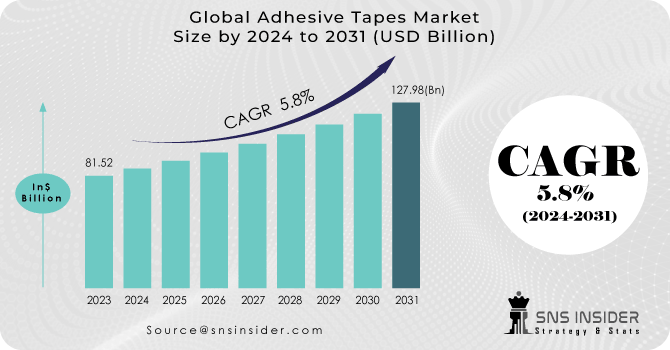

The Adhesive Tapes Market size was valued at USD 81.52 billion in 2023 and is expected to hit USD 127.98 billion by 2031. It is estimated to grow at a CAGR of 5.8% over the forecast period 2024-2031.

The adhesive tapes market is experiencing significant growth due to increased demand from industries such as packaging, automotive, healthcare, and electronics is a major driver. Technological advancements leading to the development of high-performance tapes with enhanced properties like temperature resistance, durability, and customization capabilities also contribute to market expansion. Growing awareness about the benefits of adhesive tapes over traditional fastening methods, such as screws and bolts, is another factor driving adoption. Additionally, the rise in e-commerce activities and the need for efficient packaging solutions further propel market growth. Emerging economies witnessing industrialization and infrastructure development are providing lucrative opportunities for market players, fostering growth in the adhesive tapes sector.

Get More Information on Adhesive Tapes Market - Request Sample Report

In addition, concerns about the environment are leading to a greater demand for adhesive tapes that are eco-friendly, and made from materials that can be recycled. These tapes also use adhesives that don't contain harmful solvents, which helps in achieving sustainability goals. Industries are increasingly adopting lightweighting techniques to make their products lighter, and adhesive tapes are becoming a preferred choice for bonding due to their cost-effectiveness and efficiency. This trend is further boosting the growth of the adhesive tapes market.

Drivers

Technological advancements help to develop high-performance tapes with enhanced properties.

Growing demand from the packaging and construction industry

The packaging industry is a major consumer of adhesive tapes, and its steady growth is a key driver for the adhesive tapes market. E-commerce and the increasing demand for convenience foods are driving the need for strong, reliable, and tamper-evident packaging solutions, which is where adhesive tapes come in. Adhesive tapes are finding increasing use in construction applications such as bonding insulation materials, sealing windows and doors, and adhering carpets and flooring. The growing construction activity in developing economies is another factor propelling the market forward.

Restraint

Volatility in raw material prices

Volatility in raw material prices poses a significant challenge for the adhesive tapes market, as it can lead to uncertain production costs and profit margins. Fluctuations in prices of key raw materials, such as petroleum-based resins or natural rubber, can directly impact the overall manufacturing expenses, potentially affecting pricing strategies and competitiveness in the market. Moreover, sudden price hikes or shortages in raw materials may disrupt supply chains and necessitate adjustments in sourcing strategies, adding complexity to operational planning and management.

Environmental concerns associated with the use of adhesive tapes

Opportunities

Rising preference for eco-friendly tapes

Potential for substitution of traditional fastening systems

Adhesive tapes can offer several advantages over traditional fastening methods such as rivets, screws, and welding, including ease of use, faster assembly times, and improved aesthetics. As manufacturers look for more efficient and cost-effective ways to join materials, the potential for adhesive tapes to substitute traditional methods presents a significant growth opportunity.

Challenges

Regulatory compliance and standards regarding the use of certain adhesive materials.

Intense competition from alternative fastening methods.

Increasing adoption of electric vehicle

Russia and Ukraine are key suppliers of raw materials like wood pulp and chemicals used in adhesives production. The war can disrupt these supplies, leading to shortages and price hikes. Sanctions placed on Russia can limit access to those materials and also inflate energy prices, a key input in adhesive tape production. This has increased production costs and potentially led to price hikes for the final product. The war disproportionately affected certain segments of the adhesive tapes market. For example, the automotive industry, a major user of adhesive tapes, was impacted by sanctions limiting access to car parts manufactured in Russia or Ukraine.

During economic downturns, businesses and consumers tend to tighten their spending. This can lead to decreased demand for adhesive tapes across various industries like construction (due to fewer building projects), manufacturing (due to lower production output), and retail (due to cautious consumer spending). Economic downturns can lead to delays or cancellations of construction and manufacturing projects that rely on adhesive tapes. Economic downturns can lead to disruptions in the global supply chain, impacting the transportation and distribution of adhesive tapes. This can cause delays and shortages, affecting manufacturers and end-users.

The demand for adhesive tapes in essential applications like packaging (particularly for e-commerce) and repairs might remain stable or even see a slight increase during economic downturns. Downturns can push manufacturers to find more cost-effective adhesive tape solutions, potentially driving innovation in material selection and production processes.

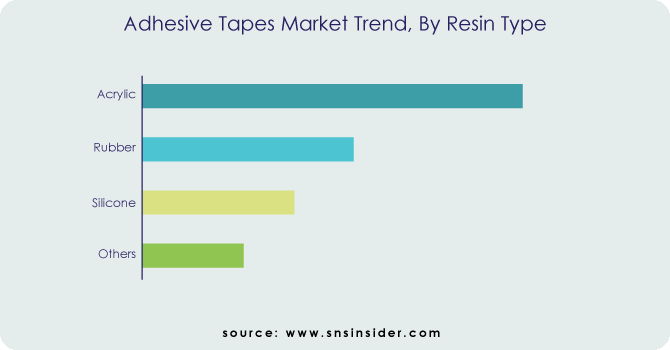

By Resin Type

Acrylic

Rubber

Silicone

Others [EVA And Butyl]

The acrylic segment dominated the resin type of adhesive tapes with the highest revenue share of more than 40% in 2023. This dominance is attributed to its exceptional versatility and performance characteristics. Acrylic adhesive tapes offer superior bonding strength, durability, and resistance to UV rays and extreme temperatures. Additionally, they exhibit excellent adhesion to a wide range of substrates, including plastics, metals, and glass, making them highly sought after across various industries such as automotive, electronics, and construction. Their ability to withstand harsh environmental conditions while maintaining adhesive integrity contributes significantly to their widespread usage and market dominance.

By Backing Material

Paper

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Others

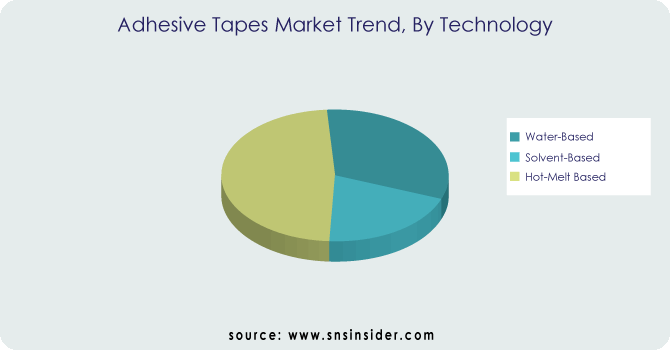

By Technology

Water-Based

Solvent-Based

Hot-Melt Based

Hot-Melt Technology held the largest revenue share of more than 45% in 2023 due to its versatility and efficiency in various applications. Its fast-setting time, strong bonding capabilities, and suitability for a wide range of substrates make it a preferred choice across industries such as packaging, automotive, and construction. Additionally, hot-melt adhesive tapes offer advantages like resistance to temperature fluctuations and moisture, contributing to their widespread adoption and dominance in the market.

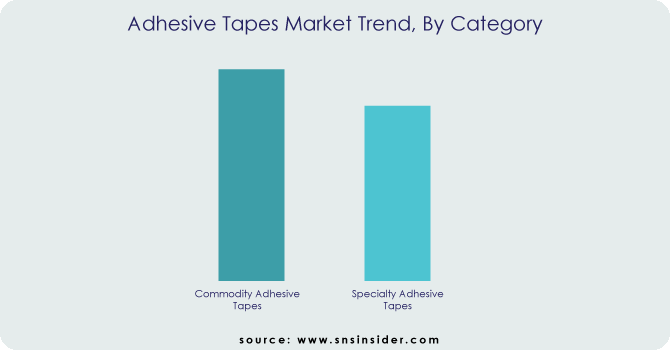

By Category

Commodity Adhesive Tapes

Specialty Adhesive Tapes

Get Customized Report as per Your Business Requirement - Request For Customized Report

By End-Use Industry

Commodity

Masking

Packaging

Consumer & Office

Industrial

Electrical & Electronics

Paper & Printing

Automotive

Healthcare

Building & Construction

White Goods

Retail

Others

The packaging segment held the largest revenue share in 2023 primarily due to the escalating demand for effective packaging solutions across diverse industries. Adhesive tapes are pivotal in packaging, offering secure sealing and ease of handling, particularly in the booming e-commerce sector. Additionally, advancements in tape technology have enhanced their adhesion and tear resistance, further bolstering their prominence in packaging applications.

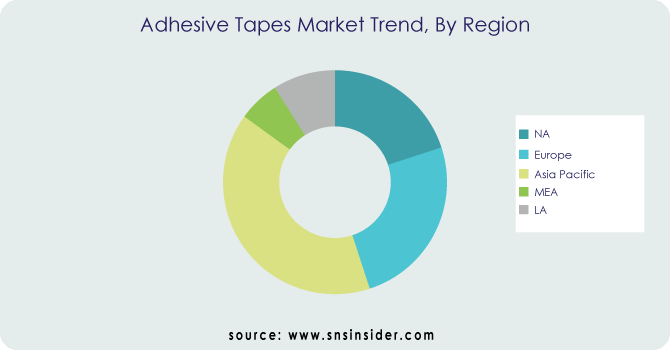

Asia Pacific dominated the Adhesive Tapes Market with the highest revenue share of more than 36% in 2023. The region's robust manufacturing sector, especially in countries like China, Japan, and South Korea, drives substantial demand for adhesive tapes across various industries such as electronics, packaging, and automotive industries. Additionally, rapid urbanization and infrastructure development in emerging economies fuel the need for construction and building materials, where adhesive tapes find extensive usage. Moreover, the burgeoning e-commerce sector in the Asia Pacific boosts the demand for packaging materials, further propelling the growth of the adhesive tapes market in the region. Additionally, the presence of key market players and technological advancements in adhesive tape production contribute to Asia Pacific's leading position in the market.

North America held a substantial share of the Adhesive Tapes Market in 2023 and is expected to grow at a significant CAGR during the forecast period. Innovations in tape technology and increasing applications in industries such as electronics and construction further bolster market growth. Moreover, the region's focus on sustainability and stringent quality standards also contribute to the steady expansion of the adhesive tapes market in North America.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Rogers Corporation (US), Berry Global Inc. (US),3M Company (US), Intertape Polymer Group (Canada), Nitto Denko Corporation (Japan), Lintec Corporation (Japan), Scapa Group PLC (Canada), Lohmann GmbH (Germany), Avery Dennison Corporation (US), Tesa SE (Germany).

In February 2024, Rogers Corporation introduced the DeWAL® Plasma X™ tape, the thinnest single-ply masking tape in the DeWAL® thermal spray masking tape product line. It is specifically designed for applications such as plasma spraying, flame spraying, and grit blasting.

In February 2023, 3M released a new medical adhesive that can adhere to the skin for up to 28 days. This breakthrough product is intended for use with various health monitors, sensors, and long-term medical wearables. Before 2022, extended medical adhesives typically lasted up to 14 days, but 3M has now doubled that standard to enhance patient care.

In May 2021, Intertape Polymer Group Inc., a prominent manufacturer of tapes and films, launched a flame-retardant polyethylene (PE) tape known as PEFR.

In April 2021, Schweitzer-Mauduit International, Inc. completed the acquisition of Scapa Group Plc, a UK-based provider of innovative solutions for healthcare and industrial markets. This strategic move has resulted in a newly combined company with annualized sales approaching $1.5 billion.

In 2020, LINTEC developed a new general-purpose permanent hot-melt adhesive to meet the increasing demand for environmentally friendly labels. This adhesive ensures that labels remain securely attached and offers superior adhesion to curved surfaces.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 81.52 Billion |

| Market Size by 2031 | US$ 127.98 Billion |

| CAGR | CAGR of 5.8% From 2023 to 2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Acrylic, Rubber, Silicone, and Others [EVA And Butyl]) •By Backing Material (Paper, Polypropylene (PP), Polyvinyl Chloride (PVC), and Others) •By Technology (Water-Based, Solvent-Based, and Hot-Melt Based) •By Category (Commodity Adhesive Tapes and Specialty Adhesive Tapes) •By End-Use Industry (Commodity (Masking, Packaging, Consumer & Office), Industrial (Electrical & Electronics, Paper & Printing, Automotive, Healthcare, Building & Construction, White Goods, Retail, and Others)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Rogers Corporation (US), Berry Global Inc. (US),3M Company (US), Intertape Polymer Group (Canada), Nitto Denko Corporation (Japan), Lintec Corporation (Japan), Scapa Group PLC (Canada), Lohmann GmbH (Germany), Avery Dennison Corporation (US), Tesa SE (Germany) |

| DRIVERS |

• Technological advancements help to develop high-performance tapes with enhanced properties. • Growing demand from the packaging and construction industry |

| Restraints |

• Volatility in raw material prices •Environmental concerns associated with the use of adhesive tapes |

Ans: The Adhesive Tapes Market was valued at USD 81.52 billion in 2023.

Ans: The expected CAGR of the global Adhesive Tapes Market during the forecast period is 5.8%.

Ans: The primary factors driving the Adhesive Tapes Market include increasing demand from diverse industries such as packaging, automotive, and electronics. Additionally, technological advancements leading to the development of high-performance tapes with enhanced properties and the rising preference for eco-friendly adhesive tapes are significant drivers.

Ans: Opportunities in the Adhesive Tapes Market include the rising preference for eco-friendly tapes made from recyclable materials, aligning with sustainability goals. Additionally, the increasing adoption of lightweighting techniques in various industries presents opportunities for adhesive tapes as cost-effective and efficient bonding solutions.

Ans: Water-based technology is expected to grow at a high CAGR during the forecast period.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Average Selling Price

9.1 North America

9.2 Europe

9.3 Asia Pacific

9.4 Latin America

9.5 Middle East & Africa

10. Adhesive Tapes Market, By Resin Type

10.1 Introduction

10.2 Trend Analysis

10.3 Acrylic

10.4 Rubber

10.5 Silicone

10.6 Others [EVA And Butyl]

11. Adhesive Tapes Market, By Backing Material

11.1 Introduction

11.2 Trend Analysis

11.3 Paper

11.4 Polypropylene (PP)

11.5 Polyvinyl Chloride (PVC)

11.6 Others

12. Adhesive Tapes Market, By Technology

12.1 Introduction

12.2 Trend Analysis

12.3 Water-Based

12.4 Solvent-Based

12.5 Hot-Melt Based

13. Adhesive Tapes Market, By Category

13.1 Introduction

13.2 Trend Analysis

13.3 Commodity Adhesive Tapes

13.4 Specialty Adhesive Tapes

14. Adhesive Tapes Market, By End-Use Industry

14.1 Introduction

14.2 Trend Analysis

14.3 Commodity

14.3.1 Masking

14.3.2 Packaging

14.3.3 Consumer & Office

14.4 Industrial

14.4.1 Electrical & Electronics

14.4.2 Paper & Printing

14.4.3 Automotive

14.4.4 Healthcare

14.4.5 Building & Construction

14.4.6 White Goods

14.4.7 Retail

14.4.8 Others

15. Regional Analysis

15.1 Introduction

15.2 North America

15.2.1 USA

15.2.2 Canada

15.2.3 Mexico

15.3 Europe

15.3.1 Eastern Europe

15.3.1.1 Poland

15.3.1.2 Romania

15.3.1.3 Hungary

15.3.1.4 Turkey

15.3.1.5 Rest of Eastern Europe

15.3.2 Western Europe

15.3.2.1 Germany

15.3.2.2 France

15.3.2.3 UK

15.3.2.4 Italy

15.3.2.5 Spain

15.3.2.6 Netherlands

15.3.2.7 Switzerland

15.3.2.8 Austria

15.3.2.9 Rest of Western Europe

15.4 Asia-Pacific

15.4.1 China

15.4.2 India

15.4.3 Japan

15.4.4 South Korea

15.4.5 Vietnam

15.4.6 Singapore

15.4.7 Australia

15.4.8 Rest of Asia Pacific

15.5 The Middle East & Africa

15.5.1 Middle East

15.5.1.1 UAE

15.5.1.2 Egypt

15.5.1.3 Saudi Arabia

15.5.1.4 Qatar

15.5.1.5 Rest of the Middle East

15.5.2 Africa

15.5.2.1 Nigeria

15.5.2.2 South Africa

15.5.2.3 Rest of Africa

15.6 Latin America

15.6.1 Brazil

15.6.2 Argentina

15.6.3 Colombia

15.6.4 Rest of Latin America

16. Company Profiles

16.1 Rogers Corporation

16.1.1 Company Overview

16.1.2 Financials

16.1.3 Products/ Services Offered

16.1.4 SWOT Analysis

16.1.5 The SNS View

16.2 Berry Global Inc.

16.2.1 Company Overview

16.2.2 Financials

16.2.3 Products/ Services Offered

16.2.4 SWOT Analysis

16.2.5 The SNS View

16.3 3M Company

16.3.1 Company Overview

16.3.2 Financials

16.3.3 Products/ Services Offered

16.3.4 SWOT Analysis

16.3.5 The SNS View

16.4 Intertape Polymer Group

16.4 Company Overview

16.4.2 Financials

16.4.3 Products/ Services Offered

16.4.4 SWOT Analysis

16.4.5 The SNS View

16.5 Nitto Denko Corporation

16.5.1 Company Overview

16.5.2 Financials

16.5.3 Products/ Services Offered

16.5.4 SWOT Analysis

16.5.5 The SNS View

16.6 Lintec Corporation

16.6.1 Company Overview

16.6.2 Financials

16.6.3 Products/ Services Offered

16.6.4 SWOT Analysis

16.6.5 The SNS View

16.7 Scapa Group PLC

16.7.1 Company Overview

16.7.2 Financials

16.7.3 Products/ Services Offered

16.7.4 SWOT Analysis

16.7.5 The SNS View

16.8 Lohmann GmbH

16.8.1 Company Overview

16.8.2 Financials

16.8.3 Products/ Services Offered

16.8.4 SWOT Analysis

16.8.5 The SNS View

16.9 Avery Dennison Corporation

16.9.1 Company Overview

16.9.2 Financials

16.9.3 Products/ Services Offered

16.9.4 SWOT Analysis

16.9.5 The SNS View

16.10 Tesa SE

16.10.1 Company Overview

16.10.2 Financials

16.10.3 Products/ Services Offered

16.10.4 SWOT Analysis

16.10.5 The SNS View

17. Competitive Landscape

17.1 Competitive Benchmarking

17.2 Market Share Analysis

17.3 Recent Developments

17.3.1 Industry News

17.3.2 Company News

17.3.3 Mergers & Acquisitions

18. USE Cases and Best Practices

19. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Chrome Plating Market Size was valued at USD 17.29 billion in 2022, and is expected to reach USD 24.03 billion by 2030, and grow at a CAGR of 4.2% over the forecast period 2023-2030.

The Consumer Foam Market Size was valued at USD 44.1 billion in 2022, and is expected to reach USD 65.15 billion by 2030, and grow at a CAGR of 5.0% over the forecast period 2023-2030

The Construction Chemicals Market was worth USD 41.94 billion in 2022 and is expected to grow to USD 72.06 billion by 2030, with a CAGR of 7.0% in the forecast period.

The Plain bearing Market Size was valued at USD 11.15 billion in 2023 and is expected to reach USD 16.92 billion by 2031 and grow at a CAGR of 5.3% over the forecast period 2024-2031.

The Zero Liquid Discharge Systems Market size was valued at USD 7.26 billion in 2023 and is expected to grow to USD 13.72 billion by 2031 and grow at a CAGR of 8.1% over the forecast period of 2024-2031.

The Squalene Market size was valued at USD 150.26 million in 2023 and is expected to grow to USD 341.24 million by 2031 and grow at a CAGR of 10.8% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone