U.S. Pharmacy Benefit Management Market Report Scope & Overview:

Get More Information on U.S. Pharmacy Benefit Management Market - Request Sample Report

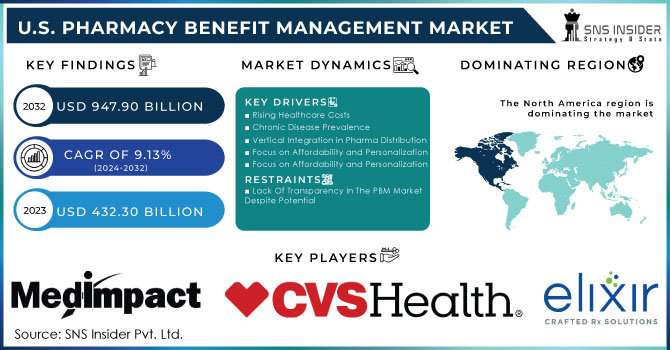

The U.S. Pharmacy Benefit Management Market was valued at USD 432.30 billion in 2023, and is expected to reach USD 947.90 billion by 2032, and grow at a CAGR of 9.13% over the forecast period 2024-2032.

Pharmacy Benefit Managers (PBMs) are a key player in the drug supply chain, acting as gatekeepers for both which drugs patients can get and how much they pay. There is a lack of transparency in how PBMs make these decisions, leaving consumers and policymakers in the dark about how PBMs might be impacting medication affordability.

PBMs negotiate rebates and discounts with drug manufacturers. While studies suggest these rebates can lower costs, others show a concerning trend – rebates may be linked to higher list prices for drugs. This creates an opaque system where PBMs might prioritize deals that benefit their bottom line over affordability for patients.

PBMs also develop formularies as well as lists of medications covered by insurance plans. This directly impacts demand for specific drugs. Patients might be directed towards formulary options, even if they're not the most effective for their condition.

A recent Federal Trade Commission report highlights a concerning trend in the pharmacy benefit management (PBM) industry. Just six companies control a whopping 96% of the PBM market, which translates to managing nearly 95% of all prescriptions filled in the US. This means these few players hold immense power over how hundreds of millions of Americans access their medications.

The market is highly concentrated, with the top three PBMs – CVS Caremark, Express Scripts, and OptumRx they are controlling a staggering 95% of prescriptions filled in the US, according to CNN Report of July 2024. This lack of competition allows PBMs to dictate terms and potentially limit patient choice.

The FTC report in July 2024 highlights how PBM practices, including vertical integration, have limited the supply of affordable prescription drugs. This is represented by nearly 30% of Americans rationing or skipping medications due to high costs.

In simpler terms, consolidation in the PBM industry has given a small number of PBMs significant control over the prescription drug market. This control allows PBMs to influence the availability and price of drugs, potentially limiting patients' access to affordable medications. The report cites the fact that nearly 30% of Americans have reported rationing or skipping medications due to high costs as evidence of this limited supply.

Government initiatives to increase transparency in healthcare costs, the US government has taken steps to address the issue of opaque healthcare pricing through two key regulations:

-

Hospital Price Transparency Final Rule in January 1, 2021: This rule mandates all hospitals to publicly disclose "clear, accessible pricing information online." This empowers patients to compare prices for procedures and services beforehand, allowing them to make informed decisions.

-

Transparency in Coverage Final Rule in July 1, 2022: This regulation targets health insurance companies. It requires insurers offering individual and group plans to publish their in-network prices and out-of-network charges. This transparency extends further with the requirement for online price estimation and comparison tools, implemented in stages throughout 2023 and 2024. These tools allow individuals to estimate their out-of-pocket costs for specific treatments based on their insurance plan.

These regulations represent a significant shift towards a more transparent healthcare system in the US. By empowering patients with price information, they can make informed choices and potentially negotiate better rates. Furthermore, these regulation and initiatives also propels the growth of the U.S. pharmacy benefit management market in coming years.

In the United States, there has been a surge of legislative activity aimed at curbing harmful practices by Pharmacy Benefit Managers (PBMs). This bipartisan effort highlights the government's growing concern about the impact of PBMs on the healthcare system. By mainly focusing on the increased transparency and reporting as well as multiple proposals target the practice of spread pricing and also with limiting PMB revenue and protecting patients to ensure that they have access to affordable medications.

MARKET DYNAMICS

Drivers

-

Rising Healthcare Costs

The ever-increasing cost of healthcare is a major driver for PBM adoption. PBMs help negotiate lower drug prices and manage overall pharmacy benefits, leading to cost savings for insurers and employers.

-

Chronic Disease Prevalence

The growing number of people with chronic conditions like diabetes and heart disease translates to a higher demand for medications. PBMs can help manage these medication needs and optimize costs associated with chronic illnesses.

-

Vertical Integration in Pharma Distribution

Mergers like CVS-Aetna and Cigna-Express Scripts are consolidating the industry and influencing supply chain dynamics. These partnerships between PBMs and health insurance companies are expected to further drive market growth.

-

Focus on Affordability and Personalization

By negotiating discounts and managing formularies, PBMs contribute to making health insurance plans more affordable. Additionally, PBM alliances with healthcare providers can lead to better-aligned treatment plans and personalized care options.

Restraints

-

Lack Of Transparency In The PBM Market Despite Potential

Despite the growth in the PBM market, a major concern is the lack of transparency in their practices. PBMs claim to deliver cost savings, but their opaque business models raise suspicions that they prioritize profit over customer benefit. This lack of clarity hinders stakeholders such as patients, employers, and healthcare providers.

KEY MARKET SEGMENTATION

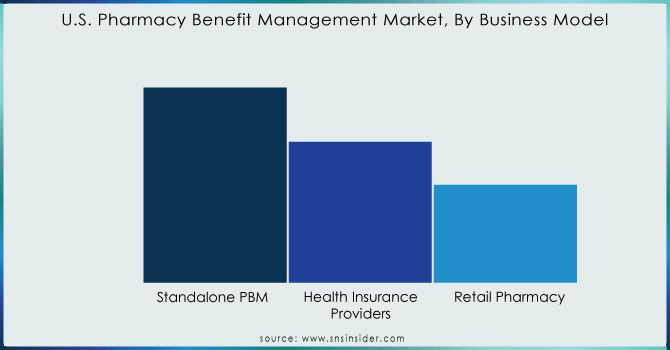

By Business Model

The pharmacy benefit management (PBM) market is dominated by the standalone PBM segment, which held a commanding 37.8% share in 2023. This segment is seeing major mergers, like those involving CVS Health and Express Scripts. These consolidations are expected to give drug manufacturers more control over pricing and better insight into competitor strategies.

However, the fastest-growing segment belongs to health insurance providers. This segment is fueled by the rising number of people with public and commercial health insurance. As the number of beneficiaries increases, insurers are increasingly opting for in-house PBMs or partnering with PBMs to build their own platforms. This trend is exemplified by Humana's acquisition of Enclara Healthcare, a hospice PBM provider, in late 2019.

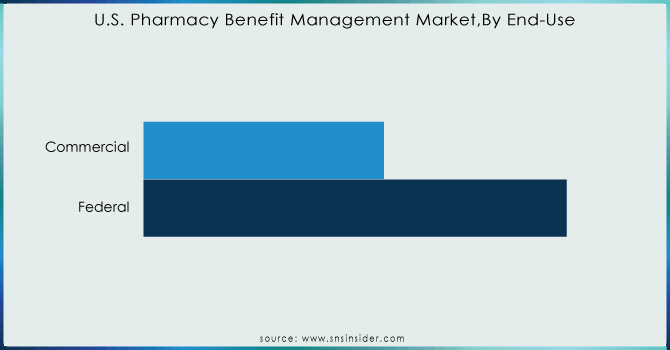

By End-use

The commercial segment is the dominated market segment for health insurance, held the maximum revenue that is 64.65% share in 2023 and projected to stay that way throughout the forecast period. This is because the majority of U.S. employees are registered under commercial private insurance plans. These plans offer a copay system that helps manage the cost of high-priced medications. In 2020, there were around 211 million people covered by private insurance, including both group and non-group plans, according to the Congressional Research Service.

Need any customization research on U.S. Pharmacy Benefit Management Market - Enquiry Now

KEY PLAYERS

MedImpact, Elixir Rx Solutions LLC, CVS Health, HUB International Limited, Cigna, Anthem, Prime Therapeutics LLC, Change Healthcare, CVS Caremark, Express Scripts, and OptumRx and others

Recent Developments

CVS Caremark is shaking things up with CVS CostVantage, a new pharmacy reimbursement model launching in 2025. This aims to simplify the system and bring transparency by linking payments to the quality of services offered. It's a step towards clearer pricing for everyone involved, potentially paving the way for more transparent PBM models.

Optum Rx is presenting a new pharmacy benefits solution named Optum Rx Clear Trend Guarantee. This innovative model tackles rising drug costs by offering a guaranteed single price per member, combining pharmacy costs across retail, home delivery, and specialty drugs. Unlike existing models, Clear Trend Guarantee simplifies budgeting for plan sponsors and potentially lowers costs for individuals and families. Launching in 2025, this solution joins Optum Rx's suite of transparent pricing options.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 432.30 Billion |

| Market Size by 2032 | US$ 947.90 Billion |

| CAGR | CAGR of 9.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Business Model (Standalone PBM, Health Insurance Providers, Retail Pharmacy) •By End-use (Commercial, Federal) |

| Company Profiles | MedImpact, Elixir Rx Solutions LLC, CVS Health, HUB International Limited, Cigna, Anthem, Prime Therapeutics LLC, Change Healthcare, CVS Caremark, Express Scripts, and OptumRx and others |

| Key Drivers | •Rising Healthcare Costs • Chronic Disease Prevalence • Vertical Integration in Pharma Distribution • Focus on Affordability and Personalization |

| RESTRAINTS | • Lack Of Transparency In The PBM Market Despite Potential |