Unified Communication as a Service Market Report Analysis:

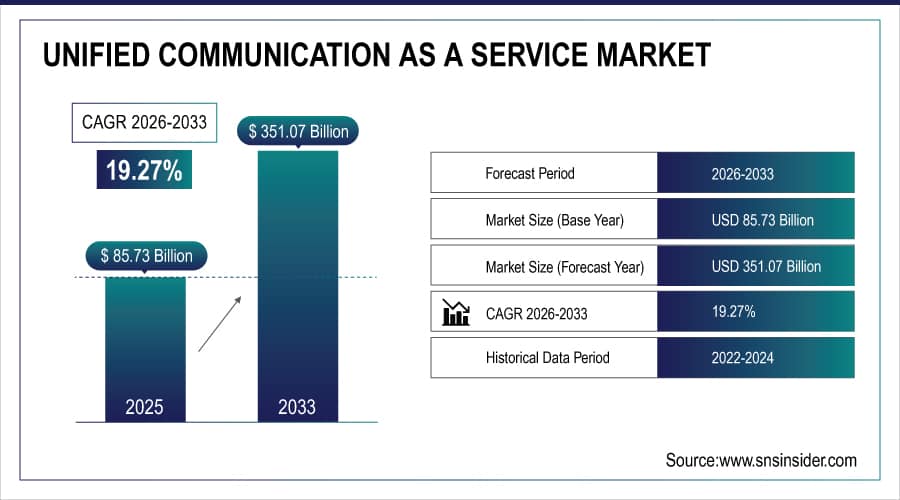

The Unified Communication as a Service Market was valued at USD 85.73 billion in 2025E and is expected to reach USD 351.07 billion by 2033, growing at a CAGR of 19.27% from 2026-2033.

The Unified Communication as a Service (UCaaS) market is growing due to the increasing adoption of cloud-based communication solutions that enhance collaboration and productivity across organizations. Rising demand for remote work tools, integration of advanced features like AI-driven analytics, video conferencing, and contact center solutions, along with the need for scalable, secure, and cost-effective communication platforms, are key drivers. Additionally, digital transformation initiatives and growing enterprise reliance on real-time communication fuel market expansion.

To Get More Information On Unified Communication as a Service Market - Request Free Sample Report

Unified Communication as a Service Market Size and Forecast

-

Market Size in 2025E: USD 86.73 Billion

-

Market Size by 2033: USD 351.07 Billion

-

CAGR: 19.27% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Unified Communication as a Service Market Trends

-

Rising demand for remote work and digital collaboration is driving the Unified Communication as a Service (UCaaS) market.

-

Growing adoption of cloud-based communication solutions, including messaging, video conferencing, and VoIP, is boosting market growth.

-

Expansion of small and medium enterprises (SMEs) seeking cost-effective, scalable communication platforms is fueling adoption.

-

Integration with collaboration tools, CRM systems, and AI-powered analytics is enhancing operational efficiency and user experience.

-

Increasing focus on improving employee productivity, business continuity, and customer engagement is shaping market trends.

-

Advancements in 5G, security protocols, and network reliability are supporting seamless communication services.

-

Partnerships between cloud providers, telecom operators, and enterprise software vendors are accelerating innovation and market penetration.

Unified Communication as a Service Market Growth Drivers:

-

Artificial Intelligence and Automation Driving the Growth of the Unified Communications as a Service Market

Artificial Intelligence (AI) and automation are transforming the Unified Communications as a Service (UCaaS) market by enhancing communication processes. AI-driven tools like chatbots, voice recognition, and automated scheduling optimize interactions, reduce manual tasks, and improve efficiency. Chatbots can handle customer queries instantly, while voice recognition enables more seamless communication, whether for transcription, transcription-to-text, or virtual assistants. Automated scheduling streamlines meeting coordination, reducing the time spent on administrative tasks. In March 2024, Zoom expanded its AI-powered collaboration platform with tools like AI Companion to boost productivity through features such as meeting summaries and follow-up assistance. This positions Zoom to compete with Microsoft Teams and Google by offering these AI features at no extra cost.

-

The Impact of Remote and Hybrid Work Trends on the Unified Communications as a Service Market

The rise of remote and hybrid work models has significantly boosted the demand for Unified Communications as a Service solution. As businesses adapt to flexible work environments, the need for communication tools that integrate voice, video, messaging, and collaboration has become more crucial. UCaaS platforms enable seamless interactions across various devices and locations, allowing employees to stay connected and productive, regardless of where they are working. These solutions facilitate better teamwork, improve communication efficiency, and reduce the complexities associated with traditional on-premise systems. As remote and hybrid work continue to evolve, businesses increasingly rely on UCaaS to enhance collaboration, ensuring that teams can work together effectively from any location.

Unified Communication as a Service Market Restraints:

-

Security Concerns and Compliance Challenges Restraining Growth in the Unified Communications as a Service Market

Security concerns are a significant restraint for the Unified Communications as a Service (UCaaS) market. As UCaaS solutions rely on cloud-based communication, they introduce risks related to data security and privacy. Sensitive business and customer information may be vulnerable to breaches, posing a major challenge for companies considering adoption. Additionally, organizations must ensure compliance with strict data protection regulations like GDPR, HIPAA, and others, which can be resource-intensive and complex. This adds another layer of concern for businesses that operate in highly regulated industries. The fear of potential data breaches, loss of control over sensitive information, and the cost of ensuring compliance can slow the adoption of UCaaS solutions, particularly among enterprises that prioritize stringent security measures.

Unified Communication as a Service Market Segment Analysis

By Organization, Large Enterprises dominated the UCaaS Market, while SMEs are projected to grow at the fastest CAGR

The Large Enterprises segment dominated the Unified Communications as a Service market in 2025, capturing around 63% of the revenue share. This is primarily driven by their extensive need for scalable, secure, and integrated communication solutions to support complex organizational structures. Large enterprises typically require robust UCaaS platforms to manage diverse communication channels across multiple locations, enhancing operational efficiency and collaboration.

The Small and Medium Enterprises segment is poised to grow at the fastest compound annual growth rate of 20.88% from 2026 to 2033. This rapid growth is fueled by SMEs' increasing adoption of cost-effective, flexible UCaaS solutions that enable them to compete with larger organizations. As cloud-based technologies become more accessible and affordable, SMEs are increasingly leveraging these solutions to streamline communication and enhance productivity, driving the demand for UCaaS services in this segment.

By Component, Telephony led the UCaaS Market, with Conferencing expected to register the highest CAGR

The Telephony segment led the Unified Communications as a Service market in 2025, accounting for approximately 37% of the revenue share. This dominance stems from the essential role telephony plays in day-to-day business operations, providing a reliable foundation for voice communication across various organizational levels. Telephony solutions are particularly valued for their integration capabilities with other UCaaS features, facilitating seamless communication across global networks and enhancing overall business efficiency.

The Conferencing segment is anticipated to experience the fastest compound annual growth rate of 21.46% from 2026 to 2033. This rapid expansion is driven by the increasing demand for virtual collaboration tools, as remote work and global teams become more prevalent. As businesses prioritize real-time collaboration and decision-making, the need for scalable and high-quality conferencing solutions continues to rise, further accelerating the growth of this segment within the UCaaS market.

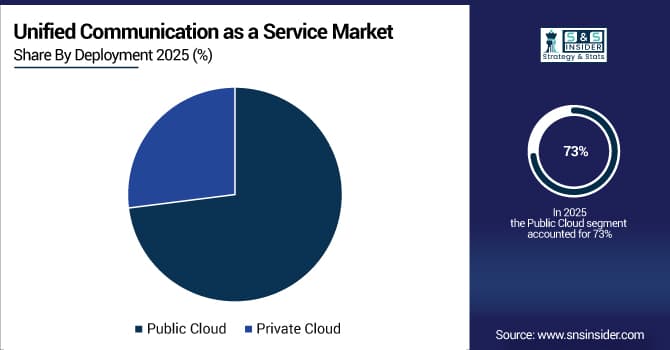

By Deployment, Public Cloud dominated the UCaaS Market and is anticipated to grow at the fastest CAGR

The Public Cloud segment dominated the Unified Communications as a Service market in 2025, capturing around 73% of the revenue share, and is projected to grow at the fastest compound annual growth rate of 19.47% from 2026 to 2033. This dominance and rapid growth can be attributed to the increasing shift of businesses towards cloud-based solutions due to their scalability, flexibility, and cost-effectiveness. Public cloud platforms enable organizations to streamline their communication systems while minimizing upfront infrastructure costs, making them particularly appealing for businesses of all sizes. As remote work, digital collaboration, and the need for integrated communication solutions continue to rise globally, the public cloud's ability to support these evolving demands ensures its continued market leadership and accelerated expansion in the coming years.

Unified Communication as a Service Market Regional Analysis

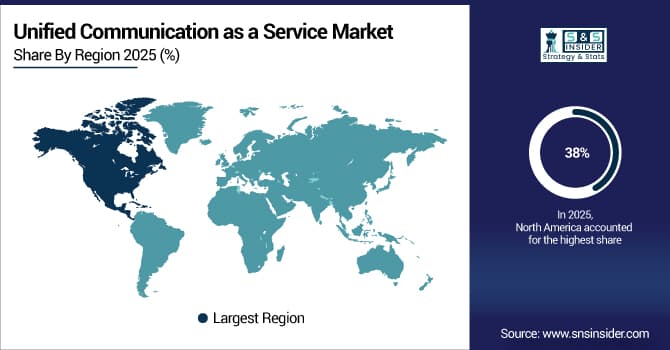

North America Unified Communication as a Service Market Insights

North America led the Unified Communications as a Service market in 2025, holding the largest revenue share of approximately 38%. This dominance is largely attributed to the region's advanced technological infrastructure and the widespread adoption of cloud-based communication solutions across businesses of all sizes. Moreover, North America’s mature market, along with a high concentration of key UCaaS providers, fosters an environment of innovation, further cementing its position as a market leader.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Unified Communication as a Service Market Insights

The Asia Pacific region is expected to grow at the fastest compound annual growth rate of 22.09% from 2026 to 2033. This remarkable growth is driven by the rapid digital transformation across emerging economies, where businesses are increasingly adopting UCaaS solutions to improve collaboration and operational efficiency. Additionally, the growing demand for cost-effective, scalable communication tools among small and medium-sized enterprises in the region is accelerating the adoption of UCaaS, positioning Asia Pacific as the fastest-growing market in the forecast period.

Europe Unified Communication as a Service Market Insights

The Europe Unified Communication as a Service (UCaaS) market is expanding rapidly, driven by widespread adoption of cloud-based communication solutions across enterprises. Key factors include increasing remote and hybrid work, integration of AI and collaboration tools, and demand for cost-efficient, scalable platforms. Strong digital transformation initiatives, government support for advanced IT infrastructure, and growing reliance on real-time communication services further propel the market’s growth in the region.

Middle East & Africa and Latin America Unified Communication as a Service Market Insights

The Middle East & Africa (MEA) and Latin America UCaaS markets are witnessing steady growth due to rising adoption of cloud-based communication solutions and digital transformation initiatives. Increasing remote work, demand for integrated collaboration tools, and cost-effective, scalable platforms drive market expansion. Additionally, investments in IT infrastructure, growing enterprise focus on operational efficiency, and the need for real-time communication solutions contribute to the positive market outlook in these regions.

Unified Communication as a Service Market Competitive Landscape:

8x8

8x8, Inc. is a global provider of cloud-based communication and customer-experience solutions, serving enterprises across contact centers, unified communications, and team collaboration. Its platforms integrate voice, video, chat, and AI-driven analytics to enhance operational efficiency and customer engagement. 8x8 emphasizes innovation in cloud-native solutions, real-time intelligence, and AI-enhanced automation to streamline workflows, improve agent productivity, and deliver measurable business outcomes for enterprises worldwide.

-

November 2024: 8x8 introduced AI-powered upgrades to its Cloud CX platform, improving transcription accuracy, multilingual support, and customer engagement tools for contact centers, enhancing service efficiency and user experience.

Avaya

Avaya Inc. is a leading provider of communication, collaboration, and contact-center solutions for enterprises. Its portfolio spans cloud, on-premise, and hybrid deployments, focusing on unified communications, AI-driven contact centers, and employee-experience platforms. Avaya helps organizations optimize engagement, improve operational efficiency, and modernize workflows while ensuring scalability and security. Its solutions target industries including healthcare, finance, and government, enabling seamless customer and employee interactions across multiple channels.

-

March 2024: Avaya launched its Communication and Collaboration Suite, supporting on-prem, Private Cloud, and public cloud deployments, in line with its “Innovation Without Disruption” strategy to enhance both employee and customer experiences.

Zoom

Zoom Video Communications is a global leader in cloud-based video, voice, and chat solutions for enterprises, enabling seamless collaboration across distributed teams. Its platform integrates video conferencing, cloud phone systems, webinars, and AI-driven features to improve productivity and engagement. Zoom focuses on scalability, security, and low-latency performance to serve businesses, education, and government sectors worldwide, supporting digital transformation and hybrid work models with flexible communication tools tailored for global enterprises.

-

October 2024: Zoom launched its cloud-based Zoom Phone service in India, integrating local phone numbers with cloud PBX capabilities for B2B clients, streamlining enterprise communication, with plans for expansion across major Indian telecom circles.

KEY PLAYERS:

-

8x8, Inc. (8x8 X Series, 8x8 Contact Center)

-

ALE International. (Rainbow Cloud, OpenTouch)

-

Avaya, Inc. (Avaya OneCloud, Avaya Spaces)

-

Cisco Systems, Inc. (Webex Suite, Cisco Unified Communications Manager)

-

Fuze, Inc. (Fuze Desktop, Fuze Contact Center)

-

IBM Corporation. (IBM Watson Workspace, IBM Cloud Video)

-

Mitel Networks Corporation. (MiCloud Connect, MiVoice Business)

-

NEC Corporation. (UNIVERGE BLUE Connect, UNIVERGE SV9500)

-

RingCentral, Inc. (RingCentral MVP, RingCentral Video)

-

Zoom Video Communications, Inc. (Zoom Meetings, Zoom Phone)

-

Vonage Holdings Corp. (Vonage Business Communications, Vonage Contact Center)

-

Google LLC. (Google Meet, Google Voice)

-

LogMeIn Inc. (GoToConnect, GoToMeeting)

-

Windstream Holdings, Inc. (OfficeSuite UC, HD Meeting)

-

DIALPAD, Inc. (Dialpad Talk, Dialpad Meetings)

-

Verizon Communications Inc. (BlueJeans, Verizon One Talk)

-

NTT Communications Corporation. (NTT Cloud Collaboration, UCaaS by NTT)

-

Masergy Communications, Inc. (Masergy Cloud Communications, Masergy Contact Center)

-

Sify Technologies, Ltd. (Sify CloudInfinit, Sify Voice Solutions)

-

Tata Communications, Ltd. (Tata InstaCC, Tata UCaaS)

-

Genesys. (Genesys Cloud CX, Genesys Engage)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 85.73 Billion |

| Market Size by 2033 | USD 351.07 Billion |

| CAGR | CAGR of 19.27% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Telephony, Unified Messaging, Collaboration Platforms, Conferencing) • By Deployment (Public Cloud, Private Cloud) • By Industry Vertical (Automotive, Education, Healthcare, BFSI, Hospitality, Real Estate, Legal, IT & Telecom, Others) • By Organization (Large Enterprises, Small and Medium Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 8x8, Inc., ALE International, Avaya LLC, Cisco Systems, Inc., Fuze, Inc., IBM Corporation, Mitel Networks Corporation, NEC Corporation, RingCentral, Inc., Zoom Video Communications, Inc., Vonage Holdings Corp., Google LLC, LogMeIn Inc., Windstream Holdings, Inc., DIALPAD, Inc., Verizon Communications Inc., NTT Communications Corporation, Masergy Communications, Inc., Sify Technologies, Ltd., Tata Communications, Ltd., Genesys |