POS Security Market Size & Overview:

To Get More Information on POS Security Market - Request Sample Report

The POS Security Market was valued at USD 4.55 billion in 2023 and is expected to reach USD 9.99 billion by 2032, growing at a CAGR of 9.16% from 2024-2032.

The POS (Point of Sale) Security Market is witnessing robust growth, driven by rising concerns over data breaches and cyber threats within retail and hospitality sectors. With more retailers adopting digital payment solutions and mobile POS systems, the demand for secure transaction environments is critical. Cybercrime rates targeting POS systems have escalated significantly. This surge highlights the vulnerabilities of traditional POS systems, emphasizing the urgent need for enhanced security measures such as encryption, tokenization, and multi-factor authentication. These measures are becoming critical to safeguard sensitive transaction data and protect against increasing cyber threats. A major growth factor in the POS Security Market is the expansion of e-commerce and contactless payment methods. Retailers worldwide are increasingly integrating contactless solutions, which can be susceptible to new forms of hacking. For instance, Visa reported in 2023 that nearly 60% of its global transactions were contactless, and along with this trend, POS security vendors are focusing on enhancing real-time fraud detection and AI-driven anomaly analysis. The introduction of regulatory standards like the Payment Card Industry Data Security Standard (PCI DSS) has also intensified the focus on POS security solutions, particularly in North America and Europe. PCI DSS-compliant solutions are mandatory for businesses processing card payments, fueling a growing need for vendors to provide certified security services.

Retailers are adopting cloud-based POS systems with integrated security features to ensure swift updates and real-time threat monitoring. For example, in 2024, Starbucks expanded its cloud POS solution to include advanced encryption and biometric authentication across its North American stores, setting a new standard in POS security for high-volume retail chains. Another real-time example is Walmart, which invested in a machine learning-based POS security system in 2023 to identify transaction anomalies instantly, reducing fraud incidents by 35%. This shift towards integrated, cloud-secured POS systems highlights the market’s move to meet emerging security demands, making POS security solutions crucial for small and large retail enterprises.

POS Security Market Dynamics

Drivers

-

Standards like PCI DSS mandate secure POS systems, pushing businesses to adopt compliant solutions.

-

Businesses are shifting to cloud POS for real-time threat updates, boosting demand for integrated security features.

-

Rising mobile POS usage, especially among small businesses, requires robust security to prevent data breaches.

The rise in mobile POS (mPOS) systems, especially among small and mid-sized businesses, has significantly impacted the POS Security Market. mPOS systems allow businesses to conduct sales transactions on mobile devices like tablets and smartphones, offering flexibility and cost savings. However, this increased convenience also brings greater security challenges, as these mobile devices are inherently more vulnerable to cyber threats and unauthorized access than traditional POS terminals. These risks are amplified for small businesses without dedicated IT resources, making secure mPOS solutions essential to prevent data breaches that could compromise customer information and impact business reputation.

A critical factor driving mPOS security demand is the shift towards contactless and digital payments, especially post-pandemic, where more businesses adopted mobile POS for safety and convenience. The risk of data breaches in mPOS systems is notably high due to factors like device theft, insecure Wi-Fi networks, and limited encryption on mobile devices. According to a recent report, 30% of small businesses using mPOS systems experienced some form of data security incident in the past year, highlighting the urgent need for robust mPOS security solutions.

Vendors are now offering security features such as end-to-end encryption, tokenization, and mobile-specific threat detection to protect these systems. For example, advanced mPOS systems now incorporate biometric authentication, ensuring only authorized users can access sensitive payment data. Additionally, some mPOS vendors provide real-time monitoring services that alert businesses to potential security issues as they arise, helping small businesses respond quickly to threats.

Moreover, regulatory compliance standards such as PCI DSS require businesses to implement security protocols that protect payment data. mPOS systems that comply with these standards have become popular, as they meet the necessary security requirements and help small businesses avoid regulatory penalties.

| mPOS Security Feature | Benefit |

|---|---|

| End-to-End Encryption | Protects transaction data from interception. |

| Tokenization | Replaces sensitive data with unique identifiers, reducing exposure. |

| Biometric Authentication | Ensures only authorized access to mPOS systems. |

| Real-Time Monitoring | Alerts businesses to security threats in real time. |

| PCI DSS Compliance | Meets regulatory standards, protecting business and customer data. |

Restraints

-

Advanced POS security solutions can be expensive, making them less accessible for small businesses.

-

Integrating security with existing POS systems can be technically challenging and time-consuming.

-

Effective use of security systems often requires technical expertise, which may be lacking in smaller businesses.

Limited human resources and technical expertise required to deploy and run the POS security system is one of the most significant factor which is expected to restrain the growth in POS security market globally, particularly for small and midsize businesses. Effective implementation of advanced POS security solutions like encryption, tokenization, and real-time threat detection requires a depth of technical expertise to configure, maintain and monitor properly. These requirements can place significant pressure on smaller businesses, which often have minimal or no dedicated IT staff. Although many small businesses rely on third-party vendors to supply and maintain their POS systems, robust security features typically fall outside the standard service offerings. Although these safeguards provide defense against threats such as data breaches and unauthorized access, they are only effective if configured correctly, updated regularly and monitored consistently. Without technical expertise, businesses might miss crucial configuration tasks and expose risk. For example, software is not updated regularly, or encryption is not properly configured, and hackers can find a way to bypass a security solution and access sensitive customer data.

Security concerns with POS systems are not something every business can sit down and solve as a team; not only are these problems often extremely difficult to investigate singularly—thus requiring a certain set of skills or qualifications—but many smaller businesses struggling to predict or fix POS security issues may not have the means to hire or train staff in these areas. Such businesses might be at a higher risk of attacks as they might not identify or react to or cope with security breaches right away due to deficit in technical expertise. Additionally, smaller retailers may face difficulties in interpreting and following complex regulatory requirements like the Payment Card Industry Data Security Standard (PCI DSS), that requires several guidelines to be followed for the protection of cardholder data.

This will drive many POS security vendors to fill this gap by providing simplified, automated security solutions targeted to minimize the time spent on technical expertise. Managed security services are also gaining traction as common security services for POS systems, outsourcing security management to experts. Nevertheless, high demand for technical knowledge still stays a problem, postponing the adaption of enough POS security systems across small enterprises and preventing the growth of the market overall.

POS Security Market Segment Analysis

By Offerings

In 2023, The Services segment dominated the market and held a larger share of 65.23%, as many small and mid-sized firms increasingly rely on managed security services, technical support, and continuously increasing system maintenance. These companies depend on services because they rarely have IT capacities in-house to secure themselves properly. Moreover, compliance standards, like PCI DSS, necessitate real-time updates and continuous threat monitoring, increasing demand for such outsourced services. That trend will continue, as more organizations choose to deploy managed services that deliver 24/7 security and incident management.

The Solutions segment is expected to grow at the highest CAGR of 10.31% during the forecast period, due to the automation of sophisticated security technologies (such as AI-based threat detection, tokenization, and encryption). With the rapid increase in cyber threats businesses are quickly adopting these solutions to protect their transactions and customer data. Due to the increased use of mobile and cloud-based POS systems, the need for integrated security solution is also rising. The future predictions suggest that the growth seems to only accelerate as AI-based solutions and real-time analytics also help businesses detect and neutralize threats proactively in an ever-changing security landscape.

By Organization Size

The Large Enterprises segment dominated the market and represented revenue share of 67.23%, in the POS Security Market is due to their high-volume transactions, greater exposure to cyber threats, and need for strict adherence to compliance standards. Such organizations deploy highly sophisticated security systems, including multi-layer encryption and real-time monitoring in order to ensure the safety of the billions of customer data and financial transactions they deal with. Also, large enterprises have the benefit of dedicated IT resources and budgets, and they can invest in robust security practices to minimize risks and comply with standards such as PCI DSS. As the likes of brand reputation and expensive breaches come under threat, large organizations will continue to put data security front and center on the agenda, ensuring this trend remains a constant.

The small and medium enterprises (SMEs) segment is projected to grow at the highest CAGR of 9.88% during the forecast period. As digital transformation picks up pace, an increasing number of SMEs are embracing mobile and cloud based POS systems that call for a strong security solution to shield themselves from evolving and sophisticated cyber threats. For most SMEs though, the absence of dedicated IT means dependence on outsourced security services and simplified security solutions that require minimal technical knowledge. With SMEs seeking cost-effective, easy-to-use defence options in protecting POS environments, the future outlook suggests that this segment will continue to grow with managed service security solutions focused on SMEs and automated security solutions.

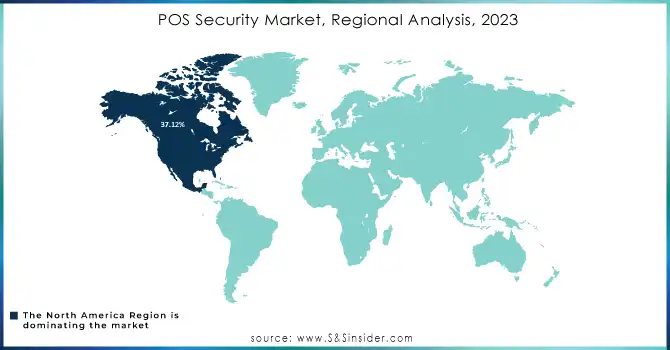

POS Security Market Regional Analysis

North America dominated the POS Security Market and represented a revenue share of 37.12%, due to its advanced infrastructure, stringent regulatory standards like PCI DSS, and high adoption of digital payment methods. The region's large number of retail businesses and high volume of transactions contribute to the demand for robust POS security solutions. Additionally, the increasing prevalence of cyber threats targeting retail and hospitality sectors further drives the market. The region is also home to several key POS security vendors offering cutting-edge security technologies such as AI-driven fraud detection and end-to-end encryption. North America is expected to maintain its dominance, with continued investment in securing payment systems against evolving threats.

Asia-Pacific (APAC) is anticipated to register the highest CAGR of 9.52% during the forecast period. The region is experiencing rapid digitalization, with a significant rise in e-commerce and mobile payments, especially in countries like China and India. The increasing adoption of mobile POS systems, particularly among SMEs, is propelling demand for affordable and efficient security solutions. Additionally, growing concerns about data breaches and rising cybercrime are pushing businesses to adopt advanced POS security technologies. The future outlook for APAC indicates further growth driven by increased government initiatives promoting cybersecurity and the expansion of retail and hospitality sectors, making POS security a top priority in the region.

Do You Need any Customization Research on POS Security Market - Enquire Now

Key Players

The major key players are

-

Verifone – Verifone Secure

-

Ingenico – Ingenico Tetra

-

Diebold Nixdorf – Vynamic Security

-

First Data – TransArmor

-

Tyco Integrated Security – Video Surveillance Solutions

-

PAX Technology – PAX A920

-

Epson – Epson TM-m30, OmniLink POS Solutions

-

Gemalto (Thales Group) – Smart Card Solutions

-

NCR Corporation – NCR Secure Pay

-

POSLine – POSLine Security Suite

-

Zebra Technologies – Zebra MP7000, Barcode Scanners with Image Capture, RFID Printers and Encoders

-

Verifone – Verifone Carbon

-

Aptos – Aptos Point of Sale

-

Oracle – Oracle Retail Xstore

-

Sierra Wireless – AirLink RV50

-

Check Point Software Technologies – SandBlast Agent

-

Fortinet– FortiGate Firewall

-

Symantec (Broadcom) – Symantec Endpoint Protection

-

Trustwave – Trustwave POS Security Solution

-

McAfee – McAfee Advanced Threat Defense

Recent Developments

January 2024: Fortinet, Inc. launched a comprehensive upgrade to its security platform aimed at protecting Point-of-Sale (POS) systems from increasingly sophisticated cyberattacks. The upgrade includes advanced features like automated threat detection and enhanced encryption protocols for transaction security

April 2024: Kaspersky Lab rolled out a new set of cybersecurity tools specifically designed for the retail sector to mitigate risks associated with POS terminals. The tools feature end-to-end encryption and AI-driven malware detection capabilities.

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.55 billion |

| Market Size by 2032 | US$ 9.99 billion |

| CAGR | CAGR of 9.16% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solutions, Services) • By Vertical (Retail, Restaurants, Hospitality, Others) • By Organization Size (Large Enterprises, Small & Medium Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Verifone, Ingenico, Diebold Nixdorf, First Data, Tyco Integrated Security, PAX Technology, Gemalto, Epson, NCR Corporation, POSLine, Zebra Technologies, Verifone, Aptos, Oracle, Sierra Wireless, Check Point Software Technologies, Fortinet, Symantec, Trustwave, McAfee |

| Key Drivers | • Standards like PCI DSS mandate secure POS systems, pushing businesses to adopt compliant solutions. • Businesses are shifting to cloud POS for real-time threat updates, boosting demand for integrated security features. • Rising mobile POS usage, especially among small businesses, requires robust security to prevent data breaches. |

| Market Restraints | • Advanced POS security solutions can be expensive, making them less accessible for small businesses. • Integrating security with existing POS systems can be technically challenging and time-consuming. • Effective use of security systems often requires technical expertise, which may be lacking in smaller businesses. |