Aerospace Materials Market Report Scope & Overview:

Get more information on Aerospace Materials Market - Request Sample Report

The Aerospace Materials Market size was valued at USD 46.24 billion in 2023 and is expected to reach USD 96.22 billion by 2032 and grow at a CAGR of 8.49% over the forecast period of 2024-2032.

The aerospace materials market is experiencing robust growth, driven primarily by the resurgence in air travel following the COVID-19 pandemic. According to the International Air Transport Association (IATA), global air travel demand surged by 22% in August 2024, demonstrating a significant recovery as passengers return to the skies. This resurgence is creating a heightened demand for new aircraft, consequently fueling the aerospace materials market. Key drivers include an increased emphasis on lightweight materials, such as Aluminum and composites, which enhance fuel efficiency and meet stringent emission standards. Notably, GE Aerospace reported a 75% rise in stock value in 2024 due to strong demand for jet engines, highlighting the industry's optimism and growth potential. The expansion of the aerospace sector is not only limited to commercial airlines but also extends to the Defense industry, which continues to innovate amidst challenges like labour shortages. According to recent analyses, major U.S. airlines are projected to see improved profits as fare wars settle, indicating a more stable pricing environment that is conducive to investment in new materials and technologies. The growing demand for eco-friendly solutions and sustainable aviation fuels further propels the need for advanced aerospace materials. Investment in research and development is crucial for keeping pace with technological advancements, ensuring that aerospace manufacturers remain competitive. Companies like Hexcel Corporation and Alcoa are leading the charge by providing high-performance materials critical to aircraft manufacturing. As air travel is expected to grow continually, the aerospace materials market is positioned for sustained growth, driven by innovation, demand for fuel efficiency, and evolving industry standards.

Market Dynamics

Drivers

-

The Compliance Catalyst Driving Government Regulations Shaping the Future of Aerospace Materials

Government regulations and standards are pivotal drivers of the aerospace materials market, compelling manufacturers to adopt advanced materials that comply with increasingly stringent emission standards and safety regulations. As the aerospace industry grapples with environmental concerns, governments worldwide are implementing rigorous regulations aimed at reducing carbon footprints and enhancing safety measures. For instance, in the United States, the government is prioritizing compliance with emission standards, which are projected to impact manufacturing processes significantly, prompting the adoption of lightweight and high-performance materials like advanced composites and aluminum alloys. These materials not only help in meeting emission regulations but also improve fuel efficiency, thereby reducing operational costs for airlines. Additionally, developments in space export controls, as highlighted by recent U.S. initiatives, are expected to boost secure trade with allies, further impacting the aerospace supply chain. As aerospace manufacturers seek to align their practices with these evolving regulations, the demand for innovative materials that meet both safety and environmental criteria is surging. The increasing focus on sustainability, driven by both regulatory pressures and consumer demand, is leading to substantial investments in research and development, fostering innovation in material technologies. This strategic shift is crucial as the industry aims to maintain compliance while enhancing performance and safety. In summary, the interplay between government regulations and the aerospace materials market underscores a transformative phase where adherence to stringent standards is not merely a legal obligation but also a pathway to competitive advantage. Manufacturers that invest in compliance-ready materials are better positioned to thrive in an industry increasingly focused on sustainability, innovation, and safety. This regulatory landscape, therefore, plays a crucial role in shaping the future trajectory of the aerospace materials market, driving growth and promoting technological advancements.

Restraints

-

Supply chain disruptions have become a significant constraint for the aerospace materials market, presenting considerable challenges for manufacturers.

Global vulnerabilities in supply chains, intensified by geopolitical tensions and recent pandemics, have resulted in material shortages and delays that adversely impact production schedules and costs. Major aerospace firms like Boeing and Airbus have encountered engine shortages linked to these supply chain issues, hindering their ability to meet production goals and customer expectations. Recent forecasts from Honeywell indicate declining sales projections due to ongoing supply chain disruptions, underscoring the fragility of material availability in the aerospace sector. The complexity of aerospace supply chains, often involving multiple suppliers and intricate logistics networks, exacerbates these difficulties. While manufacturers are increasingly reliant on modern procurement systems to address these challenges, the transition can be slow and costly, necessitating significant investments in technology and processes. Additionally, national security considerations are reshaping supply chain dynamics, leading to increased scrutiny and regulations that complicate sourcing strategies. As companies strive to enhance supply chain resilience through measures like data visibility and regionalization, the ongoing instability can stifle innovation and delay product launches, highlighting the crucial need for effective supply chain management in the aerospace materials market.

Segment Analysis

By Type

Based on Type, Composites is the largest share revenue in Aerospace Materials market of around 41% in 2023. This rise is driven by the need for lightweight materials that enhance fuel efficiency and overall performance. Composites, primarily carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP), provide excellent strength-to-weight ratios, corrosion resistance, and design versatility. They are widely utilized in commercial aircraft, such as the Boeing 787 Dreamliner and Airbus A350, as well as in military applications like fighter jets and drones. However, challenges remain, including high manufacturing costs, complicated repair processes, and supply chain disruptions. Looking ahead, advancements in manufacturing technologies and a focus on sustainable materials are expected to shape the industry's future.

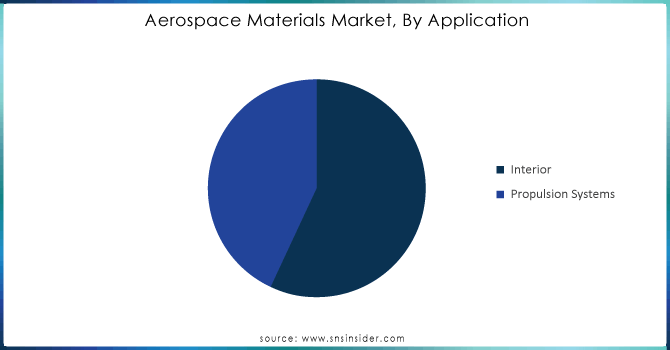

By Application

Based On Application, Propulsion Systems is captured the largest share revenue in Aerospace Materials of around 65% in 2023. This segment's significance stems from its impact on aircraft performance and efficiency. Key drivers include continuous technological advancements, leading to more efficient and eco-friendly engines, and the growing need for lightweight materials like titanium alloys and high-temperature composites. However, manufacturers face challenges, such as the high costs of advanced materials and the complexity of propulsion system designs. Looking ahead, innovations in materials technology, including lighter alloys and additive manufacturing, are expected to enhance engine efficiency. Companies like General Electric are developing ceramic matrix composites to improve fuel efficiency, while sustainability initiatives will further shape this vital segment.

Get Customized Report as per your Business Requirement - Request For Customized Report

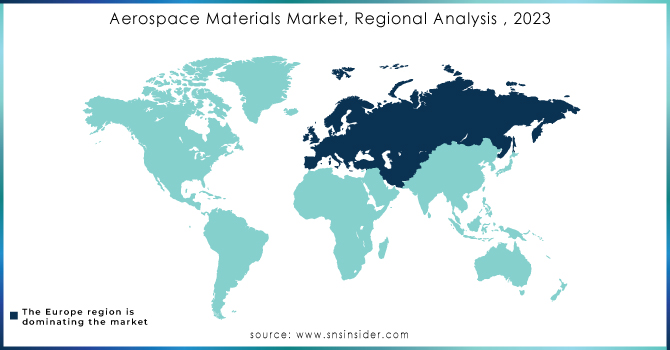

Regional Analysis

North America is dominated the largest share revenue in Aerospace Materials market of around 35% in 2023, driven by increasing demand from the United States and Canada. The U.S. holds the largest aviation market in the region, supported by a significant fleet size and strong exports of aerospace components to countries like France, China, and Germany. Government defense spending rose by USD 55 billion from 2022 to 2023, influenced by military assistance to Ukraine, with a total allocation of USD 816.7 billion in the Fiscal 2023 National Defense Authorization Act. The General Aviation Manufacturers Association reported a production increase, with 512 aircraft delivered in Q3 2023, representing 70% of global shipments. Canada’s aerospace sector generates CAD 31 billion (USD 23 billion) annually, with Montréal emerging as a major aerospace hub.

In 2023, the Asia-Pacific region emerged as the fastest-growing market for aerospace materials, fueled by a surge in air travel, a rising middle class, and increased disposable income, particularly in countries like China and India. These factors have led to significant investments in new aircraft and materials. Additionally, nations such as China, Japan, and South Korea are enhancing their aircraft manufacturing capabilities, while increased defense budgets in India and Japan further boost demand for aerospace materials. The market serves various applications, including commercial and military aviation, with key models like the Boeing 737 and Airbus A320 utilizing advanced materials. However, challenges such as supply chain vulnerabilities and regulatory compliance remain. Looking ahead, advancements in composite materials and sustainability will drive continued growth.

Key Players

Some of the major key players in Aerospace Materials with product:

-

Hexcel Corporation (Carbon Fiber Composites)

-

Alcoa Corporation (Aluminum Alloys)

-

Toray Industries (Carbon Fiber Composites)

-

Cytec Solvay Group (Epoxy Resins & Composites)

-

Constellium (Aluminum and Titanium Alloys)

-

ATI Metals (Titanium and Superalloys)

-

Thyssenkrupp Aerospace (Steel and Aluminum Alloys)

-

BASF SE (Polymer Composites)

-

Renegade Materials Corporation (High-Temperature Composites)

-

Teijin Limited (Carbon Fiber and Resins)

-

Arconic (Forged Aluminum and Titanium Alloys)

-

DuPont (Kevlar and Nomex Composites)

-

Allegheny Technologies (ATI) (Nickel-Based Super Alloys)

-

Mitsubishi Chemical Corporation (Carbon Fiber)

-

Huntsman Corporation (Epoxy and Polyurethane Resins)

-

Kobe Steel (Aluminum and Titanium Alloys)

-

VSMPO-AVISMA Corporation (Titanium Alloys)

-

Carpenter Technology (Specialty Super Alloys)

-

SGL Carbon (Graphite and Carbon Materials)

-

Morgan Advanced Materials (Ceramic Composites)

List of companies that supply raw materials for the Aerospace Materials Market:

-

Alcoa Corporation

-

Hexcel Corporation

-

Toray Industries

-

Cytec Solvay Group

-

Constellium

-

ATI Metals

-

Thyssenkrupp Aerospace

-

Kobe Steel

-

VSMPO-AVISMA Corporation

-

Carpenter Technology

Recent Development

-

In September 2024, researchers at the Massachusetts Institute of Technology (MIT) unveiled a new class of nanomaterials designed for aerospace applications, demonstrating a 30% increase in strength-to-weight ratio compared to traditional composites. This advancement aims to significantly enhance fuel efficiency and performance while maintaining safety standards in aircraft design.

-

In October 2024, Airbus announced a breakthrough in bio-based composites, successfully integrating natural fibers and bio-sourced resins into their aircraft designs. This innovative approach not only enhances the sustainability of aircraft materials but also reduces overall weight, aiming for improved fuel efficiency and a lower environmental footprint in future aviation.

-

On October 23, 2024, ATI Inc. announced its partnership with the University of Strathclyde’s Advanced Forming Research Center (AFRC) as a tier one member. This collaboration will focus on developing advanced metallic alloys to enhance sustainability in aerospace, utilizing AFRC's FutureForge facility for innovative material and process technologies aimed at improving jet engine efficiency and reducing fuel consumption.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 46.23 Billion |

| Market Size by 2032 | US$ 96.22 Billion |

| CAGR | CAGR of 8.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Aluminum Alloys, Steel Alloys, Composites, Titanium Alloys, Super Alloys, and Others) • By Aircraft Type (Commercial Aircraft, Military Aircraft, Business & General Aviation, Helicopters, and Others) • By Application (Interior (Passenger Seating, Panels, Galley, and Others), Propulsion Systems (Airframe, Windows & Windshields, and Tail & Fin) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Constellium SE, Alcoa Corporation, Toray Industries, Inc., Allegheny Technologies Incorporated, Solvay S.A., Teijin Limited, Kobe Steel, Ltd., NOVELIS, AMG N.V., Hexcel, DuPont de Nemours, Inc. |

| Drivers | • Growing demand for lightweight materials to enhance fuel efficiency and reduce emissions in aircraft • Expansion of the commercial aviation sector driven by rising air travel demand and the emergence of low-cost carriers • Shift towards electric and hybrid-electric propulsion systems in aerospace, necessitating lightweight materials for improved energy efficiency |

| Restraints | • High development and production costs associated with advanced aerospace materials, limiting adoption. • Volatility in raw material prices, particularly for specialty metals and advanced composites, impacting cost and availability |