Account-Based Marketing Market Report Scope & Overview:

The Account-Based Marketing Market Size was valued at USD 1.22 billion in 2024 and is expected to reach USD 3.74 billion by 2032 and grow at a CAGR of 15.0% over the forecast period 2025-2032.

The account-based marketing market is growing rapidly as enterprises embrace personalized, targeted marketing to engage high-value accounts. Demand for measurable ROI, sales-marketing alignment, and advanced analytics is fueling adoption across industries. Companies are investing in AI, automation, and data-driven platforms to boost targeting precision and customer engagement. Over 70% of B2B firms use ABM, with 80% of marketers reporting higher ROI versus traditional methods, making ABM a core strategy for efficiency, long-term relationships, and competitive advantage in B2B marketing.

To Get more information on Account-Based Marketing Market - Request Free Sample Report

Key Account-Based Marketing Market Trends

-

Personalized and targeted B2B marketing strategies are driving demand for ABM platforms.

-

AI, predictive analytics, and intent data are boosting ABM precision and effectiveness.

-

Omnichannel engagement through email, social media, and ads is expanding ABM adoption.

-

High costs, long sales cycles, and sales-marketing alignment challenges hinder SME adoption.

-

CRM and marketing automation integration issues limit seamless ABM execution.

-

Growing focus on retention, upselling, and cross-selling is fueling ABM investments.

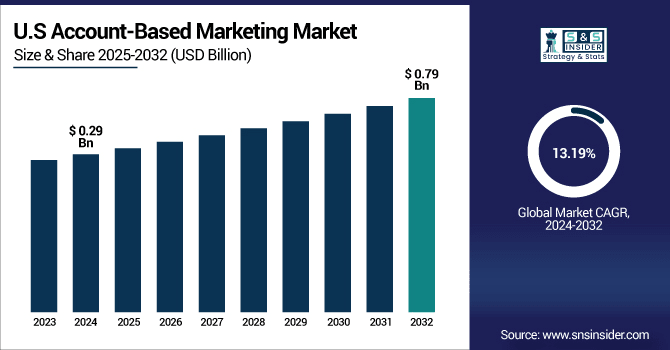

The U.S. Account-Based Marketing Market size was USD 0.29 billion in 2024 and is expected to reach USD 0.79 billion by 2032, growing at a CAGR of 13.19% over the forecast period of 2025–2032. The U.S. market is driven by increasing demand for personalized B2B engagement, advanced data analytics, and integration of AI tools, which strengthen precision targeting and measurable ROI.

The account-based marketing market trends include the rising adoption of personalized and targeted B2B marketing strategies, the integration of AI, predictive analytics, and intent data to enhance precision targeting, and the expansion of omnichannel engagement across email, social media, and programmatic advertising. Growing focus on customer retention, upselling, and cross-selling is driving ABM investments, while demand for measurable ROI and stronger sales-marketing alignment is boosting adoption.

Security Service Edge Market Growth Drivers:

-

AI-Powered Personalization and Automation Accelerate Customer Engagement in the Account-Based Marketing Market

The Account-Based Marketing market is expanding as enterprises increasingly adopt AI-driven personalization, predictive analytics, and automation to deliver real-time insights and tailored messaging at scale. These capabilities enable precise targeting of high-value accounts, improving ROI, retention, and lead conversion while reducing manual campaign efforts. With advanced recommendation engines and dynamic account insights, Account-Based Marketing platforms are reinforcing themselves as a preferred strategy for B2B enterprises.

In March 2024, Leading Account-Based Marketing platforms rolled out AI-driven updates integrating predictive analytics and hyper-personalized recommendations, enabling marketers to run dynamic, account-specific campaigns. This resulted in stronger account penetration and measurable improvements in customer satisfaction, showcasing AI as a key growth accelerator for Account-Based Marketing adoption.

Account-Based Marketing Market Restraints:

-

High Implementation Costs Restrict Account-Based Marketing Adoption Among Small and Medium Enterprises

The Account-Based Marketing market faces adoption challenges due to high implementation costs, which create entry barriers for SMEs. Advanced analytics, premium software, and complex integrations with existing data systems drive up budgets, limiting scalability outside large enterprises. Smaller organizations often struggle with resource constraints, preventing them from accessing the full benefits of Account-Based Marketing. This imbalance slows overall market maturity, as widespread adoption is critical to scaling growth across industries.

Account-Based Marketing Market Opportunities:

-

Multi-Channel Strategies Unlock New Revenue Opportunities in the Account-Based Marketing Market

The growing demand for multi-channel Account-Based Marketing strategies is opening expansion opportunities, allowing enterprises to orchestrate seamless engagement across email, social media, content platforms, and programmatic advertising. Cross-platform integrations enhance visibility, improve conversion rates, and strengthen customer retention, making Account-Based Marketing campaigns more effective. With unified campaign management tools, businesses can deliver consistent account journeys that improve lifetime value and foster stronger client relationships.

July 2024, Several Account-Based Marketing platforms launched enhanced engagement solutions with multi-channel orchestration features, enabling marketers to simultaneously target accounts via social media, web, and programmatic advertising. This innovation led to more unified customer experiences, higher conversions, and stronger revenue growth across industries.

Key Account-Based Marketing Market Segment Analysis

-

By End-user Industry, BFSI led with ~30% share in 2024; IT & Telecommunications fastest growing (CAGR 18.86%).

-

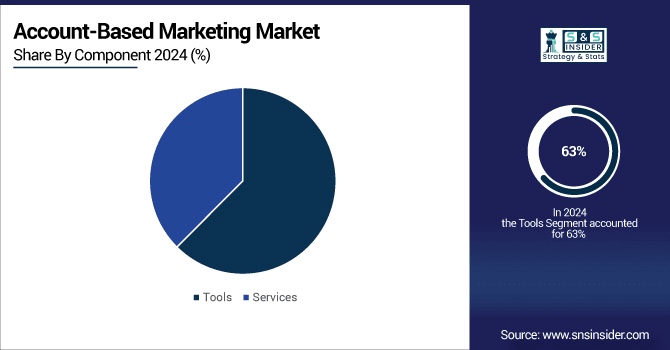

By Component, Tools dominated ~63% in 2024; Services fastest growing (CAGR 17.85%).

-

By Deployment Model, Cloud held ~56% share in 2024; On-premise fastest growing (CAGR 16.49%).

-

By Channel, Display Advertising led with ~27% share in 2024; social media fastest growing (CAGR 18.48%).

By Component, Tools Lead Market While Services Register Fastest Growth

In 2024, the Tools segment held the largest share of the Account-Based Marketing market, as enterprises increasingly adopted advanced platforms for campaign execution and analytics. The demand for automation, AI-powered personalization, and integrated dashboards reinforces the central role of tools in streamlining account targeting and engagement across industries. The Services segment is expected to grow fastest, driven by enterprises requiring expert support for strategy design, integration, and execution. Consulting, managed services, and training address the complexity of adoption, helping organizations optimize platform performance and strengthen customer engagement outcomes with tailored, resource-efficient solutions.

By End-user Industry, BFSI Leads Market While IT & Telecommunications Registers Fastest Growth

In 2024, the BFSI segment dominated the Account-Based Marketing market, driven by financial institutions prioritizing personalized engagement for high-value accounts. The increasing need for secure and tailored customer journeys is encouraging the adoption of tools that deliver real-time insights and cross-channel targeting. Predictive analytics and compliance-focused personalization further strengthen campaign performance, supporting customer acquisition, retention, and long-term revenue growth. The IT and Telecommunications segment is expected to record the fastest growth, as digital transformation and complex buying cycles create demand for highly targeted, multi-channel strategies. With AI-driven automation and predictive targeting, IT and telecom providers are enhancing account penetration and ROI, positioning this sector as a leading growth driver.

By Deployment Model, Cloud Leads Market While On-premise Registers Fastest Growth

In 2024, the Cloud segment led the Account-Based Marketing market, as organizations embraced scalable, flexible, and cost-effective solutions. Cloud deployment enables seamless integration with CRM systems, real-time updates, and accessibility across teams, while cloud-native development strengthens security and collaboration. This dominance highlights the preference for agile and innovation-driven deployment models. The On-premise segment is anticipated to grow fastest, particularly among industries requiring strict data control and regulatory compliance. Large enterprises favor on-premise solutions for safeguarding sensitive customer information, with hybrid models and secure environments further enhancing adoption in regulated markets.

By Channel, Display Advertising Leads Market While Social Media Registers Fastest Growth

In 2024, the Display Advertising segment dominated the Account-Based Marketing market, supported by its ability to deliver highly personalized campaigns to targeted accounts. Programmatic tools and advanced targeting algorithms improve visibility and ROI, while dynamic ad personalization ensures higher engagement levels, making display a cornerstone channel. The Social Media segment is expected to register the fastest growth, as enterprises increasingly leverage platforms like LinkedIn, Twitter, and emerging networks to reach decision-makers with interactive, personalized content. AI-powered social listening and advanced engagement tools enhance precision, positioning social media as the most dynamic growth driver for Account-Based Marketing strategies.

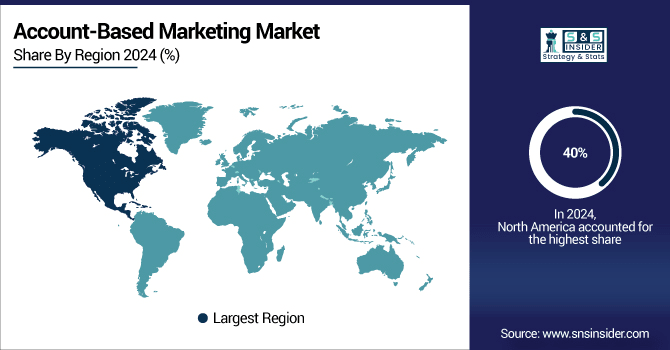

North America Account-Based Marketing Market Insights

In 2024, North America held the largest share of 40% the Account-Based Marketing market, driven by strong enterprise adoption of advanced marketing technologies, high demand for personalized B2B engagement, and the presence of leading solution providers. The region benefits from well-established digital infrastructure and enterprise-scale marketing budgets, reinforcing market maturity.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Leads Account-Based Marketing Market in North America

The U.S. dominates the regional market due to its advanced CRM integration, strong focus on customer analytics, and strategic investments in Account-Based Marketing platforms across large enterprises, solidifying its leadership position.

Asia Pacific Account-Based Marketing Market Insights

Asia Pacific represents the fastest-growing region in the Account-Based Marketing market with a CAGR of 18.65%, supported by rapid digital transformation initiatives, increasing adoption of data-driven marketing strategies, and expanding internet connectivity. The region benefits from a growing base of tech-enabled enterprises and demand for scalable Account-Based Marketing solutions.

India Leads Account-Based Marketing Market Growth in Asia Pacific

India is the regional leader, propelled by its expanding IT services sector, large digital workforce, and fast adoption of targeted marketing platforms, enhancing customer engagement across diverse industries.

Europe Account-Based Marketing Market Insights

In 2024, Europe accounted for a significant share of the Account-Based Marketing market, supported by widespread digital adoption and a strong enterprise focus on competitive B2B marketing strategies. Regulatory encouragement for data-driven practices and robust digital infrastructure strengthens the regional market landscape.

United Kingdom Dominates Europe’s Account-Based Marketing Market

The United Kingdom leads the European market with robust enterprise investments in Account-Based Marketing platforms, an established B2B ecosystem, and advanced marketing technology infrastructure, reinforcing its competitive edge.

Latin America (LATAM) and Middle East & Africa (MEA) Account-Based Marketing Market Insights

The Account-Based Marketing market in LATAM and MEA is witnessing steady growth, fueled by rising digital adoption, enterprise modernization, and increasing demand for AI-enabled marketing solutions. In MEA, the United Arab Emirates leads the market with strong infrastructure and a digital-first enterprise approach. In LATAM, Brazil dominates, supported by its competitive enterprise sector, rising adoption of affordable Account-Based Marketing platforms, and growing demand for personalized marketing solutions to strengthen business outreach.

Competitive Landscape for the Account-Based Marketing market:

Terminus is a leading Account-Based Marketing platform provider, empowering B2B enterprises to drive revenue growth through precision targeting, personalized engagement, and multi-channel campaigns. The company’s Account-Based Marketing solutions integrate advertising, email, chat, and analytics into a unified platform, enabling marketing and sales teams to identify high-value accounts and deliver consistent account-based experiences. By leveraging intent data and predictive insights, Terminus helps organizations optimize customer acquisition, retention, and expansion strategies, making it a central player in the Account-Based Marketing technology landscape.

-

November 2024 – Terminus merged with DemandScience, creating a global leader in B2B revenue marketing with an enhanced account-based experience (ABX) platform and omnichannel ABM capabilities. The Terminus CEO transitioned to CTO of the combined company under the DemandScience brand.

HubSpot provides a powerful CRM and marketing automation ecosystem, with growing emphasis on Account-Based Marketing capabilities to help businesses achieve targeted B2B engagement. Its Account-Based Marketing tools allow companies to identify and prioritize high-value accounts, orchestrate personalized campaigns, and align sales and marketing teams for revenue growth. By combining conversational intelligence, AI-driven insights, and seamless integrations, HubSpot empowers businesses to improve customer acquisition and retention. Its Account-Based Marketing focus supports enterprises in building meaningful, scalable relationships with their most valuable accounts.

-

December 2024 – HubSpot signed an agreement to acquire Frame AI, an AI-powered conversation intelligence platform able to transform unstructured data like emails and meetings into real-time insights—strengthening its Account-Based Marketing support.

Adobe, through its Marketo Engage and Adobe Experience Cloud, plays a pivotal role in advancing Account-Based Marketing by equipping enterprises with data-driven personalization, cross-channel automation, and buyer journey orchestration. Adobe’s Account-Based Marketing capabilities empower marketers to align with sales teams, target key accounts, and deliver relevant, contextual experiences at scale. With its integration of generative AI, analytics, and customer insights, Adobe strengthens account engagement and campaign effectiveness, positioning itself as a trusted leader for enterprises embracing Account-Based Marketing strategies worldwide.

-

August 2024 – Adobe launched Adobe Journey Optimizer B2B Edition with generative AI, enabling the identification of buying groups and creation of personalized journeys for each member across channels, advancing its Account-Based Marketing capabilities.

Account-Based Marketing Market Key Players:

Some of the Account-Based Marketing Market Companies

-

Terminus Software, Inc.

-

Adobe Inc. (Marketo Engage)

-

6sense Insights, Inc.

-

Demandbase Inc.

-

RollWorks (NextRoll, Inc.)

-

Triblio Inc.

-

Madison Logic

-

Engagio Inc.

-

HubSpot, Inc.

-

MRP Prelytix (MRP)

-

Folloze

-

Kwanzoo Inc.

-

Lattice Engines

-

LeanData

-

Bombora

-

TechTarget, Inc.

-

Salespanel

-

Drift.com, Inc.

-

Uberflip

-

Insider Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.22 Billion |

| Market Size by 2032 | USD 3.74 Billion |

| CAGR | CAGR of 15.0% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Tools, Services) • By Deployment Model (On-premise, Cloud) • By End-user Industry (Retail & E-commerce, BFSI, IT & Telecommunications, Government, Travel & Tourism, Healthcare & Life Sciences, Others) • By Channel (Email, Display Advertising, Social Media, Website/Personalization, Events & Webinars, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Terminus Software, Inc., Adobe Inc. (Marketo), Uberflip, Triblio Inc., 6sense Insights, Inc., Engagio Inc., HubSpot, Inc., Madison Logic, Demandbase Inc., Salespanel, Drift.com, Inc., RollWorks (NextRoll, Inc.), Folloze, MRP Prelytix (MRP), Kwanzoo Inc., Lattice Engines, LeanData, Bombora, TechTarget, Inc., Insider Inc. |