Bioplastics & Biopolymers Market Size & Overview:

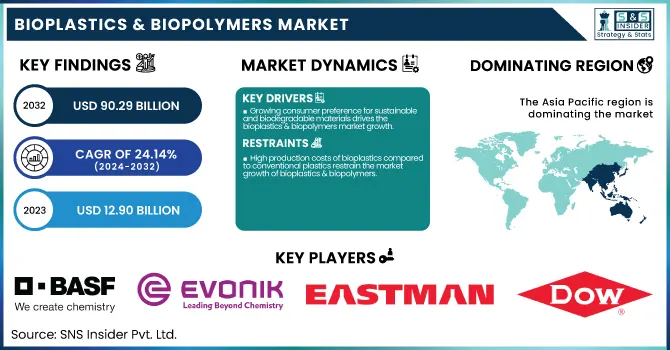

The Bioplastics & Biopolymers Market size was USD 12.90 billion in 2023 and is expected to reach USD 90.29 billion by 2032 and grow at a CAGR of 24.14% over the forecast period of 2024-2032.

To Get more information on Bioplastics & Biopolymers Market - Request Free Sample Report

The report offers detailed statistical insights and trends covering production capacity and utilization rates by country and by type for 2023. It presents feedstock pricing trends segmented by country and type, along with an analysis of regulatory impacts across major regions. The report also highlights environmental metrics, including emissions data, waste management practices, and sustainability initiatives by region. Additionally, it explores innovation and R&D advancements by material type. Insights into software adoption rates by region, key feature analysis, and regulatory adherence trends are also provided. This comprehensive data helps stakeholders assess market dynamics, sustainability efforts, and emerging growth opportunities.

The United States held the largest share in the Bioplastics & Biopolymers market in 2023, with a market size of USD 2.29 billion, projected to reach USD 16.68 billion by 2032, growing at a CAGR of 24.68% during 2024–2032. This is due to its strong emphasis on sustainability, advanced manufacturing capabilities, and substantial investment in research and development. Government initiatives like the U.S. Department of Agriculture's BioPreferred Program have significantly promoted the use of biobased products across various industries. Additionally, major players such as BASF, Eastman Chemical Company, and Dow are actively expanding their bioplastics product lines, further boosting domestic production and innovation. The country's robust consumer awareness regarding eco-friendly materials, combined with strict environmental regulations encouraging the reduction of carbon emissions and plastic waste, has accelerated the adoption of bioplastics in packaging, automotive, textiles, and consumer goods sectors. This well-developed industrial ecosystem, coupled with a growing focus on circular economy principles, has solidified the U.S.'s dominant position in the global market.

Bioplastics & Biopolymers Market Dynamics

Drivers

-

Growing consumer preference for sustainable and biodegradable materials drives the bioplastics & biopolymers market growth.

The increasing global emphasis on sustainability has significantly boosted consumer preference for eco-friendly products, driving the demand for bioplastics and biopolymers. Companies across packaging, automotive, consumer goods, and textiles are rapidly adopting biobased alternatives to meet changing regulatory standards and consumer expectations. Various government initiatives, such as the U.S. Department of Agriculture's BioPreferred Program and the European Union's Green Deal, are actively promoting the use of biodegradable materials. Moreover, advancements in material performance and cost-competitiveness of bioplastics compared to conventional plastics are making these products more attractive across industries. The rising concern over plastic pollution and the need to reduce carbon footprints further amplify this shift. Consequently, the surging demand for sustainable and biodegradable solutions is creating substantial growth opportunities for the Bioplastics & Biopolymers Market on a global scale.

Restrain

-

High production costs of bioplastics compared to conventional plastics restrain the market growth of bioplastics & biopolymers.

Despite increasing demand, the high production costs associated with bioplastics and biopolymers act as a major barrier to widespread market adoption. The sourcing of bio-based raw materials, combined with limited economies of scale and expensive processing technologies, results in higher prices compared to traditional petroleum-based plastics. Small and medium-sized enterprises particularly find it challenging to afford these alternatives, limiting their broader usage in cost-sensitive sectors. Additionally, the need for dedicated infrastructure for composting or recycling bioplastics adds to the overall costs for end-users and municipalities. While technological advancements are ongoing to lower these costs, price competitiveness remains a crucial hurdle. Thus, unless production technologies significantly advance or government subsidies increase, the cost disadvantage will continue to restrain the rapid growth of the Bioplastics & Biopolymers Market.

Opportunity

-

Expansion of compostable packaging solutions across emerging economies offers lucrative opportunities for bioplastics & biopolymers market.

The rapid growth of e-commerce and food delivery services, especially in emerging economies, is creating substantial opportunities for compostable packaging solutions, boosting the Bioplastics & Biopolymers Market. Countries across Asia-Pacific and Latin America are witnessing a surge in demand for sustainable alternatives due to rising urbanization, consumer awareness, and supportive governmental policies promoting green packaging practices. Innovations in flexible packaging, biodegradable containers, and agricultural films are further expanding the potential of bioplastics in these high-growth regions. Additionally, international brands are increasingly partnering with local companies to introduce eco-friendly packaging options, tapping into these emerging markets. The need to align with global sustainability goals and respond to stricter regulatory frameworks also accelerates investments in compostable materials. As a result, the expansion of compostable packaging solutions presents a highly lucrative avenue for market players.

Challenge

-

Lack of Industrial Composting Facilities and Recycling Infrastructure Challenges the Growth of the Bioplastics & Biopolymers Market.

One of the most critical challenges facing the Bioplastics & Biopolymers Market is the lack of adequate industrial composting facilities and recycling infrastructure worldwide. Although bioplastics are designed to be compostable or biodegradable, they require specific conditions that are not commonly available in most municipal waste management systems. This leads to improper disposal, contamination of recycling streams, and reduced environmental benefits. Emerging economies particularly struggle with the necessary investments needed to develop advanced composting and recycling plants. Moreover, public awareness regarding the correct disposal methods for bioplastics remains low, exacerbating the issue. Without significant improvements in waste management systems and consumer education, the full potential of bioplastics in reducing plastic pollution and environmental harm will remain unrealized, posing a significant challenge to the growth trajectory of the market.

Bioplastics & Biopolymers Market Segmentation Analysis

By Product

Bio-Based Plasticizers held the largest market share, around 68%, in 2023. It is due to the increasing global emphasis on sustainable waste management and reducing environmental pollution. Biodegradable plastics, derived from renewable sources like corn starch, sugarcane, and cellulose, offer the critical advantage of breaking down naturally under composting conditions, thus minimizing landfill waste and ocean pollution. Additionally, the strong demand from sectors such as packaging, agriculture, and consumer goods, combined with growing investments in the development of cost-effective biodegradable solutions, has significantly contributed to this segment’s dominance. The rising environmental consciousness among consumers and industries has made biodegradable plastics the preferred choice, driving their leadership in the overall market.

By Application

Agriculture & Horticulture held the largest market share, around 34%, in 2023. It is due to the increasing demand for sustainable farming practices and eco-friendly agricultural inputs. Bioplastics and biopolymers are widely used in applications such as mulch films, plant pots, seed coatings, and greenhouse materials, offering significant benefits like biodegradability and soil health improvement. Farmers and horticulturists are increasingly adopting biodegradable mulch films to eliminate the need for plastic waste removal, thus saving labor costs and supporting environmental sustainability. Moreover, government regulations in regions like Europe and North America promoting biodegradable agricultural products have further fueled the segment’s growth. Advances in material innovation have also enhanced the durability and performance of bioplastics in outdoor conditions, making them a preferred alternative to conventional plastics. The growing global focus on sustainable agriculture and environmental protection strongly positions Agriculture & Horticulture as the leading end-use sector in the market.

Bioplastics & Biopolymers Market Regional Outlook

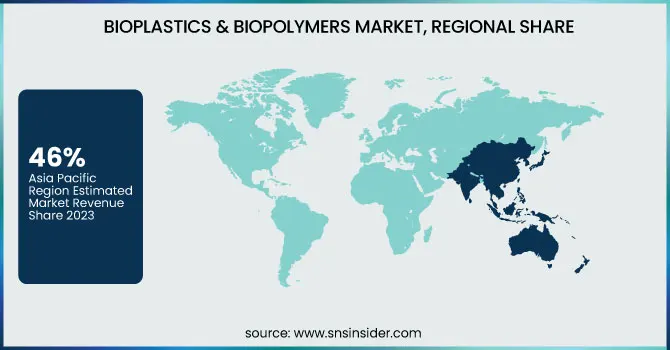

Asia Pacific held the largest market share, around 46%, in 2023. It is due to rapid industrialization, growing consumer awareness about sustainable products, and strong government support for green initiatives. Countries like China, Japan, India, and South Korea are heavily investing in bio-based material technologies to reduce dependence on fossil fuels and address environmental concerns. Additionally, the region’s large agricultural base and expanding packaging, consumer goods, and automotive sectors have created significant demand for eco-friendly materials. Initiatives such as China’s ban on single-use plastics and Japan’s "Bioplastics Roadmap" are driving the adoption of bioplastics across industries. Furthermore, the presence of key manufacturers and lower production costs in the region have strengthened Asia Pacific’s dominance. The combination of supportive policies, industrial growth, and a rising shift toward sustainable consumption patterns has firmly positioned Asia Pacific as the leading market.

North America held a significant market share. It is due to strong environmental regulations, growing demand for sustainable packaging, and increased investments in bio-based product innovations. The United States and Canada have actively promoted the adoption of biodegradable and compostable materials through supportive policies and funding for green technologies. Major players in the region are heavily investing in research and development to create advanced biopolymers that meet industrial performance standards while reducing carbon footprints. Additionally, the rising consumer preference for eco-friendly products across sectors like packaging, agriculture, consumer goods, and automotive has further fueled market expansion. Initiatives such as the U.S. Plastics Pact and Canada's Zero Plastic Waste Strategy are encouraging industries to shift towards sustainable alternatives, solidifying North America’s position as a key contributor to the global bioplastics and biopolymers market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Ecoflex, Ecovio)

-

Evonik Industries AG (RESOMER, VESTAMID Terra)

-

Eastman Chemical Company (Tritan Renew, Naia)

-

Dow Chemical Company (Agility CE, ELVALOY)

-

Arkema Group (Rilsan Clear, Pebax Rnew)

-

Perstorp Holding AB (Capa, Akestra)

-

LG Chem Ltd. (IFB, LUCEL)

-

LANXESS AG (Durethan ECO, Pocan ECO)

-

ExxonMobil Chemical (Exxelor, Achieve Advanced PP)

-

UPC Technology Corporation (Biopolyol, Polymol)

-

Wacker Chemie AG (VINNEX, VINNAPAS Eco)

-

Asahi Kasei Corporation (TENAC, Leona)

-

Hexion Inc. (ECO-LOY, VeoVa)

-

PolyOne Corporation (OnFlex BIO, Geon BIO)

-

Shandong Hongxin Chemical Co., Ltd. (HX-BIO, HX-GREEN)

-

Grupa Azoty ZAK S.A. (BIO-ZAK, OXO-BIO)

-

Nan Ya Plastics Corporation (BioPET, BioPA)

-

Meltem Kimya (MELBIO, MELGREEN)

-

KLJ Group (KLJ 610 Bio, KLJ 810 Bio)

-

Vertellus Holdings LLC (Citroflex, FlexaTrac-DME)

Recent Development:

-

In February 2024, BASF introduced Ecoflex F Blend, a new biodegradable plastic developed to improve compostability standards in flexible packaging applications.

-

In January 2024, Evonik broadened its RESOMER portfolio with the launch of medical-grade biodegradable polymers designed for advanced drug delivery systems.

-

In March 2024, Eastman expanded its Tritan Renew product line by introducing higher bio-content versions, focusing on applications in the consumer goods sector.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 12.90 Billion |

| Market Size by 2032 | USD 90.29 Billion |

| CAGR | CAGR of 24.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Biodegradable, Non-Biodegradable) •By Application (Packaging, Consumer Goods, Textiles, Agriculture & Horticulture, Automotive & Transportation, Coatings & Adhesives) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Evonik Industries AG, Eastman Chemical Company, Dow Chemical Company, Arkema Group, Perstorp Holding AB, LG Chem Ltd., LANXESS AG, ExxonMobil Chemical, UPC Technology Corporation, Wacker Chemie AG, Asahi Kasei Corporation, Hexion Inc., PolyOne Corporation, Shandong Hongxin Chemical Co., Ltd., Grupa Azoty ZAK S.A., Nan Ya Plastics Corporation, Meltem Kimya, KLJ Group, Vertellus Holdings LLC |