Furandicarboxylic Acid Market Size:

The Furandicarboxylic Acid Market Size was valued at USD 3.7 Billion in 2023 and is expected to reach USD 50.6 Billion by 2032 and grow at a CAGR of 34.0% over the forecast period 2024-2032.

To get more information on Furandicarboxylic Acid Market - Request Free Sample Report

The Furandicarboxylic Acid market is experiencing a surge in growth, driven by increasing demand for sustainable and bio-based alternatives to traditional petrochemical-based products. Furandicarboxylic Acid is gaining significant traction due to its application in producing poly (ethylene furanoate) (PEF), a 100% bio-based polymer with superior barrier properties compared to PET. The push towards reducing carbon footprints and achieving environmental sustainability has propelled innovations and investments in Furandicarboxylic Acid production. Recent technological advancements and collaborative agreements underscore the market's dynamic nature. Key developments include the establishment of new production facilities and long-term partnerships aimed at expanding the adoption of Furandicarboxylic Acid in various end-use industries such as packaging, textiles, and coatings.

In October 2024, Avantium inaugurated a biobased Furandicarboxylic Acid production plant in the Netherlands, a milestone showcasing its commitment to scaling sustainable chemical solutions. This plant represents a significant step in commercializing bio-based Furandicarboxylic Acid, highlighting its potential to transform the packaging industry. Earlier in January 2024, Avantium entered a multi-year agreement with Helios Resins to supply Furandicarboxylic Acid to produce sustainable alkyd resins. This partnership emphasizes the growing industrial interest in leveraging Furandicarboxylic Acid for diverse applications, including coatings and paints, aligning with global sustainability goals. These initiatives exemplify how leading players are focusing on strategic expansions and collaborations to capitalize on the environmental and functional advantages of Furandicarboxylic Acid, further solidifying its position in the global market.

Furandicarboxylic Acid Market Dynamics:

Drivers:

-

Rising Adoption of Bio-Based Polymers for Packaging Applications Encourages Furandicarboxylic Acid Market Expansion

The growing emphasis on sustainable packaging solutions is a key driver for the Furandicarboxylic Acid market. Furandicarboxylic Acid-based poly(ethylene furanoate) (PEF) has gained significant attention as an eco-friendly alternative to conventional plastics such as PET. PEF offers enhanced properties, including superior oxygen and carbon dioxide barrier performance, making it ideal for beverage and food packaging applications. Consumers and industries alike are demanding bio-based materials that align with their sustainability goals, which has led to increased research and development in Furandicarboxylic Acid applications. Regulatory frameworks that promote the adoption of biodegradable and recyclable materials are further accelerating this transition. Governments in regions like Europe and North America are enforcing stricter guidelines for reducing single-use plastics, creating a favorable environment for the adoption of Furandicarboxylic Acid. Companies investing in Furandicarboxylic Acid-based packaging solutions are also finding opportunities to strengthen their brand image by appealing to eco-conscious consumers, driving market growth.

-

Innovations in Catalytic Technologies Facilitate Efficient Production of Furandicarboxylic Acid

-

Supportive Regulatory Frameworks and Policies Propel Bio-Based Chemical Adoption

Governments worldwide are promoting the use of sustainable chemicals through favorable policies and financial incentives, boosting the Furandicarboxylic Acid market. Regulatory bodies in Europe and North America have introduced stringent policies aimed at reducing carbon emissions and promoting the circular economy. These measures have encouraged industries to adopt bio-based solutions, including Furandicarboxylic Acid, as part of their compliance strategies. Financial incentives such as tax rebates and subsidies for bio-based material production have further accelerated the shift towards Furandicarboxylic Acid. Additionally, Furandicarboxylic Acid’s alignment with global sustainability initiatives like the European Green Deal and the UN’s Sustainable Development Goals (SDGs) strengthens its position in the market. Policymakers are also fostering public-private partnerships to scale up bio-based chemical production, offering companies opportunities to innovate while adhering to environmental mandates. Such regulatory support ensures a steady demand for Furandicarboxylic Acid and enhances its potential across various sectors.

Restraint:

-

High Production Costs and Limited Commercialization Hinder Furandicarboxylic Acid Market Growth

The high production cost of Furandicarboxylic Acid remains a significant restraint to its market growth. The complex process of synthesizing Furandicarboxylic Acid, which involves converting fructose to hydroxymethylfurfural (HMF) and then to Furandicarboxylic Acid, requires advanced catalytic technologies and energy-intensive steps. These factors contribute to higher production costs compared to petrochemical-based alternatives like PET. Furthermore, the limited availability of raw materials, such as fructose, and the high cost of catalysts used in the production process make Furandicarboxylic Acid less accessible for manufacturers, particularly in cost-sensitive industries. This high cost structure also restricts smaller players from entering the market, limiting competition and innovation. Additionally, the market faces challenges in scaling up production to meet commercial demands, which has slowed its adoption in mainstream applications. These barriers, coupled with the well-established dominance of cheaper alternatives, make it difficult for Furandicarboxylic Acid to achieve widespread commercialization despite its environmental advantages.

Opportunity:

-

Growing Consumer Awareness for Sustainability Drives Demand for Furandicarboxylic Acid-Based Products Across Applications

-

Advancements in Feedstock Alternatives Unlock New Horizons for Furandicarboxylic Acid Production

Recent developments in the use of alternative feedstocks, such as agricultural waste and lignocellulosic biomass, have created promising opportunities for the production of Furandicarboxylic Acid. These innovations address the challenge of feedstock availability while supporting the principles of a circular economy. By utilizing non-food resources for Furandicarboxylic Acid production, manufacturers can reduce reliance on traditional feedstocks like fructose, lower costs, and enhance sustainability. These advancements have the potential to scale up production and meet the growing demand for bio-based materials, making Furandicarboxylic Acid more viable for widespread industrial use.

Challenge:

-

Competition from Petrochemical-Based Alternatives Poses Significant Threat to Furandicarboxylic Acid Market Growth

The Furandicarboxylic Acid market faces intense competition from well-established petrochemical-based alternatives like PET, which dominate global supply chains. Petrochemical polymers benefit from economies of scale, lower production costs, and deeply entrenched manufacturing processes, making them more accessible and affordable for many industries. Transitioning from these materials to Furandicarboxylic Acid-based alternatives requires significant investment in new technologies, production infrastructure, and consumer education. Additionally, the reluctance of manufacturers to shift from proven and cost-effective petrochemical materials to newer, bio-based options exacerbates the challenge. This competitive landscape creates a substantial hurdle for Furandicarboxylic Acid adoption, particularly in price-sensitive markets.

Increasing Investments and Funding Trends Fueling Growth in the Furandicarboxylic Acid Market

The Furandicarboxylic Acid market is witnessing a surge in investments and funding initiatives, reflecting the growing interest in sustainable and bio-based solutions. Key industry players and governments are investing in research and development, production facilities, and partnerships to accelerate Furandicarboxylic Acid commercialization. These investments are crucial for overcoming challenges related to production scalability and cost-efficiency, further boosting Furandicarboxylic Acid's adoption across various applications. Below is a table summarizing notable investment and funding trends shaping the Furandicarboxylic Acid market.

| Year | Investor/Organization | Funding/Investment Amount | Purpose |

|---|---|---|---|

| 2024 | Avantium | €192 Million | Construction of the world’s first commercial Furandicarboxylic Acid plant in the Netherlands. |

| 2023 | European Innovation Council (EIC) | €15 Million | Supporting Furandicarboxylic Acid research and scaling-up production in Europe. |

| 2023 | BASF and Avantium Joint Venture | Undisclosed | Developing Furandicarboxylic Acid-based PEF for packaging and textiles. |

| 2022 | Helios Resins | Multi-year investment | Collaboration with Avantium for Furandicarboxylic Acid supply for innovative resin production. |

| 2022 | Asian Development Bank (ADB) | $20 Million | Promoting bio-based chemical projects, including Furandicarboxylic Acid, in Asia-Pacific. |

These investment initiatives indicate the increasing confidence in Furandicarboxylic Acid's potential to replace petrochemical counterparts. The funding is directed towards scaling up production, exploring new applications, and enhancing Furandicarboxylic Acid's competitive edge, ensuring its relevance in the global sustainability narrative.

Furandicarboxylic Acid Market Segments

By Source

In 2023, the Biological Feedstocks segment dominated the Furandicarboxylic Acid market, holding a market share of 65%. This dominance is attributed to the increasing focus on sustainability and the shift towards renewable raw materials in various industries. Biological feedstocks, such as fructose derived from renewable resources like corn and sugarcane, are considered more eco-friendly compared to fossil-based feedstocks. These feedstocks help reduce carbon emissions, aligning with global efforts to transition to greener, more sustainable alternatives. Companies like Avantium have capitalized on this by developing biorefinery processes that convert plant-based sugars into Furandicarboxylic Acid, enabling large-scale production of sustainable chemicals. Biological feedstocks are also preferred in the production of polyethylene furanoate (PEF), a bio-based polyester used in packaging, textiles, and other applications. As the demand for sustainable and circular products continues to grow, the preference for biological feedstocks is expected to strengthen, driving further growth in the Furandicarboxylic Acid market. This trend is supported by governments offering subsidies and incentives for bio-based chemical production, making it an attractive option for producers.

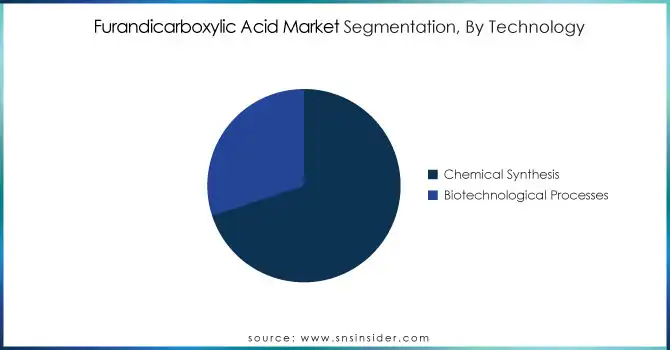

By Technology

The Chemical Synthesis segment led the Furandicarboxylic Acid market in 2023, with a market share of 60%. Chemical synthesis remains the preferred technology for large-scale Furandicarboxylic Acid production due to its proven scalability and cost-effectiveness. This method involves the conversion of fossil-based feedstocks such as glucose into Furandicarboxylic Acid using chemical catalysts and processes that are well established in the chemical industry. Major industry players, such as Avantium and BASF, have invested in refining chemical synthesis techniques to optimize Furandicarboxylic Acid production. Although biotechnological processes offer environmentally friendly alternatives, chemical synthesis remains dominant because it is more mature and can be integrated into existing industrial infrastructure. The cost-efficiency of chemical synthesis also makes it a more viable option for mass production, especially for the production of Furandicarboxylic Acid in applications like packaging, automotive, and textiles. Moreover, with advancements in process optimization, chemical synthesis has been able to reduce energy consumption and improve yield, further consolidating its position as the leading technology for Furandicarboxylic Acid production. As a result, chemical synthesis continues to be a key enabler for scaling up Furandicarboxylic Acid production globally.

By Application

The Polyesters segment dominated the Furandicarboxylic Acid market in 2023, holding a market share of 55%. Furandicarboxylic Acid is primarily used in the production of polyethylene furanoate (PEF), a bio-based polyester with superior performance characteristics compared to conventional polyethylene terephthalate (PET). PEF offers enhanced barrier properties, higher thermal stability, and better resistance to oxygen and carbon dioxide, making it an ideal material for applications in packaging. The growing consumer demand for sustainable and recyclable packaging has driven the adoption of Furandicarboxylic Acid in the production of PEF-based bottles and containers. Major companies, such as Coca-Cola and Danone, are increasingly using PEF for packaging their products to reduce their environmental impact and meet sustainability goals. As a result, the demand for Furandicarboxylic Acid in the polyester segment continues to rise. Additionally, PEF has applications in textiles and fibers, further expanding the reach of Furandicarboxylic Acid in the market. The shift towards bio-based, circular economy solutions has significantly boosted the role of Furandicarboxylic Acid in polyester production, particularly in the packaging industry, where sustainability is a key focus.

By End-Use Industry

In 2023, the Packaging industry dominated the Furandicarboxylic Acid market, accounting for 50% of the total market share. Furandicarboxylic Acid is a crucial raw material in the production of polyethylene furanoate (PEF), a bio-based alternative to traditional polyethylene terephthalate (PET). PEF’s superior properties, such as better barrier performance against oxygen and carbon dioxide, make it an ideal choice for sustainable packaging applications. The demand for environmentally friendly packaging materials has increased as companies, particularly in the food and beverage sector, strive to reduce their reliance on petroleum-based plastics and meet sustainability targets. Companies like Coca-Cola, Danone, and Nestlé have already started transitioning to PEF-based bottles made with Furandicarboxylic Acid, which can be fully recycled and are biodegradable. This trend towards more sustainable packaging solutions is helping to accelerate the adoption of Furandicarboxylic Acid in the packaging sector. Furthermore, the shift is supported by growing consumer awareness regarding plastic waste and the environmental impact of traditional packaging materials. As the demand for sustainable packaging continues to rise, the packaging industry remains the largest consumer of Furandicarboxylic Acid, driving its market growth.

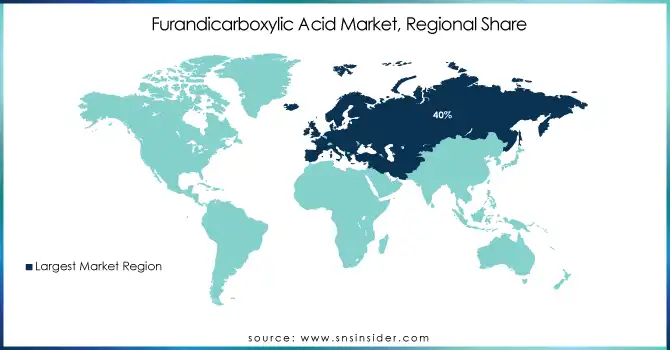

Furandicarboxylic Acid Market Regional Analysis

In 2023, Europe dominated the Furandicarboxylic Acid market, accounting for a market share of 40%. This dominance is primarily driven by strong governmental support for sustainability initiatives, coupled with significant investments in bio-based chemical production. Countries like the Netherlands, Germany, and France have been at the forefront of Furandicarboxylic Acid production, largely due to the presence of key industry players such as Avantium, which has developed the world’s first Furandicarboxylic Acid production plant in the Netherlands. Avantium's facility, a major milestone in the bio-based chemicals industry, is set to significantly boost Furandicarboxylic Acid supply, especially for applications in sustainable packaging. Additionally, Europe’s commitment to the European Green Deal and Circular Economy Action Plan has spurred the adoption of sustainable solutions like Furandicarboxylic Acid, further driving demand in the region. Germany, as the largest European economy, has also seen increasing demand for Furandicarboxylic Acid in the automotive, packaging, and textiles sectors. The region’s progressive policies and well-established research and development ecosystem have positioned Europe as the leading market for Furandicarboxylic Acid, driving innovations and adoption across various industries.

Moreover, the Asia-Pacific region emerged as the fastest growing market for Furandicarboxylic Acid in 2023, with a CAGR of 15%. This rapid growth is attributed to the increasing industrialization and rising demand for bio-based chemicals in countries like China, India, and Japan. China, in particular, has become a significant player in the global bio-based chemical sector, investing heavily in the development of sustainable alternatives to petrochemicals. The country’s push for greener solutions, supported by government policies and initiatives such as the 14th Five-Year Plan for Ecological and Environmental Protection, has accelerated the adoption of Furandicarboxylic Acid. India, with its expanding manufacturing base, has also seen a rise in demand for sustainable materials like Furandicarboxylic Acid in packaging and textiles. Furthermore, Japan's commitment to environmental sustainability and circular economy practices has led to increased interest in bio-based polymers, including Furandicarboxylic Acid. The increasing focus on reducing plastic waste and carbon emissions has further fueled the demand for Furandicarboxylic Acid-based products, particularly in packaging, where it is seen as an environmentally friendly alternative to traditional plastics. As the demand for sustainable solutions continues to grow in the region, Asia-Pacific is expected to maintain its position as the fastest growing market for Furandicarboxylic Acid.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent Developments

October 2024: Avantium opened its biobased Furandicarboxylic Acid plant in the Netherlands, with a capacity of 5,000 tons annually. The plant will produce Releaf, a sustainable alternative to petroleum-based plastics used in packaging and textiles, advancing the company’s sustainability initiatives.

Key Players

-

Anellotech (Bio-TCat technology, TPC (Bio-Based PET))

-

Avantium (YXY technology, PEF (Polyethylene Furanoate))

-

BASF (EcoFense, polyamide-based materials)

-

Corbion (Luminy, PEF (Polyethylene Furanoate))

-

DSM (Dyneema, bio-based polymers)

-

Furanix Technologies (Furanic chemicals, Furandicarboxylic Acid (Furandicarboxylic acid))

-

Genomatica (Butylene glycol, Bio-BDO)

-

Hongye Chemical (Furandicarboxylic Acid, bio-based chemicals)

-

Indorama Ventures (PET (Polyethylene Terephthalate), Bio-PET)

-

Kraton Polymers (SBS (Styrene-Butadiene-Styrene), Hydrogenated Block Copolymer)

-

LG Chem (Bio-PET, Eco-friendly polyesters)

-

Mitsubishi Chemical Corporation (Bio-based Furandicarboxylic Acid, PET)

-

Molekule (Advanced air purification, environmental technologies)

-

Nestle (Plant-based packaging, Sustainable packaging solutions)

-

Novozymes (Enzyme-based solutions, Bio-based chemicals)

-

Origin Materials (Bio-based PET, Sustainable packaging)

-

PTT Global Chemical (Bio-based PET, Polymers)

-

Reverdia (Biosuccinium, bio-based succinic acid)

-

Teijin Limited (Eco-friendly polyester, High-performance polymers)

-

TotalEnergies (Bio-based products, Sustainable chemicals)

Manufacturers:

-

Avantium

-

BASF

-

PTT Global Chemical

-

DuPont

-

Mitsubishi Chemical

Raw Material Suppliers:

-

Archer Daniels Midland Company

-

Cargill

-

DSM

-

Novozymes

Research and Development Firms:

-

Avantium

-

UPM-Kymmene

-

LanzaTech

End-Use Industries:

-

Coca-Cola (Packaging)

-

Unilever (Packaging)

-

Ford (Automotive)

-

Inditex (Textiles)

Distributors and Traders:

-

Brenntag

-

IBC Chemical

-

LyondellBasell

Regulatory Bodies:

-

European Chemicals Agency (ECHA)

-

U.S. Environmental Protection Agency (EPA)

-

Food and Drug Administration (FDA)

| Report Attributes | Details |

| Market Size in 2023 | USD 3.7 Billion |

| Market Size by 2032 | USD 50.6 Billion |

| CAGR | CAGR of 34.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Biological Feedstocks, Fossil-Based Feedstocks) • By Technology (Biotechnological Processes, Chemical Synthesis) • By Application (Polyesters, Plasticizers, Solvents, Food and Beverages, Others) • By End-Use Industry (Packaging, Textiles, Automotive, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Avantium, Genomatica, Kraton Polymers, Hongye Chemical, Mitsubishi Chemical Corporation, Corbion, Furanix Technologies, Anellotech, PTT Global Chemical, DSM and other key players |

| Key Drivers | • Innovations in Catalytic Technologies Facilitate Efficient Production of FDCA • Supportive Regulatory Frameworks and Policies Propel Bio-Based Chemical Adoption |

| Restraints | • High Production Costs and Limited Commercialization Hinder FDCA Market Growth |