Privacy Management Software Market Size & Overview:

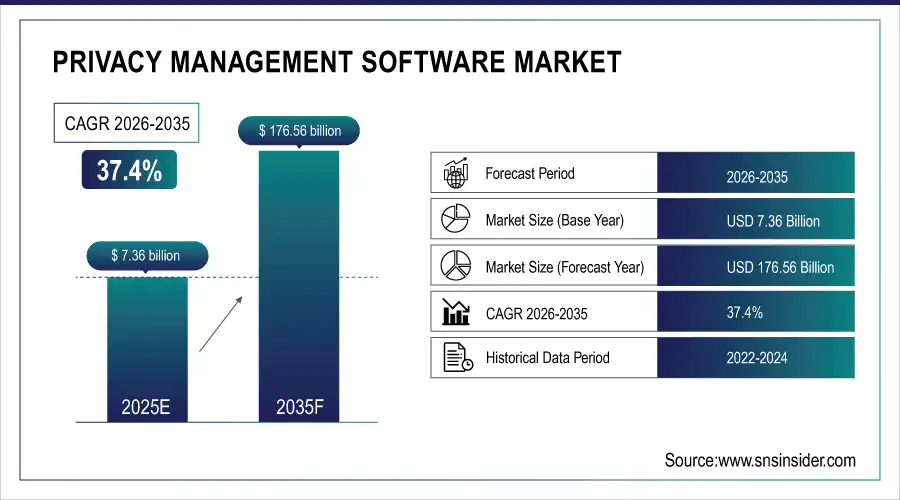

The Privacy Management Software Market size was valued at USD 7.36 Billion in 2025 and will grow to USD 176.56 Billion by 2035 and grow at a CAGR of 37.4% by 2035.

Rapid growth of the global privacy management software market, driven by rising regulatory pressures and organizations need to protect consumer data in changing digital environment. Governments worldwide are enacting strict privacy laws and regulations, pushing organizations to adopt robust privacy management solutions. California Consumer Privacy Act (CCPA) and the CCPA updates in the U.S. require organizations to protect consumer data but also give consumers a measure of power over their information. The General Data Protection Regulation (GDPR) in the EU has inspired many privacy laws worldwide and continues to push enterprises to look for data protection solutions.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 7.36 Billion

-

Market Size by 2035 USD 176.56 Billion

-

CAGR of 37.4% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

Get More Information on Privacy Management Software Market - Request Sample Report

Privacy Management Software Market Trends:

-

Increasing global regulatory pressure, with laws like GDPR and CCPA driving organizations to adopt privacy management solutions.

-

Significant financial and reputational risks from non-compliance motivating investment in compliance software.

-

Rising consumer awareness and demand for transparency, pushing businesses to implement stronger privacy measures.

-

Growing adoption of privacy management tools to improve data hygiene and governance practices.

-

Companies prioritizing privacy management as a means to build trust and maintain customer loyalty.

Privacy Management Software Market Growth Drivers:

The privacy management software market is growing with the need for regulatory compliance. With data privacy regulations tightening around the world, organizations are compelled to adopt privacy management solutions to ensure compliance and mitigate risks. The most significant example of this is the General Data Protection Regulation (GDPR) that Europe enacted, which carries fines of up to €20 million or 4% of global annual revenue whichever is greater. More than 400 fines have been issued since it took effect, exceeding €300 million, so compliance is taken seriously. At the US level, California Consumer Privacy Act (CCPA) is another important regulation that has driven many companies to improve their data hygiene practices. recent reports indicate that 55% of U.S. companies are concerned about compliance with CCPA, leading many to invest in privacy management software to navigate these complexities. Moreover, the rise in public awareness regarding data privacy and security has led consumers to demand more transparency from companies about how their data is handled. According to a survey, still 79 percent of consumers are extremely concerned about how their data is being used and businesses need effective privacy measures in order to build trust and retain customer loyalty.

Privacy Management Software Market Restraints:

The global privacy management software market is majorly hampered by limited awareness of the importance and advantages among small and medium-sized enterprises (SMEs) related to the implementation of such solutions. The risks linked to data breaches and the importance of strong privacy management systems are often underestimated by many SMEs, causing them to instill a sense of reactiveness rather than proactiveness regarding their data security. These low budgets and know-how contribute to the failure of understanding privacy management software. Additionally, SMEs may focus on immediate operational costs, sidelining the long-term advantages of investing in privacy tools. Consequently, a lot of these businesses are still poorly prepared to fulfill compliance requirements and protect sensitive data enough, thus opening loopholes that cyber threats can easily penetrate through. Efforts to enhance education and provide accessible solutions are essential to improve awareness and encourage adoption among these enterprises.

Privacy Management Software Market Segment Analysis:

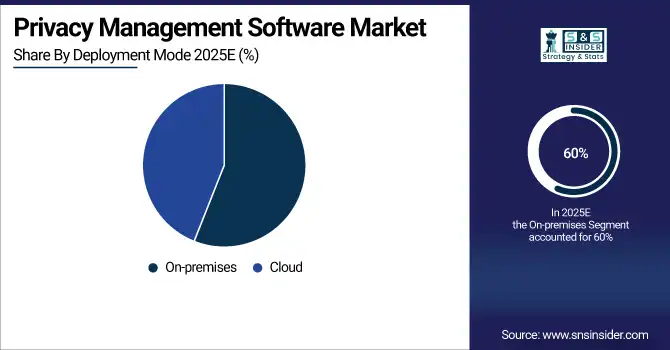

By Deployment Mode

The on-premises deployment mode was the leading segment in the privacy management software market, accounting for a share of 60% in 2025. The need of strict compliance and security especially in healthcare, government, and financial services sectors a strong preference for on-premises solutions. The U.S. Department of Homeland Security shared in a 2025 report that more than 70% of cybersecurity breaches leverage third-party cloud systems, which is driving organizations away from public deployments and towards on-premises deployments, allowing greater control over data and security. Many of enterprises prefer on-premises solutions as they keep sensitive data within the infrastructure leading to lesser cloud vulnerability risks. Furthermore, organizations in regulated sectors are usually required under government policy to manage and store data internally, as much as possible reducing external risk. This requirement for on-prem deployment follows regulatory guidelines, especially compliance and data localization and security policies, enshrined by governments worldwide.

By Application

The regulatory compliance application segment held the largest share, accounting for nearly 29% of the privacy management software market in 2025. The increasing focus on regulatory compliance owing to worldwide privacy regulations such as GDPR and CCPA is the major factor propelling this domination. According to the European Commission’s 2025 report, non-compliance fines exceeded €1 Billion within the EU only, indicating a significant financial risk in failing compliance with privacy measures. In response, organizations are adopting privacy management solutions that facilitate real-time compliance monitoring and reporting to avoid costly fines. For example, the deadlines imposed by the government for GDPR compliance reporting and CCPA updates have accelerated demand for regulatory compliance tools based on their ability to reduce compliance overheads via documentation, consent management, and tracking data handling in a way that meets requirements by region. Moreover, the increasing complexities of privacy regulations in Asia and North America are driving the need for enterprises to deploy software solutions with out-of-the-box regulatory compliance settings.

By End-use

In 2025, the BFSI (Banking, Financial Services and Insurance) accounted for the largest end-use segment of the privacy management software market. The sensitivity of the financial sector concerning data privacy and its dependence on customer data in baking transactions and service delivery makes this vertical a key segment for deploying privacy management solutions. The new report released by the U.S. Federal Reserve in 2025 states that financial institutions account for over 40% of all cyberattacks around the world which has made privacy compliance a must to ensure customer trust towards their organizations. Given the rigorous privacy laws like GDPR, Payment Card Industry Data Security Standard (PCI DSS), and state-specific privacy acts, BFSI institutions are more likely to invest in sophisticated privacy management solutions. Additionally, with the open banking regulations that exist across different regions of the world, financial institutions have grown increasingly dependent on data sharing, which has further spurred the need for privacy software that allows organizations to regulate and protect their data.

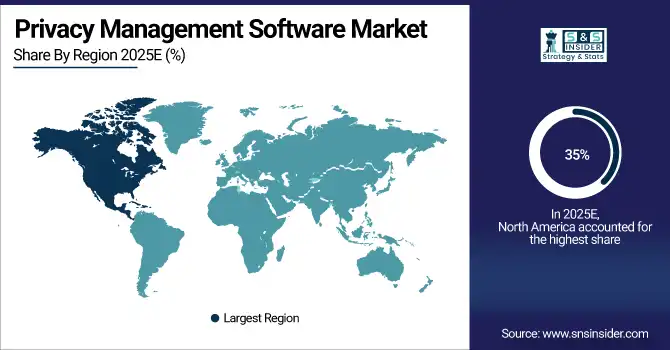

Privacy Management Software Market Regional Analysis:

North America Privacy Management Software Market Insights

North America accounted for the largest share of more than 35% in terms of revenue, globally, during the year 2025 owing to strict regulatory frameworks such as CCPA (California Consumer Privacy Act), U.S. and PIPEDA (Personal Information Protection and Electronic Documents) enacted in Canada. In addition, ongoing discussions by the U.S. federal government about a possible national privacy law have led to increased demand for privacy solutions as organizations anticipate regulatory changes. The United States is under threat from a growing number of cyberattacks. According to the Identity Theft Resource Center, the average amount of breach incidents in the country has slightly increased over previous years. Data breaches cost organizations an average of $4.35 million in 2022, according to reports from the United States. And with it, the price of data breaches is climbing as well. The average cost of a data breach in the US was $4.35 million in 2022. This cost includes the cost of notifying affected individuals, providing them with credit monitoring, and repairing the damage caused by the breach.

Do You Need any Customization Research on Privacy Management Software Market - Enquire Now

Asia Pacific Privacy Management Software Market Insights

Compound Annual Growth Rate (CAGR) is expected to be highest in the Asia-Pacific region during the forecast period. Privacy across Asia is growing into a viable market underpinned by data protection needs and evolving legislation, notably with recent revisions made to the Digital Personal Data Protection Bill of India from the Ministry of Electronics and Information Technology. As Japan, Singapore, and Australia work to bolster data protection, the Asia-Pacific market has emerged as the fastest-growing regional market for privacy management software with more organizations adopting solutions to comply with new regulations.

Europe Privacy Management Software Market Insights

The European privacy management software market is expanding rapidly due to stringent regulations like GDPR. Organizations are increasingly investing in compliance solutions to avoid hefty fines and reputational damage. Rising data protection awareness among consumers and businesses’ need for transparent data practices are further driving adoption across industries.

Latin America (LATAM) and Middle East & Africa (MEA) Privacy Management Software Market Insights

The LATAM and MEA markets for privacy management software are witnessing growth as countries strengthen data protection laws. Enterprises are adopting solutions to ensure regulatory compliance, safeguard sensitive data, and build customer trust. Increasing digitalization, cross-border data flows, and rising cybersecurity concerns are key factors driving market adoption.

Privacy Management Software Market Key Players:

-

OneTrust (Privacy Management Software, Consent Management Platform)

-

TrustArc (Data Privacy Management Platform, Compliance Automation Software)

-

DataGuard (Privacy Management Software, Risk Management Solution)

-

DPOrganizer (Privacy Management Software, Data Mapping Tool)

-

BigID (Data Discovery Platform, Privacy Management Software)

-

Nymity (Compliance Software, Privacy Management Tool)

-

SAP (Data Privacy Management, Governance, Risk, and Compliance Software)

-

SailPoint (Identity Governance, Privacy Management Solutions)

-

Symantec (Broadcom) (Endpoint Protection, Data Loss Prevention)

-

IBM (Data Security and Privacy Solutions, Risk Management Software)

Competitive Landscape for Privacy Management Software Market:

DataGuard is a leading provider of privacy management software, helping organizations achieve regulatory compliance and manage data protection risks effectively. The company offers solutions for GDPR, CCPA, and other global privacy regulations, enabling businesses to streamline data governance, enhance transparency, and build trust with customers while minimizing compliance-related fines and risks.

-

DataGuard acquired DPOrganizer, a privacy management solution provider, in June 2024 as part of its focus on strengthening security and compliance capabilities and accelerating international growth. This strategic acquisition is key to reinforcing DataGuard's Nordic & UK footprint while optimizing its overall competitive positioning in Europe & North America.

|

Report Attributes |

Details |

| Market Size in 2025 | USD 7.36 Billion |

| Market Size by 2035 | USD 176.56 Billion |

| CAGR | CAGR of 37.4% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Deployment (On-premise, Cloud) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

OneTrust, TrustArc, DataGuard, DPOrganizer, BigID, Nymity, SAP, SailPoint, Symantec (Broadcom), IBM |