Industrial Cyber Security Market Report & Overview:

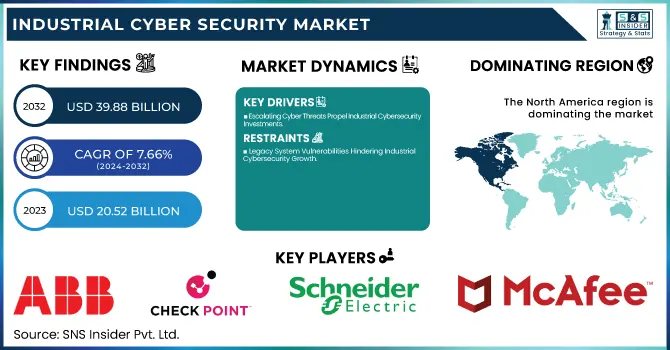

The Industrial Cyber Security Market, valued at USD 20.52 billion in 2023, is expected to reach USD 39.88 billion by 2032, growing at a CAGR of 7.66% from 2024-2032. This growth is fueled by rising cyber threats, regulatory mandates, and increasing investments in securing industrial infrastructure. Key trends include technology adoption rates across regions, compliance and regulatory frameworks, advancements in ICS/OT security, evolving threat intelligence, and future investments in AI-driven cybersecurity solutions. As industries embrace digital transformation and cloud-based security, robust cybersecurity measures are becoming essential for mitigating risks and ensuring operational resilience.

To Get more information on Industrial Cyber Security Market - Request Free Sample Report

Industrial Cyber Security Market Dynamics

Drivers:

-

Escalating Cyber Threats Propel Industrial Cybersecurity Investments

The industrial sector is witnessing a significant surge in cyber threats, particularly targeting Industrial Control Systems (ICS) and Operational Technology (OT) networks. In 2024, cyberattacks on U.S. utilities increased by nearly 70% compared to the previous year, underscoring the growing vulnerability of critical infrastructure. A notable incident in Ukraine involved a cyberattack that disrupted heating services to 600 buildings during winter, highlighting the tangible risks associated with such threats. Recognizing these dangers, 65% of energy professionals now view cybersecurity as the greatest current risk to their business, leading to increased investments in defense mechanisms. Furthermore, the World Economic Forum's Global Cybersecurity Outlook 2025 emphasizes that geopolitical tensions are contributing to a rise in cyberattacks on companies and governments, with the complexity of supply chains amplifying these risks. These developments underscore the urgent need for robust cybersecurity solutions to protect industrial operations from evolving cyber threats.

Restraints:

-

Legacy System Vulnerabilities Hindering Industrial Cybersecurity Growth

Over 60% of industrial control systems (ICS) rely on outdated operational technology (OT), making them highly vulnerable to cyber threats. Reports show that 60% of cyber incidents in critical infrastructure stem from legacy system weaknesses, leading to a 30% rise in ransomware attacks. While Zero Trust Architecture (ZTA) and OPC UA protocols can reduce security gaps by 40%, integration remains costly and complex. 50% of ICS breaches originate from third-party vendors, highlighting supply chain risks. Although AI-driven cybersecurity and cloud-based solutions offer protection, compatibility issues persist. As governments enforce stricter regulations, industrial firms must modernize security frameworks to mitigate risks and ensure resilience in an increasingly digitized and threat-prone environment.

Opportunities:

-

Zero Trust Architecture A Game Changer For Industrial Cybersecurity Market

With 70% of organizations set to implement Zero Trust Architecture (ZTA) by 2026, industrial cybersecurity firms have a major opportunity to enhance network security through advanced access control and segmentation strategies. The 40% surge in critical infrastructure security breaches over the past two years highlights the growing necessity for ZTA adoption. Governments and regulatory bodies, including NIST and the Cloud Security Alliance, are advocating for mandatory ZTA implementation in Operational Technology (OT) environments to counter evolving cyber threats. Moreover, the integration of AI-driven identity authentication and cloud-based security frameworks within ZTA is expected to fuel market growth. As industries transition toward cyber-resilient infrastructures, cybersecurity firms offering tailored ZTA solutions will benefit from rising investments and increasing demand for robust, scalable security models.

Challenges:

-

Regulatory Complexity and Compliance Burden in the Industrial Cybersecurity Market

The industrial cybersecurity market faces mounting regulatory challenges as compliance with frameworks like NIST, IEC 62443, GDPR, and sector-specific mandates grows increasingly complex. With global cyber regulations tightening in 2025, businesses struggle to keep pace with evolving compliance requirements, adding significant administrative and financial burdens. Reports highlight a 35% rise in cybersecurity compliance costs, especially in critical sectors like healthcare, rail, and supply chain networks. Additionally, AI integration in cybersecurity presents further compliance and interoperability hurdles, delaying adoption. Board-level cybersecurity oversight is increasing, forcing industrial firms to enhance security measures while balancing operational efficiency and cost constraints. Regulatory fragmentation continues to slow cybersecurity advancements, impacting market growth.

Industrial Cyber Security Market Segment Analysis

By Product

In 2023, the Gateway segment dominated the Industrial Cyber Security market, accounting for approximately 50% of the market share. This dominance is driven by the increasing need for secure network communication between IT and OT environments, as industrial systems become more interconnected. Gateways serve as critical security layers, providing firewall protection, intrusion detection, and real-time traffic monitoring to safeguard industrial control systems (ICS) from cyber threats. The rise of IIoT (Industrial Internet of Things) and cloud-based industrial operations has further fueled demand for advanced gateway solutions.

The Router segment is the fastest-growing segment in the Industrial Cyber Security market, projected to expand rapidly from 2024 to 2032. This growth is driven by the increasing adoption of secure industrial networking solutions, as industries transition to smart factories and IIoT-based infrastructures. Industrial routers provide encrypted communication, network segmentation, and remote monitoring capabilities, ensuring secure data transmission between connected devices and control systems. The rising need for high-speed, low-latency communication in critical infrastructure, coupled with the implementation of Zero Trust Architecture (ZTA) and AI-driven security features, is further accelerating the demand for advanced cybersecurity routers across manufacturing, energy, and transportation sectors.

By Solution

The Data Loss Prevention (DLP) segment dominated the Industrial Cyber Security market in 2023, holding around 40% market share. This dominance is fueled by the increasing need to protect sensitive industrial data, intellectual property, and operational insights from cyber threats and insider risks. As industries adopt cloud-based infrastructure, IoT, and remote operations, the risk of data breaches, unauthorized access, and accidental data leaks has surged, making DLP solutions essential for regulatory compliance and risk management. Industries such as manufacturing, energy, and transportation are investing heavily in DLP tools integrated with AI-driven monitoring, real-time threat detection, and automated response mechanisms, ensuring secure data flow and preventing industrial espionage and cyber sabotage in critical infrastructure.

The firewall segment is the fastest growing in the Industrial Cyber Security market from 2024 to 2032, driven by the rising frequency of cyberattacks on critical infrastructure and the increasing adoption of Industry 4.0 technologies. With the expansion of connected devices, cloud-based operations, and remote monitoring, industrial networks face heightened risks, making advanced firewalls essential for securing Operational Technology (OT) and Industrial Control Systems (ICS). The demand for next-generation firewalls (NGFWs) with deep packet inspection, AI-driven threat detection, and zero-trust architecture is surging. Industries such as energy, manufacturing, and transportation are prioritizing firewall solutions to enhance network segmentation, block unauthorized access, and prevent cyber threats effectively.

By Organization

Based on Organization, The SMEs segment dominated the Industrial Cyber Security market in 2023, accounting for around 60% market share, driven by the rising adoption of digital transformation, cloud computing, and IoT integration in small and medium-sized industries. SMEs face an increasing number of cyber threats due to limited security resources, making them prime targets for cybercriminals Many SMEs are adopting cost-effective, cloud-based security solutions, including Data Loss Prevention (DLP), next-generation firewalls, and AI-driven threat detection, to enhance network security, data protection, and operational resilience, fueling the segment’s dominance in the market.

The large enterprises segment is the fastest-growing in the Industrial Cyber Security market over the forecast period 2024-2032, driven by the increasing adoption of Industry 4.0, IoT, AI-powered security solutions, and cloud-based cybersecurity frameworks. Large enterprises manage complex industrial networks and handle vast amounts of sensitive data, making them high-value targets for cyberattacks. Investments in zero-trust architecture, next-generation firewalls, and AI-driven threat detection are accelerating, enabling real-time intrusion prevention and risk mitigation. As cybersecurity budgets increase, large enterprises are expected to drive significant market growth and innovation.

By Industries

Based on Industries, The Power Grid segment dominated the Industrial Cyber Security market in 2023, accounting for around 48% of the market share, driven by the increasing digitalization of power infrastructure and the growing risk of cyber threats targeting critical energy networks. As smart grids, IoT-enabled monitoring systems, and automation technologies become more prevalent, power utilities are facing heightened risks from ransomware, malware, and nation-state cyberattacks. The increasing integration of renewable energy sources and grid interconnectivity further necessitates robust cybersecurity frameworks, making power grids a key focus area for industrial cyber protection.

The Oil & Gas segment is the fastest-growing sector in the Industrial Cyber Security market from 2024 to 2032, driven by rising cyber threats targeting critical infrastructure and the rapid adoption of digital technologies such as IoT, SCADA systems, and AI-based predictive maintenance. With increasing automation in upstream, midstream, and downstream operations, the sector faces heightened risks from ransomware, supply chain attacks, and nation-state threats. The shift towards cloud-based data management and remote monitoring makes cybersecurity a top priority for oil and gas firms to prevent operational disruptions and financial losses.

Industrial Cyber Security Market Regional Analysis

North America dominated the Industrial Cyber Security market with a 40% share in 2023, driven by high industrial automation adoption, stringent cybersecurity regulations, and increasing cyber threats. The U.S. leads the market, supported by the National Institute of Standards and Technology (NIST) framework, the Cybersecurity and Infrastructure Security Agency (CISA) initiatives. Major industries, including power grids, oil & gas, manufacturing, and transportation, are investing heavily in AI-driven threat detection, firewalls, and intrusion detection systems (IDS). With growing 5G networks, IoT expansion, and government funding for cybersecurity, the market is projected to rise further as industrial sectors focus on securing critical infrastructure and digital transformation.

Asia Pacific is the fastest-growing region in the Industrial Cyber Security market over the forecast period 2024-2032, driven by rapid industrialization, increasing cyber threats, and government-led cybersecurity initiatives. Countries like China, Japan, India, and South Korea are heavily investing in critical infrastructure protection, smart manufacturing, and digital transformation. China’s Made in China 2025 and India’s Digital India programs are accelerating the adoption of IoT, AI, and cloud-based security solutions. The region also faces rising cyberattacks on power grids, oil & gas, and smart factories, pushing industries to enhance firewalls, intrusion detection systems, and network security. Government regulations and increasing cybersecurity budgets are further fueling market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Industrial Cyber Security Market Key Players

Some of the major key players in Industrial Cyber Security Market along with product and services:

- IBM Corporation (United States) – IBM Security QRadar (SIEM, Threat Detection)

- ABB Ltd. (Switzerland) – ABB Ability Cyber Security

- Check Point Software Technologies Ltd. (Israel) – Check Point Harmony, Quantum Security

- Schneider Electric SE (France) – EcoStruxure Cybersecurity Solutions

- McAfee, LLC (Intel Security) (United States) – McAfee MVISION Endpoint, Cloud Security

- Cisco Systems, Inc. (United States) – Cisco SecureX, Firepower NGFW (Firewall)

- Honeywell International Inc. (United States) – Honeywell Industrial Cybersecurity Platform

- Microsoft Corporation (United States) – Microsoft Defender for IoT & Cloud Security

- Siemens AG (Germany) – Siemens Industrial Security Services

- Trend Micro, Inc. (Japan) – Trend Micro Apex One (Threat Protection)

- Splunk Inc. (United States) – Splunk Enterprise Security (SIEM)

- Rockwell Automation, Inc. (United States) – FactoryTalk Security, ICS Cybersecurity

- Bayshore Networks, Inc. (United States) – Bayshore IT/OT Secure Access

- Broadcom Inc. (United States) – Symantec Endpoint Security

- Kaspersky Lab (Russia) – Kaspersky Industrial Cybersecurity (KICS)

- Dell Inc. (United States) – Dell Data Protection (Encryption, Threat Security)

- Proofpoint, Inc. (United States) – Proofpoint Email Security & DLP

- FireEye, Inc. (United States) – FireEye XDR (Threat Intelligence)

List of Potential Customers for Industrial Cybersecurity Solutions

1. Energy & Power Sector

- Siemens Energy (Germany)

- General Electric (GE) (United States)

- Schlumberger (United States)

- ExxonMobil (United States)

- Royal Dutch Shell (Netherlands)

- BP (United Kingdom)

- Saudi Aramco (Saudi Arabia)

2. Manufacturing & Industrial Automation

- Boeing (United States)

- Airbus (France)

- Tesla (United States)

- Foxconn (Taiwan)

- Caterpillar (United States)

- 3M (United States)

3. Transportation & Logistics

- Deutsche Bahn (Germany)

- Union Pacific Railroad (United States)

- Port of Rotterdam (Netherlands)

- Delta Airlines (United States)

- Maersk (Denmark)

- Tesla (United States)

4. Smart Cities & Critical Infrastructure

- New York City Cyber Command

- Singapore Cyber Security Agency

- Dubai Smart City

5. Pharmaceutical & Chemical Industry

- Pfizer

- BASF

- Johnson & Johnson

Recent Development

-

September 5, 2024, Cyolo Integrates with IBM Security to Enhance OT/ICS Cybersecurity Cyolo has integrated its PRO Secure Remote Access Platform (SRA) with IBM Security’s QRadar SIEM to strengthen threat detection and mitigation in OT/ICS environments. This builds on IBM’s Series B investment in Cyolo in 2022, reinforcing its commitment to industrial cybersecurity amidst rising Industry 4.0 regulations and the growing OT skills gap.

-

November 1, 2024, VulnCheck Identifies Critical Security Flaws in ABB Automation Software VulnCheck discovered two major vulnerabilities (CVE-2023-0636 & CVE-2024-6209) in ABB Cylon ASPECT, impacting building automation and energy management. Despite a patch available since 2022, 214 out of 265 systems remain unpatched, posing significant security risks in critical industrial control systems (ICS) environments.

-

October 21, 2024, Schneider Electric Achieves Industry-First Cybersecurity Certification for EcoStruxure IT Schneider Electric's EcoStruxure IT Network Management Card 3 (NMC3) became the first DCIM network card to receive IEC 62443-4-2 Security Level 2 (SL2) certification, enhancing protection against cyber threats. This rigorous independent certification sets a new industry benchmark for data center cybersecurity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 20.52 Billion |

| Market Size by 2032 | USD 39.88 Billion |

| CAGR | CAGR of 7.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product(Gateway, Routers, Ethernet switches) • By Solution(Antivirus, Firewall, DDOS, Data Loss Prevention (DLP), SCADA) • By Organization Size(Large, SME’s) • By Industries (Manufacturing, Transportation, Power grid, Oil & Gas) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation (United States), ABB Ltd. (Switzerland), Check Point Software Technologies Ltd. (Israel), Schneider Electric SE (France), McAfee, LLC (United States), Cisco Systems, Inc. (United States), Honeywell International Inc. (United States), Microsoft Corporation (United States), Siemens AG (Germany), Trend Micro, Inc. (Japan), Splunk Inc. (United States), Rockwell Automation, Inc. (United States), Bayshore Networks, Inc. (United States), Broadcom Inc. (United States), Kaspersky Lab (Russia), Dell Inc. (United States), Proofpoint, Inc. (United States), and FireEye, Inc. (United States) are key players in the Industrial Cyber Security market. |