AI API Market Report Scope & Overview:

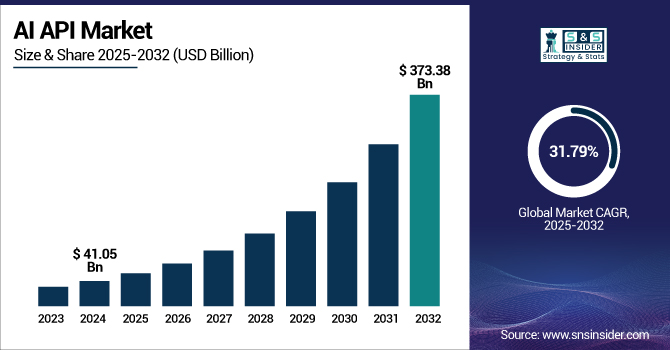

The AI API Market size was valued at USD 41.05 billion in 2024 and is expected to reach USD 373.38 billion by 2032 and grow at a CAGR of 31.79% over the forecast period 2025-2032.

To Get more information on AI API Market - Request Free Sample Report

The market is growing at a rapid pace due to increasing adoption of artificial intelligence technology across several industries including healthcare, BFSI, retail, and IT. Advancements in generative AI, computer vision, natural language processing, and recommendation systems in recent times have made it possible for companies to incorporate user-friendly AI APIs, thus streamlining operations and customer experiences. Expansion of cloud-based AI offerings is making market penetration easier by allowing companies to deploy agile, scalable, and affordable AI systems more comfortably.

In March 2025, AI adoption among the U.S. companies was 6.8% and is estimated to rise to 9.3% over the next six months. The industry creating the most AI-based jobs was the information sector, where the current usage rate was 21.3%, while the expected rate stood at 28.1%. But even in sectors where adoption of AI is more advanced, few sectors have high levels of AI penetration, indicating that there is much work to be done before AI productively saturates many industries.

The U.S. AI API Market size was USD 11.05 billion in 2024 and is anticipated to reach USD 78.86 billion by 2032, increasing at a CAGR of 27.81% over the forecast period of 2025-2032.

The U.S. holds the largest share in the North American market owing to the high technology base, expenditure on R&D, and the innovation-centric companies in the majority of companies here. The big tech corporations, such as Google, Amazon, and Microsoft are driving AI innovations, and also the adoption of AI APIs in industries such as healthcare, finance, and retail.

AI API Market Dynamics:

Key Drivers:

-

Increasing Adoption of AI-Driven Solutions Across Industries Fuels Growth

The growing use of AI solutions in various industries such as healthcare, finance, retail, and IT is one of the key drivers of the AI API market growth. Due to the high use of AI for automation, predictive analytics, and personalized customer interactions, by the leading market players, the demand for AI APIs is increasing. APIs, which are powered by AI, are simplifying healthcare by connecting with EHR systems including Epic and Cerner, further reducing administrative workloads for doctors and enhancing patient care and operational effectiveness in the sector.

For instance, in April 2024, Suki, a healthcare company that raised USD 70M in Series D to improve its AI-assisted assistant tools.

Restraints:

-

Data Privacy Concerns Hinder Widespread Adoption of AI APIs

Data privacy issues are one of the major obstacles to the Market and its growth. With the growing usage of AI APIs by enterprises to process large amounts of personal and sensitive organizational data, concerns about where and how this data is retained, processed, and secured have increased. Many enterprises struggle to ensure AI solutions are compliant with changing data protection laws, such as Europe’s General Data Protection Regulation, as well as laws in other countries and regions. Failing to adhere such regulations can cause serious legal and financial consequences.

Opportunities:

-

Surging Demand for AI APIs in Healthcare Propel Market Expansion

The surging AI-driven solutions' need in the healthcare industry provide a large opportunity for market expansion globally. The healthcare industry is accelerating its digital transformation initiatives, we begin to see more and more of them integrate AI APIs to manage the flow of patients, use predictive analytics to try and prevent diseases, and overall get better clarity and efficiency in managing resources. Increasing adoptions of AI in hospitals and by healthcare providers have led to increased needs for secure, scalable, and stable AI APIs. Factors such as increasing adoptions of AI in hospitals and by healthcare providers have led to increased needs for secure, scalable, and stable AI API Market Analysis.

In 2024, Mayo Clinic's embracing of AI-driven APIs will further enhance patient diagnosis and streamline healthcare delivery. The clinic’s AI-powered platform utilizes NLP and machine learning to analyze patient data and provide personalized care recommendations.

Challenges:

-

High Implementation Costs and Technical Complexities Hampers the AI API Adoption Globally

The market is facing high implementation costs and technical intricacies in integrating AI solutions. Implementing AI APIs within traditional application landscapes is usually linked with high costs of infrastructure, software, and expertise.

In March 2024, Deloitte found that while 40% of companies are investing in AI solutions, almost 60% experience cost and integration complexity challenges.

The funds required to implement these technologies are hard to access, particularly for small and medium-sized businesses. Furthermore, the absence of relevant AI/data science in-house expertise adds another layer of complexity in the process, resulting in AI APIs being adopted less and underused. These obstacles not only inhibit market growth but also form gaps between companies able to incorporate AI and those who cannot, which might hinder the wide-scale implementation of AI APIs in various sectors.

AI API Market Segmentation Analysis:

By Functionality

The generative AI APIs segment holds the largest share of 43% in the market in 2024, with significant investment and focus on Industry verticals for content creation and automation. Tools featuring generative AI, including OpenAI's GPT-4 from and Google’s PaLM, are disrupting industries for entertainment, marketing, and even software development.

The speech/voice APIs segment is growing rapidly, with a CAGR of 39% due to the expanding use of AI in voice recognition, natural language processing, and real-time customer support. Firms such as AWS, Google Cloud, and Microsoft Azure are creating tools in conversational AI and speech recognition, further resulting in voice interfaces in smartphones, virtual assistants, and automotive applications. As the demand for voice-enabled devices from consumers grows, this AI API Industry development allows organizations to improve interactions with customers and offer a more streamlined service.

By End-Use

The it & telecommunications segment leads the AI API Market with 33% of the revenue share in 2024. AI-driven solutions are central to improving network performance, customer engagement, and real-time communication in telecom. Companies such as Verizon, AT&T, and Ericsson are working on solutions that leverage AI APIs for improved management of the network and customer service. Market trends in the market suggest an increase in demand for real-time low-latency APIs, especially as 5G rollouts continue.

The BFSI segment is experiencing the highest CAGR of 36.3%, due to the rising penetration of Tools for the detection of fraud, customer insights, and automated tools for financial analysis. Financial services companies, such as Visa, Mastercard, and JP Morgan, are incorporating AI to protect transactions and provide tailored, personalized products.

By Deployment

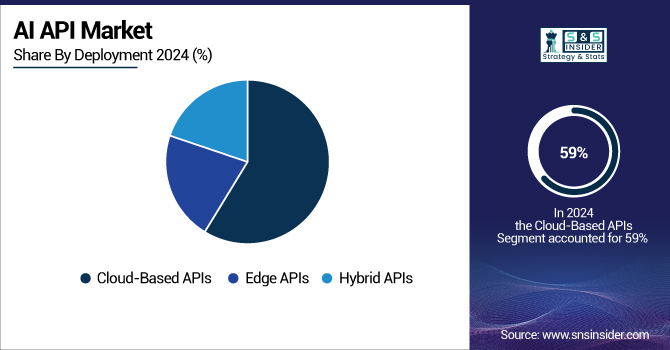

The cloud-based APIs segment held the largest market share of 59% in 2024 due to the immense flexibility, scalability, and cost-effectiveness that cloud platforms offer. Leading cloud providers, such as AWS, Google Cloud, and Microsoft Azure are leading the AI API Market with AI-powered APIs that allow enterprises to adopt AI by paying only for the AI they use and not needing to invest heavily in infrastructure. Use of such tools across sectors such as retail, healthcare, and finance, is furthering the growth of cloud-based solutions.

The edge APIs segment is experiencing the highest CAGR of 38.2%, due to the rising need for real-time AI processing with minimal latency in devices, such as IoT applications, autonomous vehicles, and smart cities. NVIDIA, Qualcomm, and other companies are leading the charge in tools for edge computing, the processing of all that data at the source, rather than in the cloud. With market trends moving in the direction of making decisions in real time.

Regional Analysis:

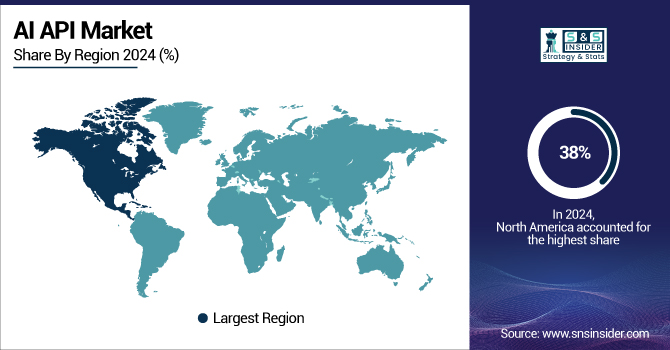

North America is the leading region, which held the AI API market share of 38% in 2024. The region's expansion is largely propelled by the U.S., where there is swift technological advancement and heavy investment in AI research and the presence of top tech firms including Google, Microsoft, and Amazon, which stimulates demand for such solutions.

For instance, in February 2024, Microsoft introduced its Azure AI APIs to assist businesses in enabling their applications with advanced AI features. These are APIs that do things like speech recognition, natural language processing, and computer vision. The introduction rolls in tandem with increased U.S. demand for AI API tools, especially from sectors, such as healthcare.

The Asia Pacific region is the fastest-growing in the market in 2024, with an estimated CAGR of 39.6%. The majority of this growth will come from countries including China, India, and Japan, which are experiencing rapid digital change, widespread 5G deployment, and a proliferation of tech startups. China is ahead in AI applications, focusing rapidly on e-commerce, smart manufacturing, and fintech, which triggers AI API adoption. The market research for APAC indicates it stands to gain a large share of the market, as the government is playing its role in the development and investment of AI infrastructure.

In 2024, the Europe region, particularly Germany, is currently the leading nation in the AI API market. The country is leading in its robust industrial prospects, specifically within automotive, manufacturing, and logistics, which have experienced AI integration to restructure their operations. Germany’s dedication to digitalization, its thriving world-class AI research and development infrastructure, and the government's backing on AI deployment and innovation continue to uphold its leadership position in the region.

In 2024, Latin America is in the developing stage in the market, and Brazil and Mexico are the frontrunners in driving this market. Leading industries, such as retail, financial services as well and agriculture are adopting AI for automation and better customer engagement. Meanwhile, the MEA is also getting healthy traction, with heavy investment in smart cities and digital infrastructure prompting growth. Countries such as the UAE and Saudi Arabia are using AI in the financial, telecommunications, and energy markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

AI API Market Companies key players:

The major players operating in the market are Google, Microsoft, IBM, AWS, Meta, OpenAI, Baidu, Anthropic, Midjourney, Scale AI, and others.

Recent Trends:

-

March 2025: Microsoft revealed that it was creating in-house AI reasoning models, MAI, to minimize dependency on OpenAI, with possible API releases to outside developers within the year.

-

June 2024: IBM announced upgrades to its AI assistant at the Think 2024 conference, including a low-code AI assistant builder in the Watson X Orchestrate platform.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 41.05 Billion |

| Market Size by 2032 | USD 373.38 Billion |

| CAGR | CAGR of 31.79% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Functionality (Generative AI APIs, Computer Vision APIs, Speech/Voice APIs, Recommendation APIs) • By Deployment (Cloud-Based APIs, Edge APIs, Hybrid APIs) • By End Use (IT & Telecommunications, BFSI, Healthcare & Life Sciences, Retail & E-commerce, Manufacturing, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The major players operating in the market are Google, Microsoft, IBM, AWS, Meta, OpenAI, Baidu, Anthropic, Midjourney, and Scale AI. |