Advanced Packaging Market report scope & overview:

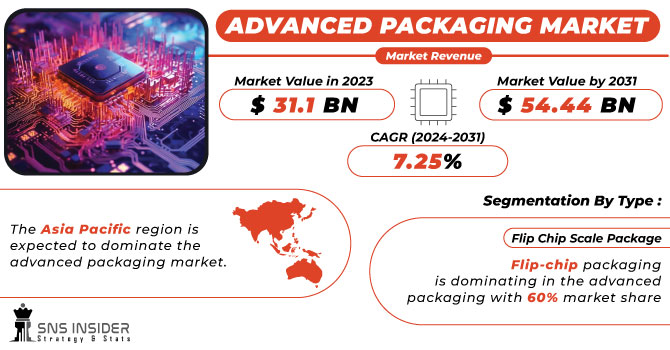

Advanced Packaging Market Size was valued at USD 31.1 billion in 2023 and is expected to reach USD 54.44 billion by 2031 and grow at a CAGR of 7.25% over the forecast period 2024-2031.

The advanced packaging market is poised for significant growth, driven by the increasing demand for miniaturization and performance improvements in electronic devices. This technology allows for the integration of multiple chips into a single package, leading to faster signal speeds, lower power consumption, and increased functionality.

Get More Information on Advanced Packaging Market - Request Sample Report

Key growth areas include embedded die packaging, which is expected to benefit from the rise of 5G technology and its requirement for compact, efficient devices. The surge in 5G adoption is fueling the advanced packaging market. Ericsson predicts a massive jump in subscriptions, from 12 million to over 4.5 billion by 2028, with Southeast Asia and neighbouring regions leading the charge. This highlights the growing need for compact and efficient devices that advanced packaging solutions can deliver.

The transition from 100mm to 300mm silicon wafers has also significantly impacted the market by reducing manufacturing costs and encouraging investment in innovative packaging solutions. However, the market faces challenges due to potential disruptions in product support after mergers and acquisitions, particularly for industries reliant on long-lived devices. With major players in the market consolidating to remain competitive, navigating this trend will be crucial for the future of advanced packaging.

MARKET DYNAMICS:

KEY DRIVERS:

-

The electronics industry's growing demand for miniaturization of devices is driving the need for advanced packaging solutions.

The tech world desires ever-smaller devices, from smartphones to medical implants. This miniaturization trend across industries like consumer electronics, healthcare, and automotive is pushing manufacturers to rethink traditional packaging solutions. Advanced packaging techniques are crucial to fit complex components into these compact devices, ensuring everything functions flawlessly.

-

Advanced packaging offers the potential to significantly improve system performance and optimize device miniaturization.

RESTRAINTS:

-

The high cost of advanced packaging remains a significant hurdle to its widespread adoption across various industries.

Compared to traditional methods, advanced packaging is significantly more expensive. This high cost is a result of several factors, including the inherent expensiveness of designing and manufacturing chips at advanced levels, the increased complexity of wafer fabrication for intricate circuits, and the elaborate packaging process itself. These high costs are a hurdle that needs to be overcome for advanced packaging to see widespread adoption.

-

The potential disruption to existing technology support after acquisitions could hinder market growth, especially for industries relying on devices with long lifespans.

OPPORTUNITIES:

-

The medical device industry is seeing a rise in demand for miniaturized equipment for robotic surgery and sophisticated wearable health gadgets.

-

Advanced packaging boosts AI by tightly linking components for faster, smarter processing, attracting industries like auto and healthcare.

Advanced packaging technology unlocks the power of artificial intelligence (AI), machine learning, and deep learning by enabling the interconnection of various processing elements and memory units through high-speed connections. This translates to enhanced operational capabilities and more precise processing, making advanced packaging a valuable asset for industries like automotive, healthcare, aerospace & defence, and industrial applications. As a result, these sectors are increasingly adopting advanced packaging solutions to improve their products' functionality and performance.

CHALLENGES:

-

The global financial crisis brought about stricter regulations and a new market landscape, impacting advanced packaging.

The global financial crisis left its mark on the advanced packaging market through stricter regulations and a fundamentally changed market landscape. In response, companies providing outsourced semiconductor assembly and test services have ramped up mergers and acquisitions (M&A) activity to stay competitive. This trend of consolidation among major players is expected to continue in the coming years, potentially reshaping the industry structure.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Ukraine is creating impact across the advanced packaging market. Disruptions to the supply chain due to depleted weapon stockpiles in Western nations and sanctions on Russia could impact the availability of key metals like cobalt and nickel, critical materials for advanced packaging substrates and interconnects. A shortage of these metals could potentially lead to production slowdowns or limitations, impacting lead times and potentially raising costs for advanced packaging materials. Additionally, rising energy costs stemming from the conflict could increase transportation costs throughout the supply chain, further pressuring margins for advanced packaging manufacturers. While the overall impact on the market remains to be seen, these factors combined could potentially lead to price hikes for advanced packaging solutions, potentially dampening demand in the short term.

IMPACT OF ECONOMIC SLOWDOWN

The advanced packaging market faces a challenging road ahead due to a potential economic slowdown. Consumer spending might decline, and raw material costs could fluctuate wildly due to geopolitical tensions. Additionally, subdued economic growth might dampen overall demand. To navigate these challenges, industry players need to adapt their supply chains, prioritize sustainability practices, and collaborate effectively to establish a robust regulatory framework. While challenges exist, this period can also be an opportunity for innovation and building resilience through strategic partnerships and a strong commitment to environmental responsibility.

KEY MARKET SEGMENTS:

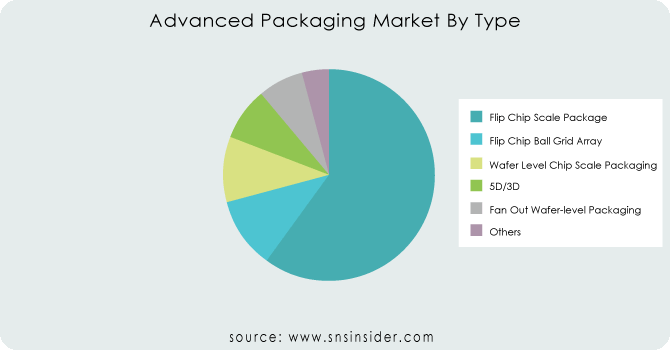

By Type

-

Flip Chip Scale Package

-

Flip Chip Ball Grid Array

-

Wafer Level Chip Scale Packaging

-

5D/3D

-

Fan Out Wafer-level Packaging

-

Others

Flip-chip packaging is dominating in the advanced packaging with 60% market share, due to its space-saving design and ability to handle complex electronics for applications like AI and IoT devices. It offers shorter connections for faster signals and more connection points in a smaller area.

Need any customization research on Advanced Packaging Market - Enquiry Now

By End User

-

Consumer Electronics

-

Healthcare

-

Industrial

-

Aerospace and Défense

-

Automotive

-

Other

The consumer electronics market is expected to be the biggest user of advanced packaging for the next decade. This is driven by the growing popularity of smart home devices and people's desire for the latest tech in their homes, all leading to a need for more advanced packaging solutions.

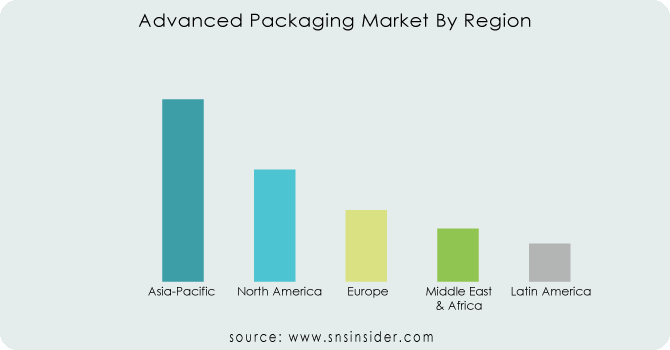

REGIONAL ANALYSES

The Asia Pacific region is expected to dominate the advanced packaging market. This dominance is fueled by several factors such as the presence of major semiconductor manufacturers like China and Taiwan, rapid industrialization across the region, and a booming consumer electronics market. Additionally, Asia Pacific is known for its high-volume semiconductor production and adoption of advanced packaging technologies in various industries like consumer electronics, automotive, and telecommunications. These factors combined are creating a lucrative opportunity for advanced packaging market players in the region. China, for example is heavily invested in its domestic chip industry with a $150 billion government fund and a new state-backed investment fund of $40 billion planned for 2023. This strong push for domestic chip production will significantly increase the demand for advanced packaging services in the region.

The US advanced packaging market is expected to reach nearly $8.9 billion by 2031. This growth is fueled by major players like Intel investing heavily in research and development facilities within the US. These efforts are focused on creating innovative packaging solutions like flip chip and fan-out wafer-level packaging. Intel's Foveros 3D technology is a prime example, promising significant performance gains. These advancements position the US as a key player from North America region in the advanced packaging industry.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Jiangsu Changjiang Electronics Technology Co. Ltd., China Wafer Level CSP Co. Ltd., ASE Technology Holding Co. Ltd., King Yuan Electronics Corp., ChipMOS Technologies Inc., FlipChip International LLC, Powertech Technology Inc., Amkor Technology Inc., HANA Micron Inc., Nepes Corporation, Taiwan Semiconductor Manufacturing Company Limited, TongFu Microelectronics Co., Ltd., UTAC, TEXAS INSTRUMENTS, MICROCHIP TECHNOLOGY INC., QUALCOMM TECHNOLOGIES, INC. and other players.

Jiangsu Changjiang Electronics Technology Co. Ltd-Company Financial Analysis

RECENT DEVELOPMENT

-

In July 2023, Amkor Technology highlighted its progress in developing packaging solutions for chips made with TSMC's advanced low-k technology. They've been collaborating with multiple clients to qualify these new packages and are gearing up for a significant increase in production volume later this year.

-

In November 2022, Intel launched construction of a new facility in Penang to expand its manufacturing capabilities. This big factory will create two buildings and bring 2,700 new jobs to the area by 2025. The factory will put together and test computer chips.

-

Amkor Technology stepped up its commitment to the European automotive industry in October 2022. They plan to ramp up semiconductor production to meet the growing demand for advanced technologies like driver-assistance systems and in-car entertainment systems in European cars.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 31.1 Bn |

| Market Size by 2031 | US$ 54.44 Bn |

| CAGR | CAGR of 7.25% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Flip Chip Scale Package, Flip Chip Ball Grid Array, Wafer Level Chip Scale Packaging, 5D/3D, Fan Out Wafer-Level Packaging, Others) • By End User (Consumer Electronics, Healthcare, Industrial, Aerospace And Defense, Automotive, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Jiangsu Changjiang Electronics Technology Co. Ltd., China Wafer Level CSP Co. Ltd., ASE Technology Holding Co. Ltd., King Yuan Electronics Corp., ChipMOS Technologies Inc., FlipChip International LLC, Powertech Technology Inc., Amkor Technology Inc., HANA Micron Inc., Nepes Corporation, Taiwan Semiconductor Manufacturing Company Limited, TongFu Microelectronics Co., Ltd., UTAC, TEXAS INSTRUMENTS, MICROCHIP TECHNOLOGY INC., QUALCOMM TECHNOLOGIES, INC. |

| Key Drivers | • The electronics industry's growing demand for miniaturization of devices is driving the need for advanced packaging solutions. • Advanced packaging offers the potential to significantly improve system performance and optimize device miniaturization. |

| Key Restraints | • The high cost of advanced packaging remains a significant hurdle to its widespread adoption across various industries. • The potential disruption to existing technology support after acquisitions could hinder market growth, especially for industries relying on devices with long lifespans |