AC Charger for EVs Market Size & Overview

Get More Information on AC Charger for EVs Market - Request Sample Report

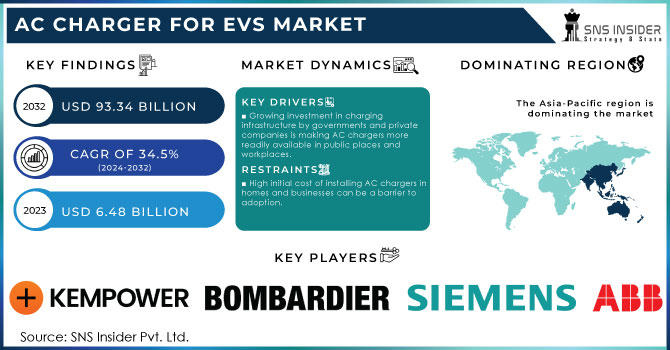

The AC Charger for EVs Market size was valued at USD 6.48 billion in 2023, and expected to reach USD 93.34 billion by 2032, and grow at a CAGR of 34.5% over the forecast period 2024-2032.

The AC charger for EVs market provides to the charging needs of electric vehicles using alternating current (AC) to replenish the battery power. This market is experiencing a rise, driven by the blossoming electric vehicle (EV) adoption worldwide. Governments promoting eco-friendly transportation and rising environmental concerns are driving this growth. Homeowners are increasingly opting for AC chargers for convenient overnight charging, while workplaces and public spaces are installing them to attract EV-owning customers.

The market offers a diverse range of AC chargers, varying in power output (from 3.3 kW to 22 kW) to cater to different charging speeds and needs. Advancements in smart charger technology are enabling features like remote monitoring, payment integration, and energy efficiency optimization, further promoting market growth.

MARKET DYNAMICS:

KEY DRIVERS:

-

Growing investment in charging infrastructure by governments and private companies is making AC chargers more readily available in public places and workplaces.

-

Increasing urbanization is creating a demand for readily available charging solutions like AC chargers, especially in areas with limited space for gas stations.

As cities grow denser, the space available for traditional gas stations becomes increasingly scarce. AC chargers, which can be installed in homes, workplaces, and even on-street parking spots, offer a convenient alternative to gas stations. Their smaller footprint makes them ideal for urban environments where space is at a premium. This shift towards AC chargers is not only driven by practicality, but also by environmental concerns. With electric vehicles producing zero tailpipe emissions, widespread adoption of AC charging infrastructure can significantly contribute to cleaner air and a more sustainable future for our cities.

RESTRAINTS:

-

Slower charging times compared to DC fast chargers can be a drawback for AC chargers, especially for long-distance trips.

-

High initial cost of installing AC chargers in homes and businesses can be a barrier to adoption.

OPPORTUNITIES:

-

Creating user-friendly interfaces for AC chargers will make them easier to operate and maintain, broadening their appeal.

The AC charger market holds immense opportunity for manufacturers who prioritize user-friendly interfaces. By developing intuitive interfaces with clear instructions and easy-to-understand displays, manufacturers can broaden the appeal of AC chargers to a wider audience. This includes not only tech-savvy individuals but also those who may be less familiar with new technologies. With clear error codes and readily available instructions, users can identify and potentially resolve minor issues themselves, reducing reliance on technical support. Ultimately, a focus on user-friendliness can not only enhance the customer experience but also translate to increased sales and a more robust AC charger market.

-

Offering innovative solutions like portable AC chargers or those integrated with solar panels can cater to specific needs and expand the market.

CHALLENGES:

-

Slow charging times compared to DC fast chargers can be inconvenient for long trips, requiring careful planning for EV owners.

-

The high cost of installing AC chargers in public places can be a barrier for businesses and governments looking to expand charging options.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has impacted the AC charger for EVs market in several ways. The conflict disrupted the supply chain for key battery materials like nickel, causing price hikes of around 50%. This translates to potentially higher production costs for AC chargers, impacting manufacturers' margins and potentially leading to price increases for consumers. The Ukraine itself was a source of wire harnesses and other automotive parts for European manufacturers. The disruption caused by the war has led to production slowdowns and delays, impacting the overall production of EVs and potentially slowing down demand for AC chargers. The war has exacerbated global energy price volatility, making the relative cost-effectiveness of electric vehicles less clear-cut in the short term. This could cause some consumers to hesitate on EV purchases, potentially leading to a temporary decline in demand for AC chargers.

IMPACT OF ECONOMIC SLOWDOWN

The economic slowdown is the disrupting the growth of the AC charger for EVs market. During economic downturns, consumer spending typically falls, and expensive purchases like electric vehicles can be the first to be put on hold. This could lead to a decrease in demand for new EVs, consequently impacting the need for AC chargers. Thus, there is 15% decrease in demand for AC chargers, considering some existing EV owners might delay charger purchases. Additionally, it can lead to reduced government and business investments in infrastructure projects, including charging station rollouts. This can further decrease the growth of the AC charger market. The Government incentives for EVs and growing environmental concerns are expected to continue driving EV adoption even in challenging economic conditions. Thus, the advancements in AC charger technology that reduce charging times and costs can help mitigate the impact of economic downturns.

KEY MARKET SEGMENTS:

By End-user

-

Residential Charging

-

Commercial Charging

Residential Charging is the dominating sub-segment in the AC Charger for EVs Market by end-user holding around 60-70% of market share. This is primarily because a significant portion of EV charging happens at home overnight, where convenience and affordability are key factors. Standard AC chargers installed in garages or carports fulfil this need effectively. Additionally, government incentives often target home charging solutions, further supporting residential dominance.

By Vehicle Type

-

BEV

-

PHEV

BEV (Battery Electric Vehicle) is the dominating sub-segment in the AC Charger for EVs Market by vehicle type. This is due to their growing popularity and longer range compared to PHEVs. As BEV sales continue to climb, the need for AC chargers to support their charging needs will correspondingly increase.

By Product

-

Standard Charger

-

Fast Charger

Standard Charger is the dominating sub-segment in the AC Charger for EVs Market by product. These chargers provide a good balance between charging time and cost, making them suitable for overnight charging at home or workplaces. While fast chargers are gaining traction, their higher installation cost and limited applicability for everyday charging scenarios keep standard chargers in the lead for now.

REGIONAL ANALYSES

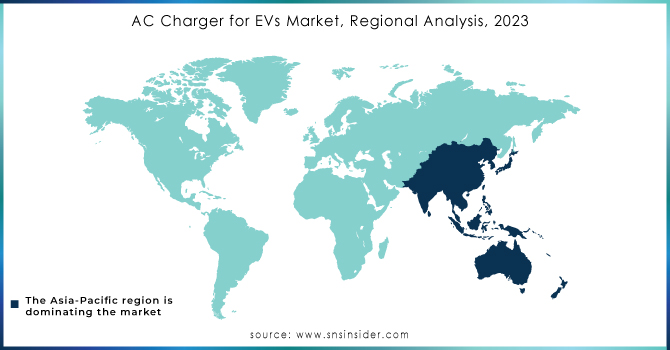

The Asia Pacific is the dominating region in the AC charger for EVs market holding around 55-60% of market share due to a potent combination of factors. Government incentives, a strong emphasis on green mobility, and a growing automotive industry have all driven exceptional EV adoption rates.

Europe is the second highest region in this market. Ambitious EV adoption targets, coupled with heavy investments in charging infrastructure, are propelling the European AC charger market forward. This focus on sustainability and stringent environmental regulations is a significant driver in the region.

The North America is experiencing the fastest growth rate in this market. Increasing government support for EVs, growing consumer environmental consciousness, and the launch of new EV models by major automakers are all contributing to this rapid surge in North America.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are ABB, Siemens, Bombardier Inc., Kempower OY, Tesla, Proterra, Chargepoint, Inc., Leoni AG (Germany), Shijiazhuang Tonhe Electronics Technologies Co, TE Connectivity (Switzerland), BESEN Group (China), Aptiv (Ireland), Phoenix Contact (Germany), Schunk Group and Coroplast (Italy), EFACEC, Kehua Hengsheng Co., Ltd. and other key players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.48 Billion |

| Market Size by 2032 | US$ 93.34 Billion |

| CAGR | CAGR of 34.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-user (Residential Charging, Commercial Charging) • By Vehicle Type (BEV, PHEV) • By Product (Standard Charger, Fast Charger) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Siemens, Bombardier Inc., Kempower OY, Tesla, Proterra, Chargepoint, Inc., Leoni AG (Germany), Shijiazhuang Tonhe Electronics Technologies Co, TE Connectivity (Switzerland), BESEN Group (China), Aptiv (Ireland), Phoenix Contact (Germany), Schunk Group and Coroplast (Italy), EFACEC, and Kehua Hengsheng Co., Ltd. |

| Key Drivers | • The growing awareness of the environmental impact of gasoline automobiles has spurred demand for electric vehicles around the world • Governments are concentrating their efforts on constructing charging stations to accelerate the adoption of electric vehicles |

| RESTRAINTS | • The market for EV charging cables may be impacted by improvements in wireless EV charging • The EV business is new, there isn't a vast choice of automobiles available to customers, which limits the market for electric vehicles |