SIP Trunking Services Market Size & Overview:

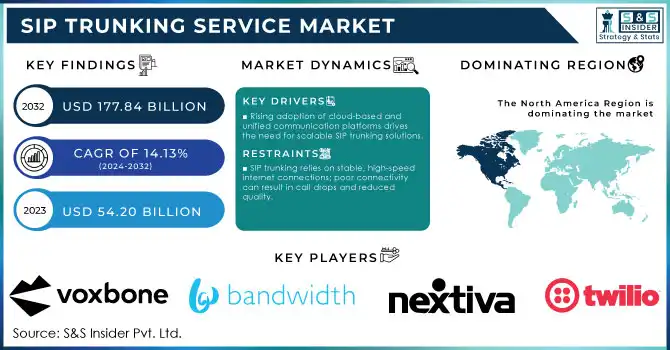

SIP Trunking Service Market was valued at USD 54.20 billion in 2023 and is expected to reach USD 177.84 Billion by 2032, growing at a CAGR of 14.13% from 2024-2032.

The SIP Trunking Service Market is experiencing rapid growth, driven by digital transformation efforts and the need for reliable, scalable communication solutions. SIP (Session Initiation Protocol) trunking allows businesses to make high-quality voice calls online, reducing reliance on traditional PSTN (Public Switched Telephone Network) lines. This service has become vital for IT, finance, and retail sectors, where robust communication infrastructure is essential for daily operations, customer support, and collaboration. Recent data shows global demand for SIP trunking services is rising, as companies look to reduce costs and improve operational efficiency. A 2024 survey found that approximately 65% of companies in North America have adopted SIP trunking as part of their communication strategy, with strong growth also seen in Europe and the Asia-Pacific, particularly among small and medium-sized enterprises (SMEs) moving to cloud-based systems.

Get more information on SIP Trunking Services Market - Request Sample Report

The market is primarily growing due to the rapid adoption of cloud communications and unified communication platforms. As hybrid work models become the norm, SIP trunking supports remote work by enabling employees to access communication tools from any location with internet access. The increase in remote teams has led to more investment in SIP trunking infrastructure to ensure secure and uninterrupted communication. For example, in 2023, several U.S.-based financial institutions shifted from traditional systems to SIP trunking to improve security and cut costs, reporting operational savings of up to 40%.

Another significant growth driver is the integration of SIP trunking with AI and machine learning to improve call management and customer service analytics. Providers now offer AI-driven analytics for assessing call quality, sentiment, and customer engagement. Real-world applications include automated customer support routing, which reduces response times and enhances customer satisfaction. As demand grows for affordable and reliable voice solutions, SIP trunking is expected to see further adoption, especially in emerging markets investing in digital infrastructure. Overall, the market is poised for ongoing expansion, as businesses of all sizes increasingly value the flexibility, scalability, and advanced features that SIP trunking offers compared to traditional voice systems.

Market Dynamics

Drivers

-

SIP trunking reduces communication expenses by minimizing reliance on traditional PSTN lines.

-

Rising adoption of cloud-based and unified communication platforms drives the need for scalable SIP trunking solutions.

-

SIP trunking offers improved security features and more reliable call quality, making it preferable to traditional telephony.

In the SIP Trunking Service Market, enhanced security and reliable call quality are leading advantages that make SIP trunking a preferred choice over traditional telephony systems. Unlike conventional PSTN lines, SIP trunking operates through an IP-based approach, allowing voice calls to be transmitted securely over the internet. This structure enables providers to incorporate advanced security protocols like end-to-end encryption and secure tunnelling, safeguarding sensitive business communications against cyber threats. Given increasing cybersecurity concerns, especially within finance, healthcare, and government sectors, the strengthened security of SIP trunking is critical for protecting communication channels and ensuring compliance with stringent data privacy regulations.

Additionally, SIP trunking offers superior call quality through advanced packet-switching technology and quality-of-service (QoS) management. QoS prioritizes voice data packets, reducing latency and minimizing call drops, echo, and background noise. This improvement in call clarity is particularly valuable for businesses dependent on customer interactions or remote teamwork, where clear, uninterrupted communication is essential. Many companies are switching to SIP trunking specifically for its reliability; unlike traditional phone systems that can be vulnerable to physical line issues, SIP trunking uses virtual pathways over the internet, making it more resilient to technical disruptions and easier to troubleshoot.

SIP trunking’s flexibility also enables it to scale as business needs evolve. Expanding lines, boosting bandwidth, or adding extra security features can be done seamlessly, making SIP trunking suitable for both large enterprises and small-to-medium businesses. For instance, during 2023-2024, several U.S. financial institutions adopted SIP trunking to save costs while benefiting from its robust security and reliable call quality, experiencing notable reductions in call disruptions and enhanced client communication. As secure, high-quality, and flexible communication channels become essential in today's market, SIP trunking emerges as a superior solution over traditional voice systems, supporting both operational efficiency and robust data security across sectors.

Restraints

-

SIP trunking relies on stable, high-speed internet connections; poor connectivity can result in call drops and reduced quality.

-

Despite security measures, SIP trunking remains vulnerable to cyberattacks like DDoS (Distributed Denial of Service) and eavesdropping if not properly managed.

-

Migrating from traditional telephony to SIP trunking can be challenging, requiring technical expertise and infrastructure changes.

Migrating from traditional telephony to SIP trunking presents several challenges for organizations, requiring technical expertise and infrastructure upgrades to fully integrate the new system. Unlike the long-established PSTN lines, which depend on physical phone lines, SIP trunking uses an IP-based model to transmit voice data, necessitating updated equipment, high-speed internet, and possibly new routers and firewalls to handle increased data traffic. This transition also demands skilled IT professionals familiar with VoIP (Voice over Internet Protocol) technology, as the configuration of SIP trunking involves setting up servers, managing network protocols, and addressing security risks. For many organizations, especially small businesses with limited IT resources, securing the necessary expertise can be difficult. Furthermore, training employees on the new SIP system and its features adds to the overall cost and complexity of the transition.

Another challenge is maintaining consistent call quality, as SIP trunking depends on internet bandwidth. Any fluctuations in internet speed or network congestion can impact call clarity, unlike traditional phone lines, which are typically more stable. To prioritize voice data traffic, SIP trunking requires network adjustments such as the implementation of Quality of Service (QoS) settings, which can complicate the setup process. Additionally, businesses that handle high call volumes may need to invest in extra bandwidth, leading to increased costs.

Despite these initial obstacles, many businesses are adopting SIP trunking due to its long-term cost-saving benefits and scalability. Once in place, SIP trunking can significantly reduce the ongoing costs of maintaining physical phone lines and offer flexibility for future expansions without major infrastructure investments. However, these advantages are realized only after overcoming the initial setup challenges, which may discourage some businesses from making the switch. With proper planning and resources, however, companies can successfully transition to SIP trunking and enjoy its numerous benefits over traditional telephony systems.

Segment Analysis

By Deployment

The on-premises segment dominated the market in 2023 and represented revenue share of 71.23% , especially for larger enterprises that require greater control over their infrastructure and security. On-premises SIP trunking involves businesses managing both hardware and software internally, providing them with full control of their communication systems. This approach is especially appealing to organizations with strict data security needs and sufficient IT resources. The main growth drivers for this segment include the rising demand for secure, high-quality, and dependable voice communication, particularly in industries like finance and healthcare. While on-premises solutions remain popular among large enterprises, the growing adoption of cloud-based solutions may eventually reduce its market share.

The cloud-based deployment segment is witnessing the highest CAGR of 14.98% in the SIP trunking market, driven by the demand for cost-effective, scalable, and flexible communication systems. Cloud-based SIP trunking eliminates the need for substantial upfront investments in hardware and maintenance, offering greater scalability that suits small and medium-sized businesses (SMBs) and start-ups. Key factors fueling this growth include the increasing adoption of cloud technologies, the rise of remote work, and the growing demand for unified communication platforms. Cloud solutions also allow businesses to scale operations swiftly without heavy infrastructure costs, making cloud deployment the preferred choice as digital transformation accelerates, particularly in emerging markets.

By Organization Size

In 2023, The large enterprises segment dominated the SIP trunking service market And Accounted for 75.32%. These organizations typically have the infrastructure and resources to manage the complex installation and maintenance requirements of SIP trunking systems. They often need customized, secure solutions and large-scale communication networks to support their operations across various regions. Growth in this segment is driven by the need for cost-effective communication, high-level voice security, and the ability to scale globally. Industries such as finance, healthcare, and retail leverage SIP trunking to improve collaboration, increase operational efficiency, and reduce the costs tied to traditional telephone systems.

The small and medium-sized enterprises (SMEs) segment is seeing the highest growth rate of 14.68% in the market. This increase is mainly due to the affordability and flexibility of cloud-based SIP trunking solutions, which are ideal for SMEs with limited budgets and fewer resources. SMEs benefit from SIP trunking’s scalability, lower initial costs, and improved customer service capabilities. The rise in remote work, digital transformation, and the growing need for unified communications platforms are all fueling this growth. By adopting SIP trunking, SMEs can access cost-effective, reliable voice services that allow them to compete with larger enterprises while ensuring high-quality communication.

Regional Analysis

North America dominated the SIP trunking service market and accounting for significant revenue share of 39.23% in 2023. With the presence of large enterprises, high cloud adoption and well established telecommunications infrastructure. As SIP trunking is cost-efficient, scalable, high-performance communication system, hence, industries like finance, healthcare, and retail are opting for it. The growth in the region can be attributed to the digital transformation, the adoption of work from home and an increased need for cost-effective and dependable communication solutions. North America still on top as the growing trend for cloud-based SIP solutions persists.

The SIP trunking market is growing at the highest rate of 16.11% in the Asia-pacific (APAC) region. The rapid digital adoption, developing internet infrastructure and large number of small–medium enterprises (SMEs) in countries (for example India, China, Japan) is expected to drive the growth. Businesses in APAC are adopting value-for-money and scalable communication solutions that allow them to grow with little or no physical infrastructure investments. Cloud-based SIP trunking is very beneficial for SMEs with easy-to-use communication. Demand for unified communications as well as the adoption of remote work across the region also continues to propel market growth.

Need any customization research on SIP Trunking Services Market - Enquire Now

Key Players

The major key players are

-

Twilio – Twilio Elastic SIP Trunking

-

Nextiva – Nextiva SIP Trunking

-

RingCentral – RingCentral SIP Trunking

-

Bandwidth – Bandwidth SIP Trunking

-

8x8 – 8x8 SIP Trunking

-

Voxbone – Voxbone SIP Trunking

-

Fuze – Fuze SIP Trunking

-

Flowroute – Flowroute SIP Trunking

-

Verizon – Verizon SIP Trunking Services

-

Comcast – Comcast Business SIP Trunking

-

Orange Business Services – Orange SIP Trunking

-

BT Group – BT SIP Trunking Services

-

MegaPath – MegaPath SIP Trunking

-

SIP.US – SIP.US SIP Trunking

-

IntelePeer – IntelePeer SIP Trunking

-

Mitel – Mitel SIP Trunking Solutions

-

TATA Communications – TATA SIP Trunking

-

Vodafone – Vodafone SIP Trunking

-

KPN – KPN SIP Trunking

-

3CX – 3CX SIP Trunking

Recent Developments

April 2024: Verizon unveiled a new SIP trunking service that prioritizes security features, including advanced encryption and fraud prevention tools, ensuring compliance with global data protection regulations

January 2024: Bandwidth Inc. launched a new suite of SIP trunking solutions designed to enhance scalability for small and medium-sized enterprises (SMEs) looking for cost-effective, cloud-based communication services

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 54.20 billion |

| Market Size by 2032 | USD 177.84 Billion |

| CAGR | CAGR of 14.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-premises, Cloud-based) |

| • By Organization Size (Small and medium-sized enterprises (SMEs), Large enterprises) | |

| • By Application (VoIP, Unified communications (UC), Contact center, Video conferencing) | |

| • By Industry (Financial services, Healthcare, Retail, Manufacturing, Information Technology) | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Twilio, Nextiva, RingCentral, Bandwidth, 8x8, Voxbone, Fuze, Flowroute, Verizon, Comcast, Orange Business Services, BT Group, MegaPath, SIP.US, IntelePeer |

| Key Drivers | •SIP trunking reduces communication expenses by minimizing reliance on traditional PSTN lines. |

| •Rising adoption of cloud-based and unified communication platforms drives the need for scalable SIP trunking solutions. | |

| •SIP trunking offers improved security features and more reliable call quality, making it preferable to traditional telephony. | |

| Market Restraints | •SIP trunking relies on stable, high-speed internet connections; poor connectivity can result in call drops and reduced quality. |

| •Despite security measures, SIP trunking remains vulnerable to cyberattacks like DDoS (Distributed Denial of Service) and eavesdropping if not properly managed. | |

| •Migrating from traditional telephony to SIP trunking can be challenging, requiring technical expertise and infrastructure changes. |