Squalene Market Report Scope & Overview:

Get more information on Squalene Market - Request Sample Report

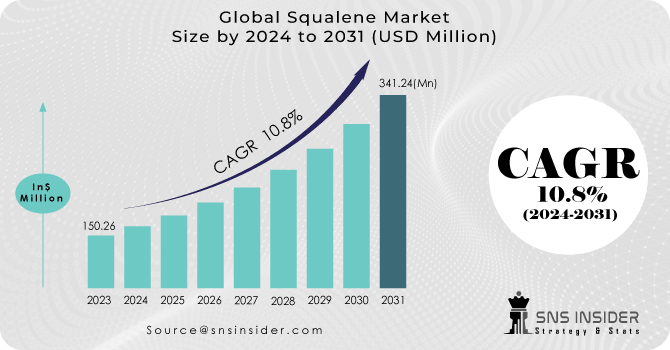

The Squalene Market Size was valued at USD 151.2 Million in 2023 and is expected to reach USD 328.1 Million by 2032, growing at a CAGR of 9.0% over the forecast period of 2024-2032.

The Squalene Market report provides a comprehensive overview of the market along with insights on consumer behavior that affects demand across sectors and supply chain insights that present sourcing challenges. The report measures price evolution, sustainability efforts favoring plant-based substitutes, and the regulatory environment shaping the market context. Investment trends and global sourcing and trade flows are also compared, while key factors and their impact on market dynamics are discussed in detail across a set of chapters.

Market Dynamics

Drivers

-

Rising Awareness of Health Benefits Drives Squalene’s Use in Nutraceuticals and Pharmaceuticals

The increased awareness of Squalene's health benefits has played a vital role in the growth of this compound in pharma and nutraceuticals. Squalene is a natural source of antioxidant, anti-inflammatory, and immune-boosting properties, and the use of squalene in dietary supplements and functional foods for general health and well-being is becoming more common. Moreover, due to its role in the suppression of chronic diseases, including cancer and heart diseases, it has evolved into pharmaceutical formulations. The increasing aging demography and the increasing focus on preventive healthcare also foster the growth of the market. Squalene is patented in Adjuvants in the vaccine industry as well which improves its immune-stimulating properties. The demand for squalene is anticipated to surge owing to the growing incorporation of the compound in health-oriented products as consumers are shifting towards natural and holistic approaches to health solutions.

Restraints

-

High Cost of Squalene Extraction Limits Market Penetration and Accessibility

Squalene extraction from natural sources (olive oil and shark liver oil) is expensive, thus still is still an important restraint for the market. The methods of squalene extraction, such as the elaborate procedures of harvesting it from deep-sea sharks, are costly and resource-heavy. Although there are plant-based Squalene alternatives on the market, Squalene from plants has a higher production cost than Squalene from synthetic routes. Squalene's high production cost restricts large-scale use of Squalene in cost-sensitive industries (food & beverages) and can act as a barrier to new entrants in the Global Squalene market. Furthermore, the cost of sourcing requirements for sustainability and compliance with environmental policies increases the cost load. This, in turn, can decrease the accessibility of Squalene-based products among consumers, restricting market growth potential in developing regions due to the high price sensitivity of the target audience.

Opportunities

-

Growth of Clean Beauty and Natural Ingredient Trends Opens New Market Segments for Squalene

Clean beauty is a growing trend and will create huge opportunities for Squalene producers as customers prefer more natural ingredients in cosmetic applications. Driving this evolution is the rise of consumer awareness of the harmful chemicals found in mainstream beauty products, alongside the rapid transition towards cleaner, sustainable & natural ingredient formulations. These trends are reflected perfectly with squalene, being the center for skin-moist and anti-aging benefits. Squalene – the new parent of the clean beauty movement with its frankness, simplicity, and environmentally friendly ketones which has created beams for skincare products across the globe. Increasing attention to natural ingredients creates a significant opportunity for Squalene manufacturers to tap into the clean beauty segment and enhance their share of sales in the global cosmetics and personal care industry.

Challenge

-

Sustainability and Environmental Impact Concerns Pose a Challenge to Market Growth

The Sustainable sourcing of raw materials, especially from marine animals makes Squalene market difficult to stand with the market trend. While the plant-based alternatives sector will continue to expand, the industry will be challenged by overfishing, ecosystem degradation, and animal welfare issues. Unfortunately, sourcing Squalene from sharks and other marine animals comes at an incredibly high environmental cost, forcing many countries to impose strict regulations enabling further backlash from the public and prompting the beauty industry to turn towards more sustainable sourcing methods. Even though plant-based and synthetic Squalene are considered greener alternatives, bottlenecks in the availability of these methods make scaling a problem in addressing the increasing demand. It is a market-level challenge to balance consumer demand for sustainable products with the need to source raw materials from the environment.

Segmental Analysis

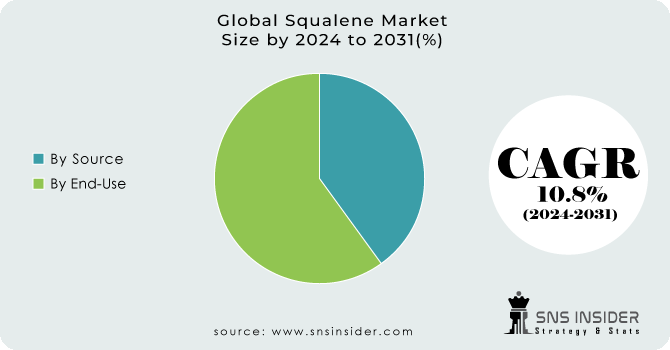

By Source

In 2023, the Plant-derived segment dominated the squalene market and accounted for nearly 45% of the market share. As consumer preference towards sustainable and eco-friendly products increases worldwide, plant-based Squalene is gaining traction in both health and wellness trends. Various organizations like the Environmental Working Group (EWG) and the International Natural and Organic Cosmetics Association (NOC) have and will always advocate for companies to ethically source natural ingredients. With the rise in popularity for more natural cosmetics comes the demand for a plant-based alternative for Squalene, that is ethically and sustainably plant-sourced, such as from olives and sugarcane, as concerns over overfishing continue to grow and consciousness evolve beyond just consumerism. Government regulations further drive the growth of the segment to protect endangered marine species and the choice of the plant segment as the preferred cheap organic substitute for a sustainable product solution among manufacturers.

By End-Use Industry

The personal care and cosmetics segment dominated the Squalene market in 2023 with a market share of nearly 50%. The notable demand for Squalene in skin care formulations should be ascribed to its excellent properties such as emollient and skin moisture enhancer properties. According to reports from organizations such as the Personal Care Products Council, growing consumer demand for clean beauty products has been driving brands in the category to use more natural ingredients such as Squalene. Notable cosmetic brands such as L’Oréal and Estée Lauder have used Squalene more as it works for almost every skin type and has high sustainability credentials. The emphasis on cleanliness and the rise of chemical chemical-free product category have made Squalene an on-trend ingredient in personal care, further cementing its position in the marketplace.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Analysis

Europe holds the largest market share in the Squalene Market as of 2023, amounting to a 38% market share owing to enormous demand for natural and sustainable products in personal care, pharmaceuticals, and nutraceuticals. Support from the European Chemicals Agency (ECHA) and European Food Safety Authority (EFSA) in favor of strict regulations preferentially favoring plant-based and synthetic alternatives to animal-derived sources have resulted in European leadership in the region. Europe, with France at the forefront due to the presence of the huge cosmetic industry in the country where brands like L'Oréal and Chanel are injecting bio-based Squalene into skin care products led the market among the countries. In 2023, French cosmetic exports surpassed €18 billion in worth, further supporting its consumer status for Squalene. Also, Germany is a key country owing to the presence of a well-established pharmaceutical sector in which companies like BASF and Merck & Co., Inc. have adopted Squalene in vaccines and drug formulations. An important input also came from Italy, with its long tradition in the production of olive oil, a main plant-based source of Squalene. Europe remained the global Squalene market leader due to the European Union's emphasis on a larger replacement of shark-derived Squalene as well as substantial investments in sustainable alternatives.

Moreover, the Asia-Pacific region emerged as the fastest-growing market with a CAGR of about 8.5% during the forecast period, primarily due to increasing consumer awareness related to skincare, health supplements, and the advantages of Squalene in pharmaceuticals. That growth would not have been possible without the likes of China, Japan, and South Korea. Fueled by the cosmeceuticals industry and the ongoing trend for investment in bio-chemical companies manufacturing plant Squalene, the expansion of the region was headed by China. Japan has a beauty and personal care market above $76 billion in 2023, incorporating Squalene into skincare products from such notable names as Shiseido, Proya, and several others. Japanese consumers tended to embrace Squalene-based formulations with a high demand for anti-aging and hydrating solutions, including from Shu Uemura and KOSÉ Corporation. Apart from K-beauty, which is an internationally recognized booming market, the demand for bio-based Squalene from serums and moisturizers in South Korea was also owing to the country's attention as a beautiful skincare solution. Furthermore, the regional uptake was fuelled by government initiatives pushing for sustainable sourcing in India and Southeast Asia. With an increase in the number of the middle-class population and rising investments in the research & development of biotechnology-based production of Squalene, Asia-Pacific will emerge as the fastest-growing region for Squalene.

Recent Highlights

-

October 2024: Evonik receives the CPHI Pharma Award for its PhytoSquene, the first GMP-compliant plant-based squalene for parenteral drug delivery, derived from amaranth oil. It was awarded during the CPHI trade show in Milan.

-

May 2023: Amyris has completed a licensing agreement for sustainable squalene supply, giving it a renewable alternative to its traditional sources while strengthening its stance on eco-friendly biotechnology solutions.

Key Players

-

Amyris Inc. (Squalane, Biofene)

-

Asahi Kasei Corporation (Squalane, Olive Squalane)

-

Carotech Bhd (CaroSqualane, CaroSerene)

-

China National Petroleum Corporation (Squalene, Hydrogenated Squalene)

-

EFP (European Fine Chemicals) (Squalane, Plant-based Squalane)

-

Hunan NutraMax Inc. (Squalene, Natural Squalene)

-

Kobe Steel, Ltd. (Squalane, Squalene)

-

Kraton Polymers (Squalane, Kraton Polymers Squalane)

-

Merck & Co., Inc. (Squalene, Natural Squalene)

-

Nucelis (Bio-squalene, Squalene-based products)

-

Olvea (Olvea Squalane, Olive-derived Squalane)

-

Seppic (Emogreen L15, Squalane)

-

Shanxi Tianli Bio-Pharmaceutical Co., Ltd. (Squalene, Fish oil-based Squalene)

-

Sigma-Aldrich Co. LLC (Squalene, Synthetic Squalene)

-

Sophim (Sophim Squalane, Olive-derived Squalane)

-

Squalene International (Squalene, Fish-derived Squalene)

-

TCI Chemicals (India) Pvt. Ltd. (Squalene, Squalane)

-

The Dow Chemical Company (Squalene, Dow Squalane)

-

Tokyo Chemical Industry Co., Ltd. (Squalene, Synthetic Squalene)

-

Vance Group (Squalane, Natural Squalane)

Squalene Market Report Scope:

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 151.2 Million |

| Market Size by 2032 | USD 328.1 Million |

| CAGR | CAGR of 9.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Animal, Plant, Synthetic) •By End-use Industry (Pharmaceuticals, Personal Care & Cosmetics, Nutraceuticals, Food & Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amyris Inc., Merck & Co., Inc., Olvea, Seppic, Squalene International, Sophim, Nucelis, The Dow Chemical Company, Kraton Polymers, Kobe Steel, Ltd. and other key players |