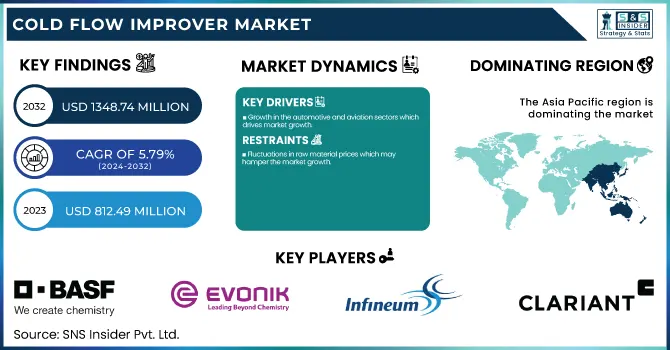

Cold Flow Improver Market Report Scope & Overview:

The Cold Flow Improver Market size was USD 812.49 Million in 2023 and is expected to reach USD 1348.74 Million by 2032 and grow at a CAGR of 5.79 % over the forecast period of 2024-2032. The cold flow improver market report comprehensively analyzes production capacity and utilization by region, highlighting key trends in polymer-based and surfactant-based additives. It covers feedstock price fluctuations and supply chain dynamics, offering insights into raw material trends. The report also examines regulatory impacts, including fuel standards and environmental compliance, shaping market growth. Additionally, it presents environmental metrics such as carbon footprint reduction, sustainability initiatives, and waste management practices. Innovation and R&D investments in bio-based and advanced formulations are explored, alongside adoption rates across key end-use industries like automotive, aviation, and marine.

To Get more information on Cold Flow Improver Market - Request Free Sample Report

Cold Flow Improver Market Dynamics

Drivers

-

Growth in the automotive and aviation sectors which drives market growth.

Cold flow improvers are witnessing considerable demand owing to growth in the automotive and aviation sectors, as these applications demand high performance of fuel, particularly in cooler climates. The cold flow improvers are majorly used to maintain the fluidity of fuels like diesel and aviation fuel at a low temperature which in turn helps in their efficient utilization by the rapidly growing global vehicle fleet and rising air traffic globally. However, stringent emission regulations in the automotive sector and demand for improving fuel efficiency are also driving advanced additives (in-use additives). Likewise, in aerospace, where jet fuels are required to meet stringent low-temperature performance standards, cold flow improvers are used to prevent fuel from freezing at high altitudes. A surge in the logistics and transportation sector coupled with the surge in infrastructure development in emerging economies have played a huge role in the growth of the market as the above-mentioned sectors are driving the overall demand for fuel additives.

Restraint

-

Fluctuations in raw material prices which may hamper the market growth.

The increase in the prices of major raw materials, such as ethylene vinyl acetate (EVA), polyalkyl methacrylates (PAMA), and other polymer-based compounds, is expected to hold back the growth of the cold flow improver market, as the market is highly sensitive to the fluctuation of the prices of these raw materials. As these materials are derived from petrochemicals, their price is dependent on crude oil price volatility, geopolitical instability, and disruptions in the supply chain. Abrupt increases in crude oil prices raise production costs thereby reducing manufacturers' profit margins and causing price fluctuations in the market. Alternatively, trade restrictions, shutdown of refineries, or bottlenecks in transportation will result in shortages that could further endanger the supply of these materials, restricting the market expansion. Consequently, manufacturers are increasingly investigating bio-based and sustainable alternatives to diversify their risk exposure to price and supply movements, as well as reduce dependence on conventional petrochemical feedstocks.

Opportunity

-

Technological advancements in fuel additive formulations create an opportunity in the market.

Technological advancement in the formulation of fuel additives is giving rise to the trends such as the development of fuel additives that can improve the performance of even poor-quality fuels in extreme temperature conditions, which have acted as a significant growth opportunity for the cold flow improver market. Recent advancements in polymer and hybrid-based cold flow improvers have resulted in enhanced fuel flow properties, reduced wax crystal formation, and better compatibility with ultra-low sulfur diesel (ULSD) and biodiesel blends. Next-generation additives such as nanotechnology-based solutions and bio-derived improvers are enabling increased efficiency and sustainability, thereby propelling the market forward. Furthermore, research and development are being significantly undertaken due to the growing demand for multi-functional additives to offer cold flow improvement and stability. Those include increased fuel reliability in cold climates along with compliance with strict, emerging fuel regulations, thus dramatically widening the potential market.

Challenges

-

Market fragmentation and competition may challenge the market growth.

The fragmented nature and high-level competition posed by regional and global players continue to hinder the hot flow improver market growth. With so many manufacturers, the price wars come in quickly, so the profit margins are lower, and it becomes hard to distinguish your product from the rest. Moreover, the market is led by well-established players because of distribution networks and market reorganization becomes the entry barrier for the new entrants. In price-sensitive regions, customers tend to care more about price versus performance, which, in turn, forces competition into a pricing battle rather than a technological one. Market fragmentation also leads to disparate product quality and regulatory compliance inconsistencies, making the competitive landscape all the more difficult.

Cold Flow Improver Market Segmentation Analysis

By Product

Ethylene Vinyl Acetate (EVA) holds the largest market share in the cold flow improver market 43% in 2023. This is because of its better functionality in improving the low-temperature behavior of fuels, especially diesel. The EVA-based cold flow improvers modify wax crystal growth and prevent gelling of the fuel and clogging of the filter in cold climates. The reason it is the leading choice amongst those who produce fuel additives is down to its ready availability, economic pricing, and ability to digest a broad range of fuel formulations. Moreover, since EVA has a well-characterized high solubility and stability, it can be used in various fuel types and conditions. The rise in demand for diesel in regions with cooler temperatures of the year a greater part of the market is also attributed to the prohibitive legislation for the quality of fuels that make their use more and more present and EVA becomes more and more preferable regionally due to the use of propolis ethanol and improved creation process.

By Application

The diesel fuel segment held the largest market share around 48% in 2023. It is widely utilized in automotive, transportation, agriculture, and industrial operations. Diesel fuel tends to crystallize/solidify into wax at low temperatures and can lead to gelling and clogging filters thereby affecting engine performance. This is where cold flow improvers come into play to avoid this problem, which helps to maintain fuel flow and efficiency, especially in colder parts of the world. Finally, both the increased consumption of ultra-low sulfur diesel (ULSD) and biodiesel blends with poorer cold flow properties have perpetuated the growing demand for cold flow improvers. Additives to meet the strict specs of government regulations on fuel performance and emissions have also kept this segment at the top of the heap as refiners and fuel suppliers mix these unique additives to remain compliant.

By End-Use Industry

Automotive held the largest market share around 65% in 2023. It is owing to the high global demand for diesel-based vehicles such as passenger cars, commercial trucks, and heavy-duty vehicles. In colder climates, low temperatures produce wax crystals in diesel fuels, which can result in the gelling of on-board fuel and short circuiting of engines. Cold flow improvers are an essential product to mitigate these problems and maintain a steady fuel flow to the vehicle. Moreover, increasing adoption of ultra-low sulfur diesel (ULSD) and biodiesel blends with poor cold temperature properties have augmented the demand for cold-flow improvers in automotive applications. The segment dominance is also due to regional stringent government regulations associated with fuel efficiency and emissions, especially in North America and Europe, where automotive players and fuel suppliers are partly merging advanced fuel additives to improve vehicle performance and compliance.

Cold Flow Improver Market Regional Outlook

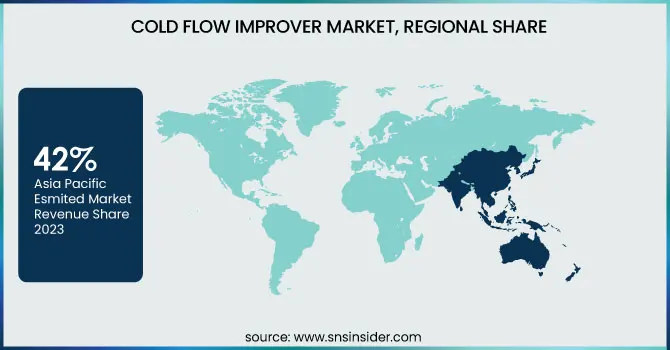

Asia Pacific held the largest market share around 42% in 2023. This is owing to as the consumption of diesel fuel in this region is estimated to be the highest across various applications, including transportation, automotive, construction, and agriculture. A rapidly increasing vehicle fleet in the region, particularly in China, India, and Japan is fueling the market for cold flow improvers for improving the performance of fuel in cold weather. Furthermore, Asia Pacific has a high demand for petroleum refiners and fuel additive producers allowing it to provide a continuous supply of cold flow improvers. The proposed heartening market has been further driven by the growing use of ultra-low sulfur diesel (ULSD) and biodiesel blends, which require effective cold flow treatments. In the region, cold flow improvers have seen large-scale use as a result of government regulation intended to promote fuel efficiency and emissions reduction.

North America held a significant market share in 2023. It is a very high consumption of diesel fuel in the automotive, transportation, oil & gas, and agricultural industries. Extreme winter conditions are a fact of life in this part of the world, especially in Canada and the northern U.S., where frigid temps can gel fuel and cause engines not to start. Thereby creating an extensive demand for cold flow improvers to increase the performance of diesel fuel at low temperatures. In addition, tight government regulations (e.g. the U.S. Environmental Protection Agency [EPA]) requiring ultra-low sulfur diesel (ULSD) and biodiesel blends, both of which possess bad cold flow properties, increase the additive demand. North America holds a significant market share in the fuel additives market, primarily due to the presence of key market players and technological advancements in fuel additives in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Keroflux, Keropur)

-

Evonik Industries AG (VISCOPLEX, VISCOBASE)

-

Infineum International Limited (Infineum R430, Infineum V620)

-

The Lubrizol Corporation (LUBRIZOL 7650, LUBRIZOL 7671)

-

Clariant AG (Addition RC 3702, Additin RC 3707)

-

Afton Chemical Corporation (HiTEC4663, HiTEC 4666)

-

Baker Hughes (DPR-801, DSR-600)

-

Bell Performance, Inc. (Cold Flow Improver, Dee-Zol Life)

-

Chevron Oronite Company LLC (OLOA 25000, OLOA 25001)

-

Dorf Ketal (Keroflux 3698, Keroflux 3699)

-

Innospec Inc. (DIESEL FLOW IMPROVER 3000, WINTER FLOW 2000)

-

TotalEnergies SE (Total Additive 123, Total Additive 456)

-

HollyFrontier Corporation (Petro-Canada Duron, Petro-Canada Supreme)

-

Nalco Water (an Ecolab company) (EC5620A, EC5970A)

-

Tianhe Chemicals (T616, T620)

-

Cestoil Chemical Inc. (Flow Improver 100, Flow Improver 200)

-

Exxon Mobil Corporation (Exxsol D80, Exxsol D110)

-

Ecolab Inc. (EC6106A, EC6190A)

-

Croda International Plc (Crodamol GTCC, Crodamol IPM)

-

Schlumberger Limited (DFA-1000, DFA-2000)

Recent Development:

-

In January 2024, BASF launched Keropur, a new gasoline additive in Taiwan, designed to enhance engine cleanliness by targeting and removing deposits in modern direct injection engines, contributing to sustainable mobility.

-

In August 2023, Evonik increased its cold flow improver production capacity at its German facility, reinforcing its commitment to supporting the automotive industry with high-performance additives, particularly for diesel fuels.

| Report Attributes | Details |

| Market Size in 2023 | USD 812.49 Million |

| Market Size by 2032 | USD 1348.74 Million |

| CAGR | CAGR of 5.79 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Ethylene Vinyl Acetate, Polyalkyl Methacrylate, Polyalpha Olefin, Others) • By Application (Diesel Fuel, Lubricating Oil, Aviation Fuel, Others) • By End-Use Industry (Automotive, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Evonik Industries AG, Infineum International Limited, The Lubrizol Corporation, Clariant AG, Afton Chemical Corporation, Baker Hughes, Bell Performance, Inc., Chevron Oronite Company LLC, Dorf Ketal, Innospec Inc., TotalEnergies SE, HollyFrontier Corporation, Nalco Water (an Ecolab company), Tianhe Chemicals, Cestoil Chemical Inc., Exxon Mobil Corporation, Ecolab Inc., Croda International Plc, Schlumberger Limited |