group, Comet Group (YXLON International), MME Group, TWI Ltd., Nikon Corporation, Olympus Corporation, Sonatest, Acuren, Intertek Group plc, CREAFORM, Vidisco Ltd., SGS S.A., General Electric, Testia, Baker Hughes, Zetec Inc., and Applied Technical Services (ATS) are prominent companies in the Non-Destructive Testing market offering a wide range of inspection services, testing solutions, and advanced technologies. |

| Key Drivers | • Accelerated Growth of the Non-Destructive Testing Market Fueled by Technological Advancements in Inspection |

| Restraints | • Impact of Regulatory and Compliance Barriers on Non-Destructive Testing Market Growth |