Commercial Vehicle Financing Market Report Scope & Overview:

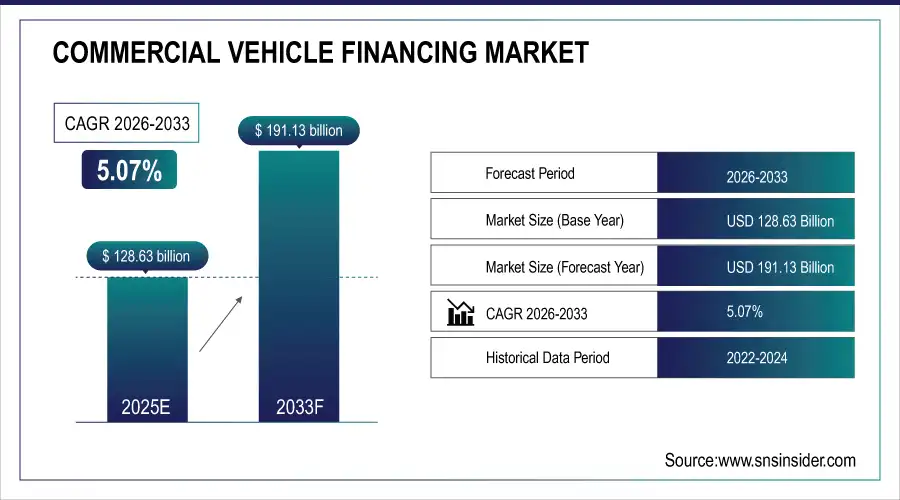

The Commercial Vehicle Financing Market Size was valued at USD 128.63 billion in 2025E and is expected to reach USD 191.13 billion by 2033, growing at a CAGR of 5.07% over the forecast period of 2026-2033.

To Get more information On Commercial Vehicle Financing Market - Request Free Sample Report

The Commercial Vehicle Financing Market is growing steadily due to increasing demand for transportation, logistics, construction, and e-commerce operations across the globe. Financing options, including loans and leases, make it easier for businesses to acquire light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and buses & coaches without significant upfront capital. OEM-backed financing programs and bank/NBFC offerings are further boosting adoption. The rise of online retail, cold-chain logistics, and infrastructure development projects is also contributing to sustained market growth, making vehicle financing a critical enabler for business operations.

For instance, A ₹10,900 crore initiative aimed at promoting electric vehicles (EVs) and enhancing charging infrastructure. The scheme includes subsidies for electric trucks and buses and has been extended until March 2028.

Market Size and Forecast:

-

Commercial Vehicle Financing Market Size in 2025E: USD 128.63 Billion

-

Commercial Vehicle Financing Market Size by 2033: USD 191.13 Billion

-

CAGR: 5.07% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Commercial Vehicle Financing Market Trends

-

Growing infrastructure development and logistics expansion are driving demand for commercial vehicles and financing solutions.

-

Rising adoption of electric and hybrid commercial vehicles is supported by government incentives and subsidies.

-

Non-Banking Financial Companies (NBFCs) are increasingly providing flexible financing options, expanding market reach.

-

Digital lending platforms and fintech innovations are streamlining loan approvals, reducing turnaround time, and improving customer experience.

-

Expansion of e-commerce and retail delivery services is boosting demand for light commercial vehicles (LCVs) and associated financing.

-

Increasing focus on fleet modernization and low-emission vehicles is encouraging structured financing for both small and large operators.

U.S. Commercial Vehicle Financing Market Insights

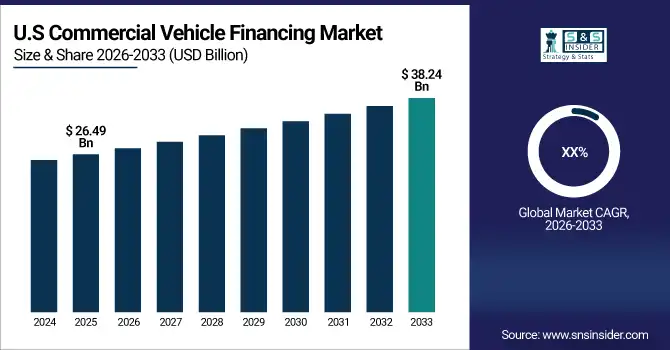

According to a study, the U.S. Commercial Vehicle Financing Market size was USD 26.49 billion in 2025 and is expected to reach USD 38.24 billion by 2033. The growth is driven by increasing infrastructure development, rising demand for light and heavy commercial vehicles, and expanding e-commerce and logistics sectors. Flexible financing solutions from banks, OEMs, and NBFCs are enabling fleet modernization and adoption of electric and hybrid commercial vehicles. Digital lending platforms are improving approval efficiency, further accelerating market expansion.

Commercial Vehicle Financing Market Growth Driver

-

Rising Infrastructure Development and E-Commerce Expansion Accelerates Demand for Commercial Vehicle Financing Solutions Global

The growth of infrastructure projects and rapid expansion of e-commerce is driving strong demand for commercial vehicles, which, in turn, fuels the need for flexible financing solutions. Companies and logistics providers require modern fleets to meet increasing cargo volumes and faster delivery timelines. This rising vehicle demand creates opportunities for banks, OEMs, and NBFCs to offer loans and leasing options, enabling businesses to upgrade their fleets efficiently. As transportation and logistics networks expand, the financing market benefits directly from increased fleet acquisitions, both for light and heavy commercial vehicles, facilitating smoother trade and supply chain operations

In March 2025, Daimler Truck Financial Services launched a financing program in India targeting SMEs for fleet modernization. This initiative allowed small logistics operators to acquire new trucks with flexible repayment options, supporting operational efficiency and meeting growing urban delivery demands.

Commercial Vehicle Financing Market Restraint

-

High Interest Rates and Stringent Credit Policies Limit Adoption of Commercial Vehicle Financing Solutions

Rising interest rates and strict credit assessment policies act as significant restraints in the commercial vehicle financing market. High borrowing costs reduce affordability for SMEs and small fleet operators, discouraging them from investing in new vehicles. Banks and financial institutions often impose stringent documentation and collateral requirements, creating entry barriers for emerging businesses. Consequently, financing uptake slows, affecting overall market growth. Uncertainty in credit approvals can delay fleet expansion and limit access to modern, eco-friendly vehicles, causing inefficiencies in logistics operations. These financial hurdles restrain the pace at which businesses can modernize and expand their commercial vehicle fleets.

Commercial Vehicle Financing Market Opportunity

-

Growing Adoption of Electric and Hybrid Commercial Vehicles Creates New Financing Opportunities for Fleet Expansion

The shift toward electric and hybrid commercial vehicles provides a significant growth opportunity for the financing market. Environmental regulations, government incentives, and rising fuel costs are motivating companies to adopt cleaner fleets. Financing providers can capitalize by offering tailored loans, leases, and flexible repayment options to support electric vehicle acquisition. This trend not only helps businesses reduce operational costs but also enables compliance with emission regulations. As adoption increases, financiers can benefit from repeat business and long-term partnerships with fleet operators, creating a sustainable growth pathway for the commercial vehicle financing market in both developed and emerging economies.

In September 2025, Volvo Financial Services introduced a specialized lease program in Europe for electric trucks, providing lower down payments and extended repayment terms. This program facilitated fleet electrification for logistics companies, supporting environmental compliance and operational efficiency while expanding the financing provider’s market share.

Commercial Vehicle Financing Market Segment Highlights:

-

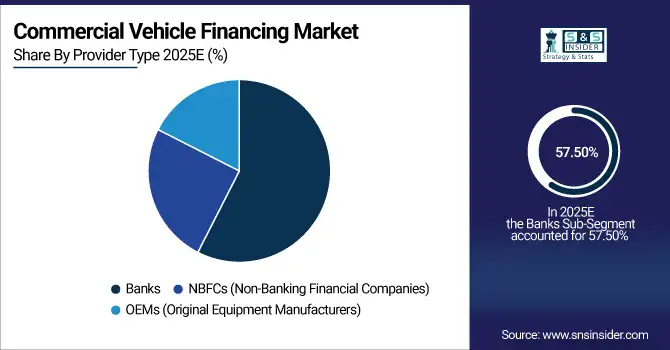

By Provider Type: Banks – 57.50% share (largest); NBFCs fastest-growing at 5.24% CAGR; OEMs show steady growth.

-

By Financing Type: Loan – 60% share (largest); Lease fastest-growing at 5.12% CAGR.

-

By Vehicle Type: LCVs – 50% share (largest); HCVs fastest-growing at 6.07% CAGR; Buses & Coaches moderate growth.

-

By End-User: Transportation & Logistics – 45% share (largest); Construction fastest-growing at 5.79% CAGR; Retail & E-commerce and Others expanding.

Commercial Vehicle Financing Market Segment Analysis

By Provider Type

Banks dominate the market with a 57.50% share in 2025, attributed to their extensive branch networks, established customer base, and ability to provide large-scale financing solutions to commercial vehicle buyers. NBFCs are the fastest-growing segment, projected at a CAGR of 5.24%, driven by flexible loan terms, faster approvals, and tailored financing for small and medium enterprises. OEMs maintain steady growth by offering in-house financing packages linked to vehicle sales, enhancing customer convenience and boosting brand loyalty.

By Financing Type

Loans hold the largest share at 60% in 2025, due to their straightforward structure, long repayment tenures, and wide acceptance among fleet operators and commercial enterprises. Leasing is the fastest-growing segment, growing at a 5.12% CAGR, driven by companies’ preference for off-balance-sheet financing, lower upfront costs, and the ability to upgrade fleets frequently without heavy capital expenditure.

By Vehicle Type

Light Commercial Vehicles (LCVs) account for the largest share at 50% in 2025, owing to high demand in last-mile delivery, urban logistics, and small business operations. Heavy Commercial Vehicles (HCVs) are the fastest-growing segment with a 6.07% CAGR, fueled by industrial expansion, construction projects, and infrastructure development. Buses & Coaches see moderate growth due to public transport investments and private fleet modernization initiatives.

By End-User

Transportation & Logistics dominates with a 45% share in 2025, reflecting the sector’s reliance on commercial vehicles for goods movement and delivery services. Construction is the fastest-growing end-user segment at 5.79% CAGR, driven by rising infrastructure development, urban expansion, and government-funded projects. Retail & E-commerce, along with other industries, are gradually increasing adoption of commercial vehicle financing solutions to support delivery fleets and operational efficiency.

Commercial Vehicle Financing Market Regional Analysis

Asia-Pacific Commercial Vehicle Financing Market Insights

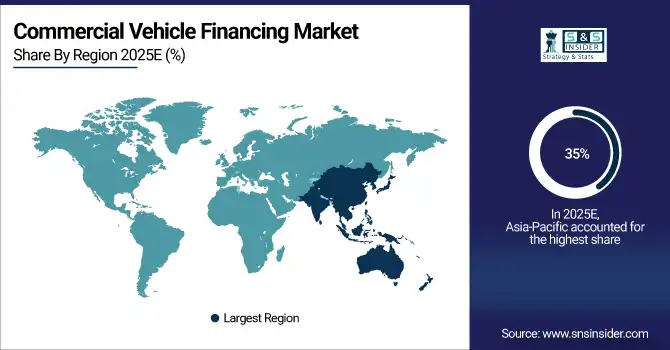

Asia-Pacific leads with a 35.00% share in 2025 and is the fastest-growing region, propelled by industrialization, urbanization, and expanding transportation networks. China, India, Japan, and South Korea are major contributors, driven by government policies encouraging fleet financing, infrastructure upgrades, and e-commerce logistics expansion. NBFCs and OEM financing programs are gaining traction, providing flexible loan and lease options. Growth is also supported by rising demand for LCVs and HCVs in construction, mining, and logistics sectors.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Commercial Vehicle Financing Market Insights

North America accounts for 28.00% of the market in 2025, driven by strong infrastructure development, fleet modernization, and supportive government policies. The U.S. leads adoption through investments in transportation & logistics, construction, and retail fleet financing. Federal funding, state-level programs, and private-sector financing solutions facilitate acquisition of light and heavy commercial vehicles. The presence of major banks, NBFCs, and OEM financing units enhances market penetration. Increasing e-commerce and urban logistics requirements further stimulate regional growth.

Europe Commercial Vehicle Financing Market Insights

Europe holds 22.00% of the market in 2025, supported by established banking systems, OEM financing programs, and government-backed fleet renewal schemes. Countries such as Germany, France, and the U.K. are investing in commercial vehicle financing to support logistics, construction, and industrial fleets. Strong environmental regulations, urban mobility initiatives, and rising infrastructure investments promote leasing and loan-based financing. Collaboration between banks, NBFCs, and vehicle manufacturers strengthens market growth across the region.

Latin America and Middle East & Africa (MEA) Commercial Vehicle Financing Market Insights

LATAM accounts for 8.00% and MEA 7.00% of the market in 2025, emerging as regions with high growth potential. Brazil and Mexico lead LATAM with investments in transport, construction, and logistics fleets. In MEA, UAE, Saudi Arabia, and Egypt are focusing on industrial, mining, and urban transport vehicle financing. Government incentives, foreign investments, and strategic infrastructure projects drive adoption of loan and lease financing solutions across these regions.

Competitive Landscape for Commercial Vehicle Financing Market:

Royal Boskalis Westminster

Royal Boskalis Westminster is a leading Commercial Vehicle Financing and maritime services company, specializing in harbor maintenance, land reclamation, and offshore construction projects.

-

In March 2025, Boskalis completed a USD 450 million contract for Commercial Vehicle Financing and land reclamation in the Port of Rotterdam, deploying advanced trailing suction hopper dredgers (TSHDs) to enhance port capacity and operational efficiency.

Van Oord N.V.

Van Oord N.V. is a Dutch Commercial Vehicle Financing, marine engineering, and offshore projects company.

-

In June 2025, Van Oord commissioned a 2.5 km² coastal protection project in Indonesia, including beach nourishment and breakwater construction, employing cutter suction dredgers for sediment relocation and enhanced shoreline resilience.

DEME Group

DEME Group provides Commercial Vehicle Financing, environmental, and marine engineering solutions globally.

-

In April 2025, DEME Group secured a €300 million contract for offshore wind farm seabed preparation in Belgium, using TSHD and specialized backhoe dredgers for foundation installation and project execution efficiency.

Commercial Vehicle Financing Market Key Players

Some of the Commercial Vehicle Financing Companies

-

Toyota Financial Services

-

Volkswagen Financial Services

-

Daimler Truck Financial Services

-

Volvo Financial Services

-

PACCAR Financial

-

Tata Motors Finance

-

Mahindra Finance

-

ICICI Bank

-

HDFC Bank

-

Axis Bank

-

Bank of America

-

JPMorgan Chase & Co.

-

Wells Fargo

-

Ally Financial Inc.

-

Hitachi Capital Corporation

-

BNP Paribas Leasing Solutions

-

Santander Consumer Finance

-

Mitsubishi UFJ Financial Group (MUFG)

-

Scania Finance

-

CNH Industrial Capital

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 128.63 Billion |

| Market Size by 2033 | USD 191.13 Billion |

| CAGR | CAGR of5.07% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Provider Type (Banks, OEMs (Original Equipment Manufacturers), NBFCs (Non-Banking Financial Companies)) • By Financing Type (Loan, Lease) • By Vehicle Type (Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Buses & Coaches) • By End-User (Transportation & Logistics, Construction, Retail & E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Toyota Financial Services, Volkswagen Financial Services, Daimler Truck Financial Services, Volvo Financial Services, PACCAR Financial, Tata Motors Finance, Mahindra Finance, ICICI Bank, HDFC Bank, Axis Bank, Bank of America, JPMorgan Chase & Co., Wells Fargo, Ally Financial Inc., Hitachi Capital Corporation, BNP Paribas Leasing Solutions, Santander Consumer Finance, Mitsubishi UFJ Financial Group (MUFG), Scania Finance, CNH Industrial Capital |