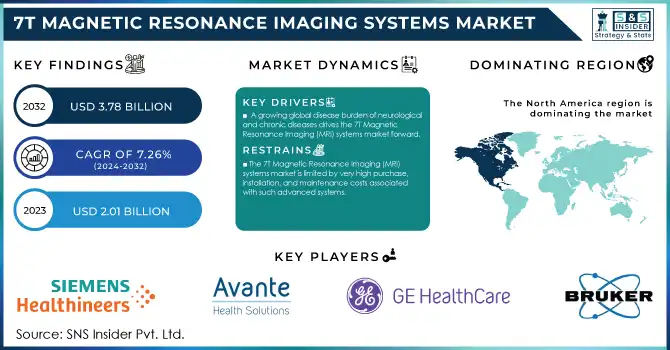

7T Magnetic Resonance Imaging Systems Market Size:

The 7T Magnetic Resonance Imaging Systems Market size was valued at USD 2.01 billion in 2023, projected to grow to USD 3.78 billion by 2032 with a 7.26% CAGR from 2024-2032.

To get more information on 7T Magnetic Resonance Imaging Systems Market - Request Free Sample Report

The 7T Magnetic Resonance Imaging (MRI) Systems market is experiencing growth because of the worldwide pace of advancement in imaging technology, and many high-resolution diagnostic tools are needed in both healthcare and research settings. Ultra-high-field MRI systems offer superior image resolution for the comprehensive study of neurodegenerative diseases, musculoskeletal disorders, and other complicated conditions. Because of their superior anatomical and functional imaging capability, thus, it have been recognized as a vital tool in clinical practice as well as in research applications.

Siemens Healthineers, for instance, was granted FDA clearance for its MAGNETOM Terra. X in March 2024. They launched a second-generation clinical 7 structure MRI scanner with new hardware and XA60A software. This new feature greatly improves scanning quality, further consolidating Siemens' leading position in the ultra-high-field MRI market. Likewise, the University of Florida purchased a Bruker 7T preclinical scanner in May 2023 with a USD 2 million NIH High-End Instrumentation Award, reflecting a growing investment in preclinical imaging research.

Other vital aspects fuelling the market growth are the rising cases of neurological disorders like Alzheimer's and multiple sclerosis, requiring accurate imaging for diagnosis and treatment, among others. World Health Organization estimates show that neurological disorders cause over 20% of DALYs worldwide, demonstrating the urgent and pressing need for improved diagnostic tools as provided by the 7T MRI systems.

Other major trends are the embedding of more AI/machine learning into scanning protocols to enable greater imaging precision, shortening acquisition time, etc. Also, governments at least are investing more and more infrastructure and funds, and increasing interdisciplinary collaborations across industry, academia, and governments in the process of using 7T MRI scanners for preclinical and translational studies.

7T Magnetic Resonance Imaging Systems Market Dynamics

Drivers

-

A growing global disease burden of neurological and chronic diseases drives the 7T Magnetic Resonance Imaging (MRI) systems market forward.

Conditions that are diagnosed as Alzheimer's disease, Parkinson's disease, multiple sclerosis, and epilepsy all require an exceptionally high definition in imaging diagnostics and treatment. The World Health Organization states that neurological disorders are responsible for over 20% of DALYs worldwide. Therefore, it is imperative to have more sophisticated diagnostic tools. 7T MRI systems boast a resolution and sensitivity that allow clinicians to visualize even the slightest structural and functional abnormalities, making it possible for early diagnosis and, subsequently, a more personalized approach to treatment. This increasing demand for high-resolution imaging is driving the adoption of 7T MRI systems in various clinical and research settings.

-

The growth in the 7T MRI systems market is fueled by the constant improvement in MRI technology and rising research funding.

Improved gradient systems, better signal-to-noise ratios, and integration with artificial intelligence (AI) for better image analysis are some of the continuous developments in MRI technology that are making 7T MRI scanners more efficient and accurate. These technological advancements enhance the resolution and capabilities of 7T MRI systems, making them capable of providing superior imaging that is needed for diagnosing complex conditions like neurological disorders, cancer, and musculoskeletal diseases.

Increasing funding for research, especially from government agencies, private organizations, and academic institutions, is accelerating the development and adoption of 7T MRI technology. Financial assistance is no longer enabling manufacturers to improve the technical features of these high-field MRI systems; it is also allowing them to be implemented in research settings in both clinical and preclinical environments. Therefore, with enhanced imaging capabilities and more significant research possibilities, 7T MRI systems emerge as an essential tool in enhancing medical diagnostics and scientific research, thereby fueling further expansion in the market.

Restraint

-

The 7T Magnetic Resonance Imaging (MRI) systems market is limited by very high purchase, installation, and maintenance costs associated with such advanced systems.

The price of a 7T MRI scanner may lie among several millions of dollars, and it turns into a serious investment for hospitals, research establishments, and diagnostic facilities. Specialized shielding and space requirements required for nuclear reactors also contribute to the total cost.

Limited access is a very important challenge, particularly in developing economies, where healthcare budgets are constrained and advanced medical technologies are scarce. A shortage of trained personnel to operate and interpret the results from 7T MRI systems is also lacking in some regions. Consequently, not only is the high cost of 7T MRI systems prohibitive, but so is the limited accessibility, restricting their wide-scale deployment primarily to well-funded research institutions and top-tier hospitals, especially in developed countries.

7T Magnetic Resonance Imaging Systems Market Segmentation Insights

By Application

The research segment dominated the market and accounted for the maximum market share at 68% in 2023. This can be mainly because of increased research. Academic institutions and medical research centers invest more in advanced imaging technologies to study complex neurological and physiological conditions. Consequently, there has been a greater demand for 7T MRI systems. This high-resolution imaging capability becomes very useful especially in research studies, allowing deeper studies and breakthrough discoveries. For example, the publication of NCBI stated that the human spinal cord, 7 Tesla MRI has successfully been demonstrated at several research institutions around the globe. The spinal cord remains the most important location where higher strengths and higher resolutions can be gained. As a result, the expanding applications in research are expected to further fuel market growth.

The clinical application segment is likely to experience the fastest CAGR of more than 8.3% over the forecast period. This growth is majorly due to increasing applications and growing government approvals for clinical use. For example, a July 2023 article from the Mayo Clinic shows an interest in the clinical use of ultrahigh field 7T MRI in managing epilepsy and multiple sclerosis (MS). Mayo Clinic neuroradiologists, however, have expanded the use of 7T MRI in the clinical arena beyond the above-mentioned common applications. They now regularly employ this high-tech technology to guide treatment for patients with neurodegenerative disorders, cerebrovascular disease, amyotrophic lateral sclerosis (ALS), and other neurological conditions.

By End Use

The research institutes segment dominated the market with over 65% share in 2023. This is due to the increasing focus on advanced imaging technologies in academic and medical research institutions, which are driving the adoption of 7T MRI systems for studying complex neurological and physiological conditions. The other point is that funding and grants also reach the research institutes, helping them fund expensive technologies like 7T MRI for furthering their research. They can, with such funds, pursue large-scale studies and clinical trials, which involve the type of detailed imaging such systems can deliver.

Among the hospital segments, the 7T MRI market is expected to grow at the fastest CAGR over the forecast period. This is due to the increasing adoption of advanced imaging technologies in hospitals for enhanced diagnostic accuracy and patient results. These institutions are among the first to explore complex neurological and physiological conditions, such as neurodegenerative diseases, multiple sclerosis (MS), and epilepsy. Additionally, regulatory approvals for the clinical use of 7T MRI systems are increasing across the globe, making it easier for hospitals to incorporate these systems into routine medical care.

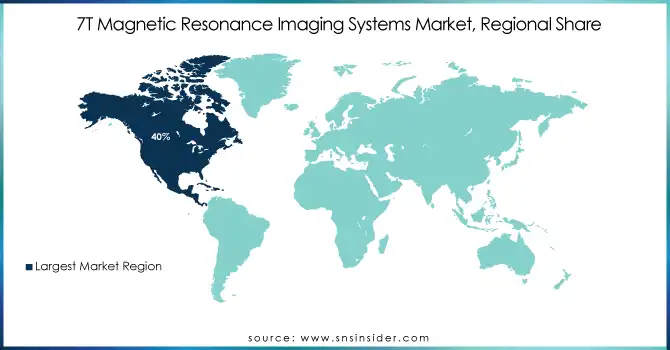

7T Magnetic Resonance Imaging Systems Market Regional Analysis

In 2023, North America dominated the market with a market share of 40%. This is due to the region's well-established healthcare infrastructure, which supports the extensive adoption of advanced medical technologies like 7T MRI systems. Favorable reimbursement policies and substantial healthcare spending in North America also facilitate broad access to 7T MRI technology for both patients and healthcare providers.

The Asia Pacific region is expected to have the fastest CAGR of 8.50% for the 7T magnetic resonance imaging systems market in the forecast period, driven by the rapid development of healthcare infrastructure in emerging economies such as China, India, and Japan. Governments and private sectors in these countries are investing heavily in the expansion of healthcare facilities, including hospitals and diagnostic centers, to improve the quality of medical care. In China, the market is expected to grow significantly, driven by an aging population and the increasing prevalence of chronic conditions such as neurological and cardiovascular disorders, which require high-resolution imaging systems like 7T MRI for superior diagnostic accuracy. Similarly, Japan is expected to see market growth shortly, driven by medical research advancements and innovation. This is bolstered by solid collaborations between universities, research institutions, and the healthcare industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

MAGNETOM Terra: The first 7T MRI scanner for clinical use, designed for advanced neuroimaging and musculoskeletal applications.

-

MAGNETOM Terra.X: An advanced version of the Terra, offering enhanced imaging capabilities and designed for clinical and research purposes.

-

SIGNA 7T MRI Scanner: Equipped with UltraG gradients, this scanner delivers superior contrast and signal-to-noise ratio (SNR) performance for improved diagnostic confidence.

-

BioSpec 70/30 USR: A 7T MRI system designed for preclinical and research applications, offering ultra-high resolution imaging.

-

BioSpec 70/20 USR: Another 7T MRI system from Bruker, tailored for small animal imaging with high sensitivity and resolution.

koninklijke philips nv

-

Philips Achieva 7T MRI: A cutting-edge, ultra-high-field MRI system designed to provide exceptionally detailed images for both clinical and research purposes.

Key suppliers

key suppliers that provide components, raw materials, or manufacturing services for personal mobility devices such as wheelchairs, scooters, and walkers:

-

Siemens Healthineers Suppliers

-

Avante Health Solutions Suppliers

-

GE HealthCare Suppliers

-

Providian Medical Equipment Suppliers

-

Bruker BioSpin Suppliers

-

Scintica Instrumentation Suppliers

-

Philips Healthcare Partners Suppliers

-

Henry Schein Medical Suppliers

-

Agiliti Health Suppliers

-

Amber Diagnostics Suppliers

Recent Developments

-

In March 2024, Siemens Healthineers announced that it received FDA clearance for the MAGNETOM Terra.X, its second-generation clinical 7-tesla magnetic resonance imaging (MRI) scanner. This advanced system integrates cutting-edge hardware and the XA60A software, significantly enhancing the capabilities of 7T MR scanning for clinical and research applications.

-

In May 2023, researchers at the University of Florida revealed plans to acquire a state-of-the-art Bruker 7 Tesla MRI/MRS preclinical scanner. The initiative is supported by a USD 2 million NIH High-End Instrumentation Award, enabling groundbreaking advancements in preclinical imaging research.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.01 Billion |

| Market Size by 2032 | US$ 3.78 Billion |

| CAGR | CAGR of 7.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Clinical, Research) • By End Use (Hospitals and Clinics, Research Institutions, Diagnostic Imaging Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens Healthineers, GE HealthCare, Bruker BioSpinand other players. |

| Key Drivers | •A growing global disease burden of neurological and chronic diseases drives the 7T Magnetic Resonance Imaging (MRI) systems market forward •The growth in the 7T MRI systems market is fueled by the constant improvement in MRI technology and rising research funding |

| Restraints | •The 7T Magnetic Resonance Imaging (MRI) systems market is limited by very high purchase, installation, and maintenance costs associated with such advanced systems |