AI Watermarking Market Report Scope & Overview:

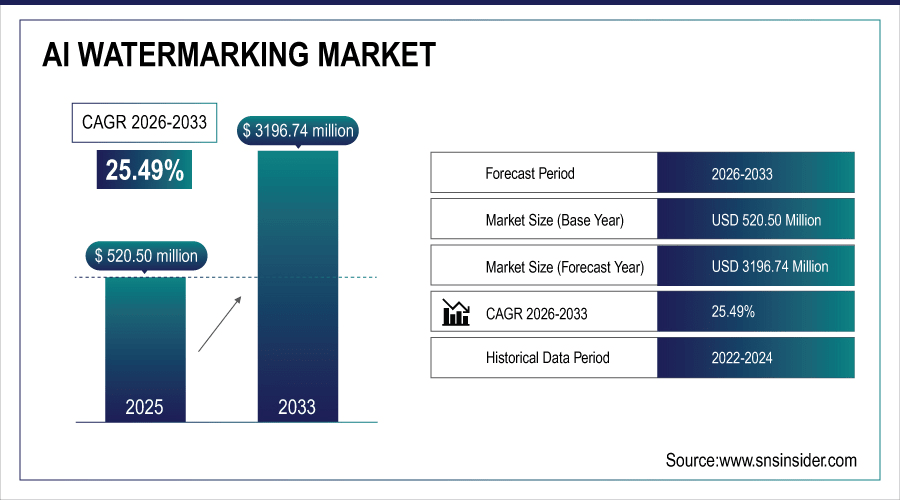

The AI Watermarking Market Size was valued at USD 520.50 Million in 2025E and is expected to reach USD 3196.74 Million by 2033 and grow at a CAGR of 25.49% over the forecast period 2026-2033.

The adoption of generative AI technologies across industries like media and entertainment, BFSI, and healthcare is driving a robust growth in the AI watermarking market. The explosion of AI-generated images, videos, and text has led to growing anxiety surrounding content authenticity and copyright protection. It includes invisible watermarking and AI-based detection approaches to prevent digital assets from being used without permission while also maintaining traceability. In addition, governments, regulatory bodies are enforcing rigorous compliance standards for digital media safety, which is anticipated to compel enterprises to include AI watermarking options for protection of intellectual property. According to study, Invisible watermarking accounts for over 45% share of adoption in AI watermarking solutions due to its non-intrusive and tamper-resistant nature.

To Get More Information On AI Watermarking Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 520.50 Million

-

Market Size by 2033: USD 3196.74 Million

-

CAGR: 25.49% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

AI Watermarking Market Trends

-

Growing generative AI adoption fuels rising demand for digital watermarking solutions.

-

Increasing focus on content authenticity strengthens copyright and IP protection needs.

-

Invisible watermarking dominates due to non-intrusive, tamper-resistant security features.

-

Technical vulnerabilities and attacks challenge watermarking reliability and market trust.

-

Blockchain integration enables immutable audit trails for content ownership verification.

-

Expanding digital ecosystems unlock new monetization models through secure watermarking.

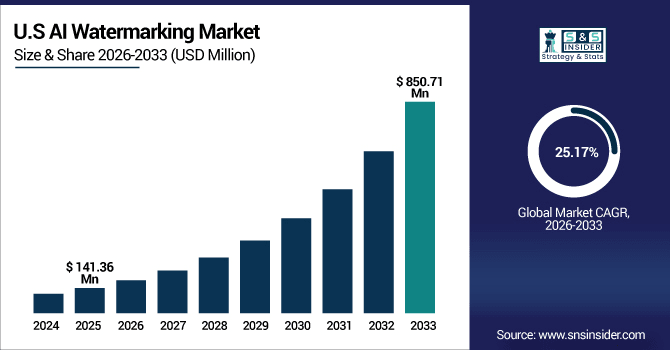

The U.S. AI Watermarking Market size was USD 141.36 Million in 2025E and is expected to reach USD 850.71 Million by 2033, growing at a CAGR of 25.17% over the forecast period of 2026-2033, driven by advanced technology adoption, rapid generative AI growth, stringent copyright regulations, and strong demand for content authenticity, intellectual property protection, and secure digital verification across media, BFSI, and healthcare sectors.

AI Watermarking Market Growth Drivers:

-

Rising Digital Authenticity Demands Propel AI Watermarking Market Growth

The first democratized explosion of generative AI tools like ChatGPT, DALL·E and Midjourney have resulted in the biggest AI-generated text, images, videos and audio in history. It has led to the erosion of trust and the ability to differentiate real vs fake content. But rather, Organizations, particularly among media & entertainment, BFSI, and e-commerce are under pressure to improve digital trust and prevent content abuse. AI watermarking answers this challenge, embedding imperceptible or perceptible markers for traceability and copyright protection. The move comes amid the global tightening of compliance regulation and the increasing adoption of watermarking solutions by enterprises to protect intellectual property and mitigate risk of unauthorized use.

Nearly 65% of watermarking adoption is compliance-driven, linked to regulations on digital rights management and AI transparency.

AI Watermarking Market Restraints:

-

Technical Gaps and Attacks Limit AI Watermarking Adoption Worldwide

Despite the benefits, AI watermarking still has obstacles in terms of robust and accurate embedding. For instance, the watermarking methods are treated as tampering, compression, or even adversarial attacks, followed by a misfit or even a total loss of embedded marks. This reads similarly for watermarking, while it has the possibility to remove the perturbations and therefore, we call it as reversible it may add to the processing complexity and slow down the adoption in real-time applications. Insecurity industries such as defense and BFSI, high false positive/negative detection rates can lower confidence in watermarking systems. These technical restrictions also impede widespread deployment as more modest companies do not have the framework to deploy advanced watermarking technologies efficiently.

AI Watermarking Market Opportunities:

-

Blockchain Integration Unlocks Immutable Verification for Digital Watermarks

One big opportunity here is to combine AI watermarking with the blockchain. With watermarking solutions being complemented by immutable record of ownership, timestamping and other verifications of digital content offered through the power of blockchain, unscrupulous copyright vessels can easily be detected. For instance, each of the watermarked image, video or AI model-based results can be recorded on a decentralized ledger, producing a record that is both transparent and resistant to tampering. In sectors such as digital art (NFT), e-commerce, and media where authenticity and provenance matter, this integration will be very useful. It can unlock new-generation monetization models and enhance trust in AI-driven ecosystems in the user adoption ramp up phase as we spend on blockchain before time from now on.

More than 50% of blockchain-integrated watermarking deployments are expected in e-commerce and media sectors, followed by BFSI and defense.

AI Watermarking Market Segmentation Analysis:

-

By Type: In 2025, Invisible Watermarking led the market with share 61.20%, while Visible Watermarking are the fastest-growing segment with a CAGR 28.50%.

-

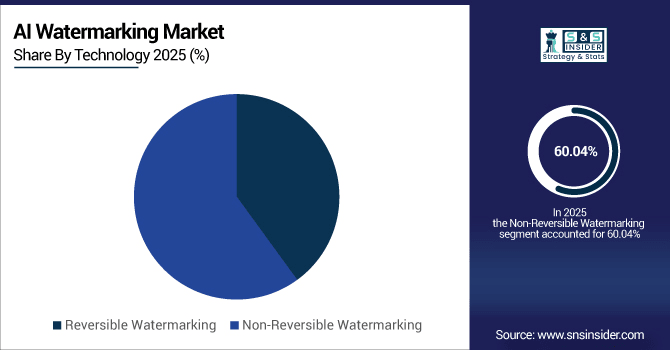

By Technology: In 2025 Non-Reversible Watermarking led the market with share 60.04%, with Reversible Watermarking the fastest-growing segment with a CAGR 28.10%.

-

By Application: In 2025, Copyright Protection led the market with share 39.80%, while Authentication & Security is the fastest-growing segment with a CAGR 27.40%.

-

By Industry: In 2025, Media & Entertainment led the market with share 30.12%, while Healthcare is the fastest-growing segment with a CAGR 28.30%.

By Technology, Non-Reversible Watermarking Leads Market while Reversible Watermarking Fastest Growth

By technology, the non-reversible watermarking segment holds a larger share of the AI watermarking market because non-reversible watermarking is highly robust to compression, tampering and unauthorized access modification, and are the preferred choice among industries (defense, BFSI and media) that demand security & authenticity. With this permanence, it provides robust protection of IP over digital assets. On the other hand, reversible watermarking is expected to be the fastest-growing segment due to the increasing need for recovering the original data in applications such as healthcare, research, and media industry. Rapid uptake in sensitive use cases is driven by its property that can hide the original content and fully restore it with a given key.

By Type, Invisible Watermarking Leads Market and Visible Watermarking Fastest Growth

By Type, Invisible Watermarking accounted for the largest AI Watermarking market share as it is not overt and strongly powerful in embedding identifiers without affecting the quality of digital assets. This means it is widely used in various sectors such as media, BFSI and healthcare for authentication, copyright protection and compliance, providing a secure means of tracking AI generated content. Visible watermarking, on the flip side, is expected to account for the fastest-growing segment due to its rising applications as branding tool, marketing aid, and content distribution technique. By showing transparent ownership marks, it increases brand exposure while protecting against misuse; thus, fueling adoption across digital touchpoints.

By Application, Copyright Protection Lead Market and Authentication & Security Fastest Growth

The copyright protection-based application segment of the AI watermarking market will dominate the market, as enterprises from media, entertainment, and publishing segments are increasingly utilizing watermarking in order to protect IP, while preventing illegal access and distribution of AI-based content. Its market share is dominated due to its ability to guarantee ownership rights and support global digital rights regulations. On the other hand, due to the increasing threat of deepfakes, fake content, and cyberattacks, authentication & security is expected to witness the fastest growth of the market. Watermarking solutions are quickly becoming a move required by industries amid increasing demand for authenticity assurance, sensitive information protection, and digital trust in AI-powered ecosystems from BFSI, defense and healthcare sectors.

By Industry, Media & Entertainment Lead Market and Healthcare Fastest Growth

By industry, the media & entertainment segment led the global AI watermarking market, as it held the major share of the market due to increasing digital content creation and streaming platforms, and protection of copyright through piracy and illegal distribution. Its pre-eminence in this sector is ensured by its widespread use for protecting films, music and digital assets. On the other hand, the fastest growth is expected for health care, as AI is adopted in medical imaging, patient data protection, and research records. Reversible watermarking enables the protection of the information along with its recovery that has made this high-security school of thought a top priority in the healthcare ecosystem, which is further accelerating adoption of reversible watermarking within the sector.

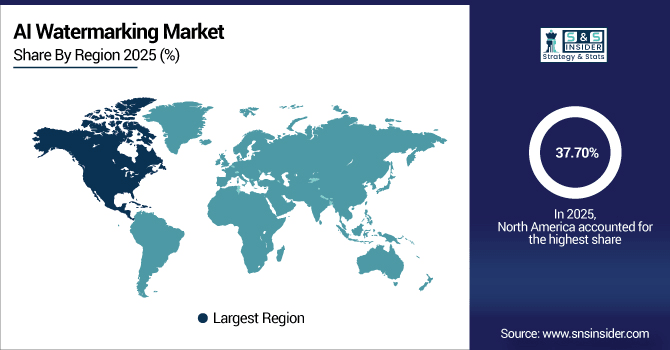

AI Watermarking Market Regional Analysis:

North America AI Watermarking Market Insights:

The AI Watermarking Market in North America held the largest share 37.70% in 2025, by the presence of big technology companies, the swift transition to generative AI adoption and the regulatory frameworks and norms backed by North American countries to protect digital rights. The Innate Watermarking market in the region is prominent by the U.S., where media & entertainment, BFSI, and the defense sectors invest in invisible watermarking to protect intellectual property and defend against deepfakes. Growing evident worry over data quality, combined with governmental promotion of AI transparency, is fast-tracking interest. Additionally, North America is expected to provide high growth opportunities owing to the advanced cloud infrastructure, along with integrating blockchain with watermarking solutions to innovate AI watermarking application.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates AI Watermarking Market with Advanced Technological Adoption

The U.S. leads the AI watermarking market, driven by rapid generative AI adoption, strict digital rights regulations, and advanced technology infrastructure supporting security, authentication, and copyright protection.

Asia-Pacific AI Watermarking Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the AI Watermarking Market, projected to expand at a CAGR of 27.43%, due to the growing digital content creation processes, increasing need for copyright protection alongside the adoption of generative AI technologies. With rapidly growing media & entertainment, e-commerce, and healthcare industries, the demand for solutions that help in verifying content ownership and protecting intellectual property is also growing. As deepfakes and fake digital personas are on the rise, adoption is getting accelerated in areas of authentication and security too. As the strongest CAGR is assumed to be recorded in this region which is driven by strong digitalization trends and increasing enterprise investment in AI-based protection tools, the future of AI watermarking is taking place here.

China and India Propel Rapid Growth in AI Watermarking Market

China and India are driving rapid growth in the AI Watermarking Market, fueled by Rapid digitalization, expanding generative AI adoption, and increasing concerns over content authenticity position.

Europe AI Watermarking Market Insights

Europe accounts for a large part of the AI watermarking market, backed by strict data privacy legislation, robust copyright regulations, and increasing focus on digital content integrity. Invisible and reversible watermarking Market Scope and Market Size The adoption of invisible and reversible watermarking solution is primarily driven by well-established media & entertainment sector in the region along with advancements in BFSI and healthcare which the keys highlight of proposed invisible and reversible watermarking industry analysis. The growth in demand also can also be associated with the increasing regulatory focus on transparency of AI functions, and fighting deepfakes. Consistent with developing standards on intellectual property for AI-generated content, enterprises are investing in AI driven watermarking to promote trust in AI-generated content

Germany and U.K. Lead AI Watermarking Market Expansion Across Europe

Strong regulatory frameworks, advanced digital infrastructure, and rising adoption of AI watermarking solutions in media, BFSI, and healthcare drive market growth in Germany and the U.K., reinforcing Europe’s leadership in content protection and authentication.

Latin America (LATAM) and Middle East & Africa (MEA) AI Watermarking Market Insights

The Latin America AI Watermarking market is emerging owing to growing digital content generation, increased emphasis on copyright protection, and adoption of AI-powered technologies across media, e-commerce, and BFSI sectors. Increasing worries about fake content and intellectual property infringement are compelling enterprises to adopt watermarking solutions. Likewise, the MEA region is growing steadily, due to the digital security and compliance requirements of organizations. Backed by the growing digital infrastructure and rising enterprise adoption, Middle East and Africa, and Latin America are emerging markets for AI watermarking, capitalising on investments in AI driven watermarking for authentication, brand protection, and copyright enforcement.

AI Watermarking Market Competitive Landscape

Google leads the AI watermarking market with its SynthID technology, embedding invisible watermarks in AI-generated images, videos, audio, and text. This innovation ensures content authenticity, traceability, and protection against misuse. Google’s advancements strengthen digital trust, support copyright enforcement, and position the company as a key enabler of responsible AI content management.

-

In October 2024, Google LLC introduced SynthID, embedding invisible watermarks in AI-generated images, videos, audio, and text to enhance content authenticity and traceability.

Microsoft drives AI watermarking adoption through its Azure OpenAI Service, integrating watermark detection for AI-generated speech and media. By enhancing transparency and enabling verification of synthetic content, Microsoft addresses deepfake and copyright concerns. Its enterprise-focused solutions support digital security, IP protection, and regulatory compliance across BFSI, media, and technology sectors worldwide.

-

In September 2024, Microsoft Corporation integrated watermarking into Azure OpenAI Service, allowing identification of AI-generated speech and media for transparency.

Meta Platforms has advanced AI watermarking with Meta Video Seal, applying imperceptible watermarks to AI-generated videos. This helps combat deepfakes and ensures content authenticity. Meta’s focus on open-source tools and AI transparency enables creators and organizations to protect intellectual property while fostering trust in AI-generated digital media across global platforms.

-

In December 2024, Meta Platforms, Inc. released Meta Video Seal, applying imperceptible watermarks to AI-generated videos to combat deepfakes.

AI Watermarking Market Key Players:

Some of the AI Watermarking Market Companies are:

-

Google LLC

-

Microsoft Corporation

-

Meta Platforms, Inc.

-

IBM Corporation

-

OpenAI, LLC

-

Amazon Web Services (AWS)

-

Adobe Inc.

-

Alibaba Cloud

-

NVIDIA Corporation

-

Hugging Face

-

Clarifai, Inc.

-

Digimarc Corporation

-

IMATAG

-

ZOO Digital Group plc.

-

Vobile Group Limited

-

Verimatrix

-

MarkAny Inc.

-

Civolution (Kudelski Group)

-

Verance Corporation

-

Activated Content.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 520.50 Million |

| Market Size by 2033 | USD 3196.74 Million |

| CAGR | CAGR of 25.49% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Invisible Watermarking, Visible Watermarking, Hybrid) • By Technology (Reversible Watermarking, Non-Reversible Watermarking) • By Application (Authentication & Security, Copyright Protection, Branding & Marketing, Others) • By End User (BFSI, Healthcare, Media & Entertainment, Government & Defense, Retail & E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Google LLC, Microsoft Corporation, Meta Platforms, Inc., IBM Corporation, OpenAI, LLC, Amazon Web Services (AWS), Adobe Inc., Alibaba Cloud, NVIDIA Corporation, Hugging Face, Clarifai, Inc., Digimarc Corporation, IMATAG, ZOO Digital Group plc., Vobile Group Limited, Verimatrix, MarkAny Inc., Civolution (Kudelski Group), Verance Corporation, Activated Content., and Others. |