Agent Performance Optimization Market Report Scope & Overview:

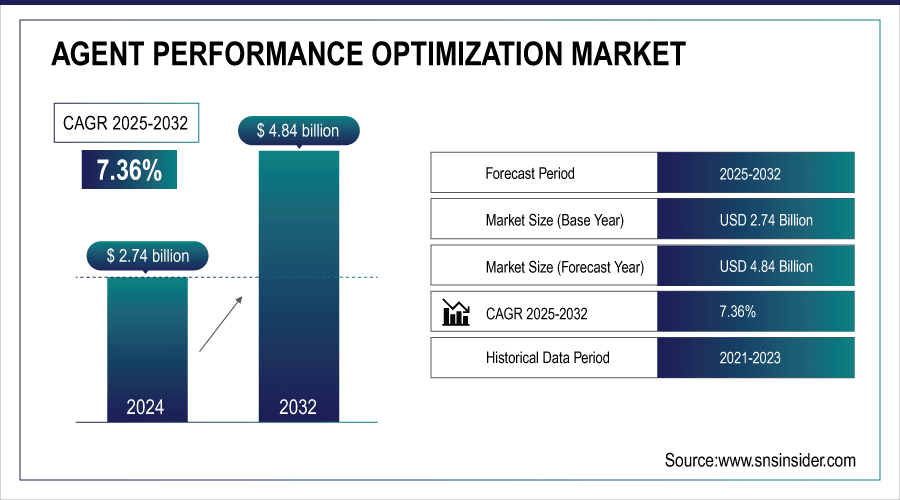

The Agent Performance Optimization Market Size was valued at USD 2.74 billion in 2025E and is expected to reach USD 4.84 billion by 2033 and grow at a CAGR of 7.36% over the forecast period 2026-2033.

The Agent Performance Optimization (APO) Market focuses on technologies and solutions designed to enhance the efficiency, productivity, and service quality of contact center agents. The market is driven by the growing need for superior customer experiences, operational efficiency, and cost reduction across industries such as BFSI, healthcare, retail, and telecom. APO solutions help optimize workflows, improve response times, and ensure consistent service quality, making them critical for modern customer engagement strategies.

Agent Performance Optimization Market Size and Forecast:

-

Market Size in 2025E: USD 2.74 Billion

-

Market Size by 2033: USD 4.84 Billion

-

CAGR: 7.36% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Agent Performance Optimization Market - Request Free Sample Report

Key Agent Performance Optimization (APO) Market Trends:

-

Increasing adoption of AI and machine learning technologies is enhancing real-time agent performance monitoring.

-

Cloud-based APO solutions are gaining popularity for scalability, flexibility, and lower deployment costs.

-

Integration of speech and text analytics is improving interaction quality and customer satisfaction.

-

Workforce optimization tools are driving efficiency by providing data-driven insights and personalized coaching for agents.

-

Growing demand for superior customer experiences across BFSI, healthcare, retail, and telecom is fueling APO adoption.

-

Automation of repetitive tasks and AI-assisted decision-making is reducing operational costs and improving response times.

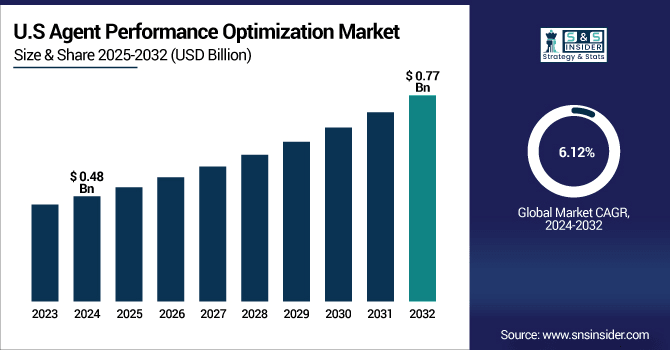

The U.S. Agent Performance Optimization Market size was USD 0.48 billion in 2025 and is expected to reach USD 0.77 billion by 2033, growing at a CAGR of 6.12% over the forecast period of 2026-2033. The growth is driven by rising adoption of AI-powered analytics, real-time performance monitoring, and cloud-based solutions, enabling organizations to improve agent productivity, enhance customer experiences, optimize workflows, and reduce operational costs across sectors such as BFSI, healthcare, retail, and telecom.

The U.S. market is witnessing significant growth driven by the increasing adoption of AI and machine learning technologies to enhance agent productivity and customer experience. Cloud-based APO solutions are becoming more popular due to their scalability, flexibility, and cost-efficiency. Integration of speech and text analytics is improving interaction quality and enabling real-time coaching for agents. Organizations across BFSI, healthcare, retail, and telecom are leveraging APO tools to optimize workflows, reduce response times, and ensure consistent service quality. Automation of routine tasks further boosts efficiency, making APO solutions critical for modern contact center operations.

Agent Performance Optimization Market Growth Drivers:

• Growing Adoption of AI and Machine Learning Technologies Drives U.S. Agent Performance Optimization Market Expansion

The market is driven by rising adoption of AI and machine learning technologies to enhance agent efficiency, productivity, and service quality. AI-powered analytics and real-time performance monitoring allow organizations to identify performance gaps, provide personalized coaching, and optimize workflows. This cause, increasing reliance on advanced technologies, effects improved customer satisfaction, faster response times, and operational efficiency. Contact centers using AI-driven APO tools report 15% higher agent productivity and a significant reduction in handling time. Companies are integrating speech and text analytics, automating repetitive tasks, and using predictive insights to boost service quality.

In August 2025, a leading APO solution provider launched an AI-powered performance analytics module that enables real-time agent coaching, directly improving customer satisfaction and operational efficiency.

Agent Performance Optimization Market Growth Restraints:

• High Implementation Costs and Complex Integration Processes Restrain U.S. Agent Performance Optimization Market Growth

The market faces restraints from high implementation costs and integration complexities associated with APO solutions. Enterprises often need to invest heavily in hardware, software, and training while ensuring compatibility with existing systems. This cause, elevated deployment costs and technical challenges, effects slower adoption among small and medium enterprises and limits overall market expansion. Additionally, the need for skilled personnel to manage advanced systems increases operational overhead. The complexity of migrating legacy systems to modern cloud-based APO platforms further delays deployment and reduces the speed of realizing benefits.

In March 2024, a mid-sized financial services company postponed its APO deployment due to integration challenges with legacy CRM systems, illustrating cost and complexity as significant barriers.

Agent Performance Optimization Market Growth Opportunities:

• Expansion of APO Solutions in Emerging Markets Provides Significant Growth Opportunities

The growing adoption of APO solutions in emerging markets offers lucrative opportunities for market expansion. As enterprises in these regions increasingly prioritize customer service efficiency, AI-driven and cloud-based APO solutions are gaining traction. This cause, rising demand for operational optimization and enhanced customer experience, effects higher market penetration and adoption of innovative APO tools. Organizations are investing in predictive analytics, automated coaching, and performance dashboards to streamline contact center operations, reduce errors, and improve response times.

In June 2025, a telecom provider in India implemented a cloud-based APO system, increasing agent productivity by 18% and reducing average call handling time, highlighting market potential in emerging economies.

Key Agent Performance Optimization Market Segment Highlights:

-

By Application, Contact Center Optimization led with 46% share in 2025; Sales Performance Improvement fastest growing (CAGR 9.53%).

-

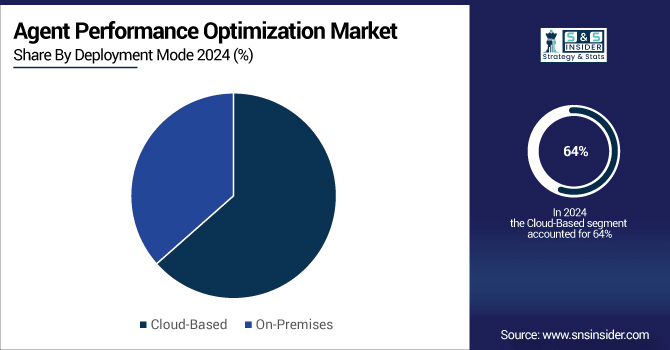

By Deployment Mode, Cloud-Based dominated 64% in 2025; On-Premises fastest growing (CAGR 7.99%).

-

By Component, Software led with 60% share in 2025; Services fastest growing (CAGR 8.11%).

-

By End User, BFSI dominated 33% in 2025; Healthcare fastest growing (CAGR 12.77%).

Key Agent Performance Optimization Market Segment Analysis:

-

By Deployment Mode, Cloud-Based Leads Market While On-Premises Registers Fastest Growth

The Cloud-Based deployment segment holds a dominant position in the APO market due to its scalability, flexibility, and ease of remote management. Cloud-native APO platforms with AI-powered analytics and real-time monitoring enhance agent performance and streamline operations across industries. The On-Premises segment is expected to grow fastest, driven by rising concerns over data security, privacy, and regulatory compliance. Advanced on-premises solutions with hybrid deployment options and customized performance monitoring modules allow organizations to maintain control over sensitive data while optimizing agent productivity and operational efficiency.

-

By Application, Contact Center Optimization Leads Market While Sales Performance Improvement Registers Fastest Growth

The Contact Center Optimization segment dominates the APO market, driven by increasing demand for efficient customer interactions, reduced call handling times, and enhanced agent productivity. Integration of AI-driven monitoring, real-time analytics, and omnichannel performance dashboards enables managers to optimize workflows, track agent efficiency, and improve customer satisfaction. The Sales Performance Improvement segment is expected to grow fastest, as companies adopt predictive analytics and performance scoring tools to monitor agent performance, identify skill gaps, optimize coaching, and boost sales effectiveness, thereby enhancing revenue generation and overall operational efficiency.

-

By Component, Software Leads Market While Services Registers Fastest Growth

The Software component dominates the APO market, fueled by widespread adoption of AI-powered dashboards, predictive insights, and automated coaching tools. These solutions enhance agent efficiency, reduce errors, and improve customer service quality across contact centers. The Services segment is projected to grow fastest as organizations increasingly require consulting, training, implementation, and maintenance support. Professional services help enterprises maximize the benefits of APO systems, ensuring seamless deployment, continuous agent performance optimization, and improved overall operational effectiveness.

-

By End User, BFSI Leads Market While Healthcare Registers Fastest Growth

The BFSI segment dominates the APO market, driven by the need for efficient customer support, fraud detection, and compliance management in banking, insurance, and financial services. APO solutions help monitor agent performance, automate routine tasks, and provide analytics-driven coaching, enhancing operational efficiency and customer satisfaction. The Healthcare segment is expected to grow fastest, fueled by telemedicine adoption and increased patient engagement initiatives. Healthcare-specific APO tools optimize workflows, track agent interactions, and ensure timely responses, improving service quality and enabling efficient patient support operations.

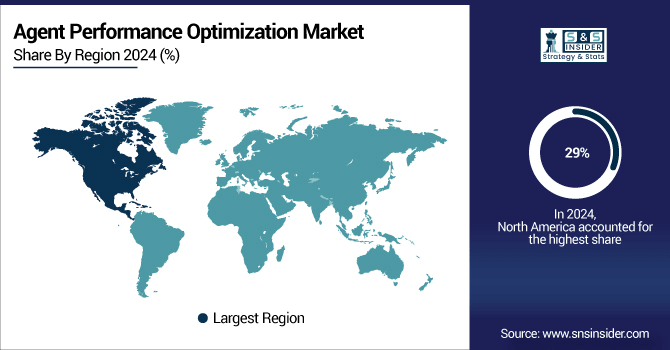

Agent Performance Optimization Market Regional Analysis:

-

North America Agent Performance Optimization Market Insights

In 2025, North America dominates the APO market share is 29%, driven by widespread adoption of AI-powered contact center solutions, cloud-based deployments, and a strong focus on customer experience. The region benefits from mature contact center infrastructure, advanced technology integration, and high demand for operational efficiency, supporting extensive deployment of APO tools that enhance agent productivity, reduce response times, and improve customer satisfaction.

Get Customized Report as Per Your Business Requirement - Enquiry Now

-

U.S. Leads Agent Performance Optimization Market in North America

The U.S. dominates with the largest market share, supported by advanced BPO and contact center industries, robust technological capabilities, and focus on AI-driven monitoring. Continuous investment in real-time analytics, workforce optimization, and predictive coaching strengthens agent performance, operational efficiency, and customer engagement, securing its leadership position within North America.

-

Asia Pacific Agent Performance Optimization Market Insights

Asia Pacific is the fastest-growing region with a CAGR of 9.72% in the APO market in the forecasted period 2026-2033, supported by rapid digital transformation, expanding IT and BPO sectors, and rising telecommunication and service industry investments. Businesses increasingly adopt AI-powered, cloud-based APO solutions to optimize workflows, monitor agent performance, and enhance customer experience, driving widespread market penetration.

-

India Leads Agent Performance Optimization Market Growth in Asia Pacific

India leads the regional market due to its large outsourcing and IT services industry, growing contact center operations, and government support for digital adoption. Integration of predictive analytics, real-time monitoring, and AI-assisted coaching improves agent productivity, reduces response times, and positions India as a key driver of APO market growth in Asia Pacific.

-

Europe Agent Performance Optimization Market Insights

In 2025, Europe holds a significant share in the APO market, driven by strong investments in digital transformation, AI-based contact center solutions, and regulatory compliance requirements. Enterprises increasingly adopt APO tools to enhance agent efficiency, optimize workflows, and deliver superior customer service, supporting steady regional growth.

-

Germany Dominates Europe’s Agent Performance Optimization Market

Germany leads the European market with its advanced financial, healthcare, and industrial sectors, strong technological ecosystem, and continuous AI-driven innovation. Adoption of cloud-based and analytics-enabled APO solutions improves agent performance, operational efficiency, and customer satisfaction, reinforcing Germany’s leadership position within Europe.

-

Latin America and Middle East & Africa Agent Performance Optimization Market Insights

The APO market in Latin America and MEA is witnessing steady growth, driven by expanding BPO and telecom sectors, increasing digital adoption, and growing demand for enhanced customer support. Rising investment in AI-powered monitoring, workflow optimization, and cloud-based APO platforms supports operational efficiency and improved agent performance across enterprises in these regions.

-

Regional Leaders in Latin America and MEA

Brazil leads Latin America due to its growing contact center industry and digital transformation initiatives, while the UAE dominates MEA, driven by smart city projects, advanced IT infrastructure, and adoption of cloud-based APO solutions enhancing agent productivity and service quality.

Competitive Landscape for the Agent Performance Optimization Market:

NICE Ltd., headquartered in Israel, is a global leader in AI-driven software solutions for customer engagement, financial crime prevention, and operational efficiency. Founded in 1986, it offers cloud and on-premises platforms that integrate analytics, workforce management, and robotic process automation to enhance productivity and customer experience. In the Agent Performance Optimization market, NICE provides tools that monitor agent performance in real time, analyze interaction quality, and deliver actionable insights for coaching. By enabling managers to optimize workflows, reduce response times, and improve service quality, NICE helps organizations enhance both agent efficiency and overall customer satisfaction.

-

August 7, 2025, NICE Ltd. was recognized as a leader in the 2025 ISG Buyers Guide for Customer Experience Management and Conversational AI for CX. This dual recognition highlights NICE's strong performance in both product innovation and customer experience delivery, solidifying its position as a market leader in AI-powered customer experience solutions.

Verint Systems, based in New York and founded in 1994, specializes in customer engagement solutions, security intelligence, and workforce optimization software. Its AI-powered analytics, speech and text analytics, and workforce management tools support enterprises in banking, retail, healthcare, and government sectors. Verint’s solutions focus on transforming customer interactions into actionable intelligence while boosting operational efficiency. In the Agent Performance Optimization market, Verint helps track agent productivity, evaluate conversation quality, and provide automated coaching insights. By enabling data-driven decision-making, Verint ensures agents deliver high-quality service consistently, enhancing customer experience and overall contact center performance.

-

June 28, 2024, Verint secured a $6.5 million contract from a top 10 U.S. public utility company to deploy multiple AI-powered bots. This initiative aims to enhance operational efficiency and customer service capabilities, reflecting the increasing adoption of artificial intelligence within essential services sectors to improve performance and user experiences.

Genesys Cloud Services, part of Genesys Inc. in California, provides cloud-based contact center solutions that integrate AI, omnichannel engagement, and workforce optimization. Founded in 1990, Genesys helps organizations manage interactions via voice, chat, email, and social media in a unified platform. Its solutions leverage AI to deliver real-time insights and automation that improve operational efficiency and customer satisfaction. In the Agent Performance Optimization market, Genesys tracks agent performance, identifies coaching needs, and optimizes scheduling. By providing actionable analytics and tools for workflow improvement, Genesys empowers managers to enhance agent productivity, service quality, and overall customer experience across channels.

-

December 12, 2024, Genesys Cloud AI represented more than 10% of the platform's new business during the first nine months of fiscal year 2025. This growth underscores the increasing demand for AI-driven solutions to enhance customer and employee experiences.

Cisco Systems, founded in 1984 and headquartered in San Jose, California, is a global leader in networking, cybersecurity, collaboration, and cloud solutions. Its products and services support enterprises, service providers, and government organizations in achieving digital transformation, secure networking, and operational efficiency. Cisco integrates AI and automation into its contact center and collaboration solutions to enhance communication, productivity, and customer experience. In the Agent Performance Optimization market, Cisco monitors agent productivity, evaluates service quality, and provides AI-driven coaching insights. This ensures consistent performance, faster response times, and higher customer satisfaction, helping organizations optimize operations and maximize the effectiveness of their contact center teams.

-

February 12, 2025, Cisco Systems raised its annual revenue forecast, expecting increased demand for its cloud networking gear amid the artificial intelligence boom. Corporate customers are heavily investing in AI infrastructure, boosting demand for data centers and Cisco's products such as Ethernet switches and routers. This shift is positively impacting Cisco's sales and market position.

Agent Performance Optimization Market Key Players:

Some of the Agent Performance Optimization Market Companies

-

NICE Ltd.

-

Verint Systems Inc.

-

Genesys Cloud Services

-

Cisco Systems Inc.

-

Avaya Holdings Corp.

-

Calabrio Inc.

-

Five9 Inc.

-

Talkdesk Inc.

-

8x8 Inc.

-

Oracle Corporation

-

RingCentral Inc.

-

Zendesk Inc.

-

Salesforce.com Inc.

-

Mitel Networks Corporation

-

Aspect Software Inc.

-

SAP SE

-

Alcatel-Lucent Enterprise

-

Vonage Holdings Corp.

-

IBM Corporation

-

Amazon Connect

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.74 Billion |

| Market Size by 2033 | USD 4.84 Billion |

| CAGR | CAGR of 7.36% from 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Contact Center Optimization, Sales Performance Improvement, Customer Engagement Enhancement) • By Deployment Mode (Cloud-Based, On-Premises) • By Component (Software, Services, Consulting) • By End User (BFSI, Healthcare, Retail, Telecommunication) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | NICE Ltd., Verint Systems Inc., Genesys Cloud Services, Cisco Systems Inc., Avaya Holdings Corp., Calabrio Inc., Five9 Inc., Talkdesk Inc., 8x8 Inc., Oracle Corporation, RingCentral Inc., Zendesk Inc., Salesforce.com Inc., Mitel Networks Corporation, Aspect Software Inc., SAP SE, Alcatel-Lucent Enterprise, Vonage Holdings Corp., IBM Corporation, Amazon Connect. |