Digital Signature Market Size & Overview:

Get more information on Digital Signature Market - Request Free Sample Report

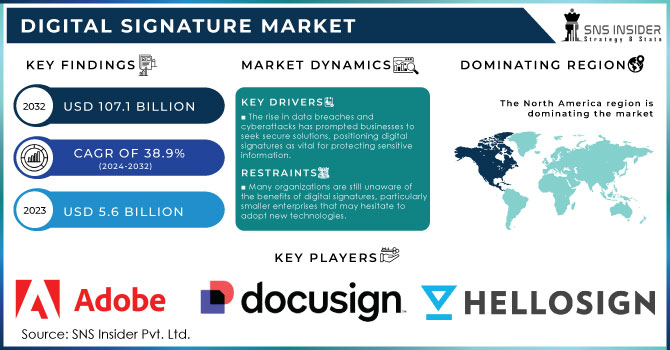

Digital Signature Market size was valued at USD 5.6 Billion in 2023 and is expected to grow to USD 107.1 Billion by 2032 and grow at a CAGR of 38.9 % over the forecast period of 2024-2032.

The digital signature market is driven by growing government initiatives focusing on digitalization, and abiding by legal regulations. Governments across the globe have introduced regulations that demand the use of secure digital signature solutions to reduce fraud, streamline processes, and increase transparency. For instance, the European Union eIDAS Regulation was introduced, which includes a clear legal framework for electronic signature and trust services in Europe. Furthermore, the U.S. government’s passing of the Electronic Signatures in Global and National Commerce Act, alongside the Uniform Electronic Transactions Act also gives digital signatures the same legal stand as handwritten ones in the country. The U.S. Department of Commerce 2023 report stipulates that by 2026, digital transactions will have risen by 35% due to the adoption of secure digital signatures both in the government and private sector. Correspondingly, the Indian government has been pushing for the adoption of digital signatures through its Digital India initiative, and in 2023, the government was reporting a year-on-year increase of 40% in the number of digitally signed documents. These regulatory shifts and growing security concerns continue to drive the digital signature market.

The market is also characterized by opportunities to introduce technologies such as blockchain, which enhances the security and efficiency of signing processes. In addition, the adoption of cloud-based solutions offers scalability and flexibility with regard to the market segments that can be served. The application of digital signatures continues to grow, with the increasing number of e-commerce platforms and remote working. As more countries establish legal frameworks that recognize digital signatures, global expansion becomes feasible. Furthermore, the drive to adopt paperless transactions trends in many industries continues to drive the market.

Digital Signature Market Dynamics

Divers

-

The rise in data breaches and cyberattacks has prompted businesses to seek secure solutions, positioning digital signatures as vital for protecting sensitive information.

-

The transition to cloud computing allows businesses to easily implement digital signatures, enhancing flexibility and accessibility while maintaining security.

-

Legislative frameworks like the ESIGN Act and similar laws worldwide legitimize digital signatures, encouraging widespread adoption across various sectors.

The major driver of the growth of the digital signature market is the increase of security concerns. Nowadays, as organizations are intensively digitalizing their activity, the number of cyber-attacks is becoming more acute. For example, in the recent 2022 study, it was reported that the average data breach cost $4.35 million. So, this financial stroke together with the threats to the reputation of the company motivates companies to look for a more secure way of managing hearing documents. Digital signature brings more security as it guarantees the authenticity and integrity of electronic documents. For this purpose, they use encryption which makes it almost impossible for unauthorized persons to make any changes to signed documents. In addition, as it was reported in the Cybersecurity report, Adobe Sign company possesses information that companies that used their digital signing service filed 50% fewer fraud claims compared to the companies that sought traditional paper signatures. Moreover, in light of such regulatory frameworks as GDPR, companies are forced to apply secure ways of document signing. All these factors together may lead to the assumption that the digital signature market will increase. As organizations become more aware of the potential threats and the benefits of secure signing solutions, the demand for digital signatures is expected to grow significantly.

Restraints:

-

Many organizations are still unaware of the benefits of digital signatures, particularly smaller enterprises that may hesitate to adopt new technologies.

-

Companies with established legacy systems may find it challenging to integrate digital signatures, leading to disruptions and reluctance to change.

One significant restraint for the digital signature market is regulatory compliance challenges. Many of these organizations are challenged by the complexity of such compliance. The laws in different jurisdictions that regulate digital signatures are different. For example, the Electronic Signatures in Global and National Commerce Act governs signature laws in the US, whereas the countries in the European Union adhere to eIDAS. This regulation has some stringent requirements for electronic signatures. The findings recent survey show that 54% of companies consider compliance as the main obstacle to digital transformation, including the implementation of digital signatures. These challenges can lead to hesitation among businesses to adopt digital signature solutions, as the potential for legal repercussions creates a barrier to entry

Digital Signature Market Segment analysis

By Component

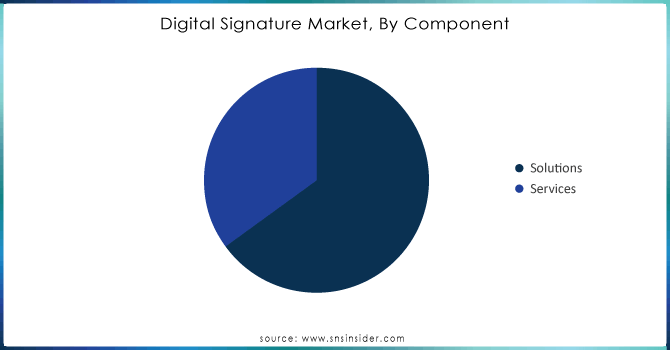

In 2023, the solutions segment accounted for the largest revenue share, 64%, in the digital signature market. This segment’s leadership is associated with a steadily increasing demand for tools for secure and compliant signing with the law and the requirements of a particular region. Over the years, digital signing tools have become critical to organizations that want to handle their transactions, contract signing, and document management digitally. One of the other significant growth drivers is the contribution of governments. According to data published by the European Commission, 85% of the public sector entities and organizations in EU member states have implemented or updated their tools for signing to comply with the eIDAS regulation. This trend likely has a global context, meaning that both big businesses and governments invest in advanced studies. Solutions are expected to remain the segment with the highest share of revenues as more organizations realize the contemporary need for enhanced security and compliance.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Level

In 2023, the Advanced Electronic Signatures segment dominated the market. AES solutions offer superior security features, including cryptographic algorithms that cannot be tampered with, and are compliant with a range of international regulations, including eIDAS in Europe and the E-SIGN Act in the United States. Various organizations handling secure and regulated data, such as health, finance, and government facilities, are increasingly purchasing AES. The 2023 ETSI report on the Digital Signature Market in Europe demonstrated that 78% of surveyed organizations selected AES when implementing a digital signature because of its compliance with strong European data protection rules: GDPR, and the NIST report on digital signature solutions in the United States in 2023 stated that only AES provides higher assurance than a simple electronic signature. Therefore, since the regulatory landscape in the EU, the U.S., and other countries is likely to continue increasing, the AES segment is poised to expand further.

By Industry Vertical

The Banking, Financial Services, and Insurance, or BFSI sector, accounted for the largest share of 27% in the digital signature market. This is because this industry is highly regulated providers of financial services have to comply with strict requirements related to customer authentication, fraud prevention, and sensitive data protection. Therefore, the adoption of electronic signatures has become a response to this industry’s need for secure and well-regulated processes for performing transactions, approving loans, and filing documents with different authorities. Therefore, according to the 2023 report made by The Federal Reserve, 70% of U.S. banks used digital signature solutions to comply with the financial requirements and enhance the client experience. In addition, according to The Reserve Bank of India, the usage of electronic signatures for KYC purposes has increased by 60% in 2023, and this was another factor influencing the above-share percentage of BFSI. The requirements for processes to be secure, compliant, and timely will continue to drive the usage of digital signatures in this field.

Regional Analysis

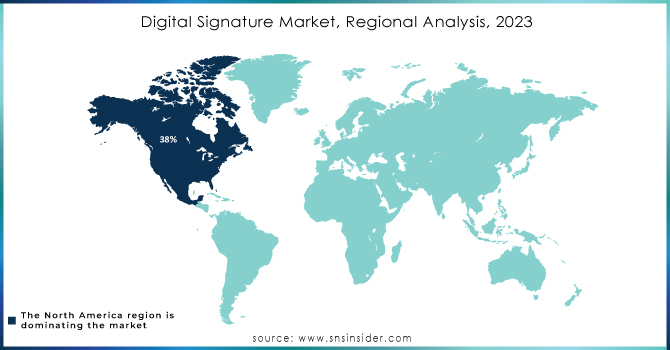

In 2023, North America dominated the digital signature market and held 38% of the market share. This was primarily a result of the early adoption of digital signatures as well as a strong regulatory framework limiting the use of standard digital signatures. In the U.S., the E-SIGN Act together with UETA enforces the adoption of digital signatures in government, businesses, and individuals. On the other hand, in Canada, the Personal Information Protection and Electronic Documents Act established a similar environment favoring the growth of the digital signature market. Moreover, the high receptiveness of digital technologies in various markets including BFSI, healthcare, real estate, and government services creation contributed to this growth. A 2023 report by the U.S. Department of Commerce indicates that North America recorded an approximately 30% increase in using digital signatures in various industrial sectors, reflecting the growing demand for secure digital transactions.

However, the Asia-Pacific region has the highest CAGR. China, India, and Japan were the leading countries in the market accounting for approximately 24% of the market. The growing governments’ and citizens’ adoption of electronic digital signature solutions as part of their digitalization strategies fueled this growth. For example, in India, the Ministry of Communications presented a 40% increase in digitally signed documents in 2023, whereas, In China, the Ministry of Industry and Information Technology announced a set of regulations demanding online sales and government services to utilize standard signatures. The rising adoption of digital services, combined with government support, is positioning Asia-Pacific as a key growth region for the digital signature market.

Key Players

Key Service Providers

-

DocuSign (DocuSign Agreement Cloud, DocuSign eSignature)

-

Adobe Systems (Adobe Sign, Adobe Document Cloud)

-

HelloSign (HelloSign API, HelloSign eSignature)

-

PandaDoc (PandaDoc eSign, PandaDoc Document Automation)

-

SignNow (SignNow eSignature, SignNow API)

-

eSignLive by VASCO (eSignLive, eSignLive API)

-

OneSpan (OneSpan Sign, OneSpan Identity Verification)

-

SignEasy (SignEasy for iOS, SignEasy for Android)

-

RightSignature (RightSignature Document Management, RightSignature API)

-

CybSafe (CybSafe Digital Signature, CybSafe Compliance)

Key Users of Digital Signature Services

-

JPMorgan Chase (Digital Document Management, eSigning Solutions)

-

HSBC (HSBC Digital Banking, eSignatures for Transactions)

-

Wells Fargo (Wells Fargo Digital Documents, eSigning Services)

-

Morgan Stanley (Morgan Stanley Client Agreements, Digital Signatures)

-

CitiBank (CitiBank E-Signature Services, Digital Banking Solutions)

-

American Express (American Express Digital Accounts, eSigning Features)

-

Allianz (Allianz Digital Insurance, eSignatures for Policies)

-

Deloitte (Deloitte Digital Solutions, E-signature Integration)

-

Pfizer (Pfizer Clinical Trials, Electronic Signatures for Approvals)

-

Boeing (Boeing Digital Document Management, eSigning for Contracts) and others

Recent Developments

-

In May 2023, The U.S. National Institute of Standards and Technology reviewed guidelines for digital signatures and released them as a part of the Digital Identity Guidelines to enhance the security standards of AES and QES. Consequently, the NIST guidelines will be used for enhancing security in data transactions for the numerous amounts of federal and private sector entities.

-

In February 2023, Zoho upgraded a Zoho Sign product for ISVs and OEMs to enable them to include digital signature functionality in other products. Thus, the Zoho Sign application will obtain strong APIs, mobile SDKs, SSO authentication, and fully customized branding features.

-

In January 2023, DocuSign and TechnoBind established a cooperation to introduce eSignature technology in India, supporting the Digital India rescue. Hence, the agreement process will be facilitated by the embedded eSignature, contract life cycle management, and document generation tools.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 |

USD 5.6 Billion |

| Market Size by 2032 |

USD 107.1 Billion |

| CAGR | CAGR of 38.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Deployment Model (On-premises and Cloud) • By End-user (Individuals, Businesses, Organizations) • By Industry Vertical (BFSI, Health Care & Life Science, IT & Telecom, Government, Retail, Others) • By Level (Advanced Electronic Signatures (AES), Qualified Electronic Signatures (QES)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

DocuSign, Adobe Systems, HelloSign, PandaDoc, SignNow, eSignLive by VASCO, OneSpan, SignEasy, RightSignature, CybSafe |

| KEY DRIVERS | •The rise in data breaches and cyberattacks has prompted businesses to seek secure solutions, positioning digital signatures as vital for protecting sensitive information •The transition to cloud computing allows businesses to easily implement digital signatures, enhancing flexibility and accessibility while maintaining security •Legislative frameworks like the ESIGN Act and similar laws worldwide legitimize digital signatures, encouraging widespread adoption across various sectors. |

| Restraints | •Many organizations are still unaware of the benefits of digital signatures, particularly smaller enterprises that may hesitate to adopt new technologies •Companies with established legacy systems may find it challenging to integrate digital signatures, leading to disruptions and reluctance to change |