Dermatology Contract Research Organization Market Size Analysis

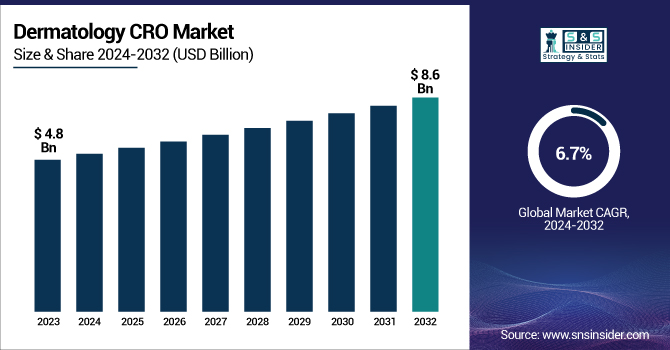

The Dermatology CRO Market was valued at USD 4.8 Billion in 2023 and is expected to reach USD 8.6 Billion by 2032, growing at a CAGR of 6.7% over the forecast period 2024-2032.

To Get more information on Dermatology CRO Market - Request Free Sample Report

The Dermatology Contract Research Organization Market Report includes key statistical insights and trends impacting the industry. The report discusses the incidence and prevalence of dermatological disorders, showcasing the growing need for dermatology clinical trials. The report assesses clinical trial activity and pipeline trends, reporting increases in dermatology-focused research across multiple drug types. The report additionally discusses dermatology R&D spending, trends in products approved by, and compliance with, regulatory agencies, and their potential impact on market growth. The increasing burden of skin diseases across the globe is one of the key factors driving the growth of the dermatology contract research organization (CRO) market. Skin diseases worldwide come in at around 900 million cases according to the World Health Organization of skin diseases and include acne, psoriasis, and eczema. Skin cancer is the most common cancer in the United States, with more than 5 million cases diagnosed each year, according to the U.S. National Institutes of Health.

Dermatology Contract Research Organization Market Dynamics

Drivers

-

Rising prevalence of skin disorders, such as psoriasis, eczema, and acne, necessitating advanced research and clinical trials.

The rising prevalence of skin disorders is a major driver for the dermatology CRO market. With recent studies pointing to an increasing prevalence of disorders including acne, atopic dermatitis (eczema), and psoriasis, the growing need for advanced research and clinical trials. Acne has seen a global increase in prevalence. In the UK, the estimated prevalence of acne among adolescents and young adults was around 14.65% (95% UI, 14.49–14.88) in 2021, a rise from the 1990 prevalence of 13.57% (95% UI, 13.52–13.62). This increase is attributed to factors, including diet, stress, obesity, increased amount of air pollution exposure, and increased accessibility to healthcare. The British Association of Dermatologists suggests that the reality in the UK is likely more that between 75-95% of cases are being managed in this manner (the upper figure being those not seeking treatment to manage the condition at all). Atopic dermatitis also poses a significant burden. It affects 15–30% of children and 2–10% of adults globally in developed countries. In the USA alone, 15 million people are affected, with prevalence rates almost tripling in the past 30–40 years.

Psoriasis, another chronic skin condition, impacts over 8 million Americans. It is about five times more frequent among people of European descent than in Asians, and it is more common in countries further away from the equator. The rising incidence of these skin disorders necessitates ongoing research and development of effective treatments. Dermatology CROs are involved in the execution of clinical trials and the development of new therapies. As the demand for innovative dermatological solutions grows, CROs are increasingly essential in addressing the challenges posed by the escalating prevalence of skin conditions.

Restraints:

-

Stringent regulatory requirements for dermatological drug approvals, leading to extended timelines and increased costs.

Drug approval has strict regulations which present challenges for the dermatology contract research organization (CRO) market. These types of regulations often require long and expensive clinical trials, extending the time to market for new therapies. For instance, recent European Union (EU) guidelines, effective from January 2024, have imposed stricter limitations on medical trials, particularly affecting rare disease treatments. These guidelines favour large-scale randomized controlled trials (RCTs) over single-arm studies, which are often more practical for rare diseases. This shift has raised concerns among nearly 40 patient advocacy groups, who argue that such stringent requirements could delay or deny critical treatments for patients with rare diseases.

In the United States, the Food and Drug Administration (FDA) has seen an increase in dermatologic drug approvals, with 52 new drugs approved between 2012 and 2022. However, the approval process remains rigorous, requiring substantial evidence of efficacy and safety. This often involves multiple phases of clinical trials, each with its own set of regulatory hurdles, contributing to extended development timelines and increased costs for pharmaceutical companies. Additionally, regional regulatory changes can impact market dynamics. In Queensland, Australia, a recent directive has enforced stricter rules on the administration of cosmetic injectables, prohibiting registered nurses and other non-authorized individuals from purchasing and administering substances like Botox without direct involvement from a doctor or nurse practitioner. This has led to confusion and potential legal challenges among industry operators, highlighting how evolving regulations can disrupt existing practices and pose challenges for CROs operating in the dermatology sector.

Opportunities:

-

Adoption of virtual and decentralized clinical trials, leveraging telemedicine and remote monitoring to enhance efficiency and patient participation.

The integration of virtual and decentralized methodologies in dermatology clinical trials presents a significant opportunity to enhance efficiency and patient engagement. Decentralized clinical trials (DCTs) utilize digital health technologies, such as telemedicine, mobile health applications, and remote monitoring devices, enabling patients to participate from their homes. This helps reduce the need for in-person site visits, which can ease the burden on patients and extend access to a wider patient population.

Recent data highlights the increasing adoption of DCTs. In 2021, 94% of research sites had adopted at least one decentralized methodology according to a WCG survey, and 88% were hosting hybrid trials that combined remote technology and in-person visits. The mobile health represented the most frequently used component and was included in 47% of DCTs. This shift is particularly advantageous for the dermatology sector. Standard dermatology trials often struggle to recruit and retain patients in the trial due to the requirement for numerous site appointments. Such decentralised trials can remove travel burdens thereby improving patient convenience and adherence. Furthermore, the use of digital applications for remote monitoring of skin conditions and teledermatology platforms enables real-time data collection and a more dynamic engagement of patients.

Challenges:

-

High competition among CROs, potentially leading to price wars and challenges in maintaining service quality.

One of the biggest challenges in the dermatology Contract Research Organization (CRO) market is intense competition among service providers. This competitive landscape can lead to price wars, where companies undercut each other's pricing to secure contracts, potentially compromising service quality and profitability. Furthermore, the increased number of CROs has saturated the market, preventing individual organizations from recognizing their differentiating factors. In such an environment, CROs should be constantly innovating if they want to be able to provide a unique value proposition for the customer. Additionally, quality issues in relation to CRO services and intellectual property rights (IPR) issues, also hamper the industry growth. Dermatology CROs need to be able to adapt to these new challenges, focusing on improving service quality, protecting intellectual property, and communicating their unique capabilities effectively to prospective clients.

Dermatology Contract Research Organization Market Segmentation Analysis

By Type

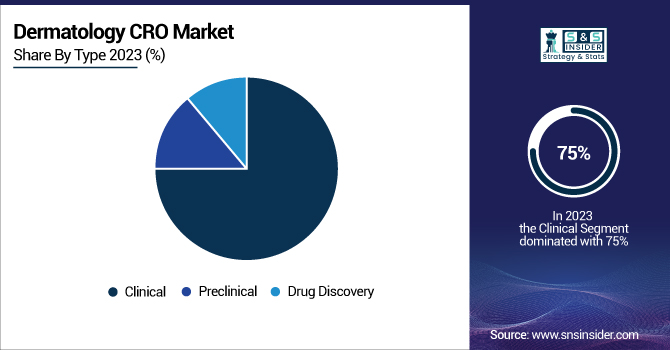

The clinical type segment dominated the Dermatology CRO market, contributing over 75% of revenue share in 2023. This dominance is driven by the growing complexity of clinical trials to the increasing necessity for specialized expertise in dermatological research. According to the U.S. Food and Drug Administration (FDA), dermatology-related Investigational New Drug (IND) applications increased by 68% over the last five years, demonstrating the increasing amount of clinical research in this area. The preclinical segment is anticipated to grow and register the highest CAGR over the forecast period. The growth is majorly attributed to the growing focus on early-stage drug discovery and the necessity of credible preclinical data to back clinical trials. The National Institute of Arthritis and Musculoskeletal and Skin Diseases (NIAMS), whose dermatology funding reflects the complexity of the dermatology research pipeline, has increased its preclinical dermatology funding by 15% over the prior 2 years, as the first phase of drug development is critical.

Government statistics further support these trends. The National Institutes of Health (NIH) allocated $435 million to dermatology research in fiscal year 2023, a 7% increase from the previous year. This additional input resulted in a 22% increase in preclinical studies for innovative dermatology medications. and, the FDA has introduced new guidelines to eliminate bottlenecks from the preclinical to clinical phase, shortening the time for average IND approval in dermatology by 30%. Both clinical and preclinical research in dermatology continue to be buoyed by the increasing prevalence of chronic skin diseases and the continued need for therapeutics. According to the Centers for Disease Control and Prevention (CDC), psoriasis affects about 3% of the U.S. adult population, and atopic dermatitis affects as many as 10% of adults and 20% of children. These statistics underscore the significant market potential for dermatological therapies and the crucial role of CROs in advancing research in this field.

By Service Type

Clinical monitoring held the largest market share 22% of revenue in 2023, owing to the standard and time-consuming process involved in preclinical studies and clinical studies. Such prevalence is largely explained by the importance of clinical monitoring in maintaining the quality of data integrity and safety in dermatological clinical trials. According to the US Food and Drug Administration (FDA), dermatology-related clinical trials have grown by 35% in the past five years indicating an ongoing need for robust clinical monitoring services for the dermatology space. Government statistics also further underscore the importance of research clinical monitoring in dermatology. According to the National Institutes of Health (NIH) Clinical Center, there were over 1,500 dermatology-related clinical studies reported in 2022, a 12% increase from the previous year.

Increasing attention to patient safety and data integrity leads to significant investments in clinical monitoring technologies and resources. Financial performance in dermatology over the past 3 years included a 25% increase in funding for clinical trial oversight and monitoring programs, according to the U.S. Department of Health and Human Services. This investment resulted in tangible patient outcomes a 15% reduction in protocol deviations, and a 20% increase in patient retention rates in dermatology trials. Moreover, the recent increase in the complexity of dermatology studies, including more extensive utilization of precision medicine approaches and incorporation of digital health technologies, further highlights the importance of performance monitoring. According to the National Cancer Institute, 40% of active skin cancer clinical trials today utilize biomarker-driven patient selection, posing the need for high-level monitoring technologies.

Dermatology Contract Research Organization Market Regional Analysis

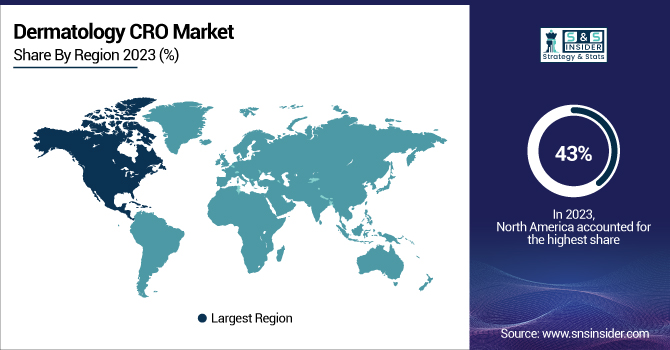

In 2023, North America held the largest share of the Dermatology CRO market with a 43% market share Reflecting the region's robust healthcare infrastructure and high burden of skin disorders, with strong investment in dermatological research. In fiscal year 2023, the U.S. National Institutes of Health (NIH) funded dermatology research with a budget of $435 million dollars, representing a 7% increase over the prior year. Moreover, 8 new dermatology drugs were approved by the U.S. Food and Drug Administration (FDA) in 2023, indicating a strong pipeline within the region. The European region accounted for a prominent market share in 2023, owing to the excellent focus of the region on dermatological research and development. According to EMA, dermatology products represented 12% of total new drug applications in 2023. In 2023, the UK’s National Institute for Health and Care Research (NIHR) awarded £75 million to dermatology research programs, a 15% increase over the previous year.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. Factors such as the rising incidence of skin diseases, increasing healthcare expenditure, and the growing number of clinical trials in countries such as China and India are expected to drive rapid growth. Approved dermatology clinical trials by the Chinese National Medical Products Administration (NMPA) reached more than 300 in 2023, a 30% increase compared to the previous year. In India, the ICMR has worked to make dermatology a funded area in the last two years with an increase in funding of 25% last year.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Dermatology Contract Research Organization Market

-

Galderma (Cetaphil, Differin)

-

ICON PLC (Clinical Trial Management, Data Management Services)

-

Parexel (Clinical Trial Management, Regulatory Consulting)

-

Crown Bioscience International (PDX Models, In Vitro Assays)

-

Sun Pharma (Ilumya, Odomzo)

-

Covance (Clinical Development Services, Laboratory Testing)

-

Quintiles IMS (Clinical Trial Services, Data Analytics)

-

PPD (Pharmaceutical Product Development) (Clinical Trial Management, Laboratory Services)

-

Charles River Laboratories (Preclinical Testing, Safety Assessment)

-

Medpace (Clinical Trial Management, Regulatory Consulting)

-

Syneos Health (Clinical Development Services, Commercialization)

-

PRA Health Sciences (Clinical Trial Management, Data Solutions)

-

WuXi AppTec (Laboratory Testing, Clinical Development)

-

Eurofins Scientific (Bioanalytical Services, Clinical Diagnostics)

-

Labcorp Drug Development (Clinical Trial Management, Central Laboratory Services)

-

KCR (Clinical Development Solutions, Regulatory Affairs)

-

Novotech (Clinical Trial Services, Regulatory Consulting)

-

Tigermed (Clinical Trial Management, Data Management)

-

Pharmaron (Preclinical Research, Clinical Development)

-

ICON Central Laboratories (Central Laboratory Services, Biomarker Analysis)

Recent Developments in the Dermatology Contract Research Organization Market

-

In January of 2025, the U.S. FDA announced an initiative to accelerate dermatology drug development, proposing $50 million in funding for new clinical trial design and to streamline the approval process for dermatological drugs.

-

In November 2024, the European Medicines Agency (EMA) implemented new guidelines for conducting dermatology clinical trials, emphasizing the use of patient-reported outcomes and real-world evidence in regulatory decision-making.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.8 Billion |

| Market Size by 2032 | USD 8.6 Billion |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Drug Discovery, Preclinical, Clinical) • By Service (Project Management/Clinical Supply Management, Data Management, Clinical Monitoring, Regulatory/Medical Affairs, Medical Writing, Quality Management/Assurance, Technology, Patient and Site Recruitment, Bio-statistics, Investigator Payments, Laboratory, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Galderma, ICON PLC, Parexel, Crown Bioscience International, Sun Pharma, Covance, Quintiles IMS, PPD (Pharmaceutical Product Development), Charles River Laboratories, Medpace, Syneos Health, PRA Health Sciences, WuXi AppTec, Eurofins Scientific, Labcorp Drug Development, KCR, Novotech, Tigermed, Pharmaron, ICON Central Laboratories |