3-Hydroxypropionic Acid Market Report Scope & Overview:

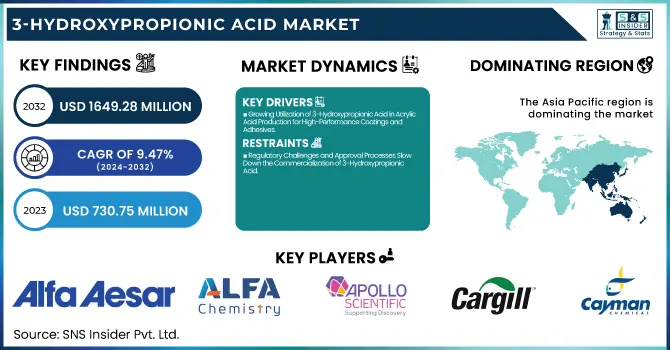

The 3-Hydroxypropionic Acid Market Size was valued at USD 730.75 Million in 2023 and is expected to reach USD 1,649.28 Million by 2032, growing at a CAGR of 9.47% over the forecast period of 2024-2032.

To Get more information on 3-Hydroxypropionic Acid Market - Request Free Sample Report

The 3-Hydroxypropionic Acid Market is evolving with rising applications in pharmaceuticals, biodegradable polymers, and chemical intermediates. Our report explores price trends of raw materials, analyzing cost fluctuations affecting production. A detailed import and export data by region highlights key trading hubs and supply chain shifts. The market is also shaped by investment and funding trends, with growing R&D efforts driving innovation. Additionally, the impact of inflation and economic factors provides insights into pricing dynamics and demand fluctuations. As industries advance, automation and digitalization in manufacturing are enhancing efficiency and scalability. This comprehensive study delivers valuable intelligence, helping stakeholders navigate emerging opportunities and challenges in this rapidly growing market.

3-Hydroxypropionic Acid Market Dynamics

Drivers

-

Growing Utilization of 3-Hydroxypropionic Acid in Acrylic Acid Production for High-Performance Coatings and Adhesives

The demand for acrylic acid, a key derivative of 3-Hydroxypropionic Acid, is rising across various industries, including paints, coatings, adhesives, and sealants. Acrylic acid and its esters are widely used in the production of superabsorbent polymers, which find applications in personal care products such as diapers and sanitary pads. With the shift towards bio-based chemical production, 3-Hydroxypropionic Acid is emerging as a sustainable precursor to acrylic acid, reducing dependence on petroleum-derived chemicals. Additionally, the growth of the construction and automotive industries is fueling demand for high-performance coatings and adhesives, further driving the adoption of 3-Hydroxypropionic Acid. The increasing emphasis on sustainable and low-VOC (volatile organic compound) coatings has also propelled research into bio-based acrylic acid production. Industry players are leveraging biotechnological advancements to enhance fermentation processes, improving the yield and cost-effectiveness of 3-Hydroxypropionic Acid, thereby strengthening its market potential.

Restraints

-

Regulatory Challenges and Approval Processes Slow Down the Commercialization of 3-Hydroxypropionic Acid

The commercialization of 3-Hydroxypropionic Acid is hindered by regulatory complexities and lengthy approval processes, particularly in industries such as food, pharmaceuticals, and biodegradable packaging. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA) impose stringent safety and quality standards on bio-based chemicals, requiring extensive testing and compliance. The process of obtaining approvals for new applications can be time-consuming and expensive, delaying market entry. Additionally, regional variations in environmental regulations create challenges for manufacturers looking to expand globally. Compliance with multiple regulatory frameworks adds administrative burdens and increases operational costs. These regulatory hurdles make it difficult for emerging players to enter the market, slowing down the overall commercialization and industrial adoption of 3-Hydroxypropionic Acid.

Opportunities

-

Rising Investments in Bio-Based Chemicals and Circular Economy Initiatives Drive Market Expansion

Governments, research institutions, and private investors are increasingly funding bio-based chemical research and development, creating new opportunities for the 3-Hydroxypropionic Acid Market. As industries transition towards circular economy models, bio-based chemicals such as 3-Hydroxypropionic Acid are gaining prominence as sustainable alternatives to fossil-based compounds. Several funding initiatives are supporting the development of scalable fermentation technologies and biorefinery projects, enabling cost-effective production. Large chemical manufacturers are also partnering with biotechnology firms to accelerate commercialization efforts. The increasing alignment of bio-based chemical innovations with global sustainability goals is expected to create long-term growth prospects for 3-Hydroxypropionic Acid, driving market expansion across multiple industries.

Challenge

-

Competition from Alternative Bio-Based Chemicals and Petroleum-Derived Substitutes Limits Market Penetration

The 3-Hydroxypropionic Acid Market faces stiff competition from alternative bio-based chemicals and petroleum-derived substitutes, which offer cost advantages and established supply chains. Compounds such as lactic acid, succinic acid, and bio-based acrylic acid serve as competing alternatives, each with its own industrial applications. Additionally, traditional petroleum-based chemicals continue to dominate due to their lower production costs and extensive manufacturing infrastructure. The price sensitivity of end-users, especially in cost-driven industries such as packaging and textiles, further limits the widespread adoption of 3-Hydroxypropionic Acid. Addressing this challenge requires ongoing innovations to reduce production costs and enhance product performance, ensuring competitiveness in the evolving bio-based chemical market.

3-Hydroxypropionic Acid Market Segmental Analysis

By Source

Petroleum segment dominated the 3-Hydroxypropionic Acid Market in 2023 with a 54.8% market share. The dominance of petroleum-based 3-Hydroxypropionic Acid is primarily due to its cost-effectiveness and established industrial infrastructure for large-scale chemical synthesis. While bio-based alternatives are gaining traction, the high production cost and limited scalability of fermentation-based processes have restricted their market penetration. Organizations such as the American Chemistry Council (ACC) and the European Chemical Industry Council (Cefic) have reported continued reliance on petroleum-derived feedstocks for specialty chemicals, including 3-Hydroxypropionic Acid, due to their consistent supply and lower production costs. Additionally, the absence of stringent regulations specifically targeting petroleum-based 3-Hydroxypropionic Acid has further solidified its market dominance.

By Form

Liquid form dominated the 3-Hydroxypropionic Acid Market in 2023 with a 58.5% market share. Liquid 3-Hydroxypropionic Acid is preferred due to its enhanced solubility and ease of incorporation into various industrial processes, particularly in the production of acrylic acid, biodegradable polymers, and chemical intermediates. The U.S. Environmental Protection Agency (EPA) has recognized the increasing utilization of liquid bio-based chemicals in sustainable manufacturing, but petroleum-based liquid formulations remain the industry standard. Furthermore, several research institutions, including the National Renewable Energy Laboratory (NREL), have highlighted the growing efficiency of liquid-phase catalytic processes, which favor liquid 3-Hydroxypropionic Acid over its powdered counterpart.

By Application

Acrylic Acid application dominated the 3-Hydroxypropionic Acid Market in 2023 with a 40.3% market share. The increasing demand for acrylic acid in coatings, adhesives, and superabsorbent polymers has driven the widespread adoption of 3-Hydroxypropionic Acid as a bio-based alternative to fossil-derived acrylic acid. The European Union’s Green Deal and initiatives by the U.S. Department of Energy (DOE) have encouraged research into sustainable acrylic acid production, further boosting the use of 3-Hydroxypropionic Acid in this segment. Companies like BASF and Arkema have invested in developing bio-based acrylic acid technologies, reinforcing its dominance in the market. The growing construction and hygiene product sectors also contribute to the sustained demand for acrylic acid-based products.

By End-Use Industry

Chemical industry dominated the 3-Hydroxypropionic Acid Market in 2023 with a 35.4% market share. The chemical industry remains the largest consumer of 3-Hydroxypropionic Acid, driven by its applications in acrylic acid, solvents, and biodegradable plastics. The International Council of Chemical Associations (ICCA) has highlighted the increasing integration of bio-based chemicals into industrial formulations, yet petroleum-based 3-Hydroxypropionic Acid continues to be widely used due to its affordability and established production pathways. Government-backed sustainability initiatives, such as the European Bioeconomy Strategy, are expected to accelerate the transition toward bio-based chemicals, but in 2023, the chemical industry’s reliance on cost-effective petroleum-based derivatives ensured its market leadership.

3-Hydroxypropionic Acid Market Regional Outlook

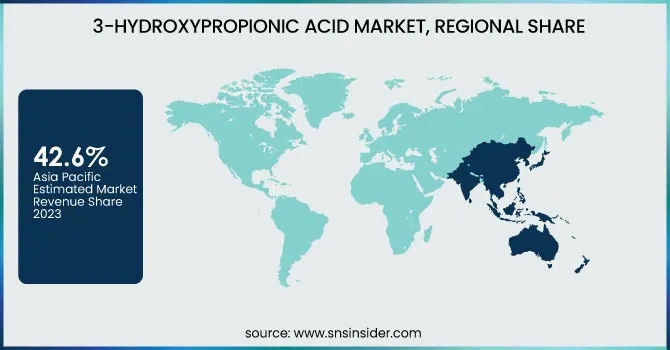

Asia Pacific dominated the 3-Hydroxypropionic Acid Market in 2023 with a market share of 42.6%. The region’s dominance is driven by rapid industrialization, growing chemical manufacturing, and strong demand from sectors such as agriculture, pharmaceuticals, and packaging. Countries like China, Japan, and India lead the market, with China holding the largest share due to its robust chemical industry and increasing investments in bio-based chemicals. According to the China National Chemical Information Center (CNCIC), the country produced over 60% of global bio-based chemicals in 2023, strengthening its position in 3-Hydroxypropionic Acid production. Japan’s government-backed initiatives, such as the Green Growth Strategy, support the expansion of sustainable chemicals, while India's Make in India initiative has boosted domestic chemical manufacturing. Additionally, China’s Ministry of Industry and Information Technology (MIIT) has reported significant investments in bio-based polymer research, further propelling the demand for 3-Hydroxypropionic Acid in the region.

On the other hand, North America emerged as the fastest-growing region in the 3-Hydroxypropionic Acid Market, with a substantial growth rate during the forecast period. The region’s rapid growth is attributed to increasing adoption of biodegradable polymers, government regulations promoting sustainability, and significant R&D investments. The United States dominates the North American market, driven by advancements in bio-based chemical production, high demand for acrylic acid, and strong presence of key players such as Cargill, Novozymes, and Thermo Fisher Scientific. The U.S. Department of Energy (DOE) and Environmental Protection Agency (EPA) have implemented policies supporting bio-based alternatives, accelerating market expansion. Canada is also witnessing growth due to its Bioeconomy Strategy, which promotes the adoption of sustainable chemicals. Furthermore, the U.S. National Renewable Energy Laboratory (NREL) has reported increased research funding for bio-based 3-Hydroxypropionic Acid, highlighting its potential in reducing dependency on fossil-based chemicals in North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Alfa Aesar (Thermo Fisher Scientific Inc.)

-

Alfa Chemistry

-

Apollo Scientific

-

Beijing PhaBuilder Biotechnology Co., Ltd.

-

Cayman Chemical Company

-

Fluoropharm Co., Ltd.

-

Hangzhou Dayang Chemical

-

Haihang Industry

-

LG Chem

-

Merck KGaA

-

Oakwood Products Inc.

-

ShanDong Fine Chemical

-

Shanxi Jinjin Chemical Co., Ltd.

-

Sigma-Aldrich

-

TCI N.V. (Tokyo Chemical Industry Co., Ltd.)

-

Toronto Research Chemicals Inc.

-

Zhengzhou Alfa Chemical Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 730.75 Million |

| Market Size by 2032 | USD 1,649.28 Million |

| CAGR | CAGR of 9.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Petroleum, Bio-based) •By Form (Powder, Liquid) •By Application (Acrylic Acid, Biodegradable Polymers, Chemical Intermediates, Others) •By End-Use Industry (Pharmaceuticals, Agriculture, Chemical, Packaging, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Beijing PhaBuilder Biotechnology Co., Ltd., Cargill, Incorporated, LG Chem, Merck KGaA, Thermo Fisher Scientific Inc., Tokyo Chemical Industry Co., Ltd. (TCI), Zhengzhou Alfa Chemical Co., Ltd., Fluoropharm Co., Ltd., Spectrum Chemical, Oakwood Products Inc. and other key players |