Accounting Software Market Report Scope & Overview:

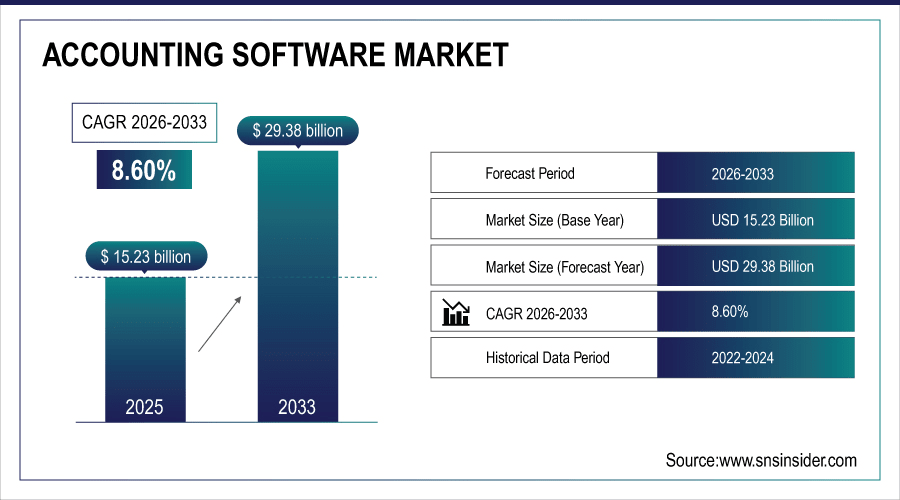

The Accounting Software Market Size was valued at USD 15.23 Billion in 2025E and is expected to reach USD 29.38 Billion by 2033 and grow at a CAGR of 8.60% over the forecast period 2026-2033.

The Accounting Software Market growth is primarily driven by Increasing Adoption of Cloud-based Solutions providing Real-time Financial Tracking, Device Accessibility and Cost Efficiency for All Sizes of Businesses. Increasing demand for automation in financial operations such as tax filing, invoicing, payroll and auditing, minimizes manual errors and enhances efficiency, which is further accelerating its adoption. Moreover, Accounting platforms are integrating AI and ML features that offers predictive insights, anomaly detection, and intelligent reporting skills that will assist enterprises in making informed choices. According to study, over 65% of enterprises now prefer cloud accounting platforms, with mobile accessibility driving nearly 40% of daily logins.

To Get More Information On Accounting Software Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 15.23 Billion

-

Market Size by 2033: USD 29.38 Billion

-

CAGR: 8.60% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Accounting Software Market Trends

-

Cloud-based accounting enables real-time access and scalability for global enterprises.

-

Automation reduces manual errors while streamlining payroll, invoicing, and tax processes.

-

AI-driven analytics transform financial reporting with predictive insights and anomaly detection.

-

Mobile accessibility empowers SMEs to manage finances flexibly across devices.

-

Integration of machine learning enhances decision-making with intelligent financial forecasting tools.

-

Rising demand for digital transformation accelerates cloud accounting adoption worldwide.

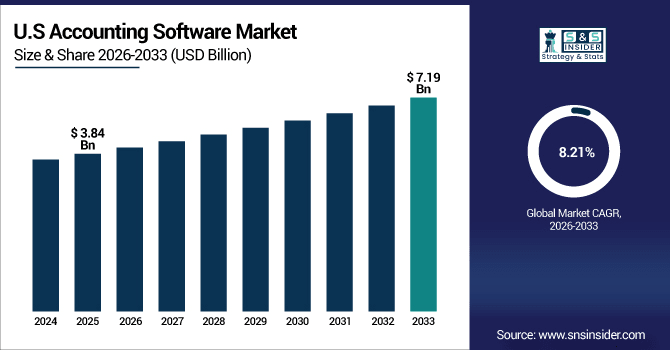

The U.S. Accounting Software Market size was USD 3.84 Billion in 2025E and is expected to reach USD 7.19 Billion by 2033, growing at a CAGR of 8.21% over the forecast period of 2026-2033, driven by widespread cloud adoption, AI-enabled automation, and integration with enterprise systems. Businesses increasingly rely on real-time financial insights, regulatory compliance, and scalable solutions, reinforcing the country’s leadership in global market growth.

Accounting Software Market Growth Drivers:

-

Cloud Accounting Revolutionizes Finance with Real-Time Access and Scalability

The Transition from on-premise system to cloud-based accounting software is one of the key drivers for the growth. On the other hand, cloud deployment provides immediate financial visibility, scalability, and availability from any device, which makes it more appealing to businesses of all sizes. Lower upfront costs and pay-as-you-go models, along with remote access-something especially critical to many SMEs in today's hybrid and globalized work environments-are just a few of the beneficial characteristics of Daas. Furthermore, the smooth integration of cloud accounting with other enterprise tools (CRM, ERP & payroll systems) improves operational efficiencies that are driving more adoption.

Cloud-based deployments improve financial visibility by 45% compared to traditional on-premise systems.

Accounting Software Market Restraints:

-

Data Security Concerns Limit Growth of Cloud Accounting Adoption Globally

Despite its advantages, data security is still one of the most critical restraints to the market. The problem is that accounting software deals with highly sensitive financial data, and they face challenges regarding breaches, unauthorized access to data, costs, and the compliance with regulations such as GDPR and SOC2. The potential for financial loss and reputational damage also rises, however; cyberattacks, ransomware incidents, and insider threats. In heavily regulated industries like BFSI and healthcare one may find many organizations still hesitate before adapting fully cloud accounting systems because of fear of vulnerabilities and compliance failure which holds back market expansion.

Accounting Software Market Opportunities:

-

AI-Powered Automation Unlocks Efficiency and Intelligence in Accounting Software

The integration of AI and automation presents a significant growth opportunity for the accounting software market. The solution involves advanced AI-based solutions which are capable of automatically identifying anomalies, reducing the typographical errors during manual entries, and streamlining processes such as invoice reconciliation, expense management, and tax compliance. Machine-learning powered predictive analytics helps organizations project the amount of cash they will be able to generate over a given period of time, allowing FD to make informed decisions about its financial strategy. In addition, automation frees up dozens of work hours each month system light for finance teams to focus their resources on strategic planning. With enterprises demanding intelligent and self-learning fintech, vendors selling AI-based solutions and answers stand to grab sizable market portions.

Predictive analytics powered by AI improves cash flow forecasting accuracy by nearly 35%, allowing businesses to make informed financial decisions, optimize working capital, and plan strategic investments effectively.

Accounting Software Market Segmentation Analysis:

-

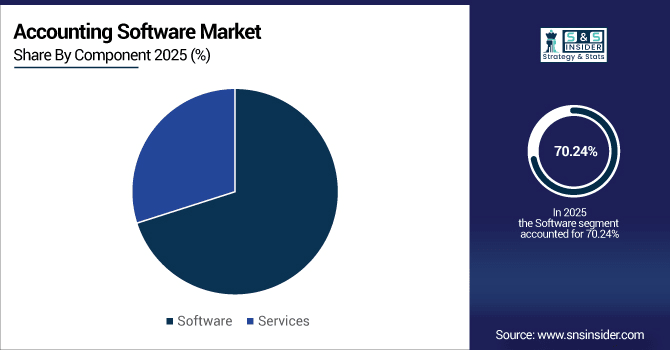

By Component: In 2025, Software led the market with share 70.24%, while Services is the fastest-growing segment with a CAGR 10.04%.

-

By Enterprise Size: In 2025, Large Enterprises led the market with share 64.06%, while Small & Medium Enterprises (SMEs) is the fastest-growing segment with a CAGR 11.24%.

-

By Type: In 2025, ERP led the market with share 42.50%, while Custom Accounting Software is the fastest-growing segment with a CAGR 10.14%.

-

By End-Use Industry: In 2025, BFSI led the market with share 28.64%, while IT & Telecommunication is the fastest-growing segment with a CAGR 11.84%.

By Component, Software Leads Market and Services Fastest Growth

The Accounting Software Market by Component is dominated by the software segment, which holds the largest market share owing to comprehensive functionality offered by the software that include tax management, invoicing, payroll, and financial reporting, which reduce time-consuming core accounting functions for small and large enterprises. This is fueled by the sustained demand of businesses relying on advanced software solutions, which provides real-time insights and a boost to the decision-making process. The services segment, however, is growing the fastest, due to increasing demand for implementation, customization, training, and support to help ensure smooth software adoption. While cloud-based and AI-enabled platforms become pervasive, the need for value-added professional services increases, making services a strategic enabler of sustained customer value and market expansion.

By Enterprise Size, Large Enterprises Lead Market and SMEs Fastest Growth

By enterprise size, large enterprises dominate the segment since large organizations with massive financial capital adequately fund the costs to buy advanced ERP-integrated accounting software packages assisting diverse and complex operational activities, and global compliance, and facilitating multi-currency transactions. These institutions are the largest consumers of these solutions and therefore focus on scalability, data security, and integration with the other enterprise tools. On the other hand, small and medium enterprises (SMEs) are the fastest-growing segment of the market as inexpensive cloud-based accounting platforms drive stronger adoption rates. Hybrid work environments give small and medium enterprises (SMEs) cost-effective solutions with pay-as-you-go models, low upfront costs, and mobile accessibility, and improve SMEs capability to track cash flow.

By Type, ERP Leads Market and Custom Accounting Software Fastest Growth

The Accounting Software Market by Type is dominated by ERP solutions, which lead the market due to it’s capable of integrating accounting with core business functions such as supply chain, HR, and CRM and offers the enterprises with complete financial visibility and operational efficiency. Large companies that manage complex, multi-location operations and regulatory requirements tend to prefer ERP systems. Contrary custom accounting software is the fastest growing segment due to demand from businesses targeting specialized requirements in workflows, compliance and unique industry requirements. The need for personalized, scalable, and adaptable accounting platform is a signal from the richest and biggest market where ERP is the most stable market and customization is the most innovative and future market.

By End-Use Industry, BFSI Leads Market and IT & Telecommunication Fastest Growth

In 2025, The BFSI sector has the largest share of the Accounting Software Market by End-Use Industry owing to its complex financial operations, high transaction volumes, and needs for stringent regulatory compliance. The demand for accurate accounting solutions, together with risk management, reporting, and automated functions for banks, insurance companies, and financial institutions, had made BFSI a stable and revenue-generating end-user segment in the accounting software market. On the production side, the IT & Telecommunication section is expected to the most encouraging segment due to increasing speed of digitalisation of work, rising subscription led revenue models, and the ability of companies to track their financials in real-time across many projects and locations.

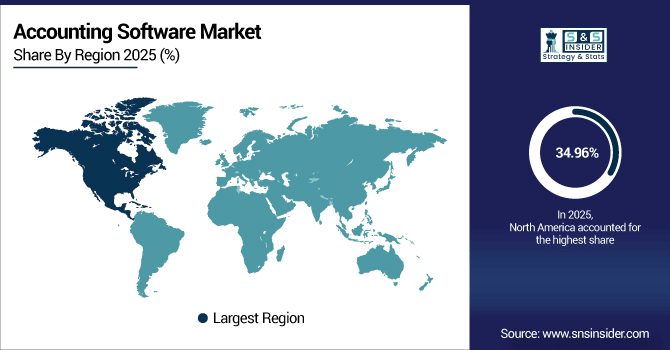

Accounting Software Market Regional Analysis:

North America Accounting Software Market Insights:

The Accounting Software Market in North America held the largest share 34.96% in 2025, owing to higher digital adoption, matured IT development environment and also the demand for the Financial Corporate Function to have been served with Cloud and AI-enabled functions. The automated process has become one of the priorities of enterprises looking for fast and real-time financial insights, regulatory compliance in the era of changing governance and operational efficiency. High adoption within the region is due to the focus of the players towards the integration of accounting software to ERP, CRM and payroll system. North America has continued to capture the highest market share owing to high investment in technology and increasing demand for scalable and secure financial management platforms. Innovation and adopting recent technologies set the region as a standard of trends in global accounting software.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Accounting Software Market with Advanced Technological Adoption

The U.S. dominates the Accounting Software Market due to advanced technological adoption, widespread cloud-based implementation, AI-driven automation, and integration with enterprise systems, enabling real-time financial insights, improved compliance, and operational efficiency across businesses of all sizes.

Asia-Pacific Accounting Software Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Accounting Software Market, projected to expand at a CAGR of 9.95%, owing to factors such as higher digitalization, higher adoption of SMEs, and high need of knowledge about cloud-based & AI enabled monetary solutions. To eliminate human error and meet compliance requirements, companies are moving away from manual bookkeeping, and onto automated platforms. By offering many of these affordable and flexible solutions via the cloud with easy mobile access, accounting software becomes even more attractive to the small and medium businesses that contribute so vibrantly to this region of the world. Furthermore, rising investment on IT infrastructure and technological innovation is driving the market growth. With organizations moving to centralise scalable, secure and integrated accounting systems, Asia-Pacific is growing the fastest region in the world.

China and India Propel Rapid Growth in Accounting Software Market

China and India drive rapid growth in the Accounting Software Market due to increasing SME adoption, digital transformation, cloud-based solutions, and demand for efficient, scalable, and AI-enabled financial management platforms.

Europe Accounting Software Market Insights

The Europe Accounting Software Market is well-established, due to a well-established business environment, stringent regulatory frameworks and good adoption of cloud based and AI-based financial solutions. Increasingly enterprises implement the accounting software for ensuring standards compliance, increasing operational efficiency and real-time access to finance and other functions. Integration with most peripheral software like ERP, CRM, and payroll software is also an advantage for market and streamlines workflows across the industry. Technological evolution, for example, through automation and predictive analytics, continues to become more and more refined, helping stakeholder entities process and analyse decisions. The increased attention towards digital transformation and spent earmarked for secure and scalable platforms by SMES and large enterprises helps the market to grow at a constant rate across Europe.

Germany and U.K. Lead Accounting Software Market Expansion Across Europe

Germany and the U.K. lead Accounting Software Market expansion in Europe due to advanced digital adoption, regulatory compliance requirements, cloud-based solutions, and growing demand for AI-enabled and integrated financial management systems.

Latin America (LATAM) and Middle East & Africa (MEA) Accounting Software Market Insights

The accounting software market in Latin America (LATAM) and Middle East & Africa (MEA) is gradually growing due to rise in adoption of cloud based and AI enabled financial solutions by enterprises. Organizations across the regions are moving from manual accounting systems to automated accounting platforms to improve efficiency, minimize errors, and remain compliant with various regulations to drive return on investment. The demand for accounting software is more prominent in SMEs that prefer these cost-effective, scalable solutions with flexible subscription models, while on the other hand, enterprises are moving towards integrated solutions with ERP, CRM, and payroll systems. Market growth is also encouraged by increasing awareness regarding digital transformation and mobile accessibility, and a need for real-time financial insights.

Accounting Software Market Competitive Landscape

Intuit Inc. leads the accounting software market with solutions like QuickBooks and TurboTax, catering to SMEs and individual users. Its focus on AI automation, cloud accessibility, and seamless integrations with payroll and ERP systems enhances efficiency. Strategic product updates and intelligent financial tools drive adoption and expand Intuit’s market share globally.

-

In July 2025, Intuit Inc. launched Agentic AI experiences and financial management capabilities for its Enterprise Suite, enhancing mid-market business growth through automated workflows and data-driven decision-making.

Oracle Corporation dominates the enterprise accounting software segment with its robust cloud ERP and AI-enabled financial management solutions. The platform automates complex processes, ensures regulatory compliance, and provides predictive analytics for strategic decision-making. Oracle’s strong presence in large organizations and continuous AI and cloud innovations support sustained growth in the accounting software market.

-

In March 2025, Oracle launched AI Agent Studio for Fusion Applications, providing tools for creating, deploying, and managing AI agents across enterprises.

Xero Ltd. provides cloud-based accounting solutions primarily targeting SMEs, offering invoicing, payroll, and bank reconciliation features. Its scalable platform supports multi-currency transactions and integrates with third-party apps, driving efficiency and real-time financial insights. Continuous product innovations and AI-driven enhancements strengthen Xero’s position in the growing cloud accounting software market.

-

In May 2024, Xero launched Just Ask Xero (JAX), a GenAI-powered smart business companion, that allows users to interact with the platform conversationally to get answers and perform tasks like creating invoices or generating reports.

Accounting Software Market Key Players:

Some of the Accounting Software Market Companies are:

-

Intuit Inc.

-

Microsoft Corporation

-

Oracle Corporation

-

SAP SE

-

The Sage Group plc

-

Xero Ltd.

-

Zoho Corporation Pvt. Ltd.

-

FreshBooks

-

Wave Financial Inc.

-

MYOB Group Pty Ltd.

-

Infor Inc.

-

Epicor Software Corporation

-

Unit4 N.V.

-

Patriot Software Company, LLC

-

Odoo SA

-

Saasu Pty Ltd.

-

Red Wing Software, Inc.

-

Reckon Limited

-

Workday

-

Tipalti

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 15.23 Billion |

| Market Size by 2033 | USD 29.38 Billion |

| CAGR | CAGR of 8.60 % From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Enterprise Size (Large, Small & Medium) • By Type (Spreadsheets, ERP, Custom Accounting Software, Tax Management Software) • By End-Use Industry (BFSI, IT & Telecommunication, Government & Public Sector, Automotive, Retail & Consumer Goods, Oil & Gas, Manufacturing, Healthcare, Construction & Real Estate, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Intuit Inc., Microsoft Corporation, Oracle Corporation, SAP SE, The Sage Group plc, Xero Ltd., Zoho Corporation Pvt. Ltd., FreshBooks, Wave Financial Inc., MYOB Group Pty Ltd., Infor Inc., Epicor Software Corporation, Unit4 N.V., Patriot Software Company, LLC, Odoo SA, Saasu Pty Ltd., Red Wing Software, Inc., Reckon Limited, Workday, Tipalti, and Others. |