Adhesion Barrier Market Report Scope & Overview:

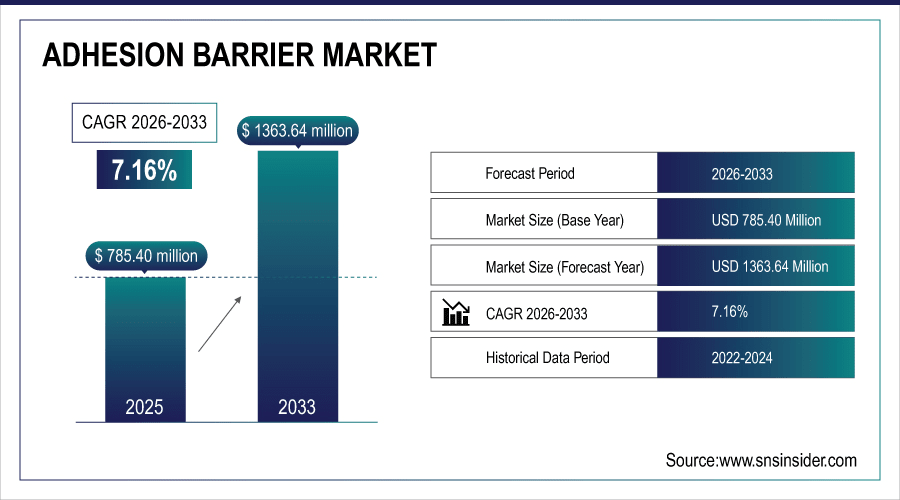

The Adhesion Barrier Market size was valued at USD 785.40 million in 2025E and is projected to reach USD 1363.64 million by 2033, growing at a CAGR of 7.16% during 2026-2033.

The growth of the global adhesion barrier market is influenced by the increasing prevalence of post-surgical adhesions, which remain associated with severe complications and prolonged morbidity among patients. In parallel to this, innovations in product development, including bioabsorbable films, hydrogel-based solutions, and sprayable products, are enhancing treatment outcomes. Such advances make their application, safety, and efficacy improved, and adhesion barriers are becoming more and more an essential part of current surgical procedures globally.

For instance, in June 2024, Baxter’s PEG-based hydrogel adhesion barrier reduced re-operation rates in cardiovascular surgeries, showing improved safety and effectiveness.

To Get More Information On Adhesion Barrier Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 785.40 million

-

Market Size by 2033: USD 1363.64 million

-

CAGR: 7.16% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Adhesion Barrier Market Trends

-

Rising number of surgical procedures, particularly gynecological, abdominal, and orthopedic, is driving global demand for adhesion barrier products.

-

Expansion of minimally invasive and laparoscopic surgeries is boosting the adoption of advanced adhesion prevention solutions in hospitals and surgical centers.

-

Growing development of next-generation adhesion barriers, including bioabsorbable films, hydrogels, and sprayable formulations, is supporting improved clinical outcomes.

-

Increasing investment by healthcare institutions and research organizations is creating steady demand for clinical trials and new adhesion barrier innovations.

-

Adoption of FDA, CE, and ISO-compliant adhesion barriers enhances safety, quality assurance, and global regulatory acceptance, strengthening market confidence.

-

Expansion of premium and innovative adhesion barrier products across North America, Europe, and Asia-Pacific offers new growth opportunities for suppliers

U.S. Adhesion Barrier Market Insights

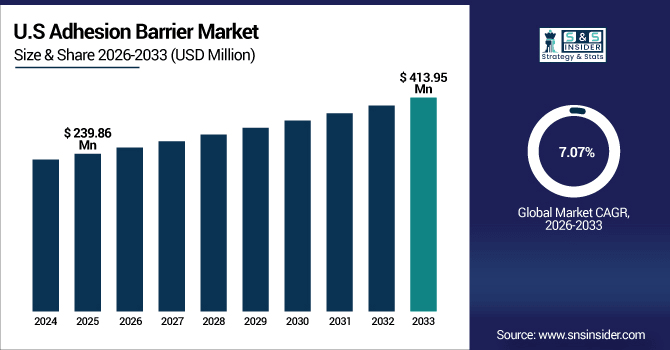

The U.S. Adhesion Barrier Market size was valued at USD 239.86 million in 2025E and is projected to reach USD 413.95 million by 2033, growing at a CAGR of 7.07% during 2026-2033. The US is the largest market for adhesion barriers due to its advanced healthcare system, which encourages the introduction and adoption of new products in hospitals and surgery centers. Furthermore, players like Ethicon, Baxter, and BD have a solid foothold, which is a big plus in favor for the market keeping the US as a hub for adhesion barrier innovation.

Adhesion Barrier Market Growth Drivers:

-

Growing Awareness of Post-Surgical Complications Driving Adhesion Barrier Consumption Growth

The adhesion barrier industry is gaining momentum due to rising post-surgery complications awareness in surgeons and healthcare professionals. Adhesions result in severe complications, including infertility, bowel obstruction, and chronic pain, and have a great influence on the quality of life. This increasing awareness leads to the implementation of adhesion barriers in hospitals and surgical centers as preventive treatment, with the reiteration of these barriers being the established standard of care in surgical procedures globally.

For instance, in March 2025, U.S. hospitals reported a 15% increase in adhesion barrier use during abdominal surgeries, reflecting a stronger focus on complication prevention.

Adhesion Barrier Market Restraints:

-

High Cost of Adhesion Barrier Products Limits Market Expansion Globally

High cost allocated to adhesion barrier products is a significant factor hindering the growth of the adhesion barrier market. These expensive items, frequently made of sophisticated biomaterials, notably add to the total cost of surgery. Where costs are more significant, or in smaller health care providers, budget restrictions preclude the adoption of such platforms, which have clinical value. Hospitals tend to favor the most essential surgical tools over high-end products, which has slowed penetration. This price challenge underscores the dichotomy of advances and cost, which limits broader use and influences the adhesion barrier market share globally.

Adhesion Barrier Market Opportunities:

-

Expansion In Minimally Invasive Surgeries Creates Growth Opportunities for the Adhesion Barrier Market

Increasing use of minimally invasive surgical procedures is a major growth opportunity for the adhesion barrier market. Laparoscopic and robot-assisted surgeries, which are becoming more common due to diminished recovery times and lower risk of surgical complications, are not without risk of postoperative adhesions. Such a trend is now pushing hospitals and surgery centers to utilise new/advanced products that serve as adhesion barriers to facilitate in avoiding complications, aiding in better outcomes for patients, and driving procedural efficiency.

For instance, in April 2024, over 70% of U.S. abdominal surgeries were laparoscopic, driving increased adoption of adhesion barrier products to prevent complications.Top of Form

Adhesion Barrier Market Segment Analysis

-

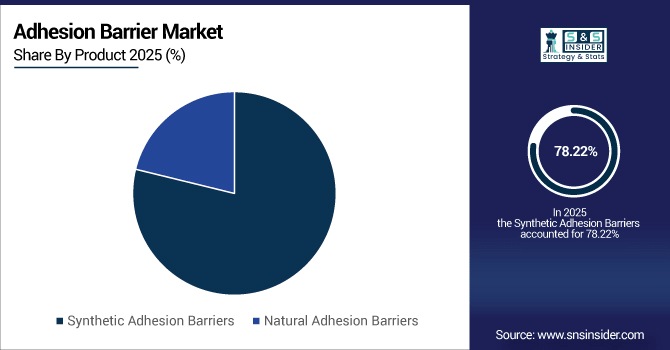

By product, synthetic adhesion barriers led the adhesion barrier market with an 78.22% share in 2025E, while natural adhesion barriers are the fastest-growing segment with a CAGR of 7.57%.

-

By application, the cardiovascular surgeries dominated the market with a 40.86% share in 2025E, whereas the gynecological surgeries segment is expected to grow fastest with a CAGR of 7.79%.

-

By formulation, film/mesh led the market with a 50.84% share in 2025E, while gel platforms are registering the fastest growth with a CAGR of 8.22%.

-

By end-user, hospitals held 72.86%share in 2025E, while ambulatory surgery centers are growing the fastest with a CAGR of 7.58%.

By Product, Synthetic Adhesion Barriers Lead Market While Natural Adhesion Barriers Register Fastest Growth

The synthetic adhesion barriers segment dominated the adhesion barrier market with a revenue share of about 78.22% in 2025E, its better biocompatibility, predictable resorption, and practical use. Key driving factors are the increasing number of surgical procedures, increasing awareness about post-surgical adhesion, and technological advancements, including the development of bioresorbable films. The natural adhesion barriers segment will grow at the highest CAGR of nearly 7.57% CAGR between 2026 and 2033, as growing demand for biocompatible, biodegradable materials. Increasing utilization of the product in gynecological and abdominal surgeries, emphasis on minimizing adverse effects.

By Application, Cardiovascular Surgeries Dominate While Gynecological Surgeries Show Rapid Growth

The cardiovascular surgeries segment was estimated to be the largest revenue generator with an approximate 40.86% of the total market share in 2025E, owing to high-risk procedures, which would favour post-operative adhesions. Market factors for expanding adhesion barrier space include the rising incidence of cardiac surgeries, the increasing awareness of adhesion-related complications. For instance, the Gynecological surgeries segment is anticipated to be the fastest growing with a CAGR of around 7.79%, by 2026-2033, owing to the increased minimally invasive procedures, post-surgical adhesions, and enhanced uptake of novel bioresorbable and sprayable barriers. Increasing awareness of fertility preservation and fewer post-treatment complications are leading to exponential market growth globally.

By Formulation, Film/Mesh Lead While Gel Platforms Register Fastest Growth

The Film/Mesh segment accounted for the highest share of revenues in the adhesion barrier market at 50.84% in the year 2025E, owing to its easy application, high effectiveness, strong prevention of adhesion, and compatibility with various experimental operations. Market drivers are its extensive use in gynaecological and general surgical procedures and strong clinician preference. While the Gel platforms segment is expected to achieve the fastest CAGR of approximately 8.22% during the predicted period from 2026-2033, as it can be used in complex and minimally invasive procedures. Drivers for this market include increasing demand for sprayable and bioresorbable gels, better patient outcomes, less adhesion formation, and global acceptance in gynecological, abdominal, and cardiovascular surgeries.

By End-user, Hospitals Lead While Ambulatory Surgery Centers Grow Fastest

The hospitals segment accounted for the largest share of the adhesion barrier market at around 72.86% in 2025E, owing to the experience with a large number of surgeries, adequate facilities, and the availability of a subspecialty surgical team. Favorable driving factors include increasing uptake of adhesion barriers in complicated surgeries, increasing recognition of post-surgical complications, and robust government support. The ambulatory surgery centers segment will have the highest CAGR of nearly 7.58% during 2026–2033, fueled by the higher population of outpatient and minimally invasive surgeries. Market drivers include growing patient preference for minimally invasive surgeries, increased uptake of innovative adhesion prevention solutions, and the growth of ASCs in North America, Europe, and the Asia Pacific.

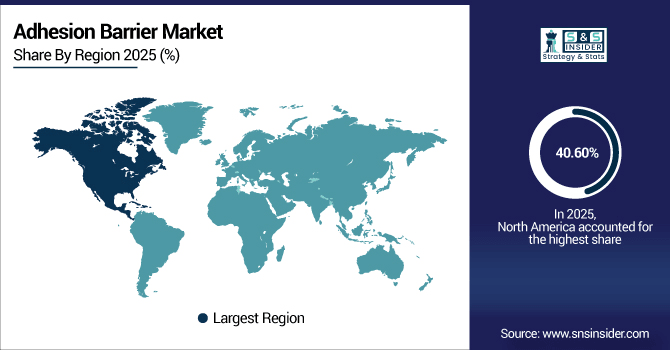

Adhesion Barrier Market Regional Analysis:

North America Adhesion Barrier Market Insights

North America dominates the adhesion barrier market with a market share of 40.60% 2025E, due to the presence of a well-established healthcare infrastructure, high volumes of surgical procedures, and prominent market players including Ethicon, BD, and Baxter. Market growth can be attributed to rising post-surgical incidence of adhesions, the increase in the aging population, and a surge in the laparoscopic surgeries in the country, and a high level of regulatory approvals with new and advanced products with newer indications and more extensive applications drove consumer demands in the country.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Adhesion Barrier Market Insights

The US is the largest market for adhesion barriers due to its advanced healthcare system, which encourages the introduction and adoption of new products in hospitals and surgery centers. Furthermore, players like Ethicon, Baxter, and BD have a solid foothold, which is a big plus in favor of the market keeping the US as a hub for adhesion barrier innovation.

Asia-Pacific Adhesion Barrier Market Insights

Asia-Pacific is the fastest-growing region in the Adhesion Barrier Market, registering a CAGR of 7.91% over the forecast period, owing to a rise in healthcare investments, growth in the hospital infrastructure, and an increase in the number of minimally invasive surgeries. The growth of this market is driven by the increasing incidence of post-surgical adhesion, the large geriatric population, the increasing volume of surgical procedures in an aging population, and the growth in the aging population. All these factors together contribute to the increasing acceptance of advanced adhesion barrier products in the region.

China Adhesion Barrier Market Insights

China is the largest market for adhesion barriers. This is attributed to a large patient base, an increasing number of hospitals and surgical centers, growing awareness about the complications associated with postsurgical adhesions, an increasing number of minimally invasive surgeries, and a high adoption rate of technologically advanced bioresorbable and hydrogel-based products.

Europe Adhesion Barrier Market Insights

Europe also occupies a significant share in the adhesion barrier market, driven by well-established healthcare systems, a large volume of surgical procedures, and high uptake of minimally invasive and other advanced surgical procedures. Some of the key driving factors the adoption of adhesion barriers market are rising awareness among surgeons regarding post-surgical adhesion, production of supportive results for adhesion barriers in clinical studies, rise in demand for post-surgical adhesion in abdominal and gynecological surgery and wide availability of sprayable adhesion barrier, bioresorbable films, and gels of adhesion barrier products in key countries including Germany, France and the U.K.

Germany Adhesion Barrier Market Insights

Germany is dominating the adhesion barrier market on account of superior healthcare facilities, large volume of surgeries, early adoption of minimally invasive procedures, well-established reimbursement system, high adoption of bioresorbable films, and hydrogel-based adhesion barriers in hospitals and surgical centres.

Latin America (LATAM) and Middle East & Africa (MEA) Adhesion Barrier Market Insights

Latin America and the Middle East & and Africa are the emerging regions in the adhesion barrier market. Growth in these regions is primarily driven by the increasing healthcare expenditure, growing hospital infrastructure, and increasing awareness about the post-surgical adhesion complications. Use of next-generation bioresorbable films, gels, and sprayable barriers has been growing steadily due to the introduction of government initiatives, regulatory approvals, and the establishment of multinational and regional manufacturers looking to tap the potential growth of these emerging healthcare markets.

Adhesion Barrier Market Competitive Landscape:

BD is one of the world's largest medical technology firms with Interceed adhesion barriers. The company has a focus on leading medical technology innovations, R&D capabilities, and increasing minimally invasive surgical applications. Its broad deployment base and compliance with regulations ensure a strong foothold in the market, especially in North America and Europe.

-

In May 2024, BD launched an enhanced Interceed film with improved handling and faster resorption for minimally invasive gynecological and abdominal surgeries, expanding adoption in North America and Europe.

Ethicon, a Johnson & Johnson subsidiary which has strong products in Seprafilm. It uses superior bioresorbable materials, along with substantial clinical data and surgeon education initiatives. Broad acceptance in gynecological, abdominal, and cardiovascular surgeries makes Ethicon one of the true market leaders globally, with its extensive healthcare infrastructure and approval processes.

-

In September 2024, Ethicon introduced a next-generation Seprafilm hydrogel formulation aimed at reducing post-surgical adhesions in cardiovascular procedures, backed by multicenter clinical trial data showing improved efficacy.

Baxter provides polyethylene glycol (PEG) based hydrogel adhesion barriers that are clinically proven for cardiovascular and abdominal procedures. The company focuses on innovation, safety, and clinical outcomes that support positive patient outcomes in hospitals and surgery centers. Strategic collaboration, global distribution, and regulatory approval facilitate the presence of Baxter in the adhesion barrier market.

-

In February 2025, Baxter expanded its PEG-based hydrogel adhesion barrier portfolio with new formulations for laparoscopic and robotic-assisted surgeries, enhancing clinical outcomes and surgeon ease-of-use in major hospitals globally.

Adhesion Barrier Market Key Players:

Some of the adhesion barrier market Companies are:

-

Becton, Dickinson and Company

-

Ethicon

-

Baxter International Inc.

-

FzioMed Inc.

-

Mölnlycke Health Care

-

Confluent Surgical

-

CryoLife, Inc.

-

Integra LifeSciences

-

Terumo Corporation

-

Cohera Medical, Inc.

-

SurgiQuest

-

Medtronic plc

-

Adhezion Biomedical

-

BioHorizons, Inc.

-

Anika Therapeutics, Inc.

-

Cousins Medical

-

GlucoSite Medical

-

Axia Medical

-

Hemoshear Technologies

-

Polyganics BV

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 785.40 Million |

| Market Size by 2033 | USD 1363.64 Million |

| CAGR | CAGR of 7.16% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Synthetic Adhesion Barriers, Natural Adhesion Barriers) • By Application (Gynecological surgeries, Abdominal general surgeries, Orthopedic surgeries, Cardiovascular surgeries, Neurological surgeries) • By Formulation (Film/Mesh, Gel, Liquid) • By End-user (Hospitals, Ambulatory Surgery Centers, Specialty Clinics) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Becton, Dickinson and Company, Ethicon, Baxter International Inc., FzioMed Inc., Mölnlycke Health Care, Confluent Surgical, CryoLife, Inc., Integra LifeSciences, Terumo Corporation, Cohera Medical, Inc., SurgiQuest, Medtronic plc, Adhezion Biomedical, BioHorizons, Inc., Anika Therapeutics, Inc. , Cousins Medical, GlucoSite Medical, Axia Medical, Hemoshear Technologies, Polyganics BV and other players. |