Print On Demand Market Report Scope & Overview:

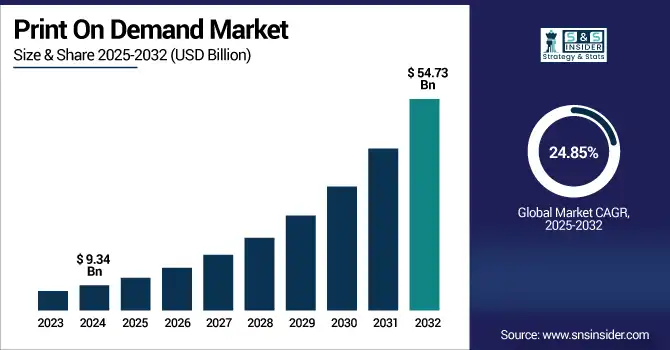

Print On Demand Market was valued at USD 9.34 billion in 2024 and is expected to reach USD 54.73 billion by 2032, growing at a CAGR of 24.85% from 2025-2032.

To Get more information on Print On Demand Market - Request Free Sample Report

The Print On Demand (PoD) market is growing rapidly due to increasing demand for personalized and customized products across categories like apparel, home décor, and accessories.

-

Shopify reports that 49% of consumers want personalized products and are willing to pay more for them. Its low startup costs, zero-inventory model, and integration with platforms like Shopify, Etsy, and Amazon make it attractive to entrepreneurs and creators.

-

In 2023, Etsy had over 95 million active buyers many of whom purchased custom, handmade, or PoD items via integrated seller platforms. Amazon's KDP Print allows creators to publish books on demand with no upfront investment and offers royalties of up to 60% on the list price, making it appealing to independent authors.

Advances in digital printing technologies have improved design flexibility, production efficiency, and turnaround time. The rise of social media and creator-driven commerce enables influencers and artists to easily launch branded merchandise.

-

Additionally, Printify states that on-demand production helps reduce waste by only producing when there is demand minimizing overproduction by 30–40% compared to traditional retail.

U.S. Print On Demand Market was valued at USD 2.50 billion in 2024 and is expected to reach USD 14.37 billion by 2032, growing at a CAGR of 24.43% from 2025-2032.

Growth in the U.S. Print On Demand market is driven by high consumer demand for customized products, strong e-commerce infrastructure, widespread use of digital printing technologies, and a surge in independent creators leveraging platforms like Shopify and Etsy for merchandise sales.

Market Dynamics

Drivers

-

Rising e-commerce penetration and demand for customized products are fueling growth in the global Print On Demand market ecosystem

Rapid expansion of e-commerce platforms globally is significantly boosting the Print On Demand market. Consumers increasingly prefer personalized products like apparel, accessories, and books tailored to their preferences. Print On Demand enables small businesses and individual creators to design and sell without holding inventory, aligning well with this customization trend. With low entry barriers, creative entrepreneurs leverage digital storefronts and POD partners to monetize designs. The convenience and scalability of the model attract both buyers and sellers, driving demand. As online shopping surges and personalization becomes a norm, Print On Demand continues to scale in reach and volume.

-

UNCTAD reports that business e‑commerce sales across 43 developed and developing economies accounting for about 75% of global GDP reached US $27 trillion in 2022, up nearly 10% from 2021; between 2016 and 2022, the increase was around 60%.

Restraints

-

Limited control over product quality and fulfillment timelines often impacts customer satisfaction and brand credibility

Print On Demand businesses frequently rely on third-party service providers for printing, packaging, and shipping, resulting in limited oversight. Delays in delivery or inconsistencies in print quality can tarnish customer experience and lead to negative reviews or returns. Brands have little control over order errors, packaging standards, or shipping issues, which can reduce customer loyalty. In a highly competitive market, maintaining consistent quality is essential to differentiation. As a result, reliance on external fulfillment chains becomes a strategic risk, especially for emerging brands striving to build trust and retain customers in a fast-moving digital environment.

Opportunities

-

Integration of AI and automation tools can personalize offerings and streamline Print On Demand operations at scale

Emerging technologies such as AI-driven design generation, predictive analytics, and automated order management are creating new efficiencies in the POD market. These tools allow businesses to forecast demand, customize products based on user data, and automate customer interactions. Personalized marketing and product recommendations improve conversion rates, while automated printing and shipping reduce human error. By embracing these innovations, sellers can offer highly tailored experiences with lower operational effort. This technological transformation is enabling mass customization at scale, opening new revenue streams and improving responsiveness to market trends, thus expanding the potential and appeal of Print On Demand services.

-

According to Shopify (2024): 57% of marketers now use AI-generated images, and 56% use AI to auto-generate text such as product descriptions. 25% of marketers leverage AI specifically for product copy, essential for POD.

-

Businesses using AI automation save an average of 2.5 hours per day, and AI-driven demand forecasting can reduce inventory levels by 20–30% without impacting service, freeing up capital for POD sellers.

Challenges

-

Dependence on third-party platforms and service providers reduces control and limits strategic differentiation for Print On Demand brands

Many POD sellers operate through marketplaces like Etsy, Amazon, or Shopify-integrated platforms, which restrict control over branding, customer data, and fulfillment. These dependencies constrain customization of the buyer experience and expose sellers to policy changes or platform outages. Additionally, reliance on external printers and logistics providers means operational disruptions can arise without notice. This lack of vertical integration can impede long-term brand development and make businesses vulnerable to third-party risks. As the market evolves, building proprietary capabilities becomes necessary for differentiation, but doing so requires resources most small players lack posing a significant structural challenge.

Segment Analysis

By Platform

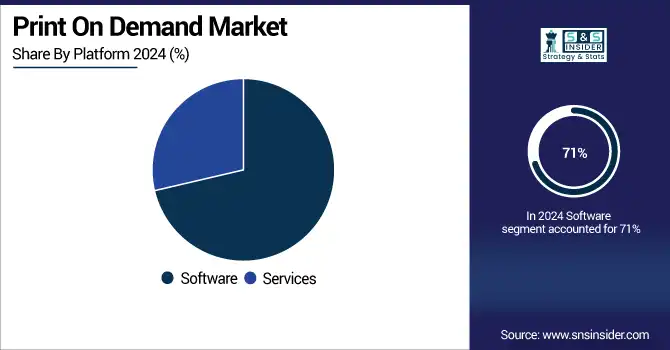

Software segment dominated the Print On Demand Market with the highest revenue share of about 71% in 2024 due to its central role in enabling customization, automation, and seamless integration across platforms. These software solutions streamline workflows, simplify design creation, and manage inventory-free order processing. Their versatility supports a wide range of users from entrepreneurs to enterprises—making software indispensable for scaling and managing Print On Demand operations efficiently.

Services segment is expected to grow at the fastest CAGR of about 26.24% from 2025–2032, driven by increasing demand for value-added offerings like design assistance, branding support, and end-to-end fulfillment. As competition rises, sellers seek differentiation through professional services that improve customer experience and reduce operational burdens. This growing reliance on outsourced expertise to scale businesses fuels rapid growth in the services segment across the Print On Demand landscape.

By End User

Fashion & Apparel segment dominated the Print On Demand Market with the highest revenue share of about 42% in 2024, largely due to high consumer demand for personalized clothing, quick trend adaptation, and visual creativity. Apparel is the most accessible entry point for creators and brands, supported by mature manufacturing infrastructure and high repeat purchase potential. The emotional appeal of wearable identity continues to drive consistent market dominance in this category.

Art & Creative segment is expected to grow at the fastest CAGR of about 28.98% from 2025–2032, fueled by a surge in independent artists using POD platforms to monetize illustrations, digital prints, and graphic content. The rise of creator economies and online art communities has broadened access to global audiences. Low upfront costs and flexible formats make Print On Demand ideal for distributing creative content across multiple mediums.

By Product

Apparel segment dominated the Print On Demand Market with the highest revenue share of about 44% in 2024 because of its massive consumer base, wide product variety, and continuous demand for personalized fashion. Clothing items like t-shirts and hoodies are inexpensive to produce, widely worn, and frequently purchased, making them ideal for customization. Their strong emotional and identity appeal sustains high volumes and profitability in the Print On Demand space.

Home Décor segment is expected to grow at the fastest CAGR of about 28.05% from 2025–2032, driven by increasing consumer interest in personalized interiors and unique decorative pieces. Print On Demand enables affordable customization of items like wall art, cushions, and posters tailored to individual tastes. As home aesthetics gain prominence through social media and lifestyle trends, the demand for personalized décor is accelerating rapidly across diverse consumer segments.

By Technology

Digital Printing segment dominated the Print On Demand Market with the highest revenue share of about 59% in 2024 and is expected to grow at the fastest CAGR of about 43.61% from 2025–2032 due to its ability to deliver high-quality, on-demand prints with minimal setup costs and rapid turnaround. It supports mass customization and short-run production, which are core to the Print On Demand model. Its compatibility with a wide range of substrates, vibrant color output, and eco-friendliness make it the preferred choice for creators and businesses seeking speed, flexibility, and cost-efficiency in personalized product manufacturing.

Regional Analysis

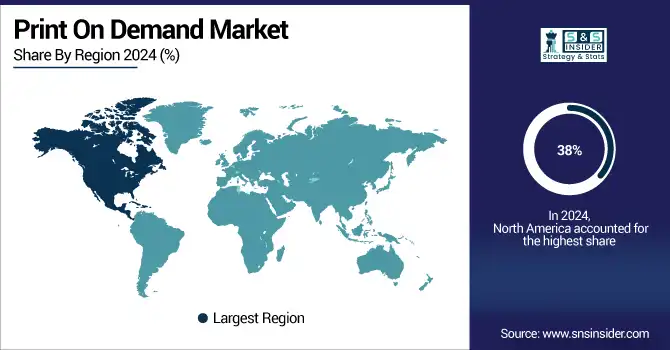

North America dominated the Print On Demand Market with the highest revenue share of about 38% in 2024 due to strong e-commerce infrastructure, high consumer spending on personalized goods, and the presence of major POD platforms. The region’s mature digital ecosystem, advanced logistics networks, and early adoption of customization trends have fueled sustained demand, making it the central hub for innovation and revenue generation in the Print On Demand industry.

The United States is dominating the Print On Demand market due to its advanced e-commerce ecosystem, strong consumer demand, and presence of major POD platforms.

Asia Pacific is expected to grow at the fastest CAGR of about 26.80% from 2025–2032, driven by expanding internet access, rapid e-commerce growth, and a rising middle-class population. Increasing digital literacy, growing youth demographics, and greater smartphone penetration are encouraging small businesses and individuals to adopt Print On Demand solutions. Localized content, low manufacturing costs, and regional startup activity further amplify the region’s growth potential in the POD space.

China is dominating the Print On Demand market in the Asia Pacific region due to its massive manufacturing capacity, e-commerce leadership, and rapid digital adoption.

Europe holds a strong position in the Print On Demand market due to its mature e-commerce landscape, growing consumer preference for personalized products, and increasing emphasis on sustainable, on-demand production methods supported by advanced digital infrastructure.

The United Kingdom is dominating the Print On Demand market in Europe due to high online retail adoption, creative industries, and strong customization demand.

Middle East & Africa and Latin America are emerging regions in the Print On Demand market, supported by increasing internet access, expanding e-commerce penetration, growing youth populations, and rising entrepreneurial activity leveraging digital platforms for customized product offerings.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Print On Demand Market companies are Spreadshirt (SPOD - Spreadshirt Print-On-Demand), TeeSpring (Spring), Society6, Printify, Inc., Printful Inc., Canva, VistaPrint (Cimpress), CustomCat, Gelato, Gooten, Printed Mint, Teelaunch, Zazzle, Inc., Redbubble Group, T-Pop, Apliiq, Amplifier, Printsome, Prodigi Group, JetPrint Fulfillment.

Recent Developments:

-

2025: Printful unveiled 86 new Kornit Digital Atlas MAX direct‑to‑garment printers across its fulfillment network, boosting print quality and color consistency, as confirmed at Impressions Expo.

-

2024: Printful and Printify announced a merger as equal partners to enhance product selection, global reach, and fulfillment capabilities; both brands continue operating independently.

-

2023: Redbubble partnered with ecommerce tech firm Rokt to integrate AI‑powered offers at checkout across eight marketplaces, aiming to increase transaction‑moment revenue.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.34 Billion |

| Market Size by 2032 | USD 54.73 Billion |

| CAGR | CAGR of 24.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Software, Services) • By Product (Apparel, Home Decor, Drinkware, Accessories, Others) • By Technology (Digital Printing, Offset Printing, Flexographic Printing, Screen Printing) • By End User (Fashion & Apparel, Furnishing, Publishing, Art & Creative, Corporate, Education, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Spreadshirt (SPOD - Spreadshirt Print-On-Demand), TeeSpring (Spring), Society6, Printify, Inc., Printful Inc., Canva, VistaPrint (Cimpress), CustomCat, Gelato, Gooten, Printed Mint, Teelaunch, Zazzle, Inc., Redbubble Group, T-Pop, Apliiq, Amplifier, Printsome, Prodigi Group, JetPrint Fulfillment |