4K Technology Market Size & Trends:

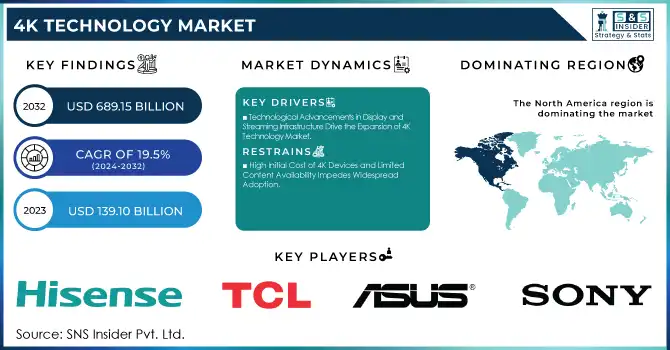

The 4K Technology Market Size was valued at USD 139.10 Billion in 2023 and is expected to reach USD 689.15 Billion by 2032 and grow at a CAGR of 19.5% over the forecast period 2024-2032.

The 4K technology market has been witnessing remarkable growth in recent years, driven by advancements in display technologies, increased consumer demand for high-quality entertainment experiences, and the rise of content creation in ultra-high-definition formats.

4K technology, which provides a resolution of 3840x2160 pixels, offers four times the resolution of Full HD (1080p), delivering significantly sharper images and enhanced visual experiences. This has fueled its adoption across various sectors, including consumer electronics, media, entertainment, gaming, healthcare, and retail, positioning the market for continued expansion.

4K Technology Market Size and Forecast

-

Market Size in 2023: USD 139.10 Billion

-

Market Size by 2032: USD 689.15 Billion

-

CAGR: 19.5% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

To get more information on 4K Technology Market - Request Free Sample Report

4K Technology Market Trends:

-

Rapid growth of OTT streaming and smart TVs is driving 4K adoption, with over 65% of new TVs shipped globally supporting 4K resolution.

-

Expansion of 4K content production across media and entertainment is increasing demand, as more than 70% of new digital content is now produced in 4K format.

-

Rising penetration of 4K cameras and displays in smartphones and consumer electronics is accelerating uptake, with over 55% of flagship smartphones offering 4K video capability.

-

Growing use of 4K in gaming and esports is boosting demand for high-refresh 4K monitors, with the gaming display segment growing at over 12% CAGR.

-

Adoption of 4K in healthcare, surveillance, and industrial imaging is expanding, improving image clarity by 4× compared to Full HD for precision applications.

The 4K technology market has experienced significant growth, driven by advancements in display technologies, increased consumer demand for high-quality content, and the proliferation of 4K-capable devices. In the United States, the adoption of 4K televisions has surged, with larger screen sizes becoming increasingly popular. This trend is further supported by the availability of 4K content from streaming services and broadcasters, enhancing the viewing experience and encouraging consumers to upgrade their devices. Additionally, the U.S. Federal Communications Commission (FCC) has reported on the performance of fixed broadband Internet access services, highlighting the importance of high-speed internet infrastructure in delivering 4K content effectively. The FCC's Measuring Broadband America program provides comprehensive data on broadband performance, underscoring the need for robust internet services to support the growing demand for 4K streaming. These factors collectively contribute to the expansion of the 4K technology market in the U.S., indicating a strong consumer preference for high-resolution displays and the necessary infrastructure to support them.

4K Technology Market Dynamics

Key Drivers:

-

Increased Consumer Demand for High-Quality Visual Experiences Propels 4K Technology Adoption in Home Entertainment Systems

The growing consumer demand for enhanced viewing experiences has significantly boosted the 4K technology market. As consumers increasingly seek better visual quality, the desire for 4K TVs, monitors, and streaming content has expanded. The rise of streaming platforms such as Netflix, Disney+, and Amazon Prime Video offering 4K content has contributed to the widespread adoption of 4K devices. With content creators producing more 4K video content, from movies to TV shows and sports broadcasts, consumers are becoming more accustomed to viewing high-definition visuals. This demand for high-quality media has driven the market for 4K-enabled devices, particularly in the home entertainment sector. Additionally, advancements in display technologies, such as OLED and QLED, have made 4K displays more accessible and affordable, further encouraging consumers to upgrade their entertainment systems. As 4K content becomes increasingly prevalent across all forms of media, including gaming, users are investing in 4K-capable screens to fully experience the high-definition clarity that 4K technology offers, resulting in a continued expansion of the market.

-

Technological Advancements in Display and Streaming Infrastructure Drive the Expansion of 4K Technology Market

Technological innovations in both display technology and internet infrastructure have played a pivotal role in driving the growth of the 4K technology market. Advances in television display technologies, such as OLED, QLED, and Mini-LED, have enhanced the visual performance of 4K displays, offering consumers brighter, sharper, and more vibrant images. These improvements in display quality, combined with decreasing production costs, have made 4K televisions more affordable for a larger audience.

Furthermore, the advancement of internet infrastructure, including the availability of high-speed broadband and the rollout of 5G technology, has enabled seamless streaming of 4K content. As internet speeds increase, consumers can stream 4K videos without buffering, contributing to the widespread adoption of 4K-capable devices. Streaming platforms have responded to this demand by expanding their 4K content libraries and upgrading their technology to provide the best possible experience. These technological advancements in both hardware and connectivity have effectively facilitated the growth of the 4K technology market, creating a strong foundation for continued expansion in the coming years.

Restrain:

-

High Initial Cost of 4K Devices and Limited Content Availability Impedes Widespread Adoption

Despite the growing interest in 4K technology, the high initial cost of 4K-enabled devices remains a significant restraint to widespread adoption, particularly in price-sensitive markets. While the prices of 4K televisions and monitors have dropped over time, they are still considered premium products, with high-quality 4K models such as OLED and QLED still carrying hefty price tags. This can deter potential buyers who are not willing to invest in a higher-cost device.

Furthermore, despite the increasing availability of 4K content on streaming platforms and media channels, there is still a limited amount of 4K content compared to standard HD. This content gap is especially evident in certain regions or platforms, where 4K video libraries are not as robust as they are in markets like North America and Europe. Consumers may hesitate to upgrade to 4K technology if they believe there is insufficient content to justify the investment. Therefore, while the 4K technology market continues to expand, the high upfront cost of devices and the content availability issue remain obstacles that could slow the pace of adoption among more price-conscious and content-demanding consumers.

4K Technology Market Segmentation Analysis

By Product

The TV monitors segment holds the largest revenue share of 40.00% in 2023 within the 4K technology market, driven by increasing consumer demand for high-quality home entertainment. This segment's dominance is largely attributed to the growing preference for 4K televisions and monitors, which deliver superior picture clarity and enhanced viewing experiences. Companies like Sony, Samsung, and LG have been at the forefront of product innovation within this segment.

For instance, Sony expanded its BRAVIA XR 4K TV lineup, incorporating its Cognitive Processor XR to enhance picture and sound quality based on ambient conditions. LG has also been developing 4K OLED displays with improved refresh rates and AI-powered image processing for an immersive experience, particularly appealing to gaming and sports enthusiasts.

The smartphones segment is expected to grow at the highest CAGR of 22.14% during the forecast period within the 4K technology market. This growth is primarily driven by increasing consumer demand for high-definition mobile content, including streaming, gaming, and photography. Leading smartphone manufacturers such as Samsung, Apple, and Xiaomi have integrated 4K technology into their latest models, contributing to the segment's rapid expansion.

For example, Samsung’s Galaxy S23 Ultra comes with a 4K display, 4K recording capabilities, and improved camera sensors to provide superior photography and videography experiences. Similarly, Apple’s iPhone 14 Pro Max supports 4K video recording with Dolby Vision HDR, allowing users to create and view high-quality content.

By End Use

The Consumer Electronics segment dominates the 4K technology market with the largest revenue share of 52.00% in 2023. This dominance is primarily driven by the increasing demand for 4K televisions, gaming consoles, and home entertainment systems. As consumers seek superior visual experiences, the adoption of 4K technology has surged, particularly in smart TVs and other display devices. Companies such as Sony, Samsung, and LG are leading the market by introducing innovative 4K products.

For instance, Sony’s BRAVIA XR 4K TVs incorporate advanced technologies like the Cognitive Processor XR for optimized image and sound quality. LG has strengthened its position by launching 4K OLED TVs with improved refresh rates and AI-based image processing, catering to the growing demand for high-definition content and gaming.

The Healthcare segment is projected to experience the highest CAGR of 21.61% during the forecast period within the 4K technology market. This growth is driven by the increasing adoption of 4K imaging and video technologies in medical procedures, diagnostics, and surgery. High-resolution 4K cameras and monitors allow healthcare professionals to view finer details in medical imaging, improving the accuracy of diagnoses and procedures.

For example, companies like Sony and Panasonic have developed 4K medical displays and cameras for use in endoscopy, surgery, and medical imaging. Sony’s medical-grade 4K monitors, which offer ultra-high-definition clarity, are increasingly being used in operating rooms to enhance surgical precision.

4K Technology Market Regional Overview

In 2023, the North America region dominated the 4K technology market, with an estimated market share of around 35%. This dominance is driven by the high demand for 4K-enabled devices across consumer electronics, including televisions, gaming consoles, and streaming services. North America, particularly the United States, has seen widespread adoption of 4K technology in home entertainment systems, largely due to the availability of high-speed internet and the rapid growth of streaming platforms like Netflix, Amazon Prime Video, and Disney+, all of which offer 4K content.

The high disposable income and tech-savvy consumer base in North America have also fueled the demand for premium 4K products. Additionally, the prevalence of gaming, with consoles like the PlayStation 5 and Xbox Series X offering 4K gaming experiences, has contributed to the region’s dominance in the 4K technology market.

The Asia Pacific region is the fastest growing in the 4K technology market in 2023, with an estimated CAGR of 21.95% during the forecast period. This rapid growth is largely attributed to the rising adoption of 4K technology in countries like China, Japan, India, and South Korea, driven by increasing urbanization, rising disposable income, and a growing middle class.

For example, China major companies like Hisense, TCL, and Xiaomi are leading the market with affordable 4K-enabled televisions and smartphones, making 4K technology more accessible to a broader consumer base.

Get Customized Report as per Your Business Requirement - Enquiry Now

4K Technology Companies are:

-

Sony Corp. (Bravia 4K TVs, Sony 4K Cameras)

-

JVC Kenwood Corp. (JVC 4K Projectors, JVC 4K Camcorders)

-

AsusTek Corp. (Asus 4K Monitors, Asus 4K Laptops)

-

Hong Kong Skyworth Digital Holdings Ltd. (Skyworth 4K Smart TVs, Skyworth 4K Set-top Boxes)

-

TCL Corp. (TCL 4K QLED TVs, TCL 4K Android TVs)

-

Hisense Co., Ltd. (Hisense 4K ULED TVs, Hisense 4K Laser TVs)

-

Amazon Inc. (Amazon Fire TV 4K, Amazon Prime Video 4K Streaming)

-

Canon Inc. (Canon 4K Professional Cameras, Canon 4K Camcorders)

-

Blackmagic Design Pty Ltd. (Blackmagic 4K Cinema Cameras, Blackmagic 4K Video Switchers)

-

Innolux Corp. (Innolux 4K Display Panels, Innolux 4K Touch Screens)

-

LG Electronics Corp. (LG OLED 4K TVs, LG UltraFine 4K Monitors)

-

Panasonic Corp. (Panasonic 4K UHD TVs, Panasonic 4K Professional Cameras)

-

Samsung Electronics Corp. (Samsung Neo QLED 4K TVs, Samsung 4K Smart Monitors)

-

Sharp Corp. (Sharp AQUOS 4K TVs, Sharp 4K Display Panels)

Recent Trends

-

In March 2023, Sony enhanced its BRAVIA XR 4K TV range by introducing the Cognitive Processor XR, which optimizes both picture and sound based on the surrounding environment and the type of content being viewed. Sony also highlighted its BRAVIA CORE streaming platform, which delivers exclusive 4K Blu-ray-quality content to users.

-

In January 2023, LG launched OLED TVs featuring upgraded refresh rates and AI-driven image processing, offering a smoother experience for 4K gaming and sports. Furthermore, LG partnered with Dolby Laboratories to integrate Dolby Vision IQ with Precision Detail, further enhancing the 4K HDR viewing experience.

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

USD 139.10 Billion |

|

Market Size by 2032 |

USD 689.15 Billion |

|

CAGR |

CAGR of 19.5 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Set-top boxes, TV monitors, Digital signage, Smartphones, Tablets & laptops) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Sony Corp., JVC Kenwood Corp., AsusTek Corp., Hong Kong Skyworth Digital Holdings Ltd., TCL Corp., Hisense Co., Ltd., Amazon Inc., Canon Inc., Blackmagic Design Pty Ltd., Innolux Corp., LG Electronics Corp., Panasonic Corp., Samsung Electronics Corp., Sharp Corp. |

|

Key Drivers |

• Increased Consumer Demand for High-Quality Visual Experiences Propels 4K Technology Adoption in Home Entertainment Systems. |

|

Restraints |

• High Initial Cost of 4K Devices and Limited Content Availability Impedes Widespread Adoption. |