Boom Trucks Market Report Scope & Overview:

Get More Information on Boom Trucks Market - Request Sample Report

The Boom Trucks Market Size was valued at USD 3.0. Billion in 2023 and is expected to reach USD 4.87 Billion by 2032 and grow at a CAGR of 5.44% over the forecast period 2024-2032.

The boom trucks market has developed with high contributions from the evolution of construction demands and technological advancement in boom trucks. Governments around the world have made policies that would increase infrastructural development directly concerning boom truck demand. The US Department of Transport has announced funding nine "mega" projects under the National Infrastructure Project Assistance Program during the fiscal year of 2023. Through this program, the government provides nearly 1.2 billion US dollars to infrastructure projects all over the country. And Hudson Yards Concrete Casing project is one of those projects that comes under the Hudson River Tunnel Project and has been funded by about 292.17 million dollars. Improved urbanization plans and incentives for using eco-friendly equipment are also stimulating the growth of these markets in regions such as North America and Asia-Pacific. Recent boom truck improvements relate to increased payloads, the hydraulic system being even more advanced, and safety has improved at every stage, implying efficient lifting and transporting. Telematics helps manage fleets, thereby reducing operational costs for boom trucks.

Opportunities in the boom trucks market will appear exciting, with prospective growth in global construction, utility, and energy projects. Government policies that promote the uptake of electric boom trucks are good prospects for growth shortly. On 27 May 2024, the Ministry of Youth Development and National Service, Trinidad and Tobago welcomed 50 youths into the HOIST Crane Operations Programme. The course provided special training in crane operations to equip participants in job positions of rigging and banksman, forklift operator, boom truck crane (HIAB) operator, mobile crane operator, and tower crane operator. Added to this are the extensions of the telecommunication infrastructure especially 5G network installation drives towards increased demand for boom trucks particularly with special lifting capabilities.

Boom Trucks Market Dynamics

KEY DRIVERS:

-

Boom Trucks Propel Infrastructure Development in Growing Economies.

The growth of boom trucks is driven by the pace of infrastructure projects worldwide, more so in developing economies. A build-up in highways, structures construction, and utilities requires a lifting capacity and mobility-all of which boom trucks provide. Heavy materials and equipment cannot be positioned precisely without boom trucks in structures of colossal buildings and infrastructure projects.

-

Rising Utility and Telecommunication Needs

Boom trucks are widely used for pole maintenance, installation, and repair in electrical lines as well as telecommunication lines in the utility and telecommunication industries. With the initiation of 5G, the telecommunication network has started spreading rapidly; high-end boom trucks with greater length and flexibility have become an immediate necessity. Interest by the utility sector in modernizing old power grids and building new energy networks is another source of steady growth demand for boom trucks.

RESTRAIN:

-

High Initial Purchasing Cost still Restrain the Market.

The main restraint for boom trucks market is the high initial investment required for purchasing high-end boom trucks. These automobiles require lifting mechanisms specific to them and a host of advanced technology, thereby making them expensive. Because of costs and high maintenance costs, small and medium-sized construction firms, utility companies, and contractors are likely to be deterred from purchasing new boom trucks. At times, the price of new boom trucks and high maintenance costs inhibit the cost from taking the smaller business.

Boom Trucks Market Segmentation Overview

BY LIFTING CAPACITY

The 21 - 30 Metric Tons segment stood at 35.26% market share in 2023 and led the market. This is the most widely used lifting capacity since the range offers an extensive versatility and capability to execute medium-sized lifting tasks in construction, utilities, as well as telecom. Boom trucks in this range provide the best balance between performance/cost and are hence utilized in a much wider range of projects.

However, the More than 50 Metric Tons segment is expected to witness the fastest growth with a CAGR of 11.0% over the forecast period 2024-2032. For large infrastructure projects such as skyscrapers and industrial facility constructions, where lifting heavy weights, high capacity boom trucks are widely used.

BY MOUNT

Behind the Cab Mount was the leading segment by mount type in the boom trucks market in 2023, holding 54.24% of the market share. This mounting configuration is popular for stability and smooth operation, mainly in applications like construction and utility where positioning is often frequent and precise. Behind the cab mounts also offer better load distribution for the overall balance and lifting efficiency of the truck.

The Rear Mount segment will be growing at the fastest pace with a CAGR of 6.6% over the forecast period. Rear-mounted boom trucks are gaining popularity, based on increased maneuverability and accessibility in hard-to-reach areas, ideal for the urban environment and confined construction locations.

BY BOOM LENGTH

Boom length below 20m dominated the market in 2023 with a 44.32% market share. Boom trucks under this category are mainly applied for residential construction and light utility work. Here the equipment is compact, and smaller to enable maneuverability in tight areas without compromising on lifting capacity.

Thus, the boom length over 40m is poised to gain the highest growth during the forecast period with a CAGR of 10.1%. Major infrastructure projects and other major installation works need long boom lengths to lift heavy materials and equipment to high locations with reach and height levels.

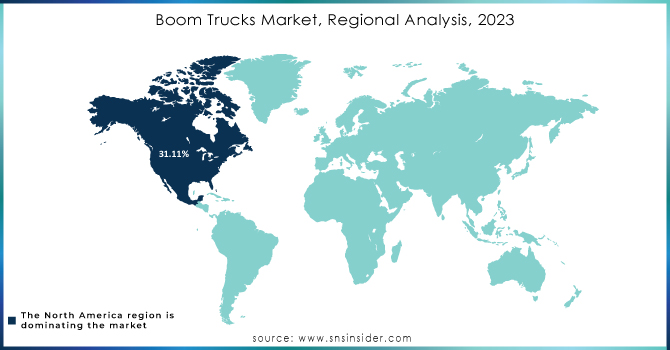

Boom Trucks Market Regional Analysis

In 2023, North America accounted for the largest boom trucks market share, at 31.11%. This is owed to high regional demand on account of construction, utility, and energy sectors, and government-supported infrastructure projects. The large size of manufacturers' presence and increasing application of sophisticated technology in boom trucks have contributed to North America's position as a market leader.

However, the boom trucks market is expected to grow at the fastest rate during the forecast period in the Asia-Pacific region with a CAGR of 8.4% wherein rapid urbanization, industrialization, and large-scale infrastructure projects across countries like China and India are driving growth factors. Concomitantly, higher investments in renewable energy projects and telecommunication infrastructure will further accelerate boom truck demand in this region.

Need any customization research on Boom Trucks Market - Enquiry Now

KEY PLAYERS

The major market players are:

-

Terex Corporation (XT Pro Boom Truck, Crossover Boom Truck)

-

Altec Industries, Inc. (AC40-152S Boom Truck, AT40-G Telescopic Aerial)

-

Manitowoc Company, Inc. (National Crane NBT45, National Crane NBT60XL)

-

Palfinger AG (PK 165.002 TEC 7, PK 135.002 TEC 7 Boom Truck)

-

Tadano Ltd. (GT-750EL Boom Truck, ATF 400G-6 Boom Truck)

-

Elliott Equipment Company (E160 E-Line Boom Truck, 40142 Boom Truck)

-

Link-Belt Cranes (HTC-86110 Boom Truck, HTC-8675 Series II)

-

Autocar LLC (DC-64 Boom Truck, ACX XPEDITOR Boom Truck)

-

Sany Group (STC250T4 Boom Truck, STC800S Boom Truck)

-

XCMG Group (XCT25L5 Boom Truck, XCT100 Boom Truck)

-

Zoomlion Heavy Industry Science & Technology Co. (ZTC350H552 Boom Truck, ZTC550H561 Boom Truck)

-

Fassi Gru S.p.A. (F2150RAL Crane Boom Truck, F545RA Boom Truck)

-

Cargotec Corporation (Hiab X-HiPro 192, Hiab X-HiDuo 138)

-

Liebherr Group (LTM 1650-8.1 Boom Truck, LTM 1450-8.1 Boom Truck)

-

Bronto Skylift (S 70 XR Aerial Platform, S 50 XDT-J Boom Truck)

-

Konecranes (CXT Boom Truck, SMV Series Boom Truck)

-

Stellar Industries, Inc. (7621 Telescopic Boom, 9630 Boom Truck)

-

Versalift East, LLC (VST-7500-T Boom Truck, SST-40-EIH Boom Truck)

-

Tadano Faun GmbH (ATF 220G-5 Boom Truck, ATF 70G-4)

-

Dur-A-Lift, Inc. (DVS-29 Boom Truck, DPM-47 Boom Truck)

RECENT DEVELOPMENTS

-

March 2024: PALFINGER, a global leader for innovative crane and lifting solutions, presented its new products at Work Truck Week, in Indianapolis, Indiana, exclusively its mechanics truck, the PAL Pro 58 Mechanics Truck, and service crane, the PSC 8600 TEC Service Crane. This is a new benchmark set by an industry pioneer, and it underlines the commitment of PALFINGER toward working relentlessly for the North American market with unique innovation.

-

January 2024: German crane and access rental firm Anker Kran und Arbeitsbühnen has completed delivery of a new Tadano HK 4.050-1 truck crane mounted on a four-axle DAF commercial chassis. The crane can operate fully laden on the public road network at full counterweight of 8.5 tonnes, while still achieving axle loads of less than 9.5 tonnes and can reach eight-tonne axle loads with 4.5 tonnes on board. The boom is broken down into four sections and has a length of 35.2 meters, and at the end of it is a 9.3-metre swingaway extension to tip the crane at nearly 48 meters.

-

August 2023: Link-Belt introduced a 120 TTLB telescopic boom truck crane in August 2023. The Link-Belt 120 TTLB truck terrain crane offers a 197 ft. (60 m) seven-section pin and latch boom as well as all-wheel steering plus tight turn radius. With a steerable rear axle and super single tires, 120 TTLB offers maximum maneuverability in confined jobsite spaces through its all-wheel steering capability. Four modes of steering are also available: independent rear, independent front, combination, and crab.

-

March 2023: Manitex International, Inc. introduced the TC850 Series truck-mounted crane. The TC85159 has an 85-ton base rating at a 10-foot radius with a 159-foot, 5-section full power boom extending proportionally. Tip height at 168 feet is available or up to 228 feet if the optional 2-piece, 30'60' bifold offset lattice jib is ordered.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.0 Billion |

| Market Size by 2032 | US$ 4.87 Billion |

| CAGR | CAGR of 5.44 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | BY LIFTING CAPACITY (Less than 10 Metric Tons, 10 - 20 Metric Tons, 21 - 30 Metric Tons, 31 - 40 Metric Tons, 41 - 50 Metric Tons, More than 50 Metric Tons) BY MOUNT (Behind the Cab Mount, Rear Mount, Swing Seat) BY BOOM LENGTH (Less than 20m, 20 - 30m, 31 - 40m, More than 40m) BY PRODUCT TYPE (Boom truck cranes,Bucket Trucks) BY APPLICATION (Infrastructure, Commercial Construction, Power & Utility, Industrial/Petrochemical, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Terex Corporation, Altec Industries, Inc. Manitowoc Company, Inc. , Palfinger AG , Tadano Ltd. , Elliott Equipment Company , Link-Belt Cranes , Autocar LLC, Sany Group, XCMG Group, Zoomlion Heavy Industry Science & Technology Co., Fassi Gru S.p.A. , Cargotec Corporation, Liebherr Group, Bronto Skylift, Konecranes, Stellar Industries, Inc., Versalift East LLC , Tadano Faun GmbH, Dur-A-Lift, Inc. and others |

| Key Drivers | • Boom Trucks Propel Infrastructure Development in Growing Economies.• Rising Utility and Telecommunication Needs |

| Restraints | • High Initial Purchasing Cost still Restrain the Market. |